The following is an excerpt from a white paper, available in full here.

There have always been a lot of independent insurance agencies in the marketplace, just as there are today. But the competition seems to be increasing by the hour, thanks largely to the proliferation of digital technology and online marketing.

Consequently, most agents hear the following comments quite frequently:

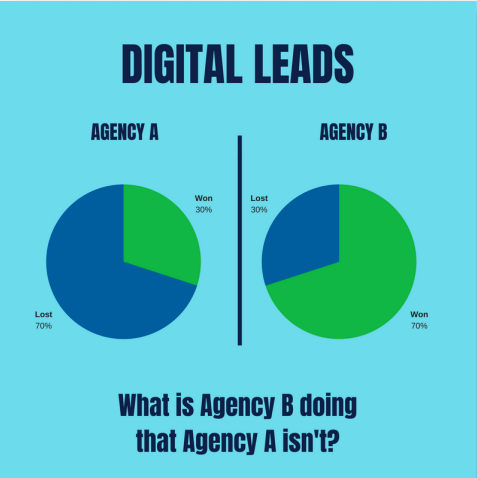

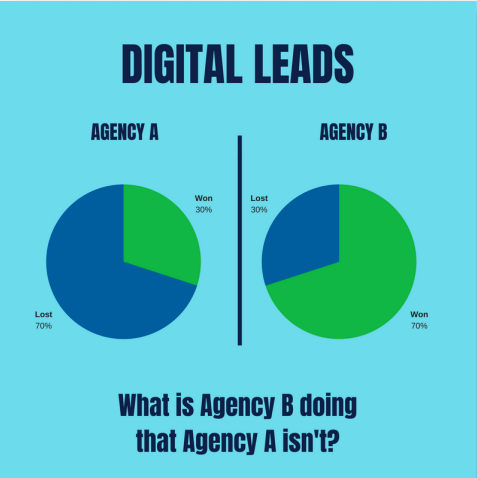

What is one doing to get the prospect’s business that the other one isn’t? When an opportunity arrives, what are you/your producers doing and saying to connect with the prospect and close the deal? What’s your process, and how do you follow up on it?

What is one doing to get the prospect’s business that the other one isn’t? When an opportunity arrives, what are you/your producers doing and saying to connect with the prospect and close the deal? What’s your process, and how do you follow up on it?

- “You insurance people are all the same.”

- “Sure, you can bid on my business insurance; we shop it every three years.”

- “Can you give me a quote on my business insurance? I’m just trying to keep my current agent honest.”

- “I’d like a quote on my automobile insurance.”

- “I noticed my homeowners insurance increased $25. Could you shop it around?”

- “We give great service.”

- "We're local."

- “We represent all of the major insurance companies.”

- “We’ve been in business for 100 years.”

- “We have the best people.”

- What’s your 30-second commercial? What’s your two-minute infomercial?

- What’s your unique selling proposition (USP) — the unique and appealing ideas and things that separate you from all other “me too” competitors?

- What’s different in your process of risk assessment, risk transfer and risk prevention?

- Do you and all of your team members know your top five PODS, or points of differentiation, and do you actually deliver on them?

What is one doing to get the prospect’s business that the other one isn’t? When an opportunity arrives, what are you/your producers doing and saying to connect with the prospect and close the deal? What’s your process, and how do you follow up on it?

What is one doing to get the prospect’s business that the other one isn’t? When an opportunity arrives, what are you/your producers doing and saying to connect with the prospect and close the deal? What’s your process, and how do you follow up on it?