“Do you know the only thing that gives me pleasure? It’s to see my dividends come in.” – John D. Rockefeller, 1908

It’s 2022, and inflation, geopolitical instability, rising interest rates and more are driving uncertainty to heights not reached since the late 1970s. Meanwhile, economic growth is falling and market volatility is at its highest since the onset of the pandemic. In the wake of this, many insurance companies have begun to reevaluate their equity investments. Is it time for them to follow John D. Rockefeller’s example and focus on dividend-paying equities?

When compared with an index equity strategy such as the S&P 500 Index commonly found in many insurance company portfolios, a dividend-paying equity strategy may offer insurers lower volatility, income opportunities and potential tax advantages. It may also prove to be a more effective equity strategy during a period of rising interest rates when viewed from a duration perspective.

A History of Lower Downside Risk

Historically, insurance companies have been reluctant to invest in equities, preferring fixed income securities’ typically higher yields and lower volatility. More recently, the need for portfolio growth led companies to take on equity exposure, often via passive index funds. Insurers became more willing to accept the higher volatility and lower income of equities in return for their potential capital appreciation. Unfortunately, insurers also accepted that they would only be able to convert the value of their equities into cash by selling shares, triggering a taxable event.

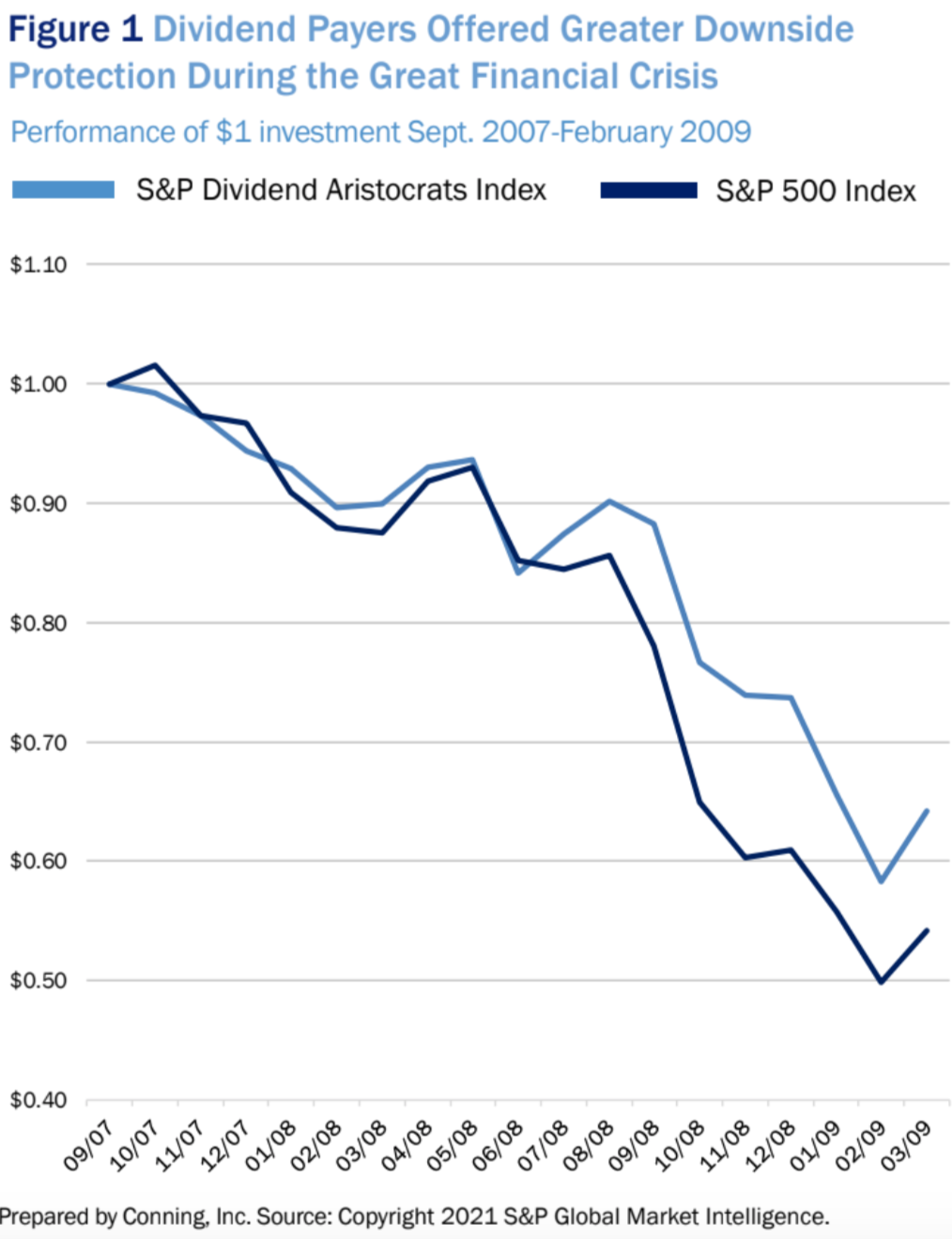

The Great Financial Crisis (GFC) of 2008-2009 caused many insurance companies and asset managers to again adjust their approach to equity investing. During the GFC, insurance companies experienced the downside of passive investing: When the market falls, passive investments bear the full brunt of the downturn. Lost to many in the chaos of the time was that dividend-paying stocks did not drop nearly as much as the broader market (as Figure 1 illustrates, the decline of dividend-paying stocks was only about 80% of the broader equity market between September 2007 and February 2009).

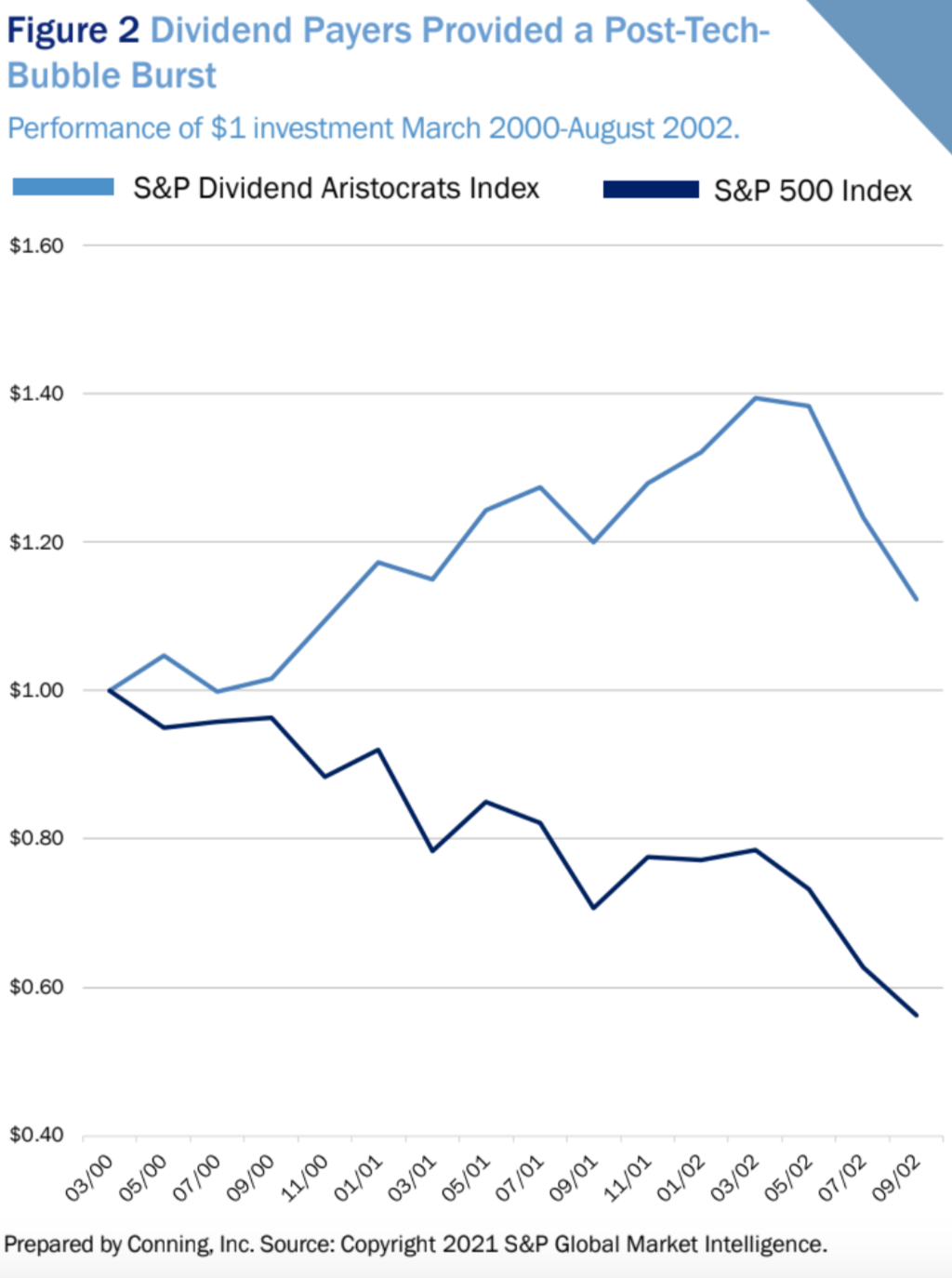

In fact, dividend-paying stocks have outperformed in other downturns, as well, notably after the tech bubble burst in 2001 (see Figure 2). After the GFC caused interest rates to drop and equity yields to rise, insurance companies began to look for an equity investment solution that combined higher yields with lower volatility. Many turned to dividend-paying stocks.

