Carriers are looking to adapt to technological advances, but digitalization across the board is even more challenging when undertaken by a smaller life insurer with limited resources.

Many small carriers and fraternals have limited or outsourced IT resources. The prospect of modernizing their aging policy administration systems and implementing digital sales and service solutions can seem difficult, if not impossible. But it can be done.

Why is digital transformation critical to carriers with limited resources?

Disruption and change are inevitable, so smaller insurers must use the resources they do have to adapt to changing market forces and keep up with the evolving ecosystem.

1. It's important to keep up with stakeholder expectations

Digital transformation is driven by the needs of stakeholders such as members, agents and insurance regulators. And, as insurers grow, they face increasing regulatory challenges. For instance, NSS Life is a small company in terms of headcount, totaling fewer than 30 employees. But they have grown from $52 million to $1.6 billion in assets in the last 15 years. And now, they find themselves in the difficult position of being a small organization that is treated as a large insurer by the regulators.

Easier access to data and adaptable reporting makes it possible to stay compliant even with few resources to assign to the effort.

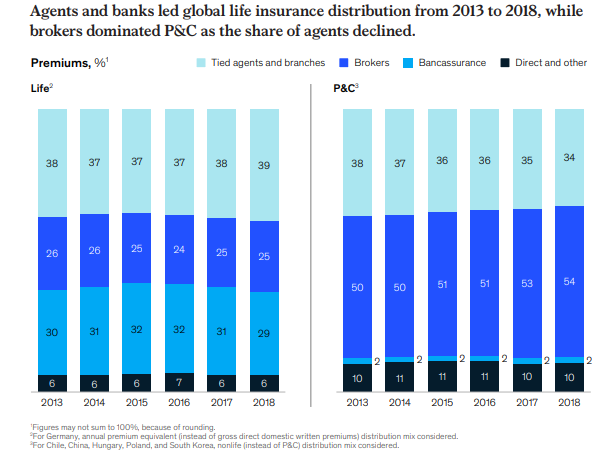

2. Digital transformation can be a point of differentiation against competitors

Texas Service Life, for example, started looking at digital conversion as a way to differentiate themselves as a very small company against competitors that were 30x larger.

The insurance industry has been slow to catch up with technology. This means that companies that undergo digital transformation sooner rather than later can stand out against other and potentially larger competitors that take more time.

3. Consumers are already enjoying the benefits from digital experiences in other industries

Whether it's personalized concert suggestions sent by music audio streaming companies or subscription-based meal deliveries, consumers are exposed to highly personalized and efficient experiences in almost all industries. Life insurance consumers expect no less.

Like all insurers, smaller carriers risk losing potential customers, especially in younger generations, if they can't deliver real-time and online service, straight-through processing of applications, accelerated claims resolution and a host of other transformative solutions that consumers have come to expect.

Digital transformation isn't just a nice-to-have option for life insurance companies -- it's a requirement if they are going to stay relevant to consumers. Automating manual processes also addresses labor shortages.

You don't have to boil the ocean - companies can undergo digital transformation one step at a time.

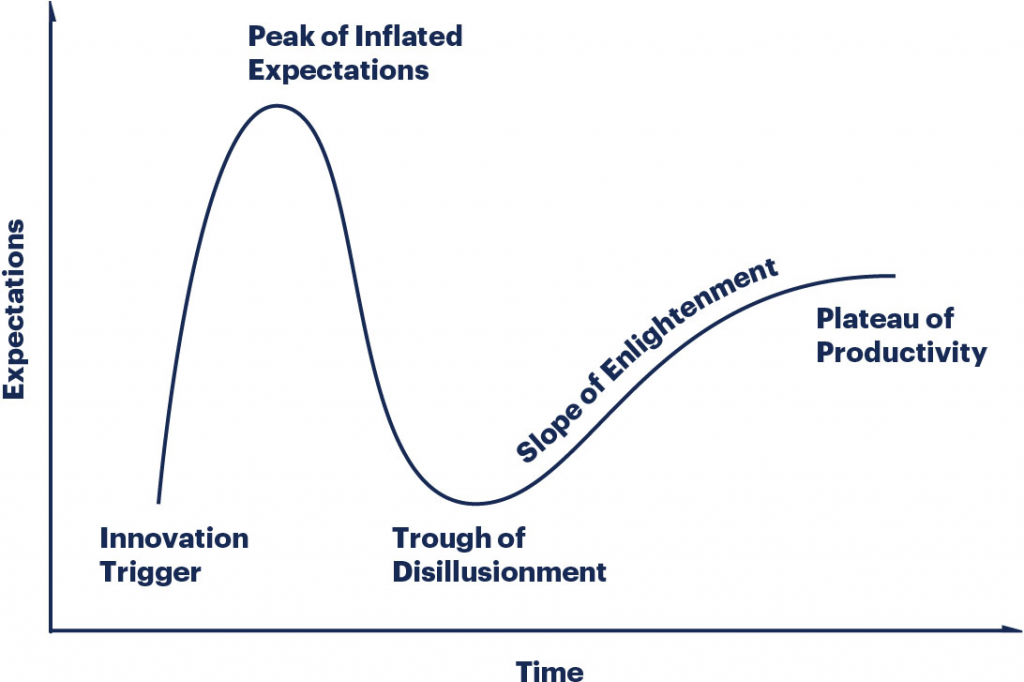

See also: Beyond the Digital Transformation Hype

Set your North Star

One key piece of advice for resource-constrained carriers undergoing digital transformation is to define your vision for it. Irrespective of size, it's important to have a vision for your digital transformation. It will enable you to map out the process and take small steps that are always moving the company in the direction of its end goal.

Thousands of important calls will have to be made as conditions evolve during the modernization journey. Not all those decisions will be clear-cut, easy or even a choice between good and bad outcomes. Your digital transformation vision makes priorities clear and gives you a North Star to guide you toward your destination, no matter how convoluted the path may become.