Many industry executives talk confidently about the opportunities the Internet of Things (Iot) presents, but is it really an exciting opportunity, or is it all hype?

To begin to think about opportunities and threats, a simple operational definition is probably going to help:

The Internet of Things is: Different “things” connected by a network that collect and transmit data; interpret it and then make use of the aggregated information. Those “things” could be everyday items in homes, in workplaces, in vehicles and in public. The technology allows automated responses, as well as remote access and control from around the world.

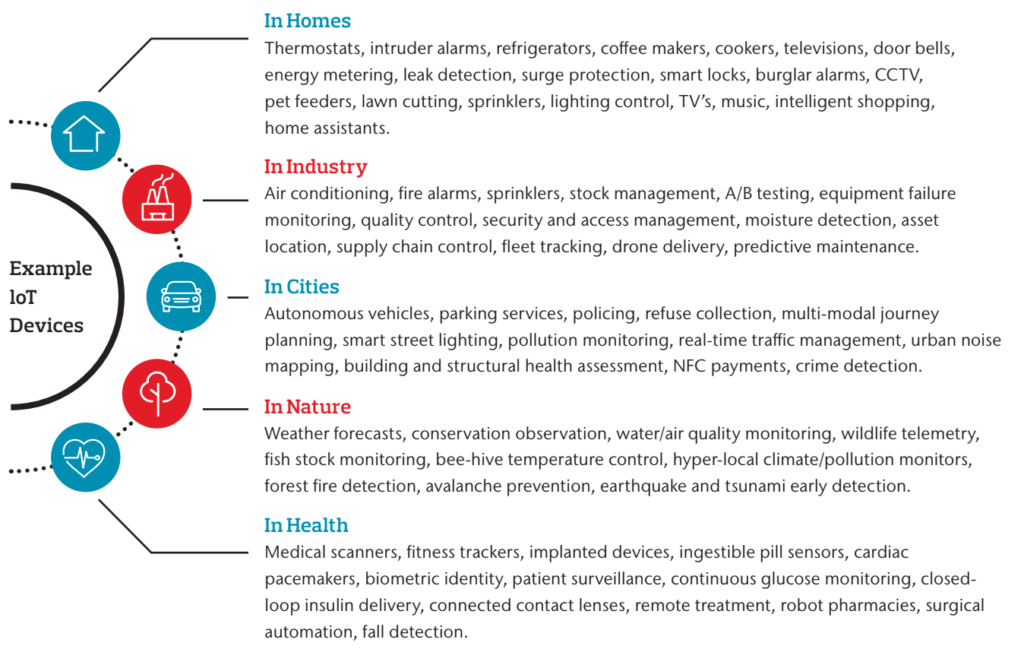

Some of the many examples of the application of IoT technology:

So, yes, the IoT is a hugely exciting development that creates significant efficiency opportunities for individuals and businesses. As with most new technologies, over the coming years we will see some IoT implementations fail (a few catastrophically). People will become disillusioned. But, over time, there will be more successes, the benefits will start to crystallize and it will be more widely understood.

The application of the technology in the insurance world will also be far-reaching. The IoT will help monitor, detect and control risks. It will allow early intervention in the event of a loss, potentially mitigating further losses, while providing valuable evidence of what has actually happened. However, the increased embeddedness of IoT also exposes new risks: A fault in the hardware, software or firmware of a device could lead to a catastrophic loss -- imagine heart rate monitors switching off, vehicles disabled midway through journeys, ovens turned on when premises are empty.

Insurers must adapt or may become irrelevant

Many insurance executives find the subject stimulating but a little abstract when it comes to changing the way we do business. The impact will most likely be significant (either positively or negatively) whether we embrace the possibilities or wait until we need to deal with the fallout.

There are plenty of estimates on the future number of IoT devices, some more speculative than others, but there appears to be consensus for somewhere in the region of 26 billion by 2020, and growing fast over the following few years. The insurance industry is, therefore, facing an involuntary paradigm shift as clients implement IoT ecosystems in their homes and businesses.

Client needs and the very nature of the risks they face will be changing. Insurers and reinsurers can either be part of the journey that their clients are taking or try to catch up with the new paradigm once the world has changed. With or without an insurer in the equation, these changes will fundamentally alter the insurance products that clients need. Insurers that are prepared for these shifts, working with their clients to design appropriate solutions, will be the winners.

Probably the best-known IoT deployment in insurance is telematics in auto insurance, but new examples are appearing all the time, such as the adoption rate of water sensors to detect leaks or the recent partnership between Lloyd’s of London and Parsyl that places IoT sensors alongside sensitive marine cargo (to monitor temperature-controlled foods, pharmaceuticals or high-tech products).

Even the most advanced businesses can get it wrong, though. It is worth considering how two of the largest technology companies have approached the integration of IoT. Apple and Amazon both sought to capitalize on IoT to capture the home assistant market. Probably the most important factor determining their relative success has been their ability to interact with the wider smart home ecosystem. One of the companies employed "compatibility strategy" that favored compatibility with its own IoT products, while the other was quick to ensure its product would work with just about every smart gadget in the home through its "distribution strategy"…. We will leave to you to judge which strategy was more effective!

The lesson: Those who stick to a closed ecosystem of products that don’t interact with others are going to lose out to those who provide integration with added-value services that go beyond their core offering.

See also: Global Trend Map No. 7: Internet of Things

In insurance, data from IoT devices will unlock wonderful new approaches to underwriting and claims:

- Live underwriting: An enhanced view of risk through asset performance and usage data. Increased customer engagement, becoming a "risk partner," not just "risk finance." Alternative usage-based propositions. Live monitoring of compliance with warranties. Real-time coverage adjustments based on changing needs.

- Smart claims: Improved visibility of loss events and their proximate cause, but also some element of loss prevention as the IoT stops the loss from occurring in the first place. Quicker responses to events and better early loss estimation. Enhanced loss data and insight for risk advisory. New triggers for parametric products. Reduced need for (and cost of) loss adjusting.

But, we also need to think about this from the client perspective. With more data, clients become more sophisticated. They understand more about their risk than we do and can control much of it. Potentially, the IoT devices can independently prevent the loss from occurring at all. So, with less uncertainty, they need less insurance, and premiums could begin to fall. What they choose to buy could be very different. In short, insurers and reinsurers need to think about how products are designed to meet client needs.

Being left behind by more forward-thinking (and maybe new) competitors is a real risk. However, the good news is that it is not too late. Most insurer-led IoT propositions are still in the proof of concept stage. With limited evidence of a loss ratio reduction, it can be difficult to convince clients, or even our own executive teams, to disrupt business as usual for unproven technology pilots. The lessons learned by those insurers and reinsurers that are experimenting with IoT will help them win. Being late to this party is not really a viable option.

Grasping the opportunities of IoT and the Internet of Risk

While the opportunities may be great, and the threats from outside the industry may be very real, insurers still need to be careful to avoid leaving themselves open to unforeseen exposures. As an example, "traditional" cyber products have focused primarily on data breach, but now they must also take account of physical hazards. Security cameras, conference phones, vehicles and industrial machinery can provide a gateway for determined hackers. IoT terrorism is also a potential concern, whereby the manipulation of physical objects could lead to death and destruction.

Insurers focused on “disconnected assets” need to evolve their thinking and propositions as the economy moves toward IoT. We will see fewer disconnected assets (each requiring less coverage), while there will be far more intangible and connected assets that require protection.

Insurers will need to service clients holistically: Few clients operate uniquely disconnected, connected or intangible assets. They will look for insurance partners capable of servicing their needs across their balance sheet (or lifestyle). Limited products are currently available to cover IoT-related exposures; thus, it falls to brokers and insurers to innovate and raise awareness (before clients find alternative risk financing solutions).

Insurers and brokers must look to identify how the IoT is changing their clients’ needs and help them holistically understand and manage the risks inherent in their business or personal life. Opportunities will be found in several places:

1. New clients — e.g. asset-less, sharing and gig economy firms/individuals, challenger banks, new physical-tech firms, blockchain service providers, cloud and data dependent services, etc.

2. New risks — e.g. cyber coverage, drones, intangible assets, autonomous vehicles, crypto-assets being stolen, instant supply chains and connected cities etc.

3. New propositions — e.g. new distribution models including players that have never operated in the insurance world but have access to IoT insights, e.g. Amazon, usage- based insurance, parametric covers, partnerships with different organizations etc.

These will all continue to evolve, so taking a lead means being as advanced as possible in thinking how IoT will change the insurance world and how these new (and evolving) opportunities can be grasped. However, this cannot be a purely academic exercise. There must be a focus on actions that can drive short-term revenues, while creating a sustainable advantage for the longer term.

IoT complexity necessitates collaboration

A multidisciplinary approach is essential, factoring in many views from experts in several areas. When considering how IoT could change what Aon needs to do and how Aon serves its clients, we use expertise from various practice groups across our insurance and reinsurance operations, including the cyber, digital economy and technology practice groups, but also colleagues like Stroz Friedberg, a leader in cybersecurity in today’s digital, connected and regulated business world.

But it isn’t only about getting insights from within your business: IoT is such a broad, societal mega-trend that anyone who only has a single-dimension perspective would be having a blinkered view (and almost certainly slightly rose-tinted). Aon Inpoint works with several global insurtech accelerators to find companies supporting innovation, while gaining experience in IoT and insurtech more broadly. An example includes an insurtech with which Aon is exploring approaches to quantify IoT-related cyber-physical exposure.

Aon has also created Aon Digital Monitor, tracking or capturing proprietary insights from activity across the insurance ecosystem, to complement our extensive network of startups, vendors, investors and expert advisers tracking what people are investing in.

The bottom line is that insurers and reinsurers shouldn’t try an "in house" solution. In an IoT-enabled future, partnering with organizations that have the necessary skills and knowledge is essential – either directly, or through an organization that is set up already with those partnerships.