See also: Private Equity Drives Agency Change

Benefits of Dividend-Paying Stocks for Insurers

Dividend-paying stocks can offer insurers several potential benefits, mainly steady income streams, lower volatility and some tax advantages.

Income Stream

Income-producing investments are very important for insurance companies and typically make up most of their assets. Companies often use this income to pay operating costs or increase earnings. Many dividend-paying stocks offer a consistent income stream paid on a quarterly basis. In fact, many dividend payers (unlike most fixed income securities) offer growing payouts by annually raising their dividend, while also offering the potential for capital appreciation if the equity market rises.

Lower Volatility

Equities tend to be riskier than bonds because the equity of a company represents a subordinate claim on the cash flows of a company relative to its bonds. As such, equity markets tend to loathe uncertainty because it calls into question the present value of these future cash flows. Within the cross-section of equities, though, dividend-paying stocks tend to have lower volatility. Because these stocks typically provide a cash payout each quarter, the level of return uncertainty associated with them is lower than for companies whose expected equity return is based solely on price appreciation.

Tax Advantages

Companies that receive dividends from their equity investments can take advantage of a tax rule that the average investor cannot. Known as the Dividends Received Deduction (DRD), this rule allows companies to deduct from their taxable income a portion (between 50% and 65%) of the dividends they receive from other companies. This rule applies to all dividends received except for those paid by real estate investment trusts (REITs) or other companies that are tax-exempt according to the Internal Revenue Code.

Tax-advantaged dividends tend to be a preferred source of funding from equities for these companies because the other source would be the sale of equity investments. Again, a good portion of dividends received can be deducted from taxable income, but equity sales will always generate either a capital gain (which is taxable) or a loss (which will reduce earnings).

Taken together, these three benefits provide a compelling argument for insurers to consider dividend-paying equities rather than an index fund representing the broader equity markets.

A “Shorter Duration” Equity

Insurers always face the risk of inflation, and that is especially true in 2022. Rising interest rates are also a reality now as the U.S. Federal Reserve has begun to aggressively raise rates and promises to continue this practice, with at least several more 50-basis-point increases expected in the near term, in an effort to tamp down inflation rates not seen since the late 1970s. Conning’s view is that most dividend-paying stocks will likely offer better protection in a rising rate environment than stocks that don’t pay a dividend.

Fixed-income investors are familiar with the concept of “duration,” which helps predict the behavior of bond prices as interest rates change. If we compare a 10-year bond that pays a coupon twice a year to a 10-year bond that pays no coupon until maturity (a “zero coupon” bond), we can see that the coupon-paying security will have a lower duration than the zero-coupon bond. As a result, the price of the coupon-paying bond will fall less than the zero-coupon bond as interest rates rise.

A similar case can be made that dividend-paying stocks are lower-duration instruments than non-dividend-paying stocks. In a general sense, any stock will have a higher time to maturity (essentially infinite) than any bond. As in many things, though, what matters is relative. With stocks, the analogy to the principal payment that is received when a bond matures is the price received upon the sale of the stocks. The intrinsic value of the stock is based upon the present value of the sale price and any payments received before the sale.

Because dividend-paying equities typically pay a consistent income stream in the nearer term while non-payers do not, dividend-paying equities effectively have the lower duration of the two groups and should be affected less as rates rise.

