In 2024, insured losses from U.S. severe convective storms (SCSs) exceeded $50 billion for the second consecutive year. This category of peril — which includes tornadoes, hail and straight-line winds — has grown increasingly prominent in recent years, posing significant challenges for risk managers across multiple sectors, including energy, agriculture, insurance, construction and transportation.

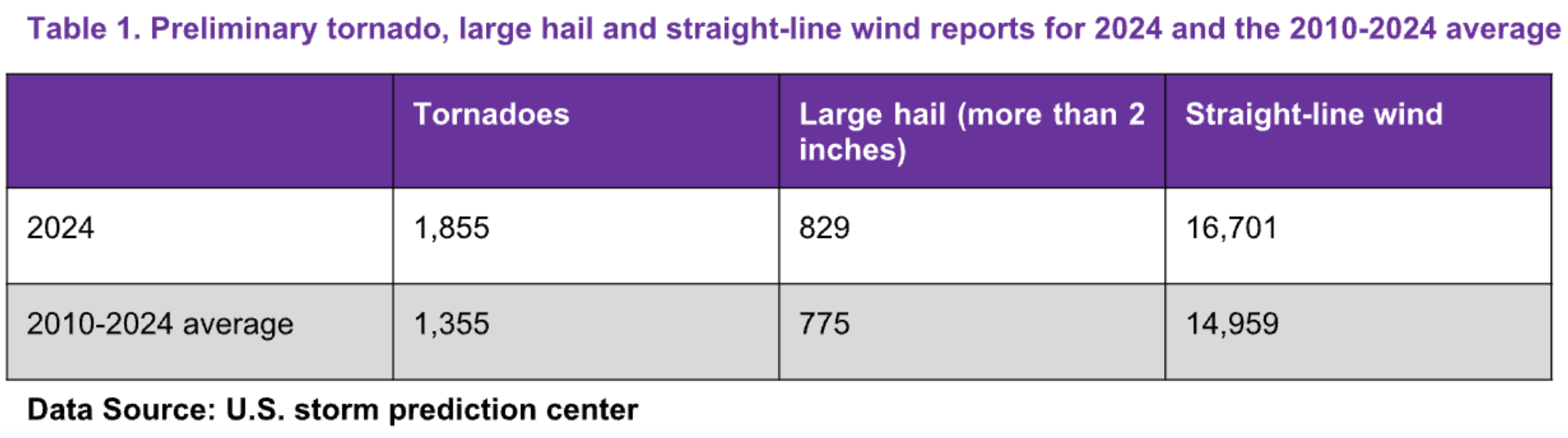

The 2024 season began at a rapid pace, with 1,264 preliminary tornado reports from January to June — the second-highest total for this period since 2010. This momentum carried into the second half of the year, culminating in 1,855 preliminary reports for 2024 (Table 1), surpassed only by the 2,240 reports in 2011.

Additionally, 2024 experienced above-average large hail activity — historically the leading cause of SCS-related property damage in the U.S. — with 829 preliminary reports. Straight-line wind activity also exceeded historical norms, with 16,701 reports, making 2024 the third most active year since 2010.

Storm clouds over solar farms

One sector facing increasing risk from SCS events is utility scale solar energy — large solar installations that generate electricity for the power grid. This industry has seen rapid growth in recent years, particularly in Texas. Since 2014, solar energy generation in Tornado Alley and Dixie Alley states has increased by almost a factor of 50, from one terawatt hour to 48 terawatt hours. Most of this growth comes from Texas due to its high solar irradiance levels and streamlined process for approving and building solar energy projects.

However, as more solar farms are built in storm-prone states, the risk of large losses for farm owners and insurers is increasing. The risk is heightened by a recent trend toward larger, thinner solar panels, which are more vulnerable to damage. In March 2024, for example, a hailstorm damaged thousands of solar panels at the Fighting Jays Solar Farm in Fort Bend County, Texas. This event resulted in costly panel replacements and reduced energy output. Insurers anticipated paying out $50 million, reaching the farm's hail coverage sublimit.

The risk is not just restricted to the Central U.S. In October 2024, an EF2 tornado that spawned from Hurricane Milton tore through a solar farm in central Florida, also damaging 30 homes in the area.

The property insurance market for utility-scale solar has struggled with high premiums and limited coverage availability. These challenges stem from significant losses in recent years and the unique vulnerability of solar panels, which complicates risk assessment. As a result, utility-scale developers have turned toward improving resiliency through engineering design and innovations in tracking technology.

Harnessing resilience in a changing climate

The most significant natural peril loss drivers for solar projects are hail and named windstorms. The solar panel modules are the primary components that have high vulnerability to windborne debris and hail-related damage, which is dependent on the module glass thickness. While the exposure value of solar modules is project-dependent, they typically account for a significant proportion of the insurable risk.

As a result of the recent increase in SCS loss activity, risk managers for solar projects are increasingly considering a range of mitigation strategies, such as:

- Stowing solar panel modules at specific tilt angles, decreasing the angle of impact for hailstones and reducing the likelihood of wind-related damage

- Implementing real-time weather monitoring and automation, automatically initiating protective measures, such as tilting, as storms approach

New and existing solar projects can also benefit from a comprehensive risk assessment, including geographic and historical analyses of hail, tornado and straight-line wind events. WTW works with utility-scale solar developers and operators evaluate and quantify probable maximum losses, considering site-specific engineering design, risk mitigation and tracking system stow strategies for both wind and hail to quantify natural catastrophe risk precisely.

Additionally, understanding how the risk is evolving over time is vital for effective risk management. WTW Research Network partner Columbia University has found a two-to-threefold increase in tornado outbreaks across the southeastern U.S., particularly during winter and spring, over the past four decades.

By combining these risk assessment and mitigation methods into a comprehensive approach, the solar industry can better prepare for severe weather events and navigate an evolving risk landscape.