Retailers and others have been able to provide customers the experiences they want. Why is this so hard for carriers?

Insurance companies have struggled to meet evolving customer needs and expectations. As a result, they are facing serious obstacles to growth. In the P&C sector, gaining market share is a zero sum game, particularly in the saturated auto insurance marketplace. The life insurance market is shrinking as fewer consumers purchase policies.

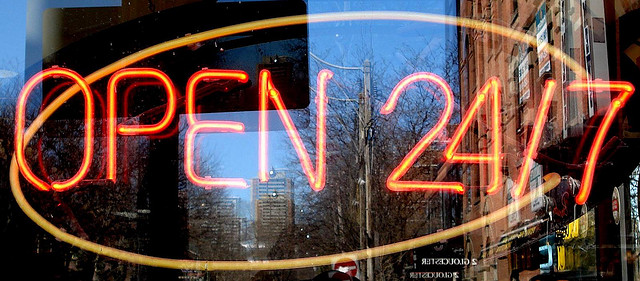

Over the last decade, in particular, insurers have struggled to meet customer expectations for greater price transparency, top-notch customer service, real-time response to service requests 24/7 access and more. Many retailers and companies in other industries have been able to provide customers the experience they want, so why are carriers struggling to do this?

There are three primary reasons:

- Insurers know little about their end customers because they’ve historically viewed intermediaries as their customers.

- A growing number of customers want a self-service option, but product and process complexity (unfamiliar language and many product options) makes it difficult for insurers to provide one.

- Insurance carriers’ fragmented operating models lead to inconsistent customer experiences. And the operating models make it difficult for carriers to gain the complete view of customers that’s needed to design tailored solutions.

Rather than making products and agents their business focus, it’s time for insurers to put customers at the center of their business models. Customer-centricity has three dimensions:

- Customer insights: Carriers should mine the wealth of available data about their customers to gain insights into their needs and behaviors so they can deliver the experiences and products that customers want.

- Customer experience: All interactions with the customer should be consistent and streamlined, and they should match each customer’s needs and preferences.

- Customer-centric operating model: The organization’s structures, systems and processes should operate with one goal in mind: delivering quality customer experiences efficiently and at a reasonable cost.

By adopting a customer-centric approach, insurance companies can win new business, increase sales to existing customers and build brand loyalty. Customer centricity also yields other benefits, including increased operational efficiency and reduced costs and more predictable, data-driven business results.

For the full paper on which this article is based, click here.