Source: Celent[/caption]

The kinds of strategies carriers take are heavily influenced by their view of the agent. In no other industry that I know of do we have a disagreement about who the customer is. Yet in the insurance industry, this is a matter of religion for many people. Some insurers say that the policyholder is the customer. After all, they’re the ones who write the check and use the service. But others are adamant that the agent is the customer. They influence or make the placement decision — deciding which insurer will write the account.

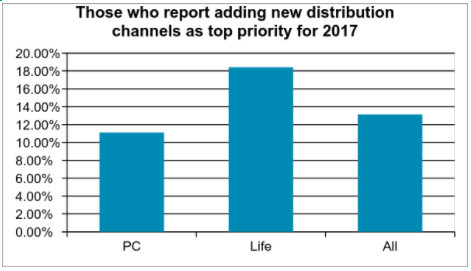

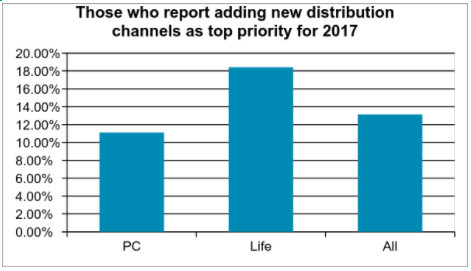

This question of who is the agent appears to have an impact on the investments insurers are making when it comes to managing the channels. Those who see the agent as their primary customer also are more likely to see distribution channel management as a top corporate priority.

In addition to the traditional channels, a number of new channels are emerging. The biggest news here is the explosion of insurtech startups that have high hopes of disrupting the acquisition process. They provide a unique experience online and hope to garner a large portion of the online marketplace because of their ease of doing business. Some focus on unique slivers of the marketplace. We are aware of more than 145 startups in the US and over 300 worldwide.

While a few insurers are very worried about the impact of InsureTech startups, most are watching closely and a little worried. This is more true for PC insurers where more than 40% say they’re a little worried – likely because of the greater activity in PC. Life insurers generally are watching, but not too worried, or see them as potential partners (31%).

Direct-to-consumer isn’t limited to insurtech startups. There are also a large number of insurers that are actively engaged in building out direct-to-consumer capabilities. Many insurers offer some sort of direct sales capabilities for personal auto. Increasingly, they are extending to this direct sales capability to more complex lines including homeowners, workers compensation, and small business. To be successful here, an insurer has to have a streamlined process, a slick user interface, minimal data input, tailored advice, and real-time decisions.

However, going direct to the consumer can create channel conflict. A variety of techniques are utilized to include and preserve the existing channel. Some will use a different brand such as biBerk, Say Insurance, TypTap, Haven Life, or eSurance. Some will assign an agent using algorithms that take into account location, status, or current production levels. Some will prompt the consumers to choose an agent.

Going direct isn’t the only new distribution strategy carriers are experimenting with. Digital agents, aggregators, partnerships with other carriers and partnerships with non-traditional distributors are all gaining traction. As consumers increasingly expect instant action, insurers are looking for ways to be available at the point of need rather than after the need has been generated.

Many insurers have defined themselves by their channel, saying “We’re a direct writer” or “We’re an independent agency company.” You don’t have to abandon those channels. But as a CEO of an insurtech startup said in a recent conversation, “Choosing your channel as the driving identity of your company is like me wearing a high school letterman jacket when I go out to dinner. It may be part of my identity, but I’m a 42 year old man. It doesn’t work anymore.” For most insurers, shedding the letterman jacket means integrating multiple distribution channels into whatever their historic context is.

See also: How to Find Distribution Payday

This doesn’t come cheap. Expanding channels requires expanded technology capabilities. As consumers become more digital, the channel that is changing the most is the agent channel. Consumers are already voting with their wallet and moving online in droves, and insurtech firms are taking advantage of that. But it’s not easy for insurers to just go direct. Most insurers don’t have the skills necessary to sell a policy. They may have programs to help the agents, but don’t have their own capabilities. Decisions need to be made about how to proceed. Will they create an in-house call center? Will they commit marketing dollars to organically generate traffic to the website?

