“Parametric” is a buzzword in insurance today.

Imagine that you have signed up for travel insurance. Your flight is delayed; instead of your reporting a claim and waiting weeks to be reimbursed, your insurance is connected to an open-data source exposing real-time flight schedules, so it automatically proceeds with the payment with no further formality.

Same applies for corporate risks when an industrial group signs up for a hail coverage, which payment is based on the size of the hail stones.

Is the growing buzz about parametric insurance due to its enhanced user experience (UX)? Certainly, but the appeal shouldn’t be restricted to this.

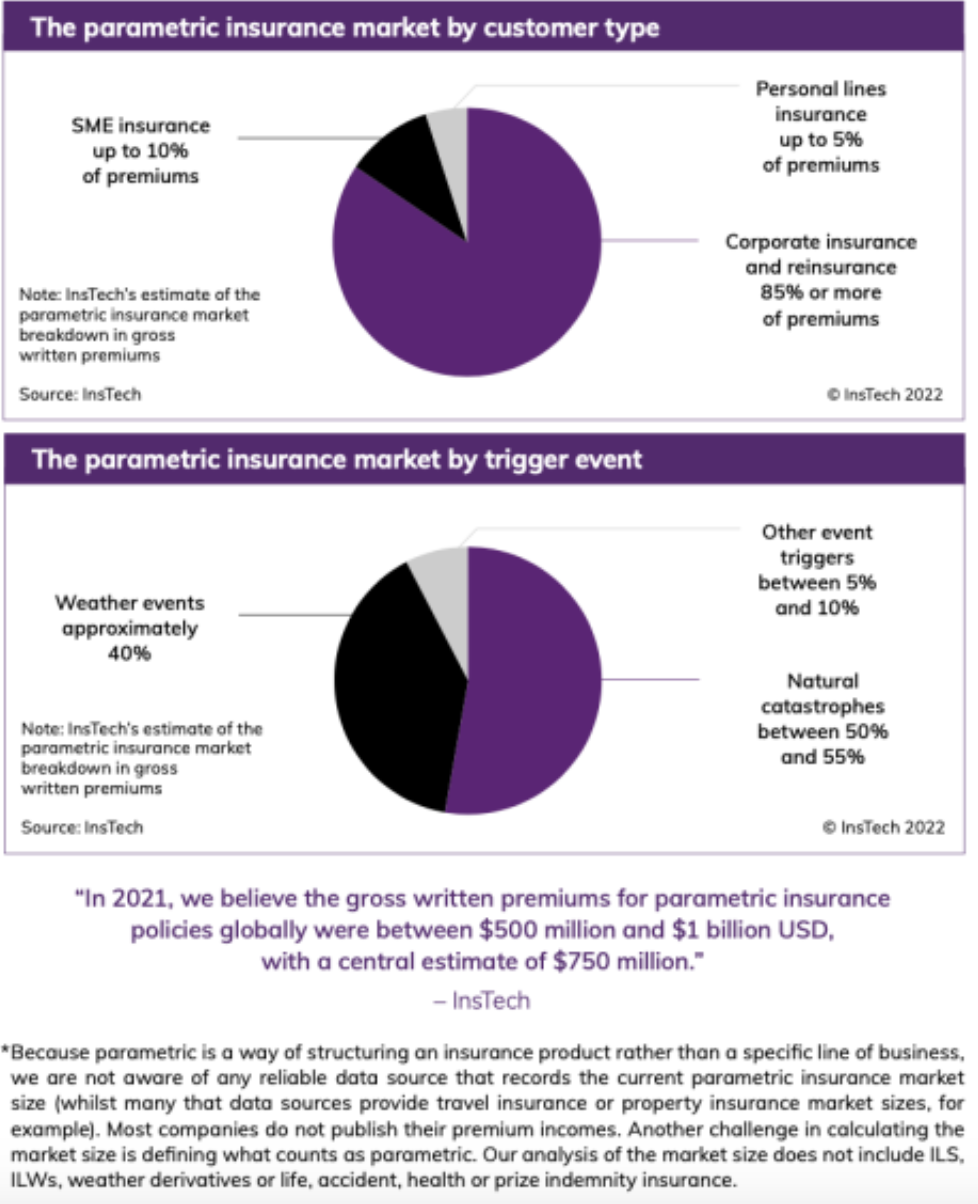

First things first, let's set the scene with some raw figures:

(source: InsTech)

Buzz is high, but the market is still emerging. It is focused on corporate lines and natural events.

See also: Best of Both: Bundling Parametric, Indemnity

Closing the protection gap

Figures show that the main merit of parametric insurance is to provide answers when traditional, indemnity-based insurance demonstrates some limits.

Parametric insurance is often proposed as a complement to an indemnity-based contract, for instance when terms and conditions exclude certain perils or assign limits or exclusions. Parametric insurance can fill those coverage gaps.

More substantially, parametric insurance stands for a solution to protect uncovered populations or situations

There is a continuous flow of announcements about parametric insurance about natural events in developing countries. This involves several sources of innovation:

--It often consists of micro-insurance for farmers or small business owners who would not have access to insurance otherwise.

