Telematics enables insurance to be done in a smarter way. Telematics data can be made available as a core component of the analytical rating engine, personalizing pricing. The same data can be used to make personalized appeals to customers as a retention tool, when it’s the right time to do so.

Insurance carriers will better understand their customer profiles and risks, improving sales and profitability, thus making the use of telematics data a concrete opportunity in all geographies.

The U.S. market has focused on using telematics data to enable continuous underwriting that personalizes pricing. We believe this approach will help usage-based insurance (UBI) move to the next level of adoption, convincing motor insurers that driving data is more than just longer something to experiment with because some of the competitors have it. Today, it’s truly an element that cannot be disregarded.

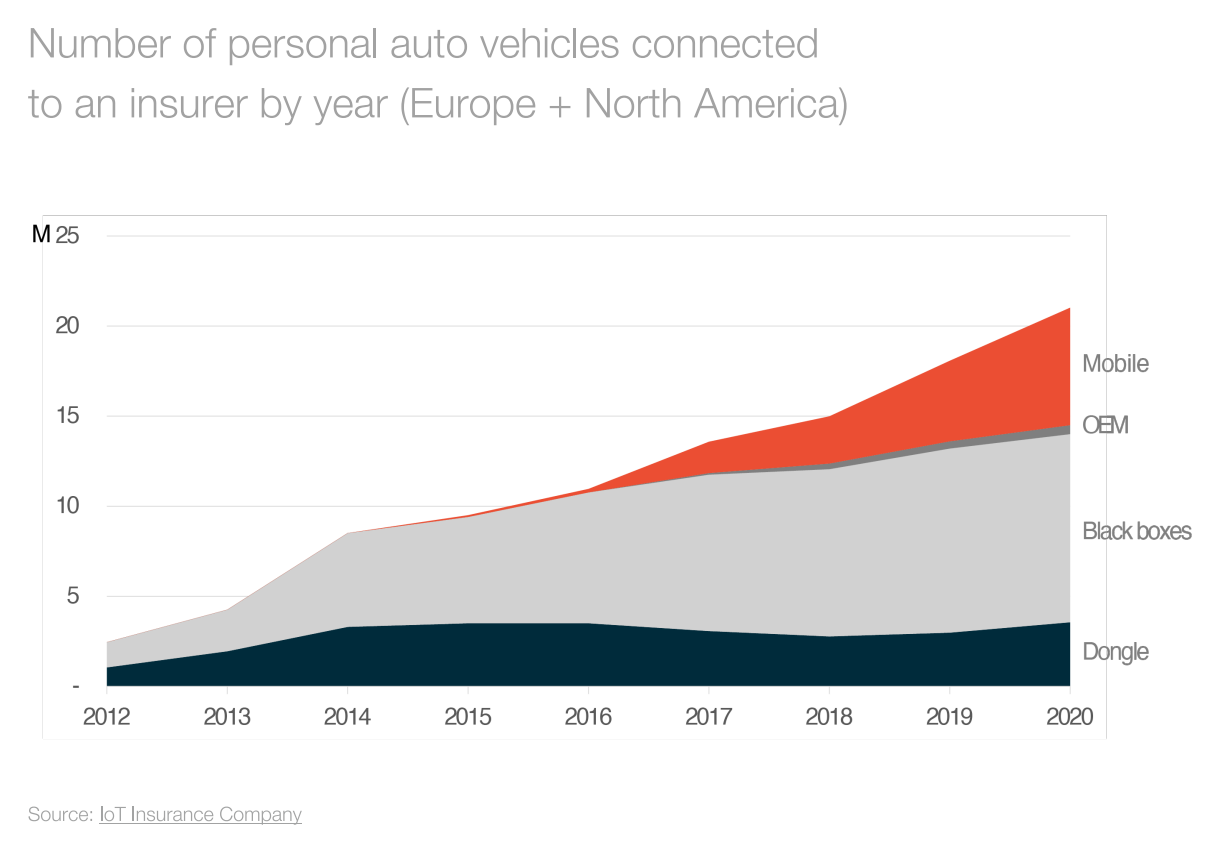

Some insurers worldwide have already successfully introduced a wide range of telematics-based applications. However, motor insurance telematics is still at the beginning of the development curve. Based on IoT Insurance Observatory research, there are fewer than 10 insurers globally with a portfolio bigger than one million telematics-based policies.

In Europe, usage of telematics data has not yet scaled to full potential, and still is rarely used to assess driver risks for modeling. UBI is either a small niche or telematics usage is limited to risk selection and claims management, where it has scaled. The two most advanced markets have been Italy and the U.K., with recent developments in Germany.

In the U.K., UBI is still considered a product for young drivers. In the Italian market, telematics was already present in 22% of the personal motor policies at the end of 2021. Italian personal auto insurance is still globally in a leading position regarding telematics portfolio size, value proposition toward its customers and demand for such services. Many insurers have mastered the use of telematics for self-selection of risks, for claim management and for delivering services to policyholders.

European markets can leverage the recent development in the U.S. market, where the transition to the less expensive, mobile phone-based approach has driven penetration and made the business cases more sustainable.

The opportunity for telematics will only grow. Consumers love to interact with their smartphones, and digital tools and large tech companies are addressing consumers' needs based on the collected data with highly targeted offers, which consumers seem to like. Carriers' experience will mature, and the cost of technology will keep dropping, making it even more accessible. Data sources will increase, too, letting carriers create a powerful mix of elements and better assess driver risks.

We believe that telematics is becoming necessary for dealing with the future of insurance and that there is a concrete opportunity to use it to operationalize any motor book of business!