In this blog series, we explore what benefits insurers would gain if they start boosting what we call the Artificial Intelligence Quotient (AIQ), and give an overview of why and how insurers should leverage technology, data and people to get started.

Perhaps some of you remember when an IBM computer called “Deep Blue” defeated world chess champion Garry Kasparov, in 1997. Twenty years later, he said:

“Human plus machine isn’t the future, it’s the present; Don’t fear intelligent machines, work with them.”

Please note, he says “plus” not “versus” or “against.” I believe he is right – there is actually an optimistic story of unlocked potential.

When AI was enlisted to detect breast cancer

A team of Harvard pathologists recently showed how some commentators on the future of artificial intelligence – who either wax enthusiastic about the productivity gains or predict the elimination of jobs – are missing the most important point.

The doctors created an

AI-based technique to identify breast cancer cells. It did well, scoring 92% accuracy, but still fell short of human pathologists, who typically achieve precision rates of around 96%. The biggest surprise came when humans and AI combined forces.

Together, they accurately identified 99.5% of cancerous biopsies.

Much like Kasparov, I believe this is how AI will realize its fullest potential—when human ingenuity and intelligent machines combine synergistically to deliver more than either can on its own.

How does this relate to Insurance?

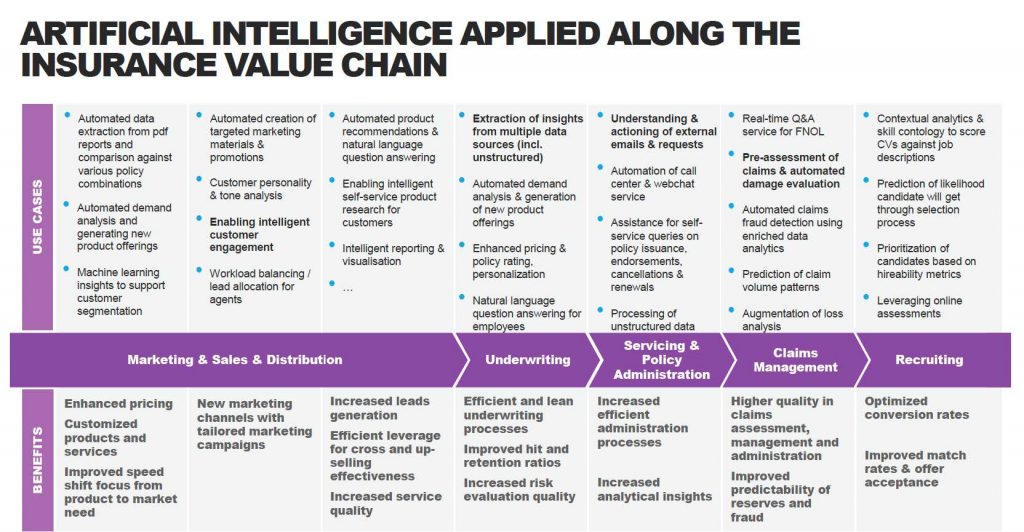

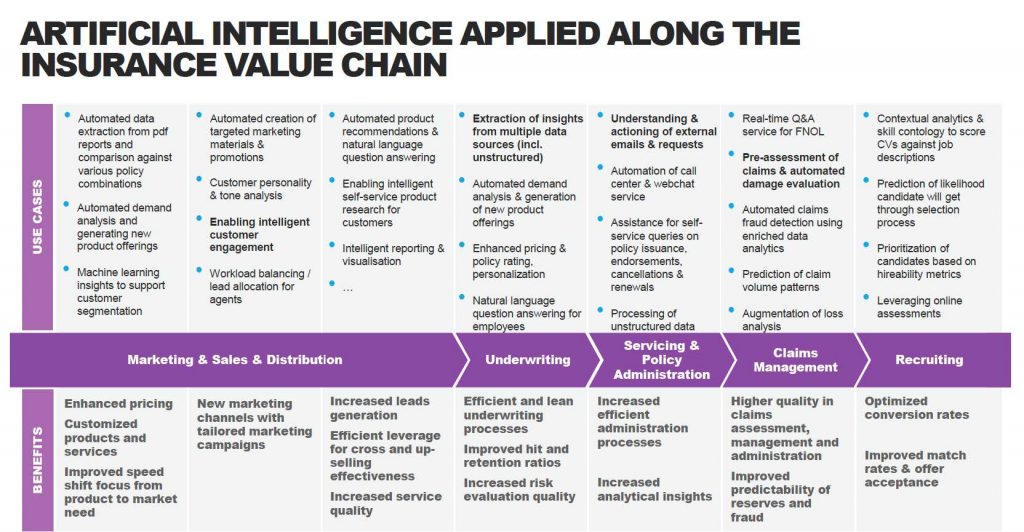

There are numerous use cases of AI that can be applied along the insurance value chain, such as enhanced pricing, customized products and services, efficient underwriting and claims administration processes.

Sales & Distribution —

Sales & Distribution — Employing machine learning insights to support customer segmentation could lead to benefits such as customized products and services and increased sales.

