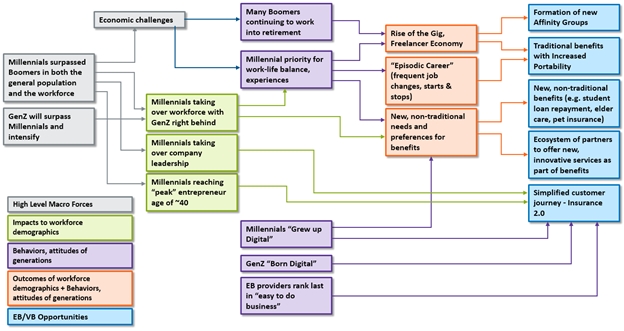

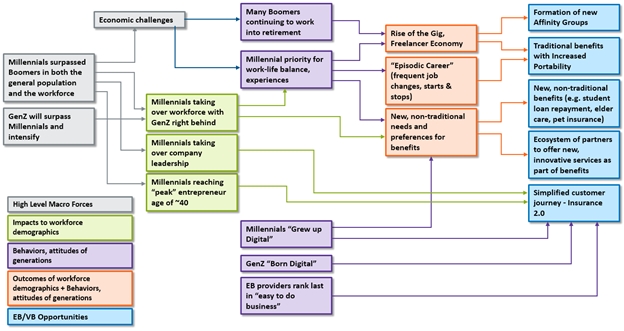

Figure 1: Forces creating opportunities in the employee and voluntary benefits market

The two largest generations, Baby Boomers and millennials, are in the midst of rapid transition. Their shifting positions within the general population, the workforce and business leadership are rapidly reshaping the market landscape. The behaviors and attitudes of both generations are substantially influenced by economic conditions, and digital technology is rapidly becoming an integral part in their lives. Gen Z is further intensifying this shift. These factors have helped fuel the rise of the gig and sharing economy, which is estimated to encompass 35% of the U.S. workforce today and is continuing to grow and expand.[i]

Together, these and other forces are creating employee and voluntary benefit needs and expectations that present unprecedented opportunities for growth. The growth in new affinity groups; increased demand for benefit portability; and the growing demand for new, non-traditional benefits and services that offer a simplified, satisfying customer experience are just a few of the dramatic shifts in needs and expectations.

See also: 4 Good Ways to Welcome Employees

The market landscape will continue to rapidly transform as workers’ and employers’ needs and expectations shift, healthcare reform continues to change, industry boundaries shift with M&A, marketplaces evolve, new products are introduced and new competitors emerge from within and outside the industry. The surge in employee demand for innovative voluntary benefits are an increasingly critical element to attract and retain top talent for companies, particularly as we continue to see unemployment rates decline, as boomers retire and as the fight for technology talent intensifies.

Adding fuel to the market shift is the rapid emergence of new technologies like wearables and advanced medical devices and exploding data (among others) that are redefining the insurance market into one focused on well-being, lifestyle and longevity, rather than illness and death. Innovative benefits are increasingly focused on digital health and well-being, elderly care, pet insurance, college loan repayment and the demand for digitally enabled customer engagement.

Making the Marketplace and Workforce Changes Work for You

Greenfields and startups saw these opportunities early, but existing insurers are now quickly developing strategies and plans to capture this once-in-a-generation opportunity. Insurtech has fueled significant investment by venture capitalists, spawning companies like Zenefits, Maxwell Health, ZhongAn, Discovery, Allan, Bright Health and Clover Health. We now see existing insurers begin to focus on the opportunities, such as MetLife focusing on the SMB market. At the same time, the increased demand for portability of voluntary benefits due to the generational acceptance of frequent job change offers insurers a unique opportunity to cost-effectively capture employees as individual customers and to keep and grow individual relationships (and premiums), rather than losing relationships through attrition.

The robust, once-in-a-generation opportunity is seeing insurers of all types developing strategies and plans to capture business, including:

--Traditional worksite carriers specializing in supplemental products such as accident, cancer, critical illness, hospital indemnity, voluntary STD, term life, universal life and heart/stroke insurance are expanding their portfolios to include voluntary LTD, gap, dental, whole life or vision products.

--True group carriers that historically specialized in group products, including term life, basic AD&D, group STD and LTD, dental and vision are expanding their product portfolios to include accident, critical illness, hospital indemnity and gap insurance.

