A culture clash in construction can cause confusion that leaves a project uninsured or the employer in breach of contract.

There is a culture clash in the construction industry.

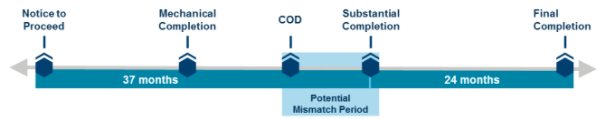

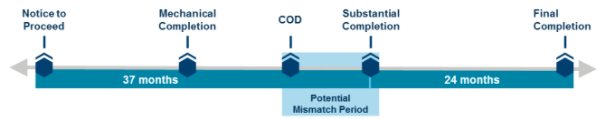

Employers and lenders want their contractors on the hook for any insurable losses as long as possible, whereas insurers want to switch from the construction phase to operations, where they usually have rights of subrogation against the contractor as soon as the facility has achieved commercial operations date (COD).

This can cause a mismatch where either a project may be uninsured but does not realize that is the case, or the employer is in breach of its contract with the contractor.

Both these potential situations can produce an excellent payday for lawyers, with a cost to the litigating parties far higher than the premium and advisory expenses to ensure it didn’t arise in the first place.

See also: Strategies to Master Massively Big Data

Most construction underwriters aim to have their policies cease once the project insured is able to operate and thereby achieve its (COD). Part of their desire for this is that they can then issue operational policies, which exclude some parties previously insured during the construction phase and thus ensure that insurers have rights of subrogation against those parties, primarily the engineering, procurement and construction (EPC) or turnkey contractor and major original equipment manufacturers (OEMs).

This approach may resonate and align with a concession agreement or power purchase agreement (PPA)-type contractual structure because these agreements often allow commercial revenue generation at the earliest possible time to facilitate usage of the project by the public, whether it be a hospital, power station or road, etc.

But the employer, which has the exposure to the availability and efficiency risks, wishes to receive a project of unquestioned quality, so many modern construction contracts demand a more stringent process for reaching a point where the employer will accept risk of loss back from the EPC contractor. These policies require the contractor to perform numerous tasks beyond simply helping achieve commercial revenue generation before a form of "completion" is awarded to the contractor and risk of loss reverts back to the employer.

Indeed, terms such as COD are rarely found in construction contracts. A recent example from a project where Aon is the broker involves a contract where the contractor is required to provide confirmation of the successful finalization of more than 20 items in addition to completing a testing regime to allow for the COD to be issued.

Therefore, the issue is essentially about a disparity between insurance industry practice and the risk allocation in the main contracts that create and drive projects and especially in public-private partnership (PPP, or P3), build-operate-transfer (BOT), build-own-operate-transfer (BOOT), build-own-operate (BOO)-type deals where greater lifecycle risk remains with the private sector stakeholders even during operation.

The disparity can lead to a situation in which:

- COD has been awarded under a concession-type agreement, and therefore commercial revenue is being generated,

- So the construction-period insurers are looking to come off risk,

- But the EPC contractor still has risk of loss (for at least a part of the project), which, contractually, is still considered as being under construction,

- And the owner has agreed within the construction contract to maintain insurance on behalf of the contractor until completion, however defined, in the construction contract

- Which can create confusion as to the date of commencement of any defects liability or maintenance or warranty period insurance cover.

- Plus, there are situations in which through this initial period (i.e. until the contractor has demonstrated that the project can meet the performance criteria required by the EPC contract, which may have some differences to the owner’s agreement with their client), it is the EPC contractor that operates the plant, thus ensuring the need for that entity to remain an insured.

See also: Why to Refocus on Data and Analytics

Therefore, it is essential that your construction risk and insurance adviser is:

- Involved early enough in the procurement process to become fully versed in the contractual terms, clauses and nuances of all the project agreements (i.e. not just the construction contract),

- Able to engineer an insurance solution that both meets the contractual requirements that the employer desires (or has agreed to) and leaves no stakeholder exposed to an uninsured loss that could result in legal action against the employer and even become an event of default under the loan agreement, and

- Able to explain the contracts and their ramifications to the insurance market to ensure that no gaps in coverage are created and that no insurer can subsequently say: “we weren’t told about that.”

Therefore, the issue is essentially about a disparity between insurance industry practice and the risk allocation in the main contracts that create and drive projects and especially in public-private partnership (PPP, or P3), build-operate-transfer (BOT), build-own-operate-transfer (BOOT), build-own-operate (BOO)-type deals where greater lifecycle risk remains with the private sector stakeholders even during operation.

The disparity can lead to a situation in which:

Therefore, the issue is essentially about a disparity between insurance industry practice and the risk allocation in the main contracts that create and drive projects and especially in public-private partnership (PPP, or P3), build-operate-transfer (BOT), build-own-operate-transfer (BOOT), build-own-operate (BOO)-type deals where greater lifecycle risk remains with the private sector stakeholders even during operation.

The disparity can lead to a situation in which: