Does the name Ned Ryerson sound familiar? Perhaps just vaguely familiar, but you can’t quite remember where you’ve seen or heard the name? I’ll give you a hint: BING! How about now? Still don’t remember? Did you see the Harold Ramis film, "Groundhog Day"? BING!! Remember the annoying insurance salesman who torments Bill Murray’s character, Phil Connors, every morning, claiming to have attended the same high school when they were kids? BING!!! Remember how he shouted his cheesy, personalized catch-word as he badgered Phil to buy nearly every type of insurance known to man? BING!!!! “Needlenose Ned"? "Ned the Head"? BING!!!!! That was Ned Ryerson. (I’ll spare you the catch-word this last time.)

For the five people on the planet who have not yet seen this comedy classic, a supernatural event forces a self-absorbed TV weatherman covering the annual Groundhog Day event in Punxsutawney, PA, to repeat the same day over and over again. Each morning, weatherman Phil Connors awakes on Feb. 2 and re-lives the same set of events, interacting with the same people, including the cringe-worthy Ned Ryerson. The first three or four times Phil encounters Ned, he does his best to avoid him. By their fourth encounter in the movie, Phil flattens Ned with a vicious punch before he can once again launch into his déjà vu sales pitch.

After repeating the same day for the hundredth, thousandth or possibly millionth time, Phil Connors undergoes a personal transformation from egotistical jerk to a kind, caring person, thus allowing the calendar to finally turn to Feb. 3. And, yes, part of that penance included a purchase of insurance coverage from Ned Ryerson. After all, what greater demonstration of humanity is there than to be nice to an insurance salesman?

Houston, We Have an Image Problem

Ned Ryerson is the fictional embodiment of nearly every insurance stereotype in a single person. Unable to turn his “whistling belly button trick” from the high school talent show into a professional career, he did the next best thing; insurance. He’s creepy. He’s annoying. He tells bad jokes that only he finds funny. He never takes a hint. He’s relentless. He displays many of the worst traits perceived in our industry, and, sadly, he is one of the more positive depictions of the insurance industry that has appeared on the big screen.

Consider the alternatives. In the Denzel Washington movie "John Q," a desperate father holds a hospital wing hostage and forces doctors to perform a potentially life-saving surgery on his dying child because his insurance company will not authorize the procedure. "The Rainmaker," a screen adaptation of the John Grisham novel, follows a lawyer suing an insurance company for denying a bone marrow transplant to a young man who later dies as a result of the company’s “deny all claims” directive. "Sicko" offers a scathing (albeit slanted) view of the American health insurance system that takes billions of dollars from individuals and then refuses to provide them coverage.

If we are to believe Hollywood, the insurance industry steals hard-earned money from people who can least afford to lose it, seizes every opportunity to deny benefits to those in need and condemns children to death to protect profits. By contrast, Ned Ryerson is practically the patron saint of the industry.

See also: Future of Insurance Looks Very Different

So what does Ned Ryerson have to do with the future of insurance? The Bureau of Labor Statistics projects the insurance industry will need to add nearly 200,000 jobs in the next five to six years to match projected demand. Brokerage firm Guy Carpenter projects that as much as 25% of the insurance industry will have reached retirement age by 2018. With so many stable, well-paying insurance careers available, it would seem the insurance industry should have no issues filling its employment coffers. And yet we do. In fact, we may be approaching a crisis-level talent gap. Why? Perhaps it’s because so few young people have had a positive introduction to the insurance industry. Maybe it’s because there are only a handful of universities offering insurance programs. Or just maybe, college students simply don’t want to envision their future selves as Ned Ryerson.

No Degrees of Separation

Insurance is one of the only major industries in the world that does not require or even encourage prospective employees to have an educational background in the field. There are insurance professionals who hold diplomas in English, finance, economics, liberal arts and a myriad of other disciplines but virtually no insurance degrees. When people learn that some universities offer insurance as a degree program, their reactions usually fall into one of two categories:

- Sasquatch sighting: I’ve heard rumors such things exist, but I’ve never actually seen one in person.

- Unstable personality concern: You mean people actually WANT to do this for a living? Perhaps these lost souls should consider seeking professional treatment for this condition….

Why is it so surprising that an insurance professional would have an insurance degree when it’s commonplace for others to hold degrees in their chosen fields? Attorneys attend law schools. Mechanics go to technical training schools. Doctors go to medical school. Why wouldn’t an underwriter or broker study insurance? Think about it. How would a patient react if he learned his neurosurgeon attended culinary school? Would an accounting firm hire someone who studied ballet? What if the electrician re-wiring your home offered his undergraduate degree in physical therapy as proof of qualification? Wouldn’t that be strange and possibly a little unsettling? Yet this is how most of the insurance industry operates.

Professionals with educational backgrounds outside of insurance aren’t necessarily less qualified than those with insurance degrees. There are many exceptional people in our industry who did not pursue insurance as a course of study but still found their way to an insurance career. Yet how many talented young people do we miss every year simply because insurance is not offered as a career choice at the schools they attend?

If we are to solve the long-term issue of youth and talent acquisition facing our industry, we will need to make insurance a more desirable and available option for college students. To do so, we need to help more colleges and universities across the country develop meaningful insurance programs. Unless the insurance industry supports college degree programs, students aren’t likely to consider insurance as a career path worthy of their time and talents

A Bridge Under Troubled Waters

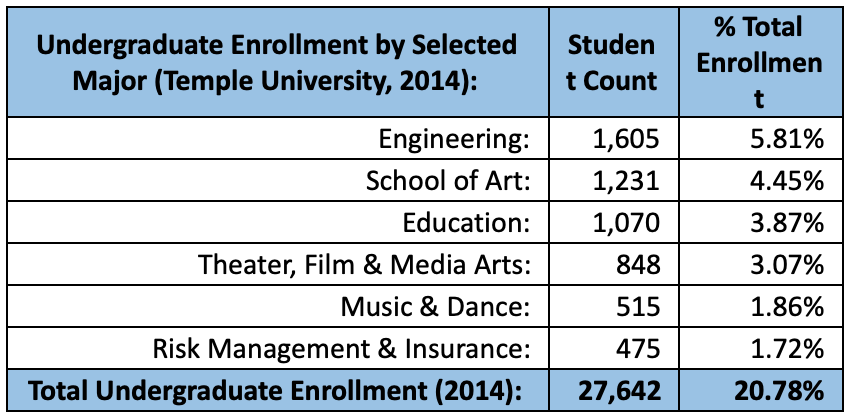

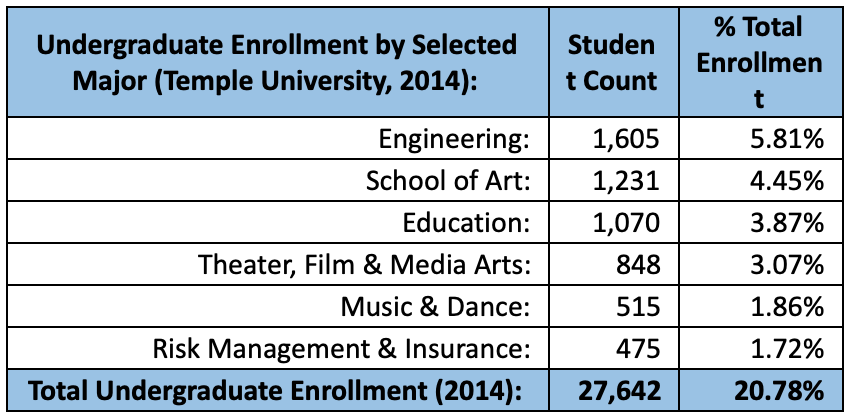

According to a 2015 study published by Business Insurance, Temple University hosted the largest insurance program in the country with 475 undergraduate students in 2014. On the surface, this number may seem impressive but when compared with the enrollment in other courses of study and the projected needs of the insurance industry over the next few years, a very different picture emerges.

