P&C insurance is becoming less important financially because the insured world is becoming safer. The safer the world, the less insurance people need to buy to protect them against losses. The less important any good or service is, the less valuable it becomes, and people will not pay as much for it. It is just simple economics.

Before jumping to conclusions like most people do when I present these facts, it is important to understand the difference between the insured world becoming safer and the part of the economy that is not insured by private companies. In the U.S. (unlike some other developed economies), the government provides most flood insurance. A material portion of the population does not buy insurance, so they become part of the non-insured world. Many of the disasters you see on the news are not insured because people did not buy insurance for those catastrophes. Lots and lots of people may lose their homes to an earthquake or forest fires, but many of those people will not have insurance coverage for those types of events. In many cases, insurance coverage is not readily available so events become uninsured. The insurance companies have made the decision to only insure people and property they are confident they can insure for a profit. Many insureds have decided to forgo purchasing coverage for many kinds of risks because they are either too expensive to cover or, in consumers' minds, the risk is too small. What does get insured because of carriers' conservative approach and the insureds' cautious approach is the part of the economy that is becoming ever safer. If we're not careful as an industry, we will eventually have nothing left to insure.

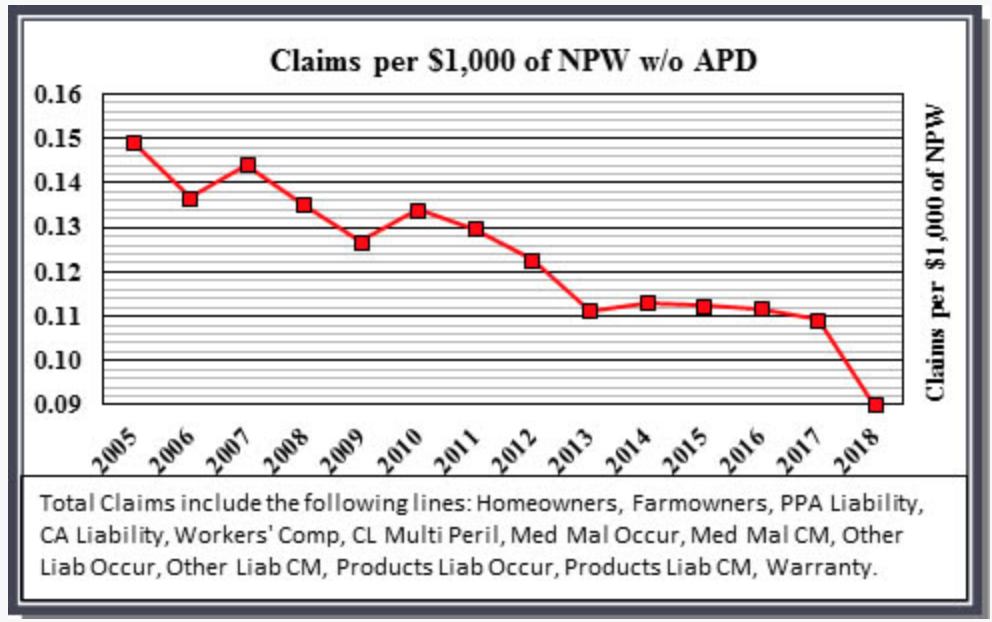

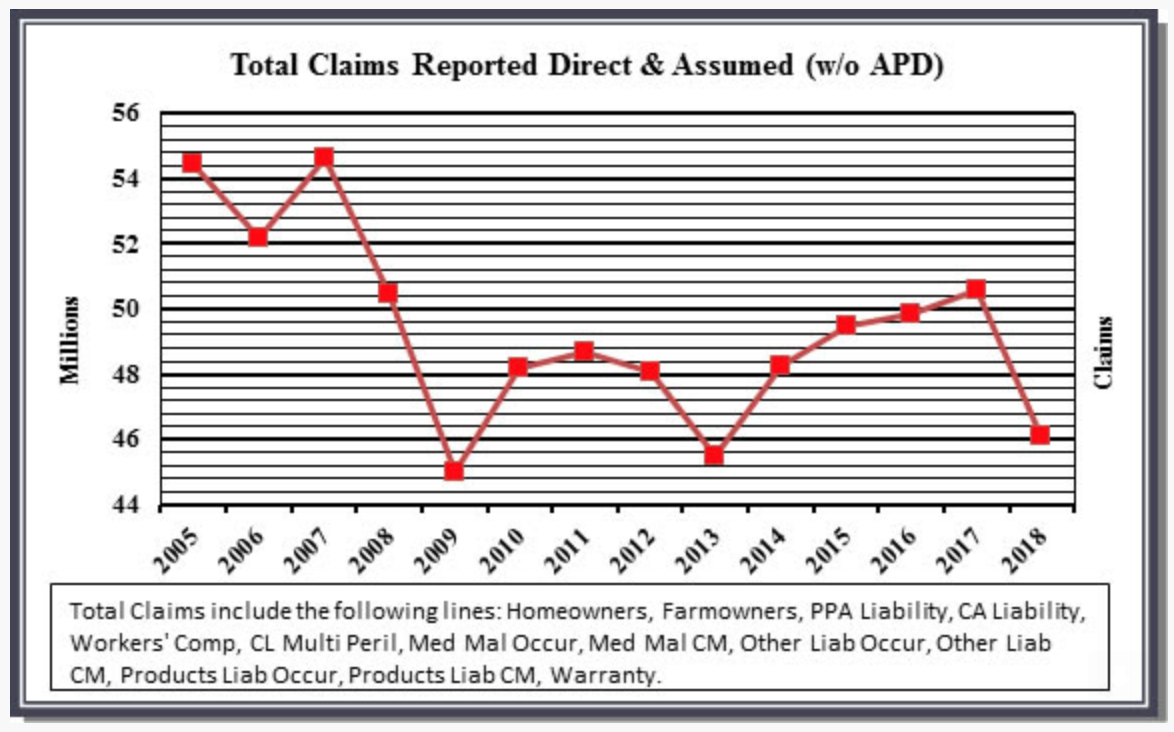

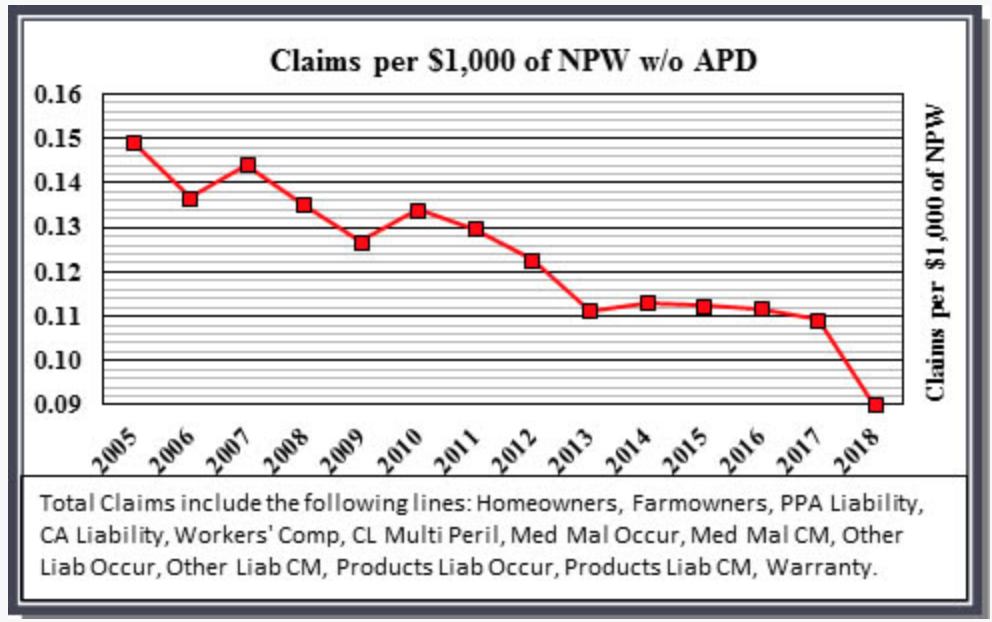

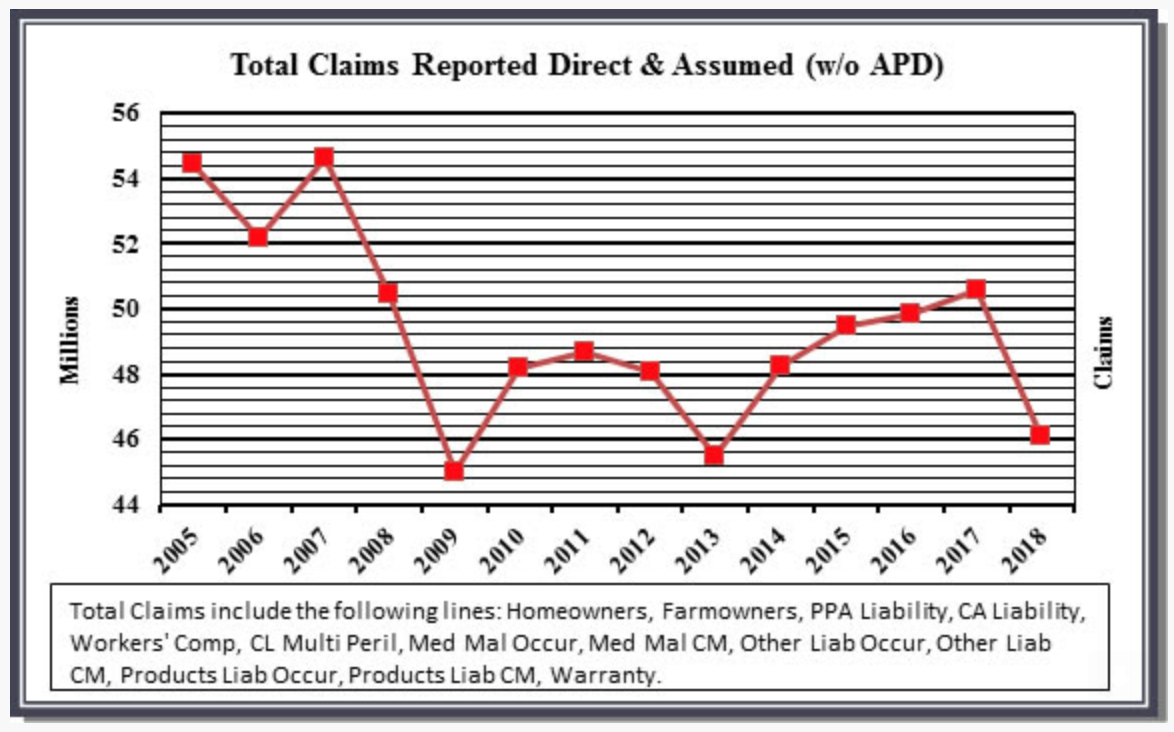

Here is the proof the insured world is becoming safer (all data is based on A.M. Best's latest Aggregates and Averages). The following two charts are for frequency, which is a better