Underwriting & Risk Management — The extraction of insights from multiple data sources can lead to improved risk evaluation quality and, hence, better pricing.

Servicing — using machine learning to handle external emails and requests can lead to an increased efficiency in administration processes.

Claims — The pre-assessment of claims and automated damage evaluation leads to higher quality and accuracy in claims assessment, management and administration and, hence, to cost savings.

Recruiting — Leveraging contextual analytics and skills-based ontology to score resumes against job descriptions leads to an optimized conversion rate.

There are many benefits for insurers – more efficiency, better pricing, customized products and services.

AI will deliver efficiencies, but its greatest benefit will be to drive growth. Especially when it’s used primarily to augment the capabilities of humans.

Artificial intelligence is set to play a major role in insurance, not only by improving efficiencies but by significantly enhancing the customer experience, boosting innovation and opening up new sources of growth.

Accenture conducted an econometric analysis that forecasts that insurers that invest in AI and human-machine collaboration at the same rate as top-performing businesses could not only profit from becoming a more efficient company but also boost their revenue by an average 17% by 2022.

But the research revealed that, while executives expect AI to completely transform insurance, they believe only 25% of their employees are ready to work with intelligent technologies.

See also: 3 Steps to Demystify Artificial Intelligence

Insurers acknowledge AI’s importance and its transformative potential. They admit their people are critical to the success of their AI initiatives, and the growing skills gap is the key factor influencing their workforce strategy

, but only 4% plan to significantly increase their investment in reskilling programs over the next three years. So, there is a major disconnect in insurers’ approach to AI.

