In the complex world of insurance underwriting, mental health presents a growing challenge. The stigma surrounding mental health may or may not be slowly dissipating, but insurers continue to face a critical question: How can they accurately assess mental health risks while providing a positive customer experience?

A study by Reinsurance Group of America (RGA) offers compelling answers, leveraging behavioral science to transform the disclosure process.

The mental health disclosure dilemma

Certain mental health conditions can affect mortality and morbidity outcomes, making accurate disclosures crucial for risk assessment. However, the persistent stigma and confusion surrounding mental health often leads to reluctance in sharing this information. RGA's 2023 Mental Health Survey highlighted this challenge, with 55% of insurers reporting difficulties in underwriting and managing mental health-related claims.

The crux of the problem lies not only in applicants' hesitancy about disclosing but also in the very design of the questions they face. Traditional approaches often fall short, creating ambiguity and emotional discomfort that hinder accurate responses.

Five key behavioral science findings

RGA's behavioral science team conducted an extensive experiment involving 4,049 participants from the U.S. and Australia. The study tested various techniques to improve how customers interpret, process, and ultimately answer mental health questions. The results were striking, offering a new paradigm for insurance underwriting.

The study revealed five key findings:

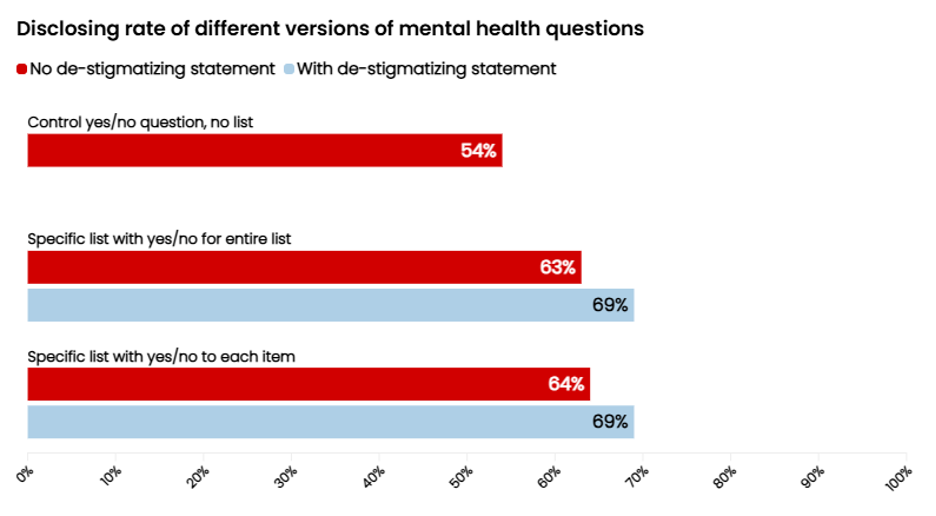

1. Specificity encourages disclosure

Providing a specific list of mental health conditions increased disclosure rates 17%. For example, instead of asking, "Have you ever been diagnosed with, suffered from, sought medical advice for, or received treatments for any mental health condition? Some examples include anxiety, post-traumatic stress, depression, or schizophrenia," an altered question that asks "Have you ever been diagnosed with, suffered from, sought medical advice for, or received treatments for any of these mental health conditions," followed by a list of 12 possibilities, yielded a more accurate yes/no response.

This approach reduced cognitive load, making it easier for applicants to recall and process information. Surprisingly, this more detailed question only took an average of six seconds longer to complete, with no negative impact on customer experience.

2. Normalizing mental health issues increases openness

Adding a de-stigmatizing statement that normalizes reporting mental health challenges boosted disclosure rates by an additional 10%.

This statement reads, "It is increasingly accepted by people everywhere that recognizing and taking care of our mental health is important. In fact, a recent study showed that the number of people reporting mental health conditions has increased by 20% since 2014, and many adults now take active steps to manage their mental health."

This simple addition increased openness and did not hurt overall user experience.