--Medical carriers specializing in major medical coverage have been acquiring supplemental benefit carriers or administrators to expand their portfolio with supplemental products. They may have a competitive advantage because of their ability to harness and analyze extensive medical data.

--Finally, we are seeing a range of other carriers including multi-nationals, P&C carriers, retiree market specialists, and others that are entering the market with unique voluntary benefits like pet insurance and legal insurance as well as expanded affinity market programs to capture the opportunity.

Underlying each of these is the need to respond with innovative products, plan designs, underwriting and pricing as well as new services, distribution channels and customer engagement approaches enabled by modern digital platforms. Thinking about the best strategic approaches to pursue to maximize the potential of these new products, services and processes will be critical for success. Several approaches that are gaining traction include:

--Product differentiation: Insurers can differentiate themselves in a crowded market by offering a complementary portfolio of unique products, services and benefits. Differentiation may be achieved through value-added services (if exclusivity is achieved), creating an integration model across products, aligning products and benefits with a carrier’s identity, etc.

--Adjacent markets: Traditional group carriers are developing individual products to compete in digital, direct-to-consumer markets, and traditional individual carriers are developing group products to compete in the gig economy or growing affinity markets. Carriers operating in the consumer market are expanding into retiree markets, and carriers in the retiree market are moving into consumer markets.

--Product bundling: The demand for product bundling, or “combo” products, has recently increased. Sample combo products may include a group hospital indemnity product with accident, critical illness and term life riders or a universal life product with a long-term care rider. While these are just two examples, a large number of product combinations may be considered. In all market segments, and in particular the SMB market, combo products can broaden coverage, increase affordability and reduce or eliminate the need for underwriting by limiting anti-selection.

--Rapid product development: We are seeing an increasingly quick pace of product development, which is in stark contrast to the long shelf life of products before the ACA. In addition, carriers in the large market are frequently required to customize benefits and rates for distribution partners as well as employers. Keeping up with this pace requires a nimble technology solution for administration, billing, claims and operations. Carriers that are using newer technologies will have a distinct competitive advantage, especially in the large account and broker markets, as these technologies provide increased flexibility and speed to market. This competitive advantage also applies to the bottom line, as more efficient technologies can eliminate manual processes and reduce expense margins.

See also: Value in Informal Employee Networks

--Partnering with emerging technology/insurtech: Insurance markets are being flooded with new insurtech startups. Some of these startups provide products or services that complement employee and voluntary benefit carriers’ value propositions. Existing carriers would be wise to identify the key startup companies in their markets and establish strategic, beneficial partnerships.

Reap the Benefits of This Unique Market Opportunity

There are a multitude of exciting opportunities for employee and voluntary benefits insurers in this rapidly evolving market. The unprecedented pace of change will drive out old business models and allow new ones to flourish with the introduction of products and the offering of new services, plus interesting mergers and acquisitions such as Aetna and CVS, and the emergence of new business models via insurtech and established insurers.

There is no longer a doubt or debate regarding the need to digitalize insurance, but this still continues to be an unpaved path for insurers. Not many understand the best way to achieve it. Insurers are still in the midst of legacy modernization of their core systems for strengthening their back-end processing capabilities, but most realize that these initiatives will fall short without digital transformations that will bring meaningful benefits to customers and ultimately to win them. In this new market, insurers will need a single platform to support individual, group, voluntary benefits and worksite across all lines of business and with a design flexible to adapt to new products, workflows, distribution channels and even devices. The platform will need to enable portability of voluntary benefits to individual policies as well as innovation of products where the same product can be offered as an employer-paid, voluntary or worksite product. Platforms must increasingly make it easy to customize plan options for groups.

There are a multitude of potential futures for group, employee and voluntary benefits insurers in an increasingly volatile world. The rapid and unprecedented pace of change will drive out old business models and allow new ones to flourish with the introduction of products and the offering of new services, and much more, from both new insurtech startups and established insurers.

At the heart of the disruption is a shift from Insurance 1.0 of the past to Digital Insurance 2.0 of the future. The gap is where innovative insurers are taking advantage of a new generation of buyers, capturing the opportunity to be the next market leaders in the digital age.

It is a once-in-a-lifetime opportunity for insurers to redefine the market and competitive landscape in employee and voluntary benefits. Be one of them!