metric relative to whether more or fewer adverse insured events are occurring. For many reasons, severity may take a different path primarily because large losses tend to make up a larger portion of the remaining claims when frequency decreases.

These charts exclude physical damage to autos because that one single line defies other trends. In other words, hail and flood auto claims are not becoming less frequent. The charts above do consider non-auto property hail claims, however, and, even with those claims, which include damage to hundreds of thousands of properties over the last few years (primarily in four states), the absolute number of claims is less. Considering that there are hundreds of thousands more businesses, people, homes and drivers, claims have decreased from around 54 million per year to, even in a cat year like 2017 (2018 numbers have not fully developed), only 50 million. The insured world is safer.

See also: Road to Success for P&C Insurers

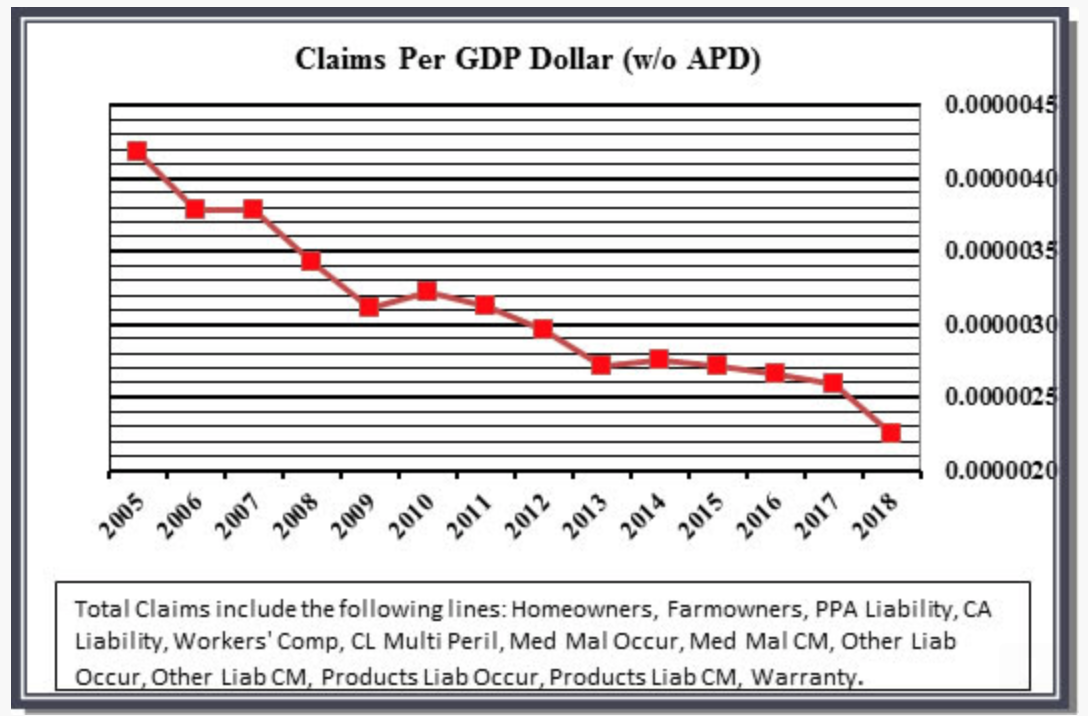