Of the nearly 28,000 undergraduate students attending this university in 2014, less than 2% chose insurance as a potential career; fewer than those pursuing music and dance. If we assume half of the undergraduates studying insurance would be graduating in any given year, this particular program would fill fewer than 1,200 positions over the next five years.

Gamma Iota Sigma, the insurance industry’s lone national professional fraternity, has active local chapters in just 50 of the 3,000 or so higher education institutions in the U.S. offering four-year degree programs. This means insurance is available as a course of study in just one out of every 60 colleges and universities across the country. In 2014, the top 20 schools offering insurance as a major had roughly 3,400 undergraduate students enrolled in those programs collectively. If the Bureau of Labor Statistics’ projections are correct and our industry will have about 200,000 jobs to fill within five years, there won’t be enough insurance graduates to fill the job vacancies left by those who are retiring, let alone the new positions.

To bridge this impending employment gap, our industry will need to look to other non-insurance graduates to fill the void. For some of these individuals, insurance will provide a challenging and rewarding career, but for others it will be an option of last resort. The best and brightest of those pursuing other fields of study will likely have found homes in their chosen career paths. Insurance will get the leftovers. If the insurance industry is to continue to evolve and improve at the same rate as those we insure, something will need to change.

The Lesser of Two Evils

In recent years, a great number of studies have been published on the attitudes, values and work ethics of millennials. A 2011 report issued by PricewaterhouseCoopers (PwC), Millennials at Work; Reshaping the Workplace, indicates personal development opportunities, organization reputation, work/life balance and opportunity to make a difference are some of the key factors millennials consider when choosing a job. Compensation was also a factor but was not among the top three criteria millennials used to make career choices.

The insurance industry would seem to meet most, if not all, of the essential criteria millennials use to judge prospective employers. There is an enormous opportunity for personal development and advancement for young people entering the insurance industry over the next few years. Likewise, many employers in the insurance industry have moved toward flexible working hours and work-from-home arrangements to accommodate a better work/life balance for their employees. Lastly, the insurance industry undoubtedly makes a difference for many people. Insurance allows people to buy homes, operate businesses and recover from life-threatening injuries without fear of possible financial ruin. It even helps people care for their families after they die.

If not for one glaring exception noted in the PwC study, the insurance industry would appear to be a nearly perfect fit for millennials seeking professional employment opportunities. But to quote the great sage Ned Ryerson, that one exception is a DOOOZY. When asked if there were any specific industries millennials would not consider based on reputation alone, insurance ranked second behind only the oil & natural gas industry. Even Ned would have a tough time spinning that one to a prospective millennial. You may hate us, but our carbon footprint is really small... How’s that for a rebuttal and recruiting pitch?

School is Back in Session

The reality for most insurance industry recruiters is that the battle for millennial talent historically was lost before it even began. Not only do we not have an extensive network of colleges and universities providing insurance as a course of study for incoming students but most prospective millennial candidates decided against insurance as a potential career option long before they even chose a college to attend. If the insurance industry is to reverse this trend and attract talented youth, we will need to develop a strategy to engage young people before they begin pursuing a profession.

Traditional career days and fairs at most high schools and colleges generate a relatively high attendance but typically offer little in the way of meaningful interaction with individual students. The likelihood of convincing someone to consider an insurance career in a two or three minute conversation is minimal. A guest lecture lasting 30 minutes (or more) provides much better odds. Many high schools now offer business classes as electives to their students. Some of these schools will occasionally invite guest lecturers from local businesses to speak in their classrooms. A guest lecture that presents an insurance career as a positive and challenging opportunity could be the first introduction to a rewarding career path for some students.

