How to manage the increase in incoming unstructured information is a key challenge in the insurance industry—we explore how Accenture’s Machine Learning Text Analyzer can achieve this using historical data.

How do you approach customer service and policy administration within your organization? In this blog post, I’ll demonstrate how artificial intelligence (AI) and a raised AIQ can help you get the most out of your data. (For the other articles in this series, click here.) To do this, I’ll discuss how insurers can use machine learning to analyze texts. How can insurers use AI in customer service and policy administration? The customer service and policy administration workforce can make their lives easier by using AI to:- Understand and act on external emails and requests.

- Automate call center and webchat services—helping companies get on with more intricate work.

- Enable self-service queries on policy issuance, endorsements, cancellations and renewals—using virtual assistants, for example.

- Process unstructured data, which means fewer mistakes and better customer service.

- Machine learning;

- Deep learning;

- Natural language processing;

- Video analytics;

- Embedded AI solutions;

- Robotic process automation;

- Computer vision.

- Machine learning — using machine vision and natural language processing to improve customer interactions.

- Virtual advice — transforming the customer and sales force experiences with data-driven virtual advisers; for example, Munich Re’s Digital Doctor.

- Everyday coaching — helping customers manage and reduce their risk by providing frequent, personalized advice and incentives; for example, Generali’s in-car device that gives real-time coaching.

- Real-time protection — leveraging applications and the IoT to help customers manage their risks; for example, Homies, an IoT-based, peer-to-peer alarm platform developed by Achmea.

- A large amount of information comes in through a variety of channels;

- Incoming data is structured as well as unstructured;

- Much of the workforce is occupied with processing unstructured information;

- A large amount of unstructured information exists within the organization.

- Workers lose a lot of time when they have to identify received information and allocate requests to the right channels;

- They also lose time owing to inefficient processes caused by breaks in the system;

- This prolongs the response time to clients;

- Humans are prone to errors, which creep in at all points.

How does MALTA work in customer service and policy administration?

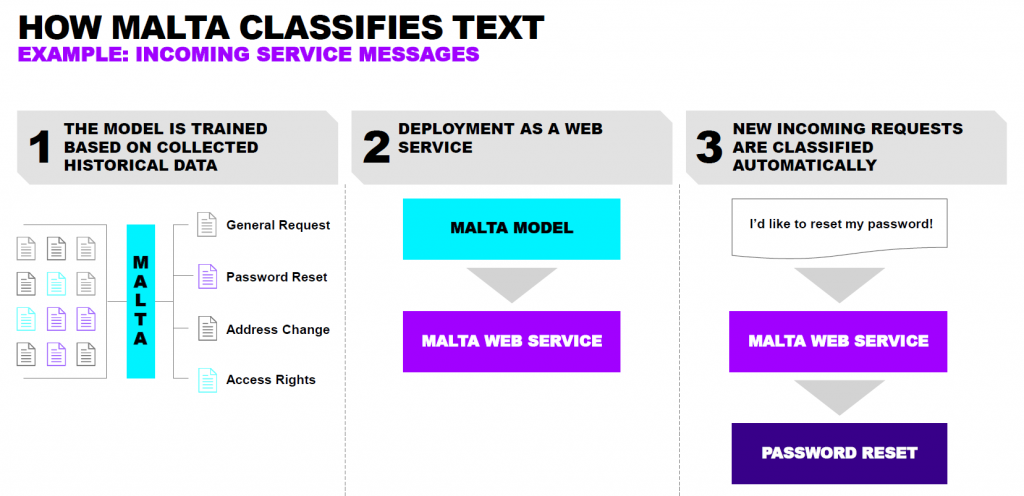

MALTA can analyze any incoming documents, for example when customers send their policy documents via email.

These documents can be analyzed and classified using natural language processing methods and machine learning algorithms. MALTA is also trained with historical data, which enables it to classify, understand and extract information.

In the next step, MALTA links your customer’s policy document to business processes, prompting different functions to take action. Depending on the business and architecture set-up, MALTA or the output of the API triggers a process chain, a robot or an agent so that the necessary processing steps can be executed.

How does MALTA work in customer service and policy administration?

MALTA can analyze any incoming documents, for example when customers send their policy documents via email.

These documents can be analyzed and classified using natural language processing methods and machine learning algorithms. MALTA is also trained with historical data, which enables it to classify, understand and extract information.

