Details of Driving Violations

It is possible and very important for insurers to gain deeper insight into original violation information for prospective and current customers, in addition to the final disposition decisions. Insurers should seek information that includes court record data so they can provide more accurate quotes and improve adhering to their underwriting guidelines. Implementing court record violation data solutions can enable insurers to capture valuable insight into: convictions from a prior state (which may be associated with a previous driver’s license number), regardless of a change in name or address; convictions while driving outside of the resident state; tickets with dispositions other than guilty; and tickets and violations that are still active (not yet adjudicated).

See also: 5 Steps to Understand Distracted Driving

Court record violation data is an essential tool for insurers to develop accurate pricing and underwriting strategies. By understanding a fuller picture of violation history, insurers will be able to more effectively assess the risk of each driver and implement programs to capture the appropriate amount of premium dollars for riskier drivers while providing more affordable premiums to cleaner drivers.

For additional information about TransUnion’s study findings and DriverRisk, please click here.

Details of Driving Violations

It is possible and very important for insurers to gain deeper insight into original violation information for prospective and current customers, in addition to the final disposition decisions. Insurers should seek information that includes court record data so they can provide more accurate quotes and improve adhering to their underwriting guidelines. Implementing court record violation data solutions can enable insurers to capture valuable insight into: convictions from a prior state (which may be associated with a previous driver’s license number), regardless of a change in name or address; convictions while driving outside of the resident state; tickets with dispositions other than guilty; and tickets and violations that are still active (not yet adjudicated).

See also: 5 Steps to Understand Distracted Driving

Court record violation data is an essential tool for insurers to develop accurate pricing and underwriting strategies. By understanding a fuller picture of violation history, insurers will be able to more effectively assess the risk of each driver and implement programs to capture the appropriate amount of premium dollars for riskier drivers while providing more affordable premiums to cleaner drivers.

For additional information about TransUnion’s study findings and DriverRisk, please click here.Getting the Full Picture on Driving Records

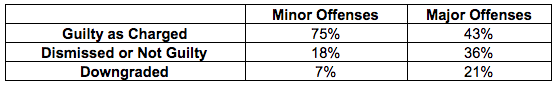

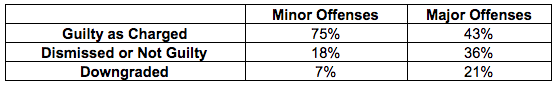

57% of major offenses, such as DUIs, are unobservable by insurers due to dismissals or downgrades. 27% of traffic tickets are dismissed.

Details of Driving Violations

It is possible and very important for insurers to gain deeper insight into original violation information for prospective and current customers, in addition to the final disposition decisions. Insurers should seek information that includes court record data so they can provide more accurate quotes and improve adhering to their underwriting guidelines. Implementing court record violation data solutions can enable insurers to capture valuable insight into: convictions from a prior state (which may be associated with a previous driver’s license number), regardless of a change in name or address; convictions while driving outside of the resident state; tickets with dispositions other than guilty; and tickets and violations that are still active (not yet adjudicated).

See also: 5 Steps to Understand Distracted Driving

Court record violation data is an essential tool for insurers to develop accurate pricing and underwriting strategies. By understanding a fuller picture of violation history, insurers will be able to more effectively assess the risk of each driver and implement programs to capture the appropriate amount of premium dollars for riskier drivers while providing more affordable premiums to cleaner drivers.

For additional information about TransUnion’s study findings and DriverRisk, please click here.

Details of Driving Violations

It is possible and very important for insurers to gain deeper insight into original violation information for prospective and current customers, in addition to the final disposition decisions. Insurers should seek information that includes court record data so they can provide more accurate quotes and improve adhering to their underwriting guidelines. Implementing court record violation data solutions can enable insurers to capture valuable insight into: convictions from a prior state (which may be associated with a previous driver’s license number), regardless of a change in name or address; convictions while driving outside of the resident state; tickets with dispositions other than guilty; and tickets and violations that are still active (not yet adjudicated).

See also: 5 Steps to Understand Distracted Driving

Court record violation data is an essential tool for insurers to develop accurate pricing and underwriting strategies. By understanding a fuller picture of violation history, insurers will be able to more effectively assess the risk of each driver and implement programs to capture the appropriate amount of premium dollars for riskier drivers while providing more affordable premiums to cleaner drivers.

For additional information about TransUnion’s study findings and DriverRisk, please click here.