Better still, pairing this statement with a list of specific conditions noted in the first key finding added only 12 seconds to completion time.

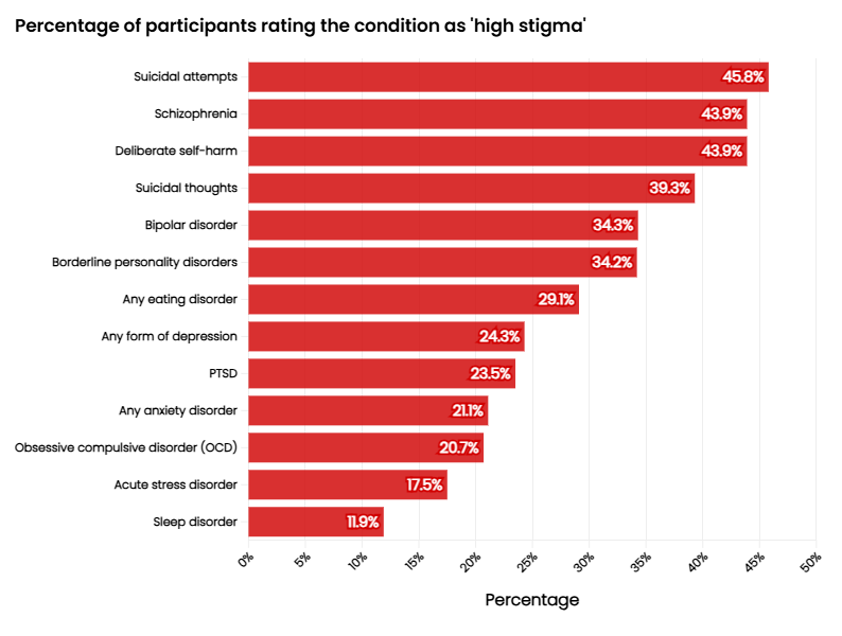

3. Segmenting stigma enhances detailed disclosures

Separating mental health conditions into distinct questions based on associated stigma levels increased the likelihood of participants disclosing multiple conditions. This approach improved disclosure rates for both highly stigmatized conditions, such as schizophrenia, and less stigmatized ones, such as stress and sleep disorders.

4. Balancing detail and emotional comfort helps

While detailed disclosures are valuable for underwriters, they can be emotionally challenging for customers. The study found no difference in disclosure rates between asking about "any conditions" vs. specific conditions. However, participants reported feeling more embarrassed when asked about specific conditions, highlighting the importance of emotional context in question design.

