Depending on the day of the week, one of three buzz words seems to fill every column inch, to be used in the marketing of every new product or service and to be cited in every press release. To me, these are,

digital (insert anything here), big data and

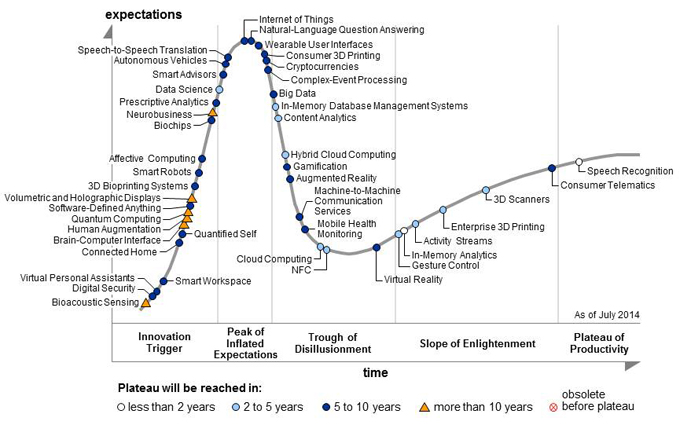

the Internet of Things (IoT). It’s no surprise that the IoT is at the peak of Inflated Expectations in

Gartner’s Hype Cycle.

In this post, I want to explore IoT a little further, specifically with the insurance world in mind.

Like any self-respecting early adopter (technology geek/gadget magpie), I personally see the IoT as a game-changing disruptor, regardless of industry. My kids won’t know a world without almost every conceivable thing being connected to the Internet. Depending on which report you read, there will be anything from 100 to 500 sensors in every home and a market for the IoT worth $7.1 trillion by 2020 (

IDC), with more than 4.9 billion connected things by 2015 (

Gartner). Very few of the technology giants are not investing heavily in this secto. The IoT is not a fad.

So what is the IoT?

It’s simply the ability to interact with a network of physical objects that feature an IP address (directly or indirectly) and can connect device to device or device to human. Today, you can connect lots of things to the Internet, some of which you would never expect. Examples include:

- Homes and commercial buildings -- Smart buildings with smart sensors and smart utilities, security systems, environment monitoring, smart carpet, etc.

- Automobiles -- tracking when, how and where you drive. Transport vehicles of any kind, including driverless cars, could be connected, as could individual items/packages on a cargo ship.

- Livestock -- WiFi sheep; see here from the BBC on why sheep are being fitted with WiFi sensors,

- Human beings -- the latest in wearables allows companies such as Vitality Health Insurance to reward healthy behavior, reducing your premium for the more active and healthy you are.

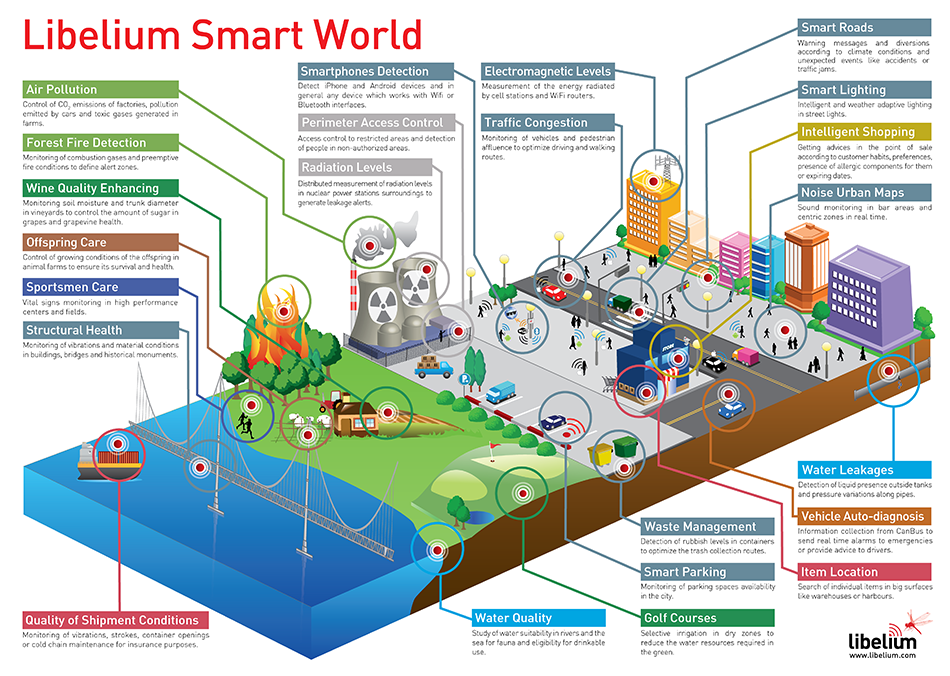

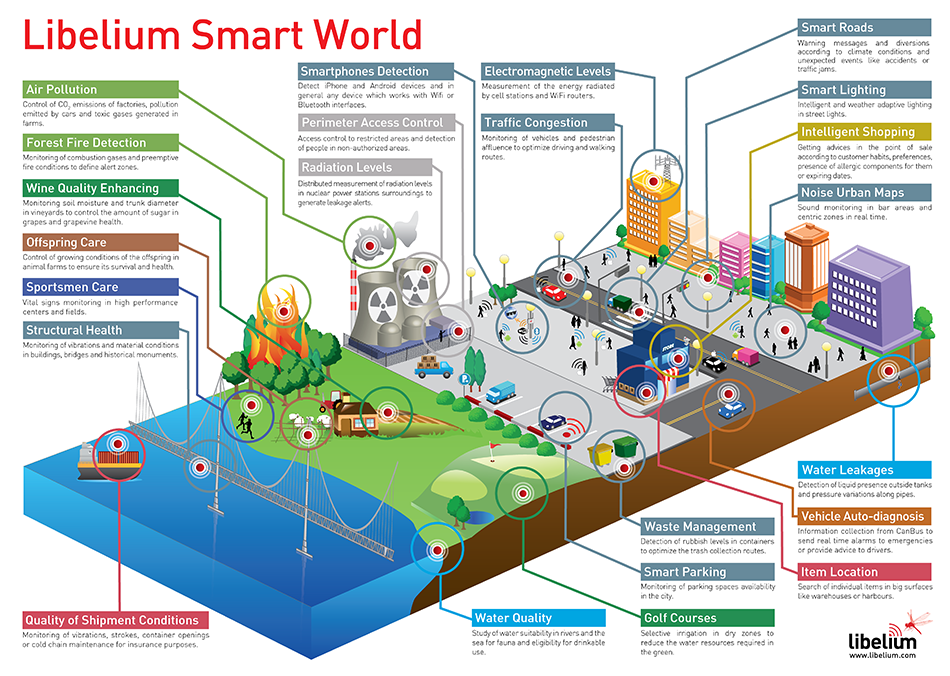

- Smart cities -- where everything is truly connected. Libelium has 50 great examples here. Have you walked down Regent Street in London recently? It’s an interesting experience. We live in a truly context-aware world.

As

Ben Evans said in his great piece, "Mobile is Eating the World," "Sensors profoundly change what a computer can know."

Perhaps an easier question to ask is: What can you

not connect to the Internet these days? This is a rapidly diminishing list. Look back 12 months or so to the

Top 25 weird things to connect to the Internet; all of a sudden they don’t seem so weird. What will happen in the next 12 months? For fans of contactless payment cards, how do you feel when you can’t use it, as a retailer hasn’t yet adopted the technology? Inconvenienced? These are the sorts of simple things that give me time back and are simple and convenient.

Ultimately, it’s all about automated data collection from the source itself. As insurers, our success depends on this. It’s what drives our very industry, right from the very first research, through to quote, bind and every event thereafter that drives our risk, pricing and actuarial teams. Getting this data and monitoring this directly from its source has huge potential in today’s traditional insurance business model.

Another example of positive uses is from Uber, whose data is now

supporting city planners with urban transport. As insurers, we could use the same data to avoid accident black spots, congestion and much more. Traffic systems would be linked directly to the flow, density, type and vehicles themselves. Basic data such as time of day, postal code or gender is simply not enough anymore. IoT connected services can change everything.

Opportunities

The cost of connecting things today has becoming almost insignificant, and, importantly, the desire for things that are not connected is diminishing at a greater pace. Ten years ago, you would test drive a car and, nine times out of 10, focus on the driving experience. The first thing people do today is check the "infotainment," how your smart phone can connect, what you can control via an app. It’s not just cars; I recently moved house and, when looking at new house alarms, a key consideration was what can I control and monitor via my phone or an app. Manufacturers are quick to jump on the bandwagon. Have a look at

ADT Pulse (unfortunately not yet available in the UK, but many others are).

It seems there are lots of options, but they are still working on old-fashioned business models. When will alarm monitoring be undertaken by your crowd sourced/handpicked local community as opposed to the centralized service center, which then calls the police? With IoT, who needs middlemen? The first notice of loss (FNOL) or claim process becomes automated (we have talked about this for years). The level of fraud can be dramatically reduced. Everything you can interact with or monitor, you can now predict better than ever.