In the next step, MALTA links your customer’s policy document to business processes, prompting different functions to take action. Depending on the business and architecture set-up, MALTA or the output of the API triggers a process chain, a robot or an agent so that the necessary processing steps can be executed.

See also: In Age of Disruption, What Is Insurance?

Benefits of MALTA

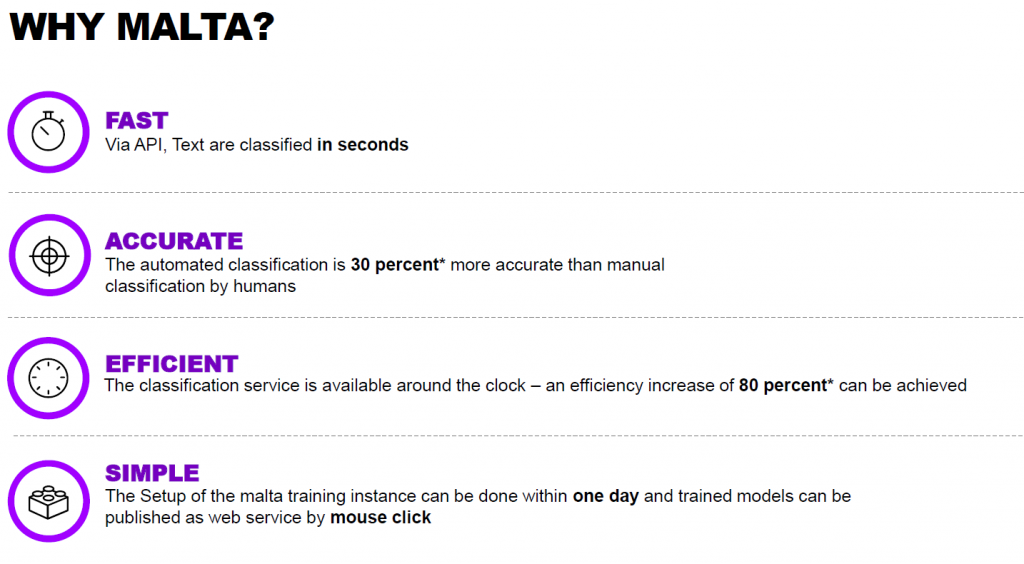

MALTA is flexible, customizable, independent, multilingual, state-of-the-art and end-to-end; using Accenture’s machine learning text analyzer, insurers can:

See also: In Age of Disruption, What Is Insurance?

Benefits of MALTA

MALTA is flexible, customizable, independent, multilingual, state-of-the-art and end-to-end; using Accenture’s machine learning text analyzer, insurers can:

- Increase classification accuracy and efficiency, and reduce errors.

- Create individual learning models based on training data.

- Deploy the solution on-premise, not only in the cloud.

- Automate repetitive tasks, allowing employees to focus on more complex work.

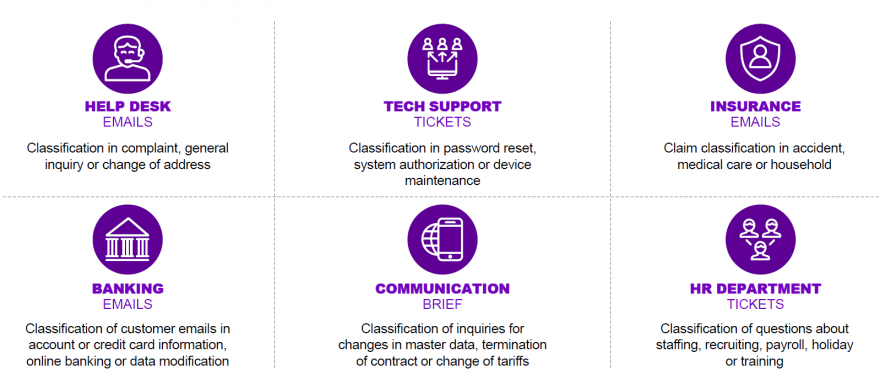

- Categorize new requests immediately and send them to the relevant departments.

- Use state-of-the-art models and tools.

- Work on a platform-independent web service.

- Carry out classification outside regular business hours.

- Cleanse data and extract and evaluate features.

- Link robotics and process automation tools to classification.

- Set up and train employees with minimal effort.

Are you ready to power up your business with AI? Download the report on How to boost your AIQ for more insight.

Are you ready to power up your business with AI? Download the report on How to boost your AIQ for more insight.