Time to Boost Your AIQ

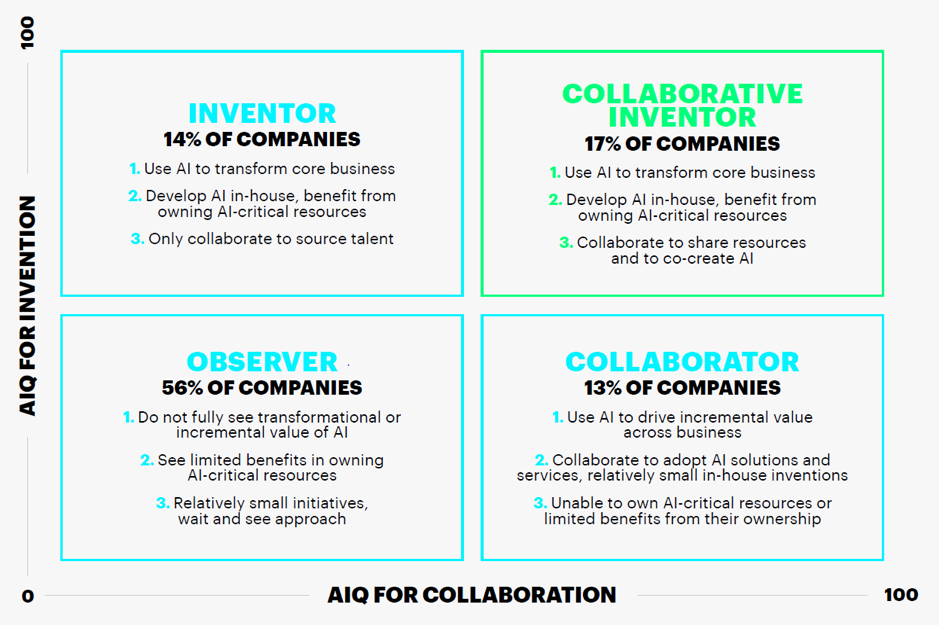

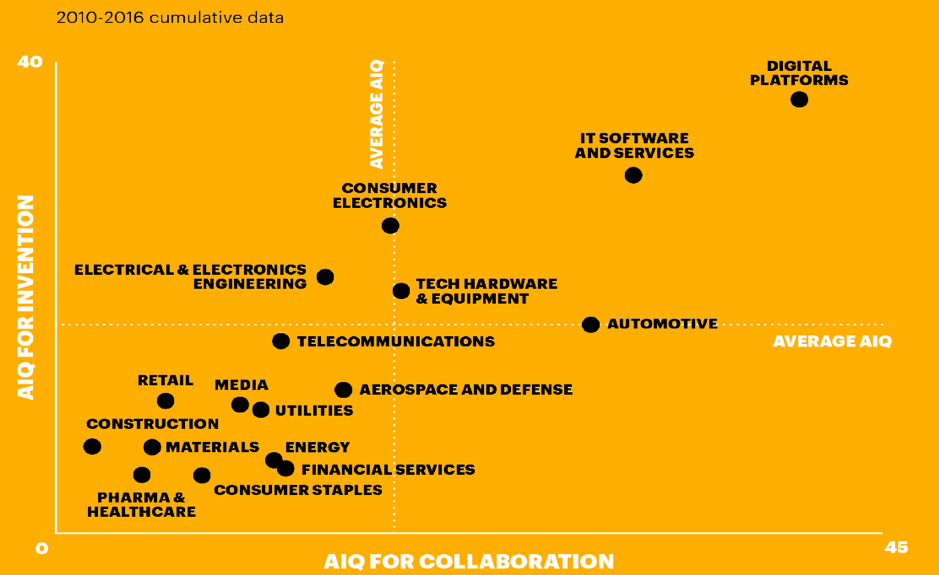

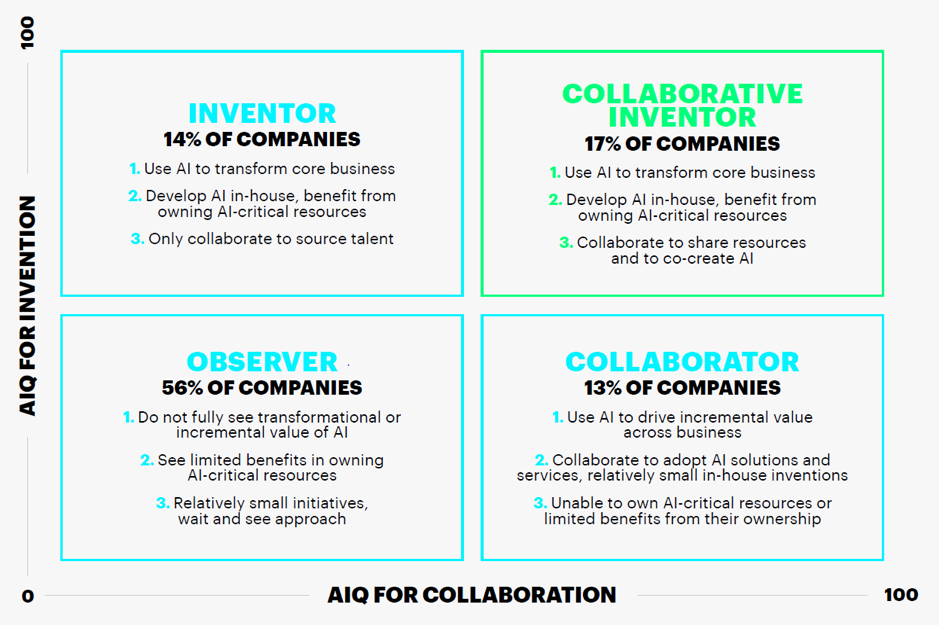

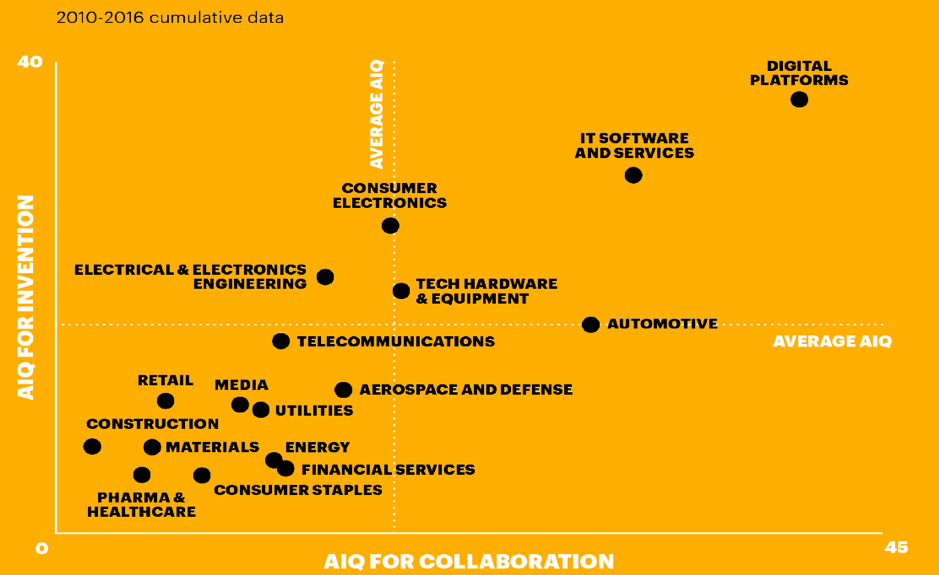

To help insurers take the next steps toward investing in AI, we created two indexes to see what is working. We studied both the FORTUNE Global 100 and what we call the “Intelligent Global 100” – these are pioneers in the development of AI technologies and applications – for the period between 2010 and 2016. For those 200 companies, we looked at both their in-house focus (their AIQ for invention) and their outside focus (AIQ for collaboration). Both are essential.

Organizations with a high AIQ invest significantly in their in-house AI capabilities