See also: Future of Insurance: Risk Pools of One

Not sure if your local high school offers business classes as part of the curriculum or if they allow guest lecturers into their classrooms? Why not pick up the phone and ask? We call on prospective clients nearly every day asking them to place their business with us. Shouldn’t we put forth the same effort to secure the future of our industry?

Supporting existing college insurance programs will also be a critical component to securing top notch talent in the future. For companies that want to participate in scholarship and grant programs without the administrative responsibilities of operating those programs, there are options available. Organizations like the Spencer Educational Foundation provide scholarships from donor companies and individuals to students pursuing careers in risk management and insurance. These scholarships provide real incentives for talented students to choose insurance as a career. Individuals can likewise help aspiring college graduates by participating in mentorship programs that pair graduating students with experienced professionals. Having a mentor available may make the transition from college to professional life easier and possibly improve the chances of those students remaining in the industry for the long term.

Lastly, while there are only about 50 colleges and universities with established insurance programs nationwide, that leaves about 3,000 opportunities to develop new insurance degree programs. It is likely that at least a handful of the multitude of retiring insurance professionals may simply be looking for a change of scenery rather than a complete departure from the working world. A new career as a college professor could be an option for some. If just one college in every state were to create a small staff of adjunct professors from the pool of retiring insurance professionals, the number of colleges in the United States offering insurance as a degree program would nearly double. This wouldn’t eliminate the talent gap on its own, but as Ned Ryerson would likely agree, it sure as heckfire would be a step in the right direction. Am I right or am I right?

Of the nearly 28,000 undergraduate students attending this university in 2014, less than 2% chose insurance as a potential career; fewer than those pursuing music and dance. If we assume half of the undergraduates studying insurance would be graduating in any given year, this particular program would fill fewer than 1,200 positions over the next five years.

Gamma Iota Sigma, the insurance industry’s lone national professional fraternity, has active local chapters in just 50 of the 3,000 or so higher education institutions in the U.S. offering four-year degree programs. This means insurance is available as a course of study in just one out of every 60 colleges and universities across the country. In 2014, the top 20 schools offering insurance as a major had roughly 3,400 undergraduate students enrolled in those programs collectively. If the Bureau of Labor Statistics’ projections are correct and our industry will have about 200,000 jobs to fill within five years, there won’t be enough insurance graduates to fill the job vacancies left by those who are retiring, let alone the new positions.

To bridge this impending employment gap, our industry will need to look to other non-insurance graduates to fill the void. For some of these individuals, insurance will provide a challenging and rewarding career, but for others it will be an option of last resort. The best and brightest of those pursuing other fields of study will likely have found homes in their chosen career paths. Insurance will get the leftovers. If the insurance industry is to continue to evolve and improve at the same rate as those we insure, something will need to change.

The Lesser of Two Evils

In recent years, a great number of studies have been published on the attitudes, values and work ethics of millennials. A 2011 report issued by PricewaterhouseCoopers (PwC), Millennials at Work; Reshaping the Workplace, indicates personal development opportunities, organization reputation, work/life balance and opportunity to make a difference are some of the key factors millennials consider when choosing a job. Compensation was also a factor but was not among the top three criteria millennials used to make career choices.

The insurance industry would seem to meet most, if not all, of the essential criteria millennials use to judge prospective employers. There is an enormous opportunity for personal development and advancement for young people entering the insurance industry over the next few years. Likewise, many employers in the insurance industry have moved toward flexible working hours and work-from-home arrangements to accommodate a better work/life balance for their employees. Lastly, the insurance industry undoubtedly makes a difference for many people. Insurance allows people to buy homes, operate businesses and recover from life-threatening injuries without fear of possible financial ruin. It even helps people care for their families after they die.

If not for one glaring exception noted in the PwC study, the insurance industry would appear to be a nearly perfect fit for millennials seeking professional employment opportunities. But to quote the great sage Ned Ryerson, that one exception is a DOOOZY. When asked if there were any specific industries millennials would not consider based on reputation alone, insurance ranked second behind only the oil & natural gas industry. Even Ned would have a tough time spinning that one to a prospective millennial. You may hate us, but our carbon footprint is really small... How’s that for a rebuttal and recruiting pitch?

School is Back in Session

The reality for most insurance industry recruiters is that the battle for millennial talent historically was lost before it even began. Not only do we not have an extensive network of colleges and universities providing insurance as a course of study for incoming students but most prospective millennial candidates decided against insurance as a potential career option long before they even chose a college to attend. If the insurance industry is to reverse this trend and attract talented youth, we will need to develop a strategy to engage young people before they begin pursuing a profession.

Traditional career days and fairs at most high schools and colleges generate a relatively high attendance but typically offer little in the way of meaningful interaction with individual students. The likelihood of convincing someone to consider an insurance career in a two or three minute conversation is minimal. A guest lecture lasting 30 minutes (or more) provides much better odds. Many high schools now offer business classes as electives to their students. Some of these schools will occasionally invite guest lecturers from local businesses to speak in their classrooms. A guest lecture that presents an insurance career as a positive and challenging opportunity could be the first introduction to a rewarding career path for some students.

See also: Future of Insurance: Risk Pools of One

Not sure if your local high school offers business classes as part of the curriculum or if they allow guest lecturers into their classrooms? Why not pick up the phone and ask? We call on prospective clients nearly every day asking them to place their business with us. Shouldn’t we put forth the same effort to secure the future of our industry?

Supporting existing college insurance programs will also be a critical component to securing top notch talent in the future. For companies that want to participate in scholarship and grant programs without the administrative responsibilities of operating those programs, there are options available. Organizations like the Spencer Educational Foundation provide scholarships from donor companies and individuals to students pursuing careers in risk management and insurance. These scholarships provide real incentives for talented students to choose insurance as a career. Individuals can likewise help aspiring college graduates by participating in mentorship programs that pair graduating students with experienced professionals. Having a mentor available may make the transition from college to professional life easier and possibly improve the chances of those students remaining in the industry for the long term.

Lastly, while there are only about 50 colleges and universities with established insurance programs nationwide, that leaves about 3,000 opportunities to develop new insurance degree programs. It is likely that at least a handful of the multitude of retiring insurance professionals may simply be looking for a change of scenery rather than a complete departure from the working world. A new career as a college professor could be an option for some. If just one college in every state were to create a small staff of adjunct professors from the pool of retiring insurance professionals, the number of colleges in the United States offering insurance as a degree program would nearly double. This wouldn’t eliminate the talent gap on its own, but as Ned Ryerson would likely agree, it sure as heckfire would be a step in the right direction. Am I right or am I right?

Of the nearly 28,000 undergraduate students attending this university in 2014, less than 2% chose insurance as a potential career; fewer than those pursuing music and dance. If we assume half of the undergraduates studying insurance would be graduating in any given year, this particular program would fill fewer than 1,200 positions over the next five years.

Gamma Iota Sigma, the insurance industry’s lone national professional fraternity, has active local chapters in just 50 of the 3,000 or so higher education institutions in the U.S. offering four-year degree programs. This means insurance is available as a course of study in just one out of every 60 colleges and universities across the country. In 2014, the top 20 schools offering insurance as a major had roughly 3,400 undergraduate students enrolled in those programs collectively. If the Bureau of Labor Statistics’ projections are correct and our industry will have about 200,000 jobs to fill within five years, there won’t be enough insurance graduates to fill the job vacancies left by those who are retiring, let alone the new positions.

To bridge this impending employment gap, our industry will need to look to other non-insurance graduates to fill the void. For some of these individuals, insurance will provide a challenging and rewarding career, but for others it will be an option of last resort. The best and brightest of those pursuing other fields of study will likely have found homes in their chosen career paths. Insurance will get the leftovers. If the insurance industry is to continue to evolve and improve at the same rate as those we insure, something will need to change.