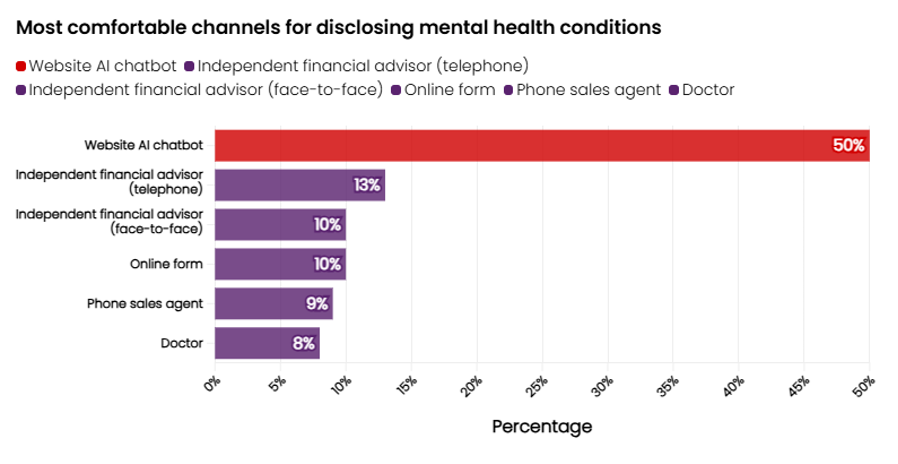

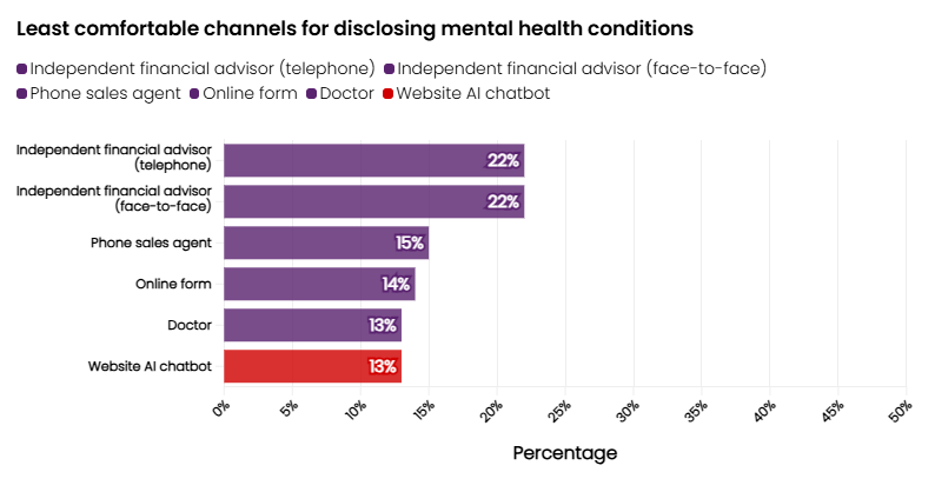

5. AI is an unexpected ally

Intriguingly, half of participants self-reported that an automated chatbot would be their most comfortable channel for disclosing mental health conditions. This preference aligns with psychological distance theory, suggesting that non-human interfaces may provide a more comfortable environment for sharing sensitive information.

Implications for the insurance industry

These findings have far-reaching implications for insurance underwriting and beyond. By incorporating behavioral science principles into question design, insurers can:

- Improve the accuracy of risk assessments

- Enhance the customer experience during the application process

- Potentially increase uptake of insurance products by making the process less daunting

Moreover, these insights can be applied to other sensitive areas of the insurance journey, such as claims forms and personalized claims conversations.

The future: A human-centered approach

As the insurance industry evolves, embracing a human-centered approach to underwriting becomes increasingly crucial. By understanding the cognitive and emotional factors that influence disclosure, insurers can create more effective, empathetic processes that benefit both the company and the customer.

The possibility of future integration of AI and chatbots presents exciting opportunities but would also create challenges requiring more detailed exploration. As these technologies advance toward reality, finding the right balance between psychological comfort and honest disclosure will be key.

By embracing these behavioral science insights, the insurance industry can take a significant step forward in addressing the mental health underwriting challenge.

Read the full report, "Improving Mental Health Disclosure for Insurance Underwriting."

References

• https://www.psychiatry.org/patients-families/stigma-and-discrimination

• https://www.cambridge.org/core/journals/bjpsych-open/article/creating-a-hierarchy-of-mental-healthstigma-testing-the-effect-of-psychiatric-diagnosis-on-stigma/3F7F87E0D4F50412B2A90072CFD8B995

• https://www.rgare.com/knowledge-center/article/how-can-life-insurers-improve-the-dtc-applicationprocess-a-behavioral-science-analysis

• Giesbrecht, G. F., Müller, U., & Miller, M. (2010). Psychological distancing in the development of executive function and emotion regulation. In B. W. Sokol, U. Müller, J. I. M. Carpendale, A. R. Young, & G. Iarocci (Eds), Self and social regulation: Social interaction and the development of social understanding and executive functions (p. 337–357). Oxford University Press.

• https://www.abi.org.uk/products-and-issues/choosing-the-right-insurance/health-insurance/mental-healthstandards/

• https://www.rgare.com/knowledge-center/article/searching-for-simplicity--improving-customercomprehension-in-life-insurance-through-behavioral-science

• https://www.rgare.com/knowledge-center/article/bringing-order-to-complexity-in-claim-forms-an-rgabehavioral-science-study