and collaborate externally. Yet our analysis revealed that fewer than 20% score well on both indexes — those companies we call “collaborative inventors” (who balance in-house innovation with external collaboration) — while 56% were weak on both.

Not surprisingly, financial services (as you can see in the lower left quadrant) currently has one of the weakest scores on this matrix.

How do you build your AIQ?

How do you build your AIQ?

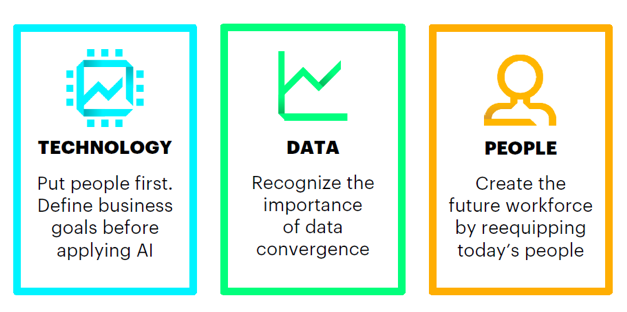

There are three key ingredients to building a high AIQ: Insurers need to own some of the technology (but define business goals before applying AI), some of the data (recognize the importance of data convergence) and some of the talent (create the future workforce; start reskilling your staff). And they will also need to be deeply involved in a broader ecosystem.