Figure 1: Forces creating opportunities in the employee and voluntary benefits market

The two largest generations, Baby Boomers and millennials, are in the midst of rapid transition. Their shifting positions within the general population, the workforce and business leadership are rapidly reshaping the market landscape. The behaviors and attitudes of both generations are substantially influenced by economic conditions, and digital technology is rapidly becoming an integral part in their lives. Gen Z is further intensifying this shift. These factors have helped fuel the rise of the gig and sharing economy, which is estimated to encompass 35% of the U.S. workforce today and is continuing to grow and expand.[i]

Together, these and other forces are creating employee and voluntary benefit needs and expectations that present unprecedented opportunities for growth. The growth in new affinity groups; increased demand for benefit portability; and the growing demand for new, non-traditional benefits and services that offer a simplified, satisfying customer experience are just a few of the dramatic shifts in needs and expectations.

See also: 4 Good Ways to Welcome Employees

The market landscape will continue to rapidly transform as workers’ and employers’ needs and expectations shift, healthcare reform continues to change, industry boundaries shift with M&A, marketplaces evolve, new products are introduced and new competitors emerge from within and outside the industry. The surge in employee demand for innovative voluntary benefits are an increasingly critical element to attract and retain top talent for companies, particularly as we continue to see unemployment rates decline, as boomers retire and as the fight for technology talent intensifies.

Adding fuel to the market shift is the rapid emergence of new technologies like wearables and advanced medical devices and exploding data (among others) that are redefining the insurance market into one focused on well-being, lifestyle and longevity, rather than illness and death. Innovative benefits are increasingly focused on digital health and well-being, elderly care, pet insurance, college loan repayment and the demand for digitally enabled customer engagement.

Making the Marketplace and Workforce Changes Work for You

Greenfields and startups saw these opportunities early, but existing insurers are now quickly developing strategies and plans to capture this once-in-a-generation opportunity. Insurtech has fueled significant investment by venture capitalists, spawning companies like Zenefits, Maxwell Health, ZhongAn, Discovery, Allan, Bright Health and Clover Health. We now see existing insurers begin to focus on the opportunities, such as MetLife focusing on the SMB market. At the same time, the increased demand for portability of voluntary benefits due to the generational acceptance of frequent job change offers insurers a unique opportunity to cost-effectively capture employees as individual customers and to keep and grow individual relationships (and premiums), rather than losing relationships through attrition.

The robust, once-in-a-generation opportunity is seeing insurers of all types developing strategies and plans to capture business, including:

--Traditional worksite carriers specializing in supplemental products such as accident, cancer, critical illness, hospital indemnity, voluntary STD, term life, universal life and heart/stroke insurance are expanding their portfolios to include voluntary LTD, gap, dental, whole life or vision products.

--True group carriers that historically specialized in group products, including term life, basic AD&D, group STD and LTD, dental and vision are expanding their product portfolios to include accident, critical illness, hospital indemnity and gap insurance.

--Medical carriers specializing in major medical coverage have been acquiring supplemental benefit carriers or administrators to expand their portfolio with supplemental products. They may have a competitive advantage because of their ability to harness and analyze extensive medical data.

--Finally, we are seeing a range of other carriers including multi-nationals, P&C carriers, retiree market specialists, and others that are entering the market with unique voluntary benefits like pet insurance and legal insurance as well as expanded affinity market programs to capture the opportunity.

Underlying each of these is the need to respond with innovative products, plan designs, underwriting and pricing as well as new services, distribution channels and customer engagement approaches enabled by modern digital platforms. Thinking about the best strategic approaches to pursue to maximize the potential of these new products, services and processes will be critical for success. Several approaches that are gaining traction include:

--Product differentiation: Insurers can differentiate themselves in a crowded market by offering a complementary portfolio of unique products, services and benefits. Differentiation may be achieved through value-added services (if exclusivity is achieved), creating an integration model across products, aligning products and benefits with a carrier’s identity, etc.

--Adjacent markets: Traditional group carriers are developing individual products to compete in digital, direct-to-consumer markets, and traditional individual carriers are developing group products to compete in the gig economy or growing affinity markets. Carriers operating in the consumer market are expanding into retiree markets, and carriers in the retiree market are moving into consumer markets.

--Product bundling: The demand for product bundling, or “combo” products, has recently increased. Sample combo products may include a group hospital indemnity product with accident, critical illness and term life riders or a universal life product with a long-term care rider. While these are just two examples, a large number of product combinations may be considered. In all market segments, and in particular the SMB market, combo products can broaden coverage, increase affordability and reduce or eliminate the need for underwriting by limiting anti-selection.

--Rapid product development: We are seeing an increasingly quick pace of product development, which is in stark contrast to the long shelf life of products before the ACA. In addition, carriers in the large market are frequently required to customize benefits and rates for distribution partners as well as employers. Keeping up with this pace requires a nimble technology solution for administration, billing, claims and operations. Carriers that are using newer technologies will have a distinct competitive advantage, especially in the large account and broker markets, as these technologies provide increased flexibility and speed to market. This competitive advantage also applies to the bottom line, as more efficient technologies can eliminate manual processes and reduce expense margins.

See also: Value in Informal Employee Networks

--Partnering with emerging technology/insurtech: Insurance markets are being flooded with new insurtech startups. Some of these startups provide products or services that complement employee and voluntary benefit carriers’ value propositions. Existing carriers would be wise to identify the key startup companies in their markets and establish strategic, beneficial partnerships.

Reap the Benefits of This Unique Market Opportunity

There are a multitude of exciting opportunities for employee and voluntary benefits insurers in this rapidly evolving market. The unprecedented pace of change will drive out old business models and allow new ones to flourish with the introduction of products and the offering of new services, plus interesting mergers and acquisitions such as Aetna and CVS, and the emergence of new business models via insurtech and established insurers.

There is no longer a doubt or debate regarding the need to digitalize insurance, but this still continues to be an unpaved path for insurers. Not many understand the best way to achieve it. Insurers are still in the midst of legacy modernization of their core systems for strengthening their back-end processing capabilities, but most realize that these initiatives will fall short without digital transformations that will bring meaningful benefits to customers and ultimately to win them. In this new market, insurers will need a single platform to support individual, group, voluntary benefits and worksite across all lines of business and with a design flexible to adapt to new products, workflows, distribution channels and even devices. The platform will need to enable portability of voluntary benefits to individual policies as well as innovation of products where the same product can be offered as an employer-paid, voluntary or worksite product. Platforms must increasingly make it easy to customize plan options for groups.

There are a multitude of potential futures for group, employee and voluntary benefits insurers in an increasingly volatile world. The rapid and unprecedented pace of change will drive out old business models and allow new ones to flourish with the introduction of products and the offering of new services, and much more, from both new insurtech startups and established insurers.

At the heart of the disruption is a shift from Insurance 1.0 of the past to Digital Insurance 2.0 of the future. The gap is where innovative insurers are taking advantage of a new generation of buyers, capturing the opportunity to be the next market leaders in the digital age.

It is a once-in-a-lifetime opportunity for insurers to redefine the market and competitive landscape in employee and voluntary benefits. Be one of them!Digital Insurance 2.0: Benefits

While the outlook for employee and voluntary benefits is promising, the market no longer looks anything like it once did.

Figure 1: Forces creating opportunities in the employee and voluntary benefits market

The two largest generations, Baby Boomers and millennials, are in the midst of rapid transition. Their shifting positions within the general population, the workforce and business leadership are rapidly reshaping the market landscape. The behaviors and attitudes of both generations are substantially influenced by economic conditions, and digital technology is rapidly becoming an integral part in their lives. Gen Z is further intensifying this shift. These factors have helped fuel the rise of the gig and sharing economy, which is estimated to encompass 35% of the U.S. workforce today and is continuing to grow and expand.[i]

Together, these and other forces are creating employee and voluntary benefit needs and expectations that present unprecedented opportunities for growth. The growth in new affinity groups; increased demand for benefit portability; and the growing demand for new, non-traditional benefits and services that offer a simplified, satisfying customer experience are just a few of the dramatic shifts in needs and expectations.

See also: 4 Good Ways to Welcome Employees

The market landscape will continue to rapidly transform as workers’ and employers’ needs and expectations shift, healthcare reform continues to change, industry boundaries shift with M&A, marketplaces evolve, new products are introduced and new competitors emerge from within and outside the industry. The surge in employee demand for innovative voluntary benefits are an increasingly critical element to attract and retain top talent for companies, particularly as we continue to see unemployment rates decline, as boomers retire and as the fight for technology talent intensifies.