--Specific distribution schemes are at work, through humanitarian/international organizations acting as sponsors, distributors or even financiers to reach fragmented markets.

--New sources of data fuel the range of parametric products, bringing answers where indemnity-based insurance is unable to do so.

--Satellites provide weather data used for natural events, but also for performance yield of renewable energy facilities, soil composition to determine drought conditions, 3D imagery to assess water level changes (flood), etc.

--IoT or sensors help to monitor cargo shipping, navigability of waterways, etc.

--Credit card transactions can determine business interruption without damage (linked to social unrests, pandemics, weather events).

--Network transactions make downtime insurable or help with the detection of cyber attacks.

Not to mention custom indexes built for specific parametric programs.

The list is still open and growing.

On a more general basis, parametric insurance can -- to some extent -- mitigate a lack of insurance capacity.

As a single-peril coverage, parametric insurance provides coverage that is more focused and easier to limit, compared with a comprehensive policy. (Re)insurers may have more appetite under these conditions.

More importantly, when traditional (re)insurance capacity is shrinking, financial markets may have more appetite for insurance-linked securities (ILS) as a way to diversify their portfolio (in terms of geography or financial markets cycles). In some way, parametric insurance stands for a continued evolution initiated by Cat bonds in the '90s.

Risk management or corporate finance?

Parametric insurance offers another advantage that opens up wider prospects: speed of payment.

In traditional insurance, a catastrophic event requires long filing procedures, the involvement of adjusters to determine conditions, assess losses, etc. It can take months (if not years in case of litigation), whereas parametric insurance claims triggering payment in a matter of weeks. This means much more than UX!

Most small and medium-sized businesses don’t have cash reserves or business continuity plans to withstand catastrophic events impairing their activity. A swift payment can represent a matter of survival. Enough to justify the cost of parametric insurance.

The same rationale applies to larger organizations, at a wider scale. A catastrophic event that is quickly compensated doesn't draw on cash reserves or require negotiating a credit facility. Parametric insurance turns out to be a tool to protect equity and reduce performance volatility. A key point for large listed companies!

Add to this that when parametric insurance is transferred through ILS, it tends to move the insurance cursor from risk management to corporate finance, from risk manager to CFO!

Parametric insurance is no silver bullet

Parametric is simple to explain, but designing a hail coverage, as per our above example, is not simple:

It requires high-quality data (available, accurate, real-time), possibly certified by a third party…

…and some work to define the actuarial link between the trigger and the loss incurred, through risk modeling and analysis of same events history.

Basically, a poorly calibrated parametric product can lead to:

--the trigger being reached and payout released, but no significant damage for the insured;

--the trigger not being reached, but the insured suffered a loss.

Parametric insurance is meant to avoid complex claims processes, adjudication costs, etc. If, in the end, adjusters or lawyers have to be involved to mitigate such cases, parametric insurance would lose part of its upside.

In that sense, beyond its apparent simplicity, parametric insurance still requires significant education.

What about price: Is parametric insurance cheaper? It is difficult to compare a single-peril parametric coverage cost against a comprehensive policy. Because parametric is often used to fill gaps from traditional insurance, it stands for an additional cost for sure… yet with upside.

Finally, the parametric alternative doesn’t change a basic insurance rule: If there is no risk appetite from carriers, there is no capacity; if there is no capacity, there is no insurance, parametric or not. As simple as that!

The primary way to mitigate this, especially for Cat events, is to ensure a proper mutualization of the portfolio. This is why pooling is increasingly used, sponsored by supranational organizations to provide more legitimacy.

See also: Parametric Insurance: Is It the Future?

The second mitigation is about finding alternative sources of capacity to cover primary carriers. Parametric insurance can be boosted by the appetite from financial markets for high risk/high yield in a low-interest-rate environment. With increasing interest rates, will financial markets demonstrate the same appetite for ILS-shaped parametric products?

So, what is ahead of us? My views on the drivers for parametric insurance to gain traction:

It is a data game. The development of new data sources allows parametric insurance to expand, especially beyond natural events. Parametric could become mainstream when it thrives for mainstream perils. The question is, how attractive can parametric be against indemnity insurance? The UX advantage is granted, price advantage remains to be demonstrated. The unbundling of coverage against comprehensive policy will be the next challenge.

Along with it, it is an actuarial/data science game. When current models are not applicable, new ones have to be invented. Risk modeling innovation aims both at keeping indemnity-based insurance relevant, and at using parametric as a sustainable way to transfer Cat risks.

It is a capacity game. As long as parametric insurance deals with high-severity perils, reinsurance will drive the market: It dictates conditions to the primary carriers and defines the ultimate protection of insureds through retrocession or ILS. The main question is about frequency: If frequency adds to severity (re climate change), there will definitely be a capacity issue.

It is a regulatory game. Regulation is there to protect the insureds, but when regulation impairs insurers trying to adjust their terms to market conditions, it produces a shortage in capacity. Another question is the bias introduced by the different regulatory frameworks between reinsurance and ILS on one hand and primary insurance on the other. It is not certain that this asymmetry is beneficial to the protection of insureds.