You need to work at all three, both in-house and collaboratively, to achieve success.

Business leaders need to evaluate how they invest in technology, data and people. To start, they need to ask themselves the following tough questions:

Technology:

- Does your AI amplify the skills of your people?

- Are you integrating your AI with internal and external systems?

- Does owning your own AI differentiate you in the market?

Data:

- Have you partnered with companies that can monetize your data?

- Can you integrate data with your legacy systems?

- Do you practice responsible AI?

People:

- Can you reskill your workforce to stay ahead of automation?

- Do you offer continuous on-the-job training?

- Can your leaders manage diverse teams?

Finding honest answers to these questions and taking the next steps forward matters, as they are the basis for leveraging the full potential of AI.

Before embarking on this transformational journey and to answer all these questions, it makes sense to first develop a cross-enterprise

AI strategy to clarify strategic goals – the whys, the hows and the whats of the business model.

As we have seen, the majority of insurance executives believe human-machine collaboration is important if they are to achieve their strategic objectives.

Because the workforce is a critical enabler of any AI strategy, insurers need to develop a workforce that is equipped and willing to work at a higher level in collaboration with intelligent machines.

Insurers, in my view, cannot afford to wait until the future is clear and predictable, but need to start now.

There is a choice that insurers need to make. Which company do they want to be? The one that has strategically leveraged intelligent technology, data and upskilled its people – or the one that has not?

Transforming the workforce to collaborate effectively with AI won’t be easy or quick, but it is essential if the potential of artificial intelligence is to be realized. The time to start is now.

See also: Strategist’s Guide to Artificial Intelligence

As mentioned at the beginning, the use cases for the application of AI along the insurance value chain are numerous, and I will explore some in my next posts. This series is structured to answer a number of key questions:

- How can you boost your AIQ in sales and distribution?

- How can you boost your AIQ in underwriting and risk management?

- How can you boost your AIQ in claims management?

- How can you boost your AIQ in client services and policy administration?

- What steps should you take to create the insurance workforce of the future needed to become an AI-driven company?

To learn more about how to raise your organization’s AIQ, download the report:

Boost your AIQ.

You can find the article originally published at Accenture.

Sales & Distribution — Employing machine learning insights to support customer segmentation could lead to benefits such as customized products and services and increased sales.

Underwriting & Risk Management — The extraction of insights from multiple data sources can lead to improved risk evaluation quality and, hence, better pricing.

Servicing — using machine learning to handle external emails and requests can lead to an increased efficiency in administration processes.

Claims — The pre-assessment of claims and automated damage evaluation leads to higher quality and accuracy in claims assessment, management and administration and, hence, to cost savings.

Recruiting — Leveraging contextual analytics and skills-based ontology to score resumes against job descriptions leads to an optimized conversion rate.

There are many benefits for insurers – more efficiency, better pricing, customized products and services.

AI will deliver efficiencies, but its greatest benefit will be to drive growth. Especially when it’s used primarily to augment the capabilities of humans.

Artificial intelligence is set to play a major role in insurance, not only by improving efficiencies but by significantly enhancing the customer experience, boosting innovation and opening up new sources of growth.

Accenture conducted an econometric analysis that forecasts that insurers that invest in AI and human-machine collaboration at the same rate as top-performing businesses could not only profit from becoming a more efficient company but also boost their revenue by an average 17% by 2022.

But the research revealed that, while executives expect AI to completely transform insurance, they believe only 25% of their employees are ready to work with intelligent technologies.

See also: 3 Steps to Demystify Artificial Intelligence

Insurers acknowledge AI’s importance and its transformative potential. They admit their people are critical to the success of their AI initiatives, and the growing skills gap is the key factor influencing their workforce strategy, but only 4% plan to significantly increase their investment in reskilling programs over the next three years. So, there is a major disconnect in insurers’ approach to AI.