How does the IoT affect the carrier, agent or broker? Have a look at the infographic below -- which of these "things" did you expect to monitor? (The site for the infographic is

here.) As the local city administration, can you reduce accidents or claims from understanding smart roads, pothole damage and more? Reduce health costs by understanding pollution?

We as insurers typically struggle because customers rarely want to speak to their insurers. In the new economy, we have the opportunity to be connected all the time to each other. This brings a vast number of possibilities and new potential business models to us, based on this new wealth of data.

Insurers now have the ability to know in advance of an event, ultimately improving their customers' and potential customers' experience, security and well-being.

With everything connected, what could go wrong?

However, the IoT has to come with a health warning, too. For me, three of the key things to consider here as insurance organization are:

- You are now really competing on data, nothing more. We never produced any products, anyway; now it’s even more transparent. Make sure you know your data, can process it efficiently and effectively, understand it and most importantly use it. How we use information to enrich our world will be key. Don’t drown; the volume is about to explode. As an example, every minute, OCTO stores more than 118.000 data points from drivers around the world. How will you stand out from the crowd? I wrote recently here on how brand will be critical. Ownership of the data will also be key. BMW recently announced that it would not share any of its connected car data. It does, however, have a significant partnership with a large global insurer already.

- Another key risk is from cyber security. There are already stories of usage-based insurance (UBI) car devices potentially being hacked. What happens if your driverless car gets hacked and then crashes, causing serious damage or, worse, a fatality? Who will carry the risk?

- You must see how the IoT can drive new business models, based on customer demand. Ray Wang recently said that we are now supporting mass personalization for a market segment of one. What can you now insure that you never could previously for individuals and organizations? New business models don’t mean we have to go alone, either. New partnerships will drive innovation and, importantly, convenience for the end user. Be careful not to miss out on the output, as British Gas has with Hive and nPower has with Nest. Ignore the Hive and Nest connected devices; the data they collect is what matters.

For once, the insurance industry could be as quick to adopt as everyone else to adopt, or ahead. We are on the forefront of data enrichment and much more. We can better price, engage and interact with our customers and prospects. We can interact with each and every stage of the insurance life cycle; we can join and automate the dots faster and better than ever before.

It’s an exciting time, and while it may be a while before the legacy oil tanker turns, we had better be ready and at the wheel if we are to own the opportunity.

In this post, I want to explore IoT a little further, specifically with the insurance world in mind.

Like any self-respecting early adopter (technology geek/gadget magpie), I personally see the IoT as a game-changing disruptor, regardless of industry. My kids won’t know a world without almost every conceivable thing being connected to the Internet. Depending on which report you read, there will be anything from 100 to 500 sensors in every home and a market for the IoT worth $7.1 trillion by 2020 (IDC), with more than 4.9 billion connected things by 2015 (Gartner). Very few of the technology giants are not investing heavily in this secto. The IoT is not a fad.

So what is the IoT?

It’s simply the ability to interact with a network of physical objects that feature an IP address (directly or indirectly) and can connect device to device or device to human. Today, you can connect lots of things to the Internet, some of which you would never expect. Examples include:

In this post, I want to explore IoT a little further, specifically with the insurance world in mind.

Like any self-respecting early adopter (technology geek/gadget magpie), I personally see the IoT as a game-changing disruptor, regardless of industry. My kids won’t know a world without almost every conceivable thing being connected to the Internet. Depending on which report you read, there will be anything from 100 to 500 sensors in every home and a market for the IoT worth $7.1 trillion by 2020 (IDC), with more than 4.9 billion connected things by 2015 (Gartner). Very few of the technology giants are not investing heavily in this secto. The IoT is not a fad.

So what is the IoT?

It’s simply the ability to interact with a network of physical objects that feature an IP address (directly or indirectly) and can connect device to device or device to human. Today, you can connect lots of things to the Internet, some of which you would never expect. Examples include:

We as insurers typically struggle because customers rarely want to speak to their insurers. In the new economy, we have the opportunity to be connected all the time to each other. This brings a vast number of possibilities and new potential business models to us, based on this new wealth of data.

Insurers now have the ability to know in advance of an event, ultimately improving their customers' and potential customers' experience, security and well-being.

With everything connected, what could go wrong?

However, the IoT has to come with a health warning, too. For me, three of the key things to consider here as insurance organization are:

We as insurers typically struggle because customers rarely want to speak to their insurers. In the new economy, we have the opportunity to be connected all the time to each other. This brings a vast number of possibilities and new potential business models to us, based on this new wealth of data.

Insurers now have the ability to know in advance of an event, ultimately improving their customers' and potential customers' experience, security and well-being.

With everything connected, what could go wrong?

However, the IoT has to come with a health warning, too. For me, three of the key things to consider here as insurance organization are: