The insurance industry has a trust problem – and that’s not even the bad news.

Consumers’ lack of trust in the financial services sector is well-documented. The

Edelman Trust Barometer found that financial services was the

least-trusted industry in the eyes of consumers. According to an

Accenture study, only 27% of consumers consider insurers to be trustworthy. And

Deloitte found that only 11% of people have strong trust in insurance agents and brokers.

The worse news is that the industry’s preferred instrument for narrowing this trust gap might actually be widening it.

That instrument is consumer disclosure, and it has long been the insurance industry’s go-to strategy for cultivating trust: trying to provide transparency in coverage parameters, commissions and other thorny topics.

However, as currently practiced in insurance (and most businesses), consumer disclosure is far from the elixir the industry purports it to be. If anything, it is the

antithesis of transparency, for two key reasons.

Disclosure Downside #1: Readership

First, hardly anyone reads disclosures. Admit it – as a consumer, when was the last time

you read one?

Amazon.com has underscored this point in a most amusing fashion via the

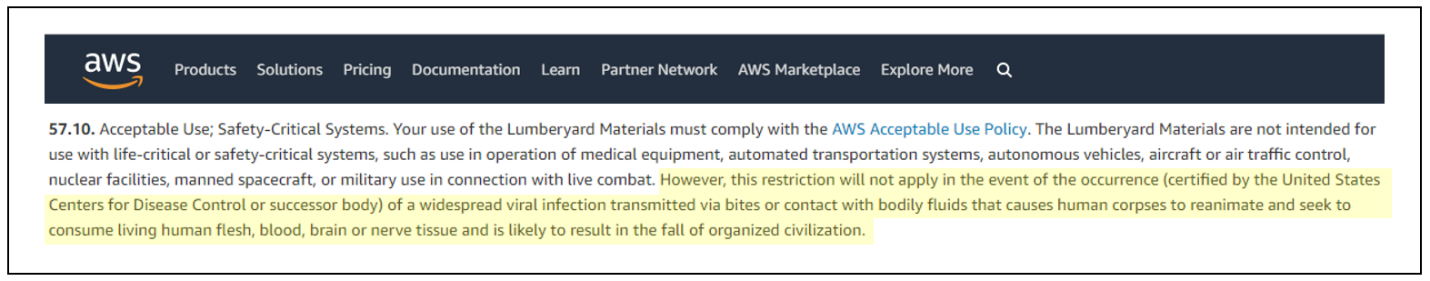

terms of service it provides to software developers who use its Amazon Web Services (AWS) platform. In the excerpt below, Amazon explains that customers can’t use AWS software to build “life-critical or safety-critical systems.”

However, as the highlighted section shows, the agreement lifts this usage restriction if the U.S. Centers for Disease Control and Prevention declare the presence of a “widespread viral infection transmitted by bites or contact with bodily fluids that causes human corpses to reanimate and seek to consume living human flesh… and is likely to result in the fall of organized civilization.”

Yes, you read that right… Amazon is disclosing a contingency for the Zombie Apocalypse. If that catastrophe befalls us, you’re allowed to use AWS software for whatever you need to survive.

The fact that the flesh-eating undead can be referenced in an official document like this, with hardly anyone noticing, speaks to a larger and more serious issue: Disclosure documents are an awful way to communicate important information to your customer.

Companies bury important details in opaque disclosures that they count on no one reading. Examples abound – conflicts of interest for your financial adviser, service fees for your bank account, cancellation fees for your gym membership, price increases for your cable TV package and – of course – coverage exclusions for your insurance.

Organizations hide behind these disclosure documents and point to them as evidence that anything important is indeed revealed to the customer. The reality, however, is that many companies (and sometimes entire industries) use disclosures to convey information that they don’t really want anyone to see.

Disclosure Downside #2: Comprehension

The second reason why disclosures fail to advance transparency and trust is because hardly anyone can understand them.

These are typically large, dense documents filled with unintelligible legalese and fine print (a shortcoming that was noted by the Federal Insurance Office in its own

study of the industry’s transparency).

The

Edelman 2018 Financial Services Trust Barometer found that consumers viewed “easily understood terms and conditions” as the No. 1 factor that would increase their trust in financial services. But, as the same study revealed, a lack of information transparency is the top reason why consumers distrust this industry.

There is a fundamental misalignment between what consumers value (information transparency) and what insurance firms actually deliver (information obfuscation). That discrepancy will continue to haunt the industry until disclosures are transformed from legally mandated administrative documents into genuine displays of customer advocacy.

Moving From Confusion to Clarity

Accomplishing that transformation will require reinventing the disclosure so it clarifies instead of confuses, and inspires confidence instead of undermining it.

Here are some examples of how the insurance industry could achieve that:

- Make disclosures obsolete. One way to attack the disclosure problem is to minimize the need for these documents in the first place. While it would be naïve to think disclosures would ever go away in the highly regulated insurance business, firms should still ask themselves: Are there changes we could make in our business practices that would reduce the need for these mind-numbing disclosures? Southwest Airlines’ highly successful “Transfarency” strategy is a great example of this approach. In contrast to many of competitors, Southwest doesn’t have to agonize over consumer disclosures because it built the business around a simplified and nearly fee-free pricing structure (i.e., no baggage fees, no ticket change fees, etc.).

- Design for visual appeal. Today’s jargon-filled insurance policy contracts, disclosures and amendments not only appear to have been written by lawyers, they appear to have been designed by lawyers. No offense to the legal community, but creating documents with visual appeal is not their forte. That is the domain of marketers, and it appears those folks rarely have an opportunity to work their magic on these types of insurance documents. They are often walls of text with little white space and few navigation clues. That might seem like an insignificant issue – marketing “fluff” – but it’s not. The layout, design and typography of a document can materially reduce the cognitive load it creates on the reader. Put simply, a visually appealing disclosure can engage and enlighten consumers much more effectively than a poorly designed one.

- Use vignettes to build understanding. Even the most jargon-free disclosures suffer from an important shortcoming – they describe terms and conditions in an almost academic fashion, detached from the realities of people’s everyday lives. One can read a disclosure paragraph and gain a theoretical understanding of a concept (e.g., damage from floods vs. wind-driven rain), yet not fully grasp its practical application. This is where explanatory vignettes can be used to great effect. Serving as a complement to traditional disclosure language, these are short “stories” that depict a common customer episode and more vividly illustrate how the legal terms translate into real life impacts. (Some insurers, for example, use this approach to underscore what types of calamities are, and aren’t, covered by a policy.)

- Leverage other communication platforms. The way people like to consume information has changed drastically in recent years, yet disclosures have not evolved accordingly. In today’s digitally enabled world, many consumers like to learn more by watching (video) than by reading (documents). Complex concepts that are conveyed in a written disclosure could be reinforced in a more engaging fashion via a few short videos delivered right to a policyholder’s inbox. The media used to communicate insurance disclosures haven’t changed in decades, but consumer behavior certainly has. It’s time for insurers to bring disclosures into the 21st century and leverage the digital communication avenues that so many other industries are using to great effect.

* * *

If insurance providers want to strengthen their customer relationships and instill greater trust in their industry, they need to move beyond regulator-mandated disclosure. After all, just because something is legal, doesn’t make it right for your customer.

The key is to communicate with consumers in a clear and forthright way – and disclosures,

if properly constructed, can help advance that cause.

It’s a cause that insurance firms should vigorously embrace because, when companies communicate with clarity, they send an unmistakable signal to consumers. It’s a signal that you’re advocating for them, that you’re helping them avoid unpleasant surprises – be it in the form of uncovered losses, unexpected fees or the zombie-induced fall of organized civilization.

And in the insurance business, that’s the kind of advocacy that makes for a great, trustworthy customer experience.

However, as the highlighted section shows, the agreement lifts this usage restriction if the U.S. Centers for Disease Control and Prevention declare the presence of a “widespread viral infection transmitted by bites or contact with bodily fluids that causes human corpses to reanimate and seek to consume living human flesh… and is likely to result in the fall of organized civilization.”

