Success in moving from the past to the future of insurance requires a two-speed strategy: Speed of Operations, which focuses on making improvements to the current, traditional business model with next-gen, mature systems and processes; and Speed of Innovation, which is all about creating agile, fast and new business models that explore, test and grow new business opportunities.

We find that Leaders continue to distinguish themselves with a stronger focus on strategic initiatives that support both components of the two-speed strategy.

Speed One: Modernize and Optimize Today’s Business

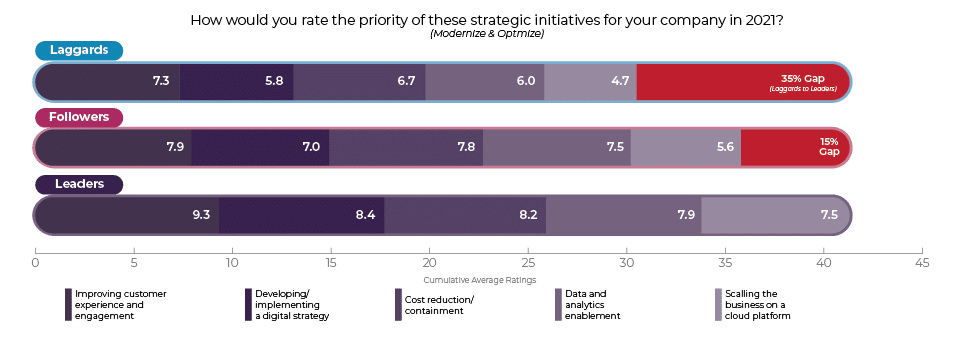

Drilling into the specific elements of Modernize and Optimize reveals a large gap of 35% between Leaders and Laggards. The two key drivers of this gap are Developing a Digital Strategy (45%) and Scaling the business on a cloud platform (60%).

The gap around cloud platform is of particular concern. In our digital age, technology and the business are fundamentally inseparable. Cloud technology is now a given; application programming interfaces (APIs) enable technology to be easily broken into components; AI and machine learning (ML) help the business to make “smart” decisions; digital experience creates unique and personalized engagement; and no code/low code eliminates complexity and accelerates the digital transformation journey, as we outlined in our report, Insurance Platforms – The Digital and No Code/Low Code Platform.

SMA has tracked cloud adoption over the past eight years. In their P&C Core Systems Purchasing Trends report, they said that 2018 was a watershed year, with three in four new core systems deployed in the cloud.[i] And in 2019 they reported that adoption hit a new high-water mark, with 84% of new core systems deployed in the cloud. They say that cloud is now a fundamental requirement in the digital world, and it is growing as we move into the new era of computing where every new technology trend, from AI and big data to microservices and the connected world, is increasingly dependent on cloud.

Figure 3: Gaps between Leaders, Followers and Laggards in Modernize & Optimize priorities

The Modernize and Optimize gap between Leaders and Laggards grew from 9% to 35% over the past three years, continuing the theme we’re seeing of Laggards falling further and further behind. Leaders are constructing future-ready platforms. Followers are moving, but less quickly. Laggards are barely moving off the status quo.

See also: Tip the Sales Scale in Your Favor

Speed Two: Create a Business for the Future

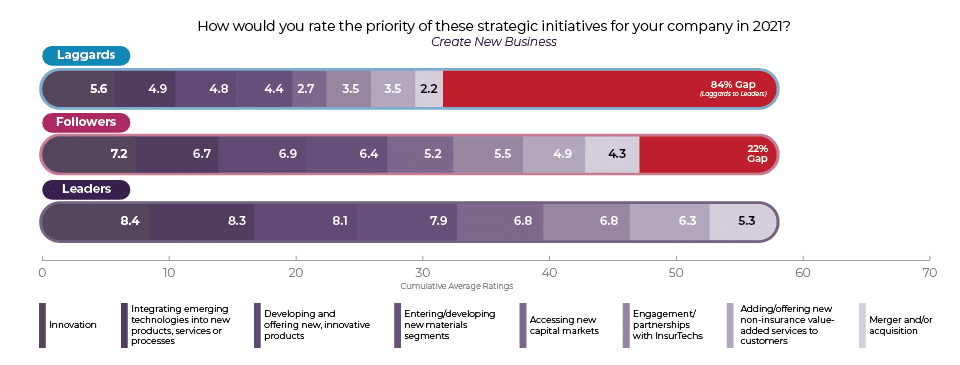

When we consider finding new benchmarks for our industry, it only makes sense that established insurers must respond to new, tech-savvy competitors by wielding innovative business launches. When it comes to business creation, Laggards fall drastically behind, with a massive gap of 84%! The gaps in the individual strategic initiatives range from a low of 50% for Innovation (which was an addition this year) and 152% for Accessing New Capital Markets. The access to new capital markets is a challenge for many of the mutual insurers, limiting what they can do, particularly in an era of significant capital that is being invested in insurtech and other digital, technology businesses.

Large gaps in Engagement/partnerships with insurtechs (94%) and Adding/offering new non-insurance value-added services to customers (80%) are also strong evidence of Laggards’ shocking weakness in speed of innovation. This gap reflects their focus on the past, rather than the future – a dangerous blind spot that suggests dim prospects for continued relevance or survival. A quick re-focus and a two-speed business strategy is the only strategy that can close this gap because we need today’s business to be successful so that it can also fund the new business

Figure 4: Gaps between Leaders, Followers and Laggards in Create a New Business priorities

The differences in planning priorities between Leaders, Followers and Laggards stand out in Majesco’s research. While many Followers may be keeping pace relative to Leaders with their modernizing and optimizing the existing business, often reflected in strong financials, this is deceiving when considering the future business needed – where Followers and Laggards are not planning effectively and are falling further behind.

Leaders continue to distinguish themselves from the other two segments with their stronger focus on strategic initiatives that support the two-speed strategy. Other insurers must accelerate their planning and turn it into doing to remain relevant, let alone be viable for the future.

Is your organization pursuing a two-speed approach to modernization, optimization and innovation? Are you waking up to new benchmarks and realizing that something needs to change?

For more detail, download Strategic Priorities 2021: Despite Challenges, Leaders Widen the Gap.