The premiums won't disappear right away. For now, California is the only state that mandates the use of mileage in setting premiums. Most companies doing business there use a hodgepodge of miles bands and a tinkling of rate adjustments from low miles to higher miles. The most sophisticated insurer uses dozens of bands with a 500-mile increment. Premium discounts go as low as 50%, with a roughly 2% incline from 500 to 25,000 miles.

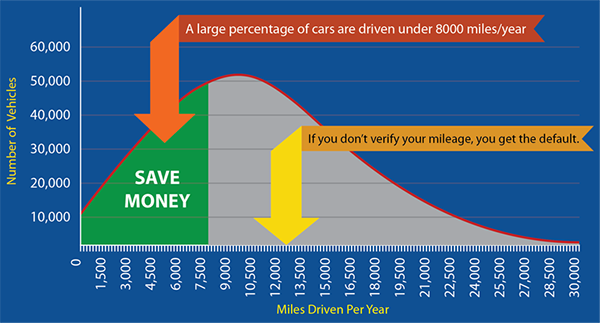

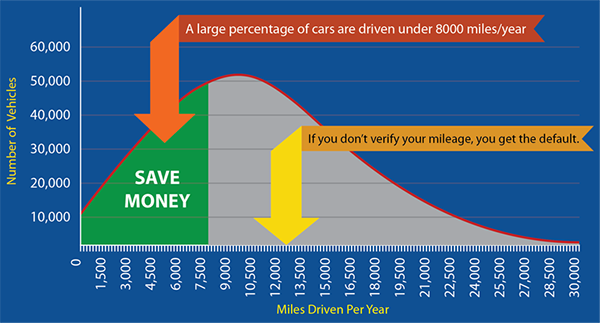

But the trend toward usage-based pricing has to pick up steam, both because it's possible to measure miles driven very precisely and because so many people are overpaying.

Practically every retiree in America drives less than when she worked. If you go out and look for a used car (use Google -- save some gas), you can find many a 15-year-old car with less than 75,000 miles, or five-year-old cars with less than 30,000 miles. Even if an owner of one of those 15-year-old cars received a 30% discount for low miles, he paid for 15 years and only used 10 years' worth of insurance.

There are sure to be many counterpoints to the simple argument being made here, but all of the readers who are honest know someone who does not drive much, but who pays the full default rate like everyone else.

Let the shopping and savings begin.

The premiums won't disappear right away. For now, California is the only state that mandates the use of mileage in setting premiums. Most companies doing business there use a hodgepodge of miles bands and a tinkling of rate adjustments from low miles to higher miles. The most sophisticated insurer uses dozens of bands with a 500-mile increment. Premium discounts go as low as 50%, with a roughly 2% incline from 500 to 25,000 miles.

But the trend toward usage-based pricing has to pick up steam, both because it's possible to measure miles driven very precisely and because so many people are overpaying.

Practically every retiree in America drives less than when she worked. If you go out and look for a used car (use Google -- save some gas), you can find many a 15-year-old car with less than 75,000 miles, or five-year-old cars with less than 30,000 miles. Even if an owner of one of those 15-year-old cars received a 30% discount for low miles, he paid for 15 years and only used 10 years' worth of insurance.

There are sure to be many counterpoints to the simple argument being made here, but all of the readers who are honest know someone who does not drive much, but who pays the full default rate like everyone else.

Let the shopping and savings begin.The $22 Billion of Auto Premiums That Will Disappear

Drivers will increasingly demand big discounts for low mileage.

The premiums won't disappear right away. For now, California is the only state that mandates the use of mileage in setting premiums. Most companies doing business there use a hodgepodge of miles bands and a tinkling of rate adjustments from low miles to higher miles. The most sophisticated insurer uses dozens of bands with a 500-mile increment. Premium discounts go as low as 50%, with a roughly 2% incline from 500 to 25,000 miles.

But the trend toward usage-based pricing has to pick up steam, both because it's possible to measure miles driven very precisely and because so many people are overpaying.

Practically every retiree in America drives less than when she worked. If you go out and look for a used car (use Google -- save some gas), you can find many a 15-year-old car with less than 75,000 miles, or five-year-old cars with less than 30,000 miles. Even if an owner of one of those 15-year-old cars received a 30% discount for low miles, he paid for 15 years and only used 10 years' worth of insurance.

There are sure to be many counterpoints to the simple argument being made here, but all of the readers who are honest know someone who does not drive much, but who pays the full default rate like everyone else.

Let the shopping and savings begin.

The premiums won't disappear right away. For now, California is the only state that mandates the use of mileage in setting premiums. Most companies doing business there use a hodgepodge of miles bands and a tinkling of rate adjustments from low miles to higher miles. The most sophisticated insurer uses dozens of bands with a 500-mile increment. Premium discounts go as low as 50%, with a roughly 2% incline from 500 to 25,000 miles.

But the trend toward usage-based pricing has to pick up steam, both because it's possible to measure miles driven very precisely and because so many people are overpaying.

Practically every retiree in America drives less than when she worked. If you go out and look for a used car (use Google -- save some gas), you can find many a 15-year-old car with less than 75,000 miles, or five-year-old cars with less than 30,000 miles. Even if an owner of one of those 15-year-old cars received a 30% discount for low miles, he paid for 15 years and only used 10 years' worth of insurance.

There are sure to be many counterpoints to the simple argument being made here, but all of the readers who are honest know someone who does not drive much, but who pays the full default rate like everyone else.

Let the shopping and savings begin.