As these operational decisions are being made, technology capabilities also must be expanded. Those who are going direct require a slick UI on the website as well as business rules, prefill, and workflow on the policy admin side to support straight-through processing. Ongoing servicing requires the ability to expose policies, bills, and claims functionality. Those who are partnering with aggregators or digital agencies need to build out connectivity solutions to pass data back and forth. Those who are partnering with other carriers may need an agency management system to track the leads and the commissions associated with them. And of course, the demand for data to manage these new channels is voracious. Distribution strategies are increasingly driving IT investments.

While multiple channels are effective at targeting specific markets, the increasing complexity of managing these channels is placing pressure on IT organizations. Additionally, the explosion of insurtech startups carries with it the potential for channel disruption. Carriers can work with these startups, invest in the startups, or imitate the startups, but those who ignore them do so at their own peril.

Source: Celent[/caption]

The kinds of strategies carriers take are heavily influenced by their view of the agent. In no other industry that I know of do we have a disagreement about who the customer is. Yet in the insurance industry, this is a matter of religion for many people. Some insurers say that the policyholder is the customer. After all, they’re the ones who write the check and use the service. But others are adamant that the agent is the customer. They influence or make the placement decision — deciding which insurer will write the account.

This question of who is the agent appears to have an impact on the investments insurers are making when it comes to managing the channels. Those who see the agent as their primary customer also are more likely to see distribution channel management as a top corporate priority.

In addition to the traditional channels, a number of new channels are emerging. The biggest news here is the explosion of insurtech startups that have high hopes of disrupting the acquisition process. They provide a unique experience online and hope to garner a large portion of the online marketplace because of their ease of doing business. Some focus on unique slivers of the marketplace. We are aware of more than 145 startups in the US and over 300 worldwide.

While a few insurers are very worried about the impact of InsureTech startups, most are watching closely and a little worried. This is more true for PC insurers where more than 40% say they’re a little worried – likely because of the greater activity in PC. Life insurers generally are watching, but not too worried, or see them as potential partners (31%).

Direct-to-consumer isn’t limited to insurtech startups. There are also a large number of insurers that are actively engaged in building out direct-to-consumer capabilities. Many insurers offer some sort of direct sales capabilities for personal auto. Increasingly, they are extending to this direct sales capability to more complex lines including homeowners, workers compensation, and small business. To be successful here, an insurer has to have a streamlined process, a slick user interface, minimal data input, tailored advice, and real-time decisions.

However, going direct to the consumer can create channel conflict. A variety of techniques are utilized to include and preserve the existing channel. Some will use a different brand such as biBerk, Say Insurance, TypTap, Haven Life, or eSurance. Some will assign an agent using algorithms that take into account location, status, or current production levels. Some will prompt the consumers to choose an agent.

Going direct isn’t the only new distribution strategy carriers are experimenting with. Digital agents, aggregators, partnerships with other carriers and partnerships with non-traditional distributors are all gaining traction. As consumers increasingly expect instant action, insurers are looking for ways to be available at the point of need rather than after the need has been generated.

Many insurers have defined themselves by their channel, saying “We’re a direct writer” or “We’re an independent agency company.” You don’t have to abandon those channels. But as a CEO of an insurtech startup said in a recent conversation, “Choosing your channel as the driving identity of your company is like me wearing a high school letterman jacket when I go out to dinner. It may be part of my identity, but I’m a 42 year old man. It doesn’t work anymore.” For most insurers, shedding the letterman jacket means integrating multiple distribution channels into whatever their historic context is.

See also: How to Find Distribution Payday

This doesn’t come cheap. Expanding channels requires expanded technology capabilities. As consumers become more digital, the channel that is changing the most is the agent channel. Consumers are already voting with their wallet and moving online in droves, and insurtech firms are taking advantage of that. But it’s not easy for insurers to just go direct. Most insurers don’t have the skills necessary to sell a policy. They may have programs to help the agents, but don’t have their own capabilities. Decisions need to be made about how to proceed. Will they create an in-house call center? Will they commit marketing dollars to organically generate traffic to the website?

As these operational decisions are being made, technology capabilities also must be expanded. Those who are going direct require a slick UI on the website as well as business rules, prefill, and workflow on the policy admin side to support straight-through processing. Ongoing servicing requires the ability to expose policies, bills, and claims functionality. Those who are partnering with aggregators or digital agencies need to build out connectivity solutions to pass data back and forth. Those who are partnering with other carriers may need an agency management system to track the leads and the commissions associated with them. And of course, the demand for data to manage these new channels is voracious. Distribution strategies are increasingly driving IT investments.