Adding fuel to the market shift is the rapid emergence of new technologies like wearables and advanced medical devices and exploding data (among others) that are redefining the insurance market into one focused on well-being, lifestyle and longevity, rather than illness and death. Innovative benefits are increasingly focused on digital health and well-being, elderly care, pet insurance, college loan repayment and the demand for digitally enabled customer engagement.

Making the Marketplace and Workforce Changes Work for You

Greenfields and startups saw these opportunities early, but existing insurers are now quickly developing strategies and plans to capture this once-in-a-generation opportunity. Insurtech has fueled significant investment by venture capitalists, spawning companies like Zenefits, Maxwell Health, ZhongAn, Discovery, Allan, Bright Health and Clover Health. We now see existing insurers begin to focus on the opportunities, such as MetLife focusing on the SMB market. At the same time, the increased demand for portability of voluntary benefits due to the generational acceptance of frequent job change offers insurers a unique opportunity to cost-effectively capture employees as individual customers and to keep and grow individual relationships (and premiums), rather than losing relationships through attrition.

The robust, once-in-a-generation opportunity is seeing insurers of all types developing strategies and plans to capture business, including:

--Traditional worksite carriers specializing in supplemental products such as accident, cancer, critical illness, hospital indemnity, voluntary STD, term life, universal life and heart/stroke insurance are expanding their portfolios to include voluntary LTD, gap, dental, whole life or vision products.

--True group carriers that historically specialized in group products, including term life, basic AD&D, group STD and LTD, dental and vision are expanding their product portfolios to include accident, critical illness, hospital indemnity and gap insurance.

--Medical carriers specializing in major medical coverage have been acquiring supplemental benefit carriers or administrators to expand their portfolio with supplemental products. They may have a competitive advantage because of their ability to harness and analyze extensive medical data.

--Finally, we are seeing a range of other carriers including multi-nationals, P&C carriers, retiree market specialists, and others that are entering the market with unique voluntary benefits like pet insurance and legal insurance as well as expanded affinity market programs to capture the opportunity.

Underlying each of these is the need to respond with innovative products, plan designs, underwriting and pricing as well as new services, distribution channels and customer engagement approaches enabled by modern digital platforms. Thinking about the best strategic approaches to pursue to maximize the potential of these new products, services and processes will be critical for success. Several approaches that are gaining traction include:

--Product differentiation: Insurers can differentiate themselves in a crowded market by offering a complementary portfolio of unique products, services and benefits. Differentiation may be achieved through value-added services (if exclusivity is achieved), creating an integration model across products, aligning products and benefits with a carrier’s identity, etc.

--Adjacent markets: Traditional group carriers are developing individual products to compete in digital, direct-to-consumer markets, and traditional individual carriers are developing group products to compete in the gig economy or growing affinity markets. Carriers operating in the consumer market are expanding into retiree markets, and carriers in the retiree market are moving into consumer markets.

--Product bundling: The demand for product bundling, or “combo” products, has recently increased. Sample combo products may include a group hospital indemnity product with accident, critical illness and term life riders or a universal life product with a long-term care rider. While these are just two examples, a large number of product combinations may be considered. In all market segments, and in particular the SMB market, combo products can broaden coverage, increase affordability and reduce or eliminate the need for underwriting by limiting anti-selection.

--Rapid product development: We are seeing an increasingly quick pace of product development, which is in stark contrast to the long shelf life of products before the ACA. In addition, carriers in the large market are frequently required to customize benefits and rates for distribution partners as well as employers. Keeping up with this pace requires a nimble technology solution for administration, billing, claims and operations. Carriers that are using newer technologies will have a distinct competitive advantage, especially in the large account and broker markets, as these technologies provide increased flexibility and speed to market. This competitive advantage also applies to the bottom line, as more efficient technologies can eliminate manual processes and reduce expense margins.

See also: Value in Informal Employee Networks

--Partnering with emerging technology/insurtech: Insurance markets are being flooded with new insurtech startups. Some of these startups provide products or services that complement employee and voluntary benefit carriers’ value propositions. Existing carriers would be wise to identify the key startup companies in their markets and establish strategic, beneficial partnerships.

Reap the Benefits of This Unique Market Opportunity

There are a multitude of exciting opportunities for employee and voluntary benefits insurers in this rapidly evolving market. The unprecedented pace of change will drive out old business models and allow new ones to flourish with the introduction of products and the offering of new services, plus interesting mergers and acquisitions such as Aetna and CVS, and the emergence of new business models via insurtech and established insurers.