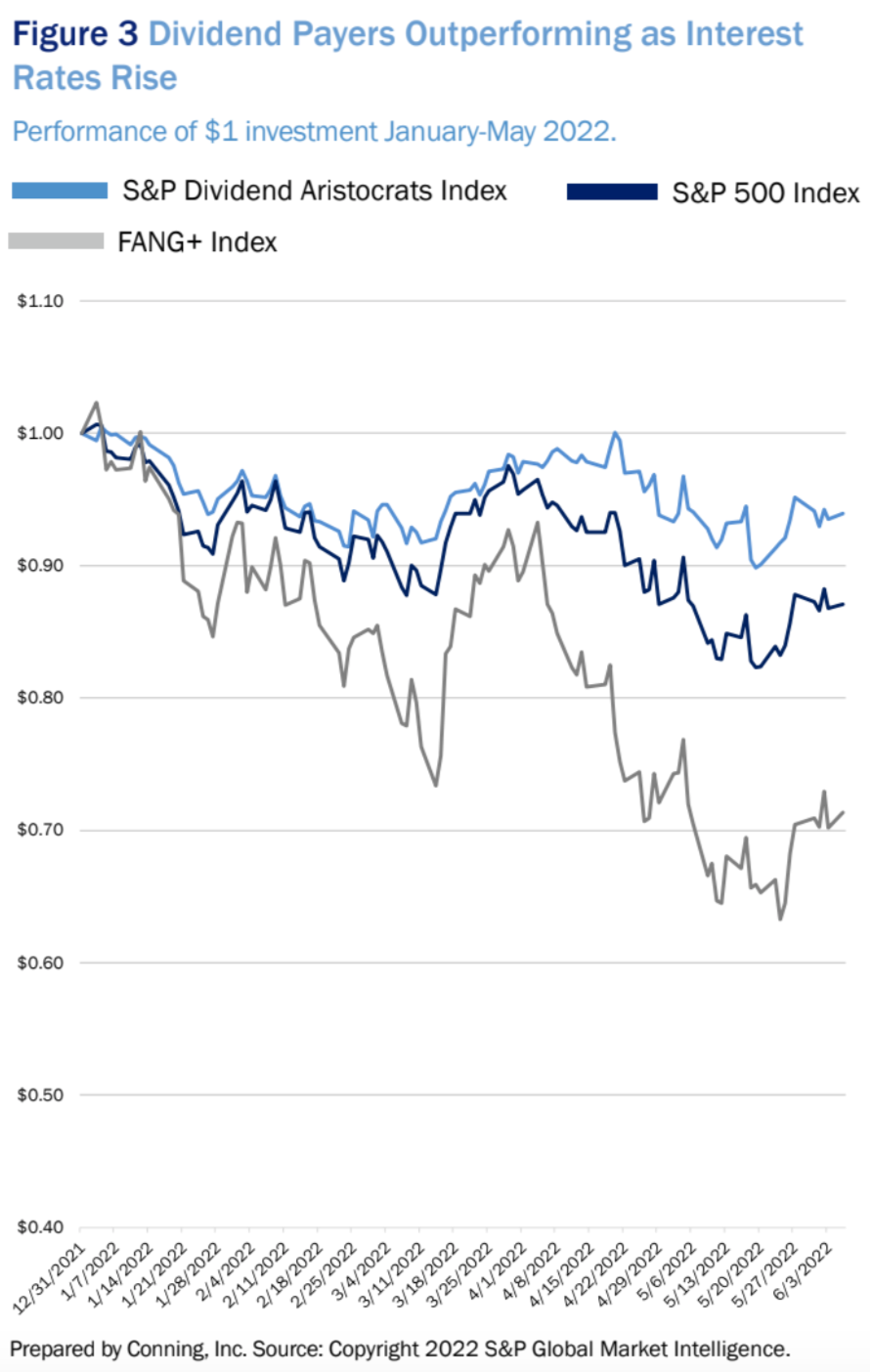

The relative relationship between the two groups of stocks (dividend payers versus non-payers) in a rising rate setting tends to hold up well across the economic spectrum, with a couple of exceptions. Stocks that pay very high dividends and also have significant debt on their balance sheets can be hurt more by rising rates than other dividend payers. For example, REITs, telecoms and utilities tend to suffer more as rates rise than less levered industries that pay more modest dividends. This implies that focusing investments on the very highest yielding stocks might not be wise in this environment. A strong argument can be made for investing in a broadly diversified portfolio of dividend-paying stocks to soften some price volatility during rate increases while still providing a competitive income stream (see Figure 3).

Going Forward

History has demonstrated the potential benefits of equity investments for insurance companies. Passive strategies, though, have tended not to provide the income stream, lower volatility or tax advantages of a dividend-paying approach. In addition, many executives and investors have yet to experience a period of rising rates as sharp as is likely in 2022.

Income-producing equity portfolios may be a good fit for insurance companies but should be approached with caution. Not all income portfolios are created equal, and they can differ widely in terms of the consistency of income streams, volatility and tax advantages, not to mention sensitivity to interest-rate increases.

Many small and mid-size insurers may not have the capabilities or desire to manage equities internally and should consider an external manager to provide them the insights into these issues and to help them navigate through an environment that promises to be very volatile for the foreseeable future.

Risks of Dividend-Paying Stocks for Insurers

Equity prices will decline in bear markets. Potential changes in dividend tax rates could lessen demand for the asset class. A sharp increase in interest rates could affect prices of income-oriented equities.