While multiple channels are effective at targeting specific markets, the increasing complexity of managing these channels is placing pressure on IT organizations. Additionally, the explosion of insurtech startups carries with it the potential for channel disruption. Carriers can work with these startups, invest in the startups, or imitate the startups, but those who ignore them do so at their own peril.Reinventing Sales: Shifting Channels

Distribution channels are exploding, but the industry still has a fundamental problem: We can't even agree on who the customer is.

Source: Celent[/caption]

The kinds of strategies carriers take are heavily influenced by their view of the agent. In no other industry that I know of do we have a disagreement about who the customer is. Yet in the insurance industry, this is a matter of religion for many people. Some insurers say that the policyholder is the customer. After all, they’re the ones who write the check and use the service. But others are adamant that the agent is the customer. They influence or make the placement decision — deciding which insurer will write the account.

This question of who is the agent appears to have an impact on the investments insurers are making when it comes to managing the channels. Those who see the agent as their primary customer also are more likely to see distribution channel management as a top corporate priority.

In addition to the traditional channels, a number of new channels are emerging. The biggest news here is the explosion of insurtech startups that have high hopes of disrupting the acquisition process. They provide a unique experience online and hope to garner a large portion of the online marketplace because of their ease of doing business. Some focus on unique slivers of the marketplace. We are aware of more than 145 startups in the US and over 300 worldwide.

While a few insurers are very worried about the impact of InsureTech startups, most are watching closely and a little worried. This is more true for PC insurers where more than 40% say they’re a little worried – likely because of the greater activity in PC. Life insurers generally are watching, but not too worried, or see them as potential partners (31%).

Direct-to-consumer isn’t limited to insurtech startups. There are also a large number of insurers that are actively engaged in building out direct-to-consumer capabilities. Many insurers offer some sort of direct sales capabilities for personal auto. Increasingly, they are extending to this direct sales capability to more complex lines including homeowners, workers compensation, and small business. To be successful here, an insurer has to have a streamlined process, a slick user interface, minimal data input, tailored advice, and real-time decisions.

However, going direct to the consumer can create channel conflict. A variety of techniques are utilized to include and preserve the existing channel. Some will use a different brand such as biBerk, Say Insurance, TypTap, Haven Life, or eSurance. Some will assign an agent using algorithms that take into account location, status, or current production levels. Some will prompt the consumers to choose an agent.

Going direct isn’t the only new distribution strategy carriers are experimenting with. Digital agents, aggregators, partnerships with other carriers and partnerships with non-traditional distributors are all gaining traction. As consumers increasingly expect instant action, insurers are looking for ways to be available at the point of need rather than after the need has been generated.

Many insurers have defined themselves by their channel, saying “We’re a direct writer” or “We’re an independent agency company.” You don’t have to abandon those channels. But as a CEO of an insurtech startup said in a recent conversation, “Choosing your channel as the driving identity of your company is like me wearing a high school letterman jacket when I go out to dinner. It may be part of my identity, but I’m a 42 year old man. It doesn’t work anymore.” For most insurers, shedding the letterman jacket means integrating multiple distribution channels into whatever their historic context is.

See also: How to Find Distribution Payday

This doesn’t come cheap. Expanding channels requires expanded technology capabilities. As consumers become more digital, the channel that is changing the most is the agent channel. Consumers are already voting with their wallet and moving online in droves, and insurtech firms are taking advantage of that. But it’s not easy for insurers to just go direct. Most insurers don’t have the skills necessary to sell a policy. They may have programs to help the agents, but don’t have their own capabilities. Decisions need to be made about how to proceed. Will they create an in-house call center? Will they commit marketing dollars to organically generate traffic to the website?

As these operational decisions are being made, technology capabilities also must be expanded. Those who are going direct require a slick UI on the website as well as business rules, prefill, and workflow on the policy admin side to support straight-through processing. Ongoing servicing requires the ability to expose policies, bills, and claims functionality. Those who are partnering with aggregators or digital agencies need to build out connectivity solutions to pass data back and forth. Those who are partnering with other carriers may need an agency management system to track the leads and the commissions associated with them. And of course, the demand for data to manage these new channels is voracious. Distribution strategies are increasingly driving IT investments.

While multiple channels are effective at targeting specific markets, the increasing complexity of managing these channels is placing pressure on IT organizations. Additionally, the explosion of insurtech startups carries with it the potential for channel disruption. Carriers can work with these startups, invest in the startups, or imitate the startups, but those who ignore them do so at their own peril.

Source: Celent[/caption]

The kinds of strategies carriers take are heavily influenced by their view of the agent. In no other industry that I know of do we have a disagreement about who the customer is. Yet in the insurance industry, this is a matter of religion for many people. Some insurers say that the policyholder is the customer. After all, they’re the ones who write the check and use the service. But others are adamant that the agent is the customer. They influence or make the placement decision — deciding which insurer will write the account.

This question of who is the agent appears to have an impact on the investments insurers are making when it comes to managing the channels. Those who see the agent as their primary customer also are more likely to see distribution channel management as a top corporate priority.

In addition to the traditional channels, a number of new channels are emerging. The biggest news here is the explosion of insurtech startups that have high hopes of disrupting the acquisition process. They provide a unique experience online and hope to garner a large portion of the online marketplace because of their ease of doing business. Some focus on unique slivers of the marketplace. We are aware of more than 145 startups in the US and over 300 worldwide.

While a few insurers are very worried about the impact of InsureTech startups, most are watching closely and a little worried. This is more true for PC insurers where more than 40% say they’re a little worried – likely because of the greater activity in PC. Life insurers generally are watching, but not too worried, or see them as potential partners (31%).

Direct-to-consumer isn’t limited to insurtech startups. There are also a large number of insurers that are actively engaged in building out direct-to-consumer capabilities. Many insurers offer some sort of direct sales capabilities for personal auto. Increasingly, they are extending to this direct sales capability to more complex lines including homeowners, workers compensation, and small business. To be successful here, an insurer has to have a streamlined process, a slick user interface, minimal data input, tailored advice, and real-time decisions.

However, going direct to the consumer can create channel conflict. A variety of techniques are utilized to include and preserve the existing channel. Some will use a different brand such as biBerk, Say Insurance, TypTap, Haven Life, or eSurance. Some will assign an agent using algorithms that take into account location, status, or current production levels. Some will prompt the consumers to choose an agent.

Going direct isn’t the only new distribution strategy carriers are experimenting with. Digital agents, aggregators, partnerships with other carriers and partnerships with non-traditional distributors are all gaining traction. As consumers increasingly expect instant action, insurers are looking for ways to be available at the point of need rather than after the need has been generated.

Many insurers have defined themselves by their channel, saying “We’re a direct writer” or “We’re an independent agency company.” You don’t have to abandon those channels. But as a CEO of an insurtech startup said in a recent conversation, “Choosing your channel as the driving identity of your company is like me wearing a high school letterman jacket when I go out to dinner. It may be part of my identity, but I’m a 42 year old man. It doesn’t work anymore.” For most insurers, shedding the letterman jacket means integrating multiple distribution channels into whatever their historic context is.

See also: How to Find Distribution Payday

This doesn’t come cheap. Expanding channels requires expanded technology capabilities. As consumers become more digital, the channel that is changing the most is the agent channel. Consumers are already voting with their wallet and moving online in droves, and insurtech firms are taking advantage of that. But it’s not easy for insurers to just go direct. Most insurers don’t have the skills necessary to sell a policy. They may have programs to help the agents, but don’t have their own capabilities. Decisions need to be made about how to proceed. Will they create an in-house call center? Will they commit marketing dollars to organically generate traffic to the website?

As these operational decisions are being made, technology capabilities also must be expanded. Those who are going direct require a slick UI on the website as well as business rules, prefill, and workflow on the policy admin side to support straight-through processing. Ongoing servicing requires the ability to expose policies, bills, and claims functionality. Those who are partnering with aggregators or digital agencies need to build out connectivity solutions to pass data back and forth. Those who are partnering with other carriers may need an agency management system to track the leads and the commissions associated with them. And of course, the demand for data to manage these new channels is voracious. Distribution strategies are increasingly driving IT investments.

While multiple channels are effective at targeting specific markets, the increasing complexity of managing these channels is placing pressure on IT organizations. Additionally, the explosion of insurtech startups carries with it the potential for channel disruption. Carriers can work with these startups, invest in the startups, or imitate the startups, but those who ignore them do so at their own peril.