There is no longer a doubt or debate regarding the need to digitalize insurance, but this still continues to be an unpaved path for insurers. Not many understand the best way to achieve it. Insurers are still in the midst of legacy modernization of their core systems for strengthening their back-end processing capabilities, but most realize that these initiatives will fall short without digital transformations that will bring meaningful benefits to customers and ultimately to win them. In this new market, insurers will need a single platform to support individual, group, voluntary benefits and worksite across all lines of business and with a design flexible to adapt to new products, workflows, distribution channels and even devices. The platform will need to enable portability of voluntary benefits to individual policies as well as innovation of products where the same product can be offered as an employer-paid, voluntary or worksite product. Platforms must increasingly make it easy to customize plan options for groups.

There are a multitude of potential futures for group, employee and voluntary benefits insurers in an increasingly volatile world. The rapid and unprecedented pace of change will drive out old business models and allow new ones to flourish with the introduction of products and the offering of new services, and much more, from both new insurtech startups and established insurers.

At the heart of the disruption is a shift from Insurance 1.0 of the past to Digital Insurance 2.0 of the future. The gap is where innovative insurers are taking advantage of a new generation of buyers, capturing the opportunity to be the next market leaders in the digital age.

It is a once-in-a-lifetime opportunity for insurers to redefine the market and competitive landscape in employee and voluntary benefits. Be one of them!

Figure 1: Forces creating opportunities in the employee and voluntary benefits market

The two largest generations, Baby Boomers and millennials, are in the midst of rapid transition. Their shifting positions within the general population, the workforce and business leadership are rapidly reshaping the market landscape. The behaviors and attitudes of both generations are substantially influenced by economic conditions, and digital technology is rapidly becoming an integral part in their lives. Gen Z is further intensifying this shift. These factors have helped fuel the rise of the gig and sharing economy, which is estimated to encompass 35% of the U.S. workforce today and is continuing to grow and expand.[i]

Together, these and other forces are creating employee and voluntary benefit needs and expectations that present unprecedented opportunities for growth. The growth in new affinity groups; increased demand for benefit portability; and the growing demand for new, non-traditional benefits and services that offer a simplified, satisfying customer experience are just a few of the dramatic shifts in needs and expectations.

See also: 4 Good Ways to Welcome Employees

The market landscape will continue to rapidly transform as workers’ and employers’ needs and expectations shift, healthcare reform continues to change, industry boundaries shift with M&A, marketplaces evolve, new products are introduced and new competitors emerge from within and outside the industry. The surge in employee demand for innovative voluntary benefits are an increasingly critical element to attract and retain top talent for companies, particularly as we continue to see unemployment rates decline, as boomers retire and as the fight for technology talent intensifies.

Adding fuel to the market shift is the rapid emergence of new technologies like wearables and advanced medical devices and exploding data (among others) that are redefining the insurance market into one focused on well-being, lifestyle and longevity, rather than illness and death. Innovative benefits are increasingly focused on digital health and well-being, elderly care, pet insurance, college loan repayment and the demand for digitally enabled customer engagement.

Making the Marketplace and Workforce Changes Work for You

Greenfields and startups saw these opportunities early, but existing insurers are now quickly developing strategies and plans to capture this once-in-a-generation opportunity. Insurtech has fueled significant investment by venture capitalists, spawning companies like Zenefits, Maxwell Health, ZhongAn, Discovery, Allan, Bright Health and Clover Health. We now see existing insurers begin to focus on the opportunities, such as MetLife focusing on the SMB market. At the same time, the increased demand for portability of voluntary benefits due to the generational acceptance of frequent job change offers insurers a unique opportunity to cost-effectively capture employees as individual customers and to keep and grow individual relationships (and premiums), rather than losing relationships through attrition.

The robust, once-in-a-generation opportunity is seeing insurers of all types developing strategies and plans to capture business, including:

--Traditional worksite carriers specializing in supplemental products such as accident, cancer, critical illness, hospital indemnity, voluntary STD, term life, universal life and heart/stroke insurance are expanding their portfolios to include voluntary LTD, gap, dental, whole life or vision products.

--True group carriers that historically specialized in group products, including term life, basic AD&D, group STD and LTD, dental and vision are expanding their product portfolios to include accident, critical illness, hospital indemnity and gap insurance.