The Lesser of Two Evils

In recent years, a great number of studies have been published on the attitudes, values and work ethics of millennials. A 2011 report issued by PricewaterhouseCoopers (PwC), Millennials at Work; Reshaping the Workplace, indicates personal development opportunities, organization reputation, work/life balance and opportunity to make a difference are some of the key factors millennials consider when choosing a job. Compensation was also a factor but was not among the top three criteria millennials used to make career choices.

The insurance industry would seem to meet most, if not all, of the essential criteria millennials use to judge prospective employers. There is an enormous opportunity for personal development and advancement for young people entering the insurance industry over the next few years. Likewise, many employers in the insurance industry have moved toward flexible working hours and work-from-home arrangements to accommodate a better work/life balance for their employees. Lastly, the insurance industry undoubtedly makes a difference for many people. Insurance allows people to buy homes, operate businesses and recover from life-threatening injuries without fear of possible financial ruin. It even helps people care for their families after they die.

If not for one glaring exception noted in the PwC study, the insurance industry would appear to be a nearly perfect fit for millennials seeking professional employment opportunities. But to quote the great sage Ned Ryerson, that one exception is a DOOOZY. When asked if there were any specific industries millennials would not consider based on reputation alone, insurance ranked second behind only the oil & natural gas industry. Even Ned would have a tough time spinning that one to a prospective millennial. You may hate us, but our carbon footprint is really small... How’s that for a rebuttal and recruiting pitch?

School is Back in Session

The reality for most insurance industry recruiters is that the battle for millennial talent historically was lost before it even began. Not only do we not have an extensive network of colleges and universities providing insurance as a course of study for incoming students but most prospective millennial candidates decided against insurance as a potential career option long before they even chose a college to attend. If the insurance industry is to reverse this trend and attract talented youth, we will need to develop a strategy to engage young people before they begin pursuing a profession.

Traditional career days and fairs at most high schools and colleges generate a relatively high attendance but typically offer little in the way of meaningful interaction with individual students. The likelihood of convincing someone to consider an insurance career in a two or three minute conversation is minimal. A guest lecture lasting 30 minutes (or more) provides much better odds. Many high schools now offer business classes as electives to their students. Some of these schools will occasionally invite guest lecturers from local businesses to speak in their classrooms. A guest lecture that presents an insurance career as a positive and challenging opportunity could be the first introduction to a rewarding career path for some students.

See also: Future of Insurance: Risk Pools of One

Not sure if your local high school offers business classes as part of the curriculum or if they allow guest lecturers into their classrooms? Why not pick up the phone and ask? We call on prospective clients nearly every day asking them to place their business with us. Shouldn’t we put forth the same effort to secure the future of our industry?

Supporting existing college insurance programs will also be a critical component to securing top notch talent in the future. For companies that want to participate in scholarship and grant programs without the administrative responsibilities of operating those programs, there are options available. Organizations like the Spencer Educational Foundation provide scholarships from donor companies and individuals to students pursuing careers in risk management and insurance. These scholarships provide real incentives for talented students to choose insurance as a career. Individuals can likewise help aspiring college graduates by participating in mentorship programs that pair graduating students with experienced professionals. Having a mentor available may make the transition from college to professional life easier and possibly improve the chances of those students remaining in the industry for the long term.

Lastly, while there are only about 50 colleges and universities with established insurance programs nationwide, that leaves about 3,000 opportunities to develop new insurance degree programs. It is likely that at least a handful of the multitude of retiring insurance professionals may simply be looking for a change of scenery rather than a complete departure from the working world. A new career as a college professor could be an option for some. If just one college in every state were to create a small staff of adjunct professors from the pool of retiring insurance professionals, the number of colleges in the United States offering insurance as a degree program would nearly double. This wouldn’t eliminate the talent gap on its own, but as Ned Ryerson would likely agree, it sure as heckfire would be a step in the right direction. Am I right or am I right?