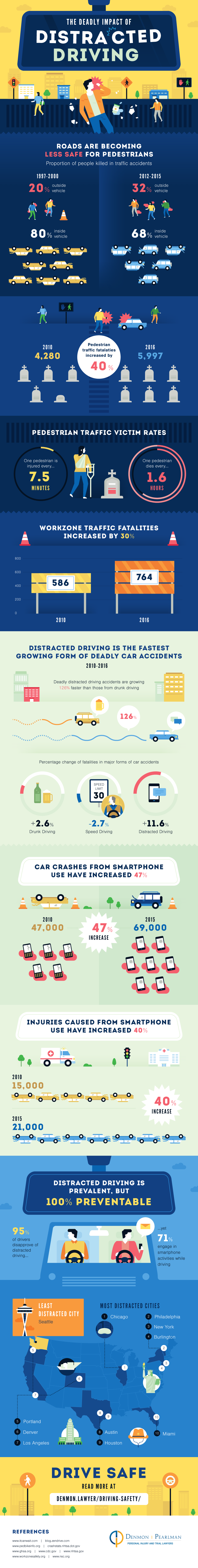

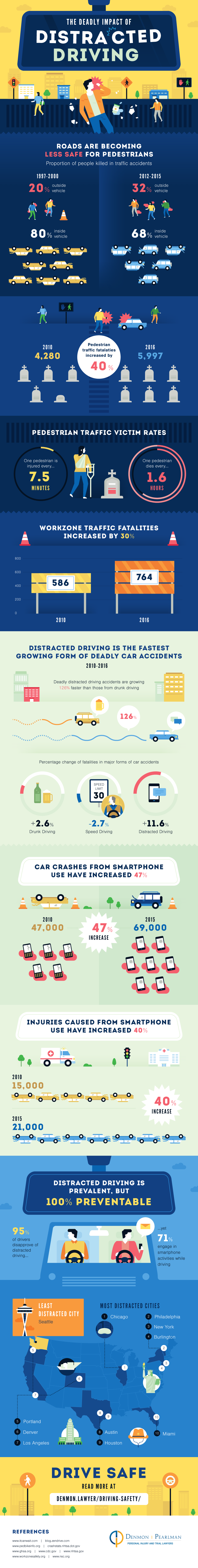

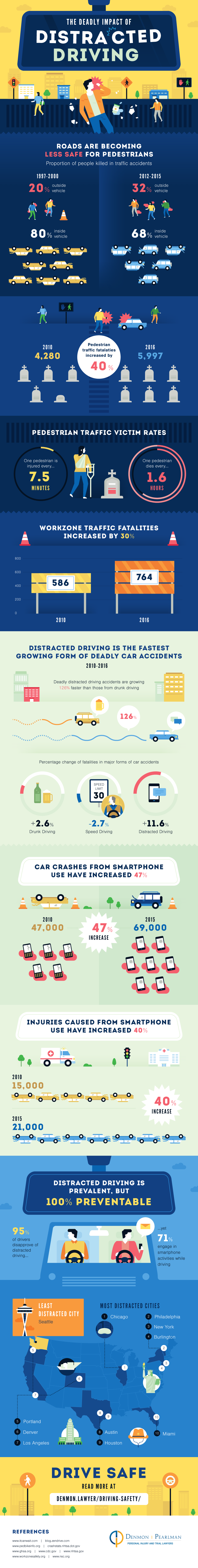

Distracted Driving -- an Infographic

Despite awareness campaigns, 52% of accidents had significant phone distraction beforehand, according to Cambridge Mobile Telematics.

Despite awareness campaigns, 52% of accidents had significant phone distraction beforehand, according to Cambridge Mobile Telematics.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Christian Denmon is a Tampa, Florida trial lawyer specializing in personal injury and divorce. He is the founding partner of Denmon & Denmon. A truly progressive firm, the firm offers fixed fee engagements, service guarantees and a focus on picking the right process to lead to a principled settlement for the client. He lives in St. Petersburg with his wife and two children.