Yes, you read that right… Amazon is disclosing a contingency for the Zombie Apocalypse. If that catastrophe befalls us, you’re allowed to use AWS software for whatever you need to survive.

The fact that the flesh-eating undead can be referenced in an official document like this, with hardly anyone noticing, speaks to a larger and more serious issue: Disclosure documents are an awful way to communicate important information to your customer.

Companies bury important details in opaque disclosures that they count on no one reading. Examples abound – conflicts of interest for your financial adviser, service fees for your bank account, cancellation fees for your gym membership, price increases for your cable TV package and – of course – coverage exclusions for your insurance.

Organizations hide behind these disclosure documents and point to them as evidence that anything important is indeed revealed to the customer. The reality, however, is that many companies (and sometimes entire industries) use disclosures to convey information that they don’t really want anyone to see.

Disclosure Downside #2: Comprehension

The second reason why disclosures fail to advance transparency and trust is because hardly anyone can understand them.

These are typically large, dense documents filled with unintelligible legalese and fine print (a shortcoming that was noted by the Federal Insurance Office in its own study of the industry’s transparency).

The Edelman 2018 Financial Services Trust Barometer found that consumers viewed “easily understood terms and conditions” as the No. 1 factor that would increase their trust in financial services. But, as the same study revealed, a lack of information transparency is the top reason why consumers distrust this industry.

There is a fundamental misalignment between what consumers value (information transparency) and what insurance firms actually deliver (information obfuscation). That discrepancy will continue to haunt the industry until disclosures are transformed from legally mandated administrative documents into genuine displays of customer advocacy.

Moving From Confusion to Clarity

Accomplishing that transformation will require reinventing the disclosure so it clarifies instead of confuses, and inspires confidence instead of undermining it.

Here are some examples of how the insurance industry could achieve that:

However, as the highlighted section shows, the agreement lifts this usage restriction if the U.S. Centers for Disease Control and Prevention declare the presence of a “widespread viral infection transmitted by bites or contact with bodily fluids that causes human corpses to reanimate and seek to consume living human flesh… and is likely to result in the fall of organized civilization.”

Yes, you read that right… Amazon is disclosing a contingency for the Zombie Apocalypse. If that catastrophe befalls us, you’re allowed to use AWS software for whatever you need to survive.

The fact that the flesh-eating undead can be referenced in an official document like this, with hardly anyone noticing, speaks to a larger and more serious issue: Disclosure documents are an awful way to communicate important information to your customer.

Companies bury important details in opaque disclosures that they count on no one reading. Examples abound – conflicts of interest for your financial adviser, service fees for your bank account, cancellation fees for your gym membership, price increases for your cable TV package and – of course – coverage exclusions for your insurance.

Organizations hide behind these disclosure documents and point to them as evidence that anything important is indeed revealed to the customer. The reality, however, is that many companies (and sometimes entire industries) use disclosures to convey information that they don’t really want anyone to see.

Disclosure Downside #2: Comprehension

The second reason why disclosures fail to advance transparency and trust is because hardly anyone can understand them.

These are typically large, dense documents filled with unintelligible legalese and fine print (a shortcoming that was noted by the Federal Insurance Office in its own study of the industry’s transparency).

The Edelman 2018 Financial Services Trust Barometer found that consumers viewed “easily understood terms and conditions” as the No. 1 factor that would increase their trust in financial services. But, as the same study revealed, a lack of information transparency is the top reason why consumers distrust this industry.

There is a fundamental misalignment between what consumers value (information transparency) and what insurance firms actually deliver (information obfuscation). That discrepancy will continue to haunt the industry until disclosures are transformed from legally mandated administrative documents into genuine displays of customer advocacy.

Moving From Confusion to Clarity

Accomplishing that transformation will require reinventing the disclosure so it clarifies instead of confuses, and inspires confidence instead of undermining it.

Here are some examples of how the insurance industry could achieve that: