The passage of the Affordable Care Act in 2010 continues to redefine the employer-sponsored healthcare market. Increased regulatory and fiduciary responsibilities, employer mandates and rising medical premiums have forced employers to evaluate all cost-effective strategies for providing health benefits to employees. One strategy, self-funding, remains an attractive alternative to the traditional fully insured and association-style health plans.

In a self-funded environment, the employer will assume the role of the insurer and agree to pay the medical claims incurred by the plan's members and dependents. A good percentage of self-funded plans will also use reinsurance and captive risk tools to provide protection from both large individual claims and the plan's collective utilization.

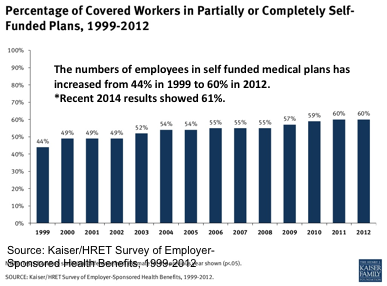

While self-funding has gained momentum as a result of healthcare reform, it is not a new concept. In 1999, a Kaiser Family Foundation (KFF) study reported that 44% of employer-sponsored healthcare was self-funded. That number has now reportedly grown to 61% in 2014.

Why Is Everyone So Interested?

Health benefits continue to be one of the greatest expenses for employers. This fact, compounded with the continual rate increases (with little to no justification), leaves employers feeling stuck in an endless cycle. Some also may feel that their employees are a generally healthy group that is a good candidate to self-fund.

Many turn to self-funding because of:

- Lower fixed costs-The majority of the expense is incurred in the payment of actual medical claims, increasing the margin for savings when the plan performs well.

- Improved transparency-An increase in premiums is easier to swallow if the employer can get an accurate understanding of its claims experience. Self-funded health plans provide employers with a tremendous amount of data. Accurate claims data strengthens the group's ability to effectively control spending on claims.

- Control of the plan design-Self-funded health plans are in a better position to adjust benefits and control increased provider costs. Unlike fully insured products, a self-funded plan design can be structured to meet the specific needs of the group and not an insurer's overall population.

- Tax savings-Fully insured premiums continue to jump to accommodate new provisions as a result of the ACA. Self-funded plan sponsors avoid items like the new Health Insurance Industry Tax, which will increase from 2% to 5% in coming years.

With the increased interest comes new strategies and opportunities as the self-funding marketplace evolves. Self-funded plan sponsors are reaping the benefits of evolving provider network and cost containment strategies. Meanwhile, employers that have yet to make the transition see obstacles lessen because of changes in the reinsurance and captive markets.

What Does This Mean for Employer Groups?

Self-Funded Feasibility Studies Are a Must

There is a strong likelihood that every corporation or public entity with 1,000 employees or more has at least heard about self-funding. However, depending on the number of employees on your health plan, it is quite possible that you have not evaluated self-funding, at least in a thorough way.

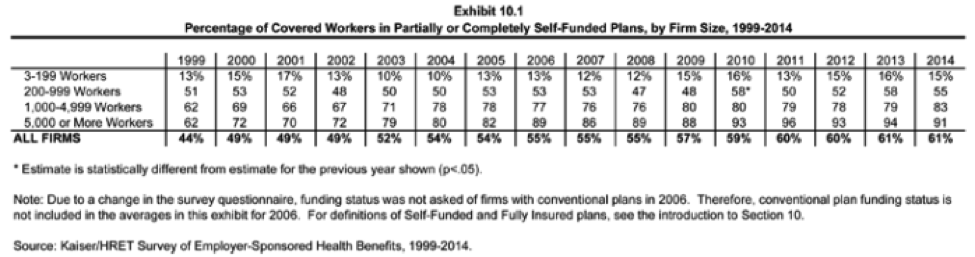

A deeper look into the composition of employers participating shows us that group size typically has a direct correlation on whether a self-funded strategy is being used. According to the 2014 KFF study, the breakdown of corporations self-funding is:

Historically, size has mattered. While all groups with more than 200 employees have a responsibility to evaluate the method as an alternative, those employer groups in the less-than-200 range are seeing more opportunity to make the transition. Lessening participation thresholds to lease competitive provider networks and new reinsurance and captive products are creating total-cost scenarios where the right employer can realize the advantages of self-funding. It can still be a challenge when certain market dynamics are present (i.e., lack of claims data, available provider network options, pending legislative actions, etc.), but more and more companies are finding success.

One More Step

The large insurance companies have noticed the changing market, as well, of course, and have introduced a number of bundled plans that look like self-funding. These products are typically entirely owned by one entity, like an insurance company or trust, and allow the employer to participate in a pre-determined portion of any surplus when the group experiences lower-than-expected claims. These products are attractive because they pull together under one brand all the component vendors of a self-funded health plan (i.e., claims administrator, network, reinsurance, etc.). These products can be a great first step for employers weary of self-funding through their own independent health plan. The products will allow them to gain insight into their claims performance while alleviating some of the additional work associated with the wholly owned approach.

For those groups already in these products, it may be time to evaluate taking that next step and realizing the benefits of a wholly owned approach. Reinsurance policies with specific advance and monthly aggregate accommodation can give these employers the ability to still limit their maximum exposure, lower their plan's fixed costs and keep all of the savings when the plan performs well.

With the tools available today, any employer group in a packaged, shared funded or full ASO model plan is a candidate to complete the transition to a self-funded plan. While the packaged, branded approaches employed by some of the major insurance companies may work for a season, deconstructing the bundled product may be the next step in the employer's long-term strategy.

Fine-Tuning Your Self-Funded Plan

There are many companies that have been enjoying the benefits of self-funding for years. As a result of the ACA, however, these employers have had to react to escalating medical costs, expensive specialty drugs and increased regulatory and fiduciary responsibilities.

For instance, self-funded health plans typically "lease" provider networks from a large insurance company. But, in 2010, the ACA removed lifetime and annual maximums from health plans, and the number of high-dollar claims has increased substantially. The networks provide discounts on fees, but the question is how important they are given the increasingly large charges they are being applied toward.

Self-funded health plans are adept in using different types of analytics both to measure historical data and to predict outcomes. This has empowered these health plans to fine tune their plans and integrate various cost-containment strategies.