--Medical carriers specializing in major medical coverage have been acquiring supplemental benefit carriers or administrators to expand their portfolio with supplemental products. They may have a competitive advantage because of their ability to harness and analyze extensive medical data.

--Finally, we are seeing a range of other carriers including multi-nationals, P&C carriers, retiree market specialists, and others that are entering the market with unique voluntary benefits like pet insurance and legal insurance as well as expanded affinity market programs to capture the opportunity.

Underlying each of these is the need to respond with innovative products, plan designs, underwriting and pricing as well as new services, distribution channels and customer engagement approaches enabled by modern digital platforms. Thinking about the best strategic approaches to pursue to maximize the potential of these new products, services and processes will be critical for success. Several approaches that are gaining traction include:

--Product differentiation: Insurers can differentiate themselves in a crowded market by offering a complementary portfolio of unique products, services and benefits. Differentiation may be achieved through value-added services (if exclusivity is achieved), creating an integration model across products, aligning products and benefits with a carrier’s identity, etc.

--Adjacent markets: Traditional group carriers are developing individual products to compete in digital, direct-to-consumer markets, and traditional individual carriers are developing group products to compete in the gig economy or growing affinity markets. Carriers operating in the consumer market are expanding into retiree markets, and carriers in the retiree market are moving into consumer markets.

--Product bundling: The demand for product bundling, or “combo” products, has recently increased. Sample combo products may include a group hospital indemnity product with accident, critical illness and term life riders or a universal life product with a long-term care rider. While these are just two examples, a large number of product combinations may be considered. In all market segments, and in particular the SMB market, combo products can broaden coverage, increase affordability and reduce or eliminate the need for underwriting by limiting anti-selection.

--Rapid product development: We are seeing an increasingly quick pace of product development, which is in stark contrast to the long shelf life of products before the ACA. In addition, carriers in the large market are frequently required to customize benefits and rates for distribution partners as well as employers. Keeping up with this pace requires a nimble technology solution for administration, billing, claims and operations. Carriers that are using newer technologies will have a distinct competitive advantage, especially in the large account and broker markets, as these technologies provide increased flexibility and speed to market. This competitive advantage also applies to the bottom line, as more efficient technologies can eliminate manual processes and reduce expense margins.

See also: Value in Informal Employee Networks

--Partnering with emerging technology/insurtech: Insurance markets are being flooded with new insurtech startups. Some of these startups provide products or services that complement employee and voluntary benefit carriers’ value propositions. Existing carriers would be wise to identify the key startup companies in their markets and establish strategic, beneficial partnerships.

Reap the Benefits of This Unique Market Opportunity

There are a multitude of exciting opportunities for employee and voluntary benefits insurers in this rapidly evolving market. The unprecedented pace of change will drive out old business models and allow new ones to flourish with the introduction of products and the offering of new services, plus interesting mergers and acquisitions such as Aetna and CVS, and the emergence of new business models via insurtech and established insurers.

There is no longer a doubt or debate regarding the need to digitalize insurance, but this still continues to be an unpaved path for insurers. Not many understand the best way to achieve it. Insurers are still in the midst of legacy modernization of their core systems for strengthening their back-end processing capabilities, but most realize that these initiatives will fall short without digital transformations that will bring meaningful benefits to customers and ultimately to win them. In this new market, insurers will need a single platform to support individual, group, voluntary benefits and worksite across all lines of business and with a design flexible to adapt to new products, workflows, distribution channels and even devices. The platform will need to enable portability of voluntary benefits to individual policies as well as innovation of products where the same product can be offered as an employer-paid, voluntary or worksite product. Platforms must increasingly make it easy to customize plan options for groups.

There are a multitude of potential futures for group, employee and voluntary benefits insurers in an increasingly volatile world. The rapid and unprecedented pace of change will drive out old business models and allow new ones to flourish with the introduction of products and the offering of new services, and much more, from both new insurtech startups and established insurers.

At the heart of the disruption is a shift from Insurance 1.0 of the past to Digital Insurance 2.0 of the future. The gap is where innovative insurers are taking advantage of a new generation of buyers, capturing the opportunity to be the next market leaders in the digital age.

It is a once-in-a-lifetime opportunity for insurers to redefine the market and competitive landscape in employee and voluntary benefits. Be one of them!