Time to Boost Your AIQ

To help insurers take the next steps toward investing in AI, we created two indexes to see what is working. We studied both the FORTUNE Global 100 and what we call the “Intelligent Global 100” – these are pioneers in the development of AI technologies and applications – for the period between 2010 and 2016. For those 200 companies, we looked at both their in-house focus (their AIQ for invention) and their outside focus (AIQ for collaboration). Both are essential.

Sales & Distribution — Employing machine learning insights to support customer segmentation could lead to benefits such as customized products and services and increased sales.

Underwriting & Risk Management — The extraction of insights from multiple data sources can lead to improved risk evaluation quality and, hence, better pricing.

Servicing — using machine learning to handle external emails and requests can lead to an increased efficiency in administration processes.

Claims — The pre-assessment of claims and automated damage evaluation leads to higher quality and accuracy in claims assessment, management and administration and, hence, to cost savings.

Recruiting — Leveraging contextual analytics and skills-based ontology to score resumes against job descriptions leads to an optimized conversion rate.

There are many benefits for insurers – more efficiency, better pricing, customized products and services.

AI will deliver efficiencies, but its greatest benefit will be to drive growth. Especially when it’s used primarily to augment the capabilities of humans.

Artificial intelligence is set to play a major role in insurance, not only by improving efficiencies but by significantly enhancing the customer experience, boosting innovation and opening up new sources of growth.

Accenture conducted an econometric analysis that forecasts that insurers that invest in AI and human-machine collaboration at the same rate as top-performing businesses could not only profit from becoming a more efficient company but also boost their revenue by an average 17% by 2022.

But the research revealed that, while executives expect AI to completely transform insurance, they believe only 25% of their employees are ready to work with intelligent technologies.

See also: 3 Steps to Demystify Artificial Intelligence

Insurers acknowledge AI’s importance and its transformative potential. They admit their people are critical to the success of their AI initiatives, and the growing skills gap is the key factor influencing their workforce strategy, but only 4% plan to significantly increase their investment in reskilling programs over the next three years. So, there is a major disconnect in insurers’ approach to AI.

Time to Boost Your AIQ

To help insurers take the next steps toward investing in AI, we created two indexes to see what is working. We studied both the FORTUNE Global 100 and what we call the “Intelligent Global 100” – these are pioneers in the development of AI technologies and applications – for the period between 2010 and 2016. For those 200 companies, we looked at both their in-house focus (their AIQ for invention) and their outside focus (AIQ for collaboration). Both are essential.

Organizations with a high AIQ invest significantly in their in-house AI capabilities and collaborate externally. Yet our analysis revealed that fewer than 20% score well on both indexes — those companies we call “collaborative inventors” (who balance in-house innovation with external collaboration) — while 56% were weak on both.

Not surprisingly, financial services (as you can see in the lower left quadrant) currently has one of the weakest scores on this matrix.

Organizations with a high AIQ invest significantly in their in-house AI capabilities and collaborate externally. Yet our analysis revealed that fewer than 20% score well on both indexes — those companies we call “collaborative inventors” (who balance in-house innovation with external collaboration) — while 56% were weak on both.

Not surprisingly, financial services (as you can see in the lower left quadrant) currently has one of the weakest scores on this matrix.

How do you build your AIQ?

There are three key ingredients to building a high AIQ: Insurers need to own some of the technology (but define business goals before applying AI), some of the data (recognize the importance of data convergence) and some of the talent (create the future workforce; start reskilling your staff). And they will also need to be deeply involved in a broader ecosystem.

How do you build your AIQ?

There are three key ingredients to building a high AIQ: Insurers need to own some of the technology (but define business goals before applying AI), some of the data (recognize the importance of data convergence) and some of the talent (create the future workforce; start reskilling your staff). And they will also need to be deeply involved in a broader ecosystem.

You need to work at all three, both in-house and collaboratively, to achieve success.

Business leaders need to evaluate how they invest in technology, data and people. To start, they need to ask themselves the following tough questions:

Technology:

You need to work at all three, both in-house and collaboratively, to achieve success.

Business leaders need to evaluate how they invest in technology, data and people. To start, they need to ask themselves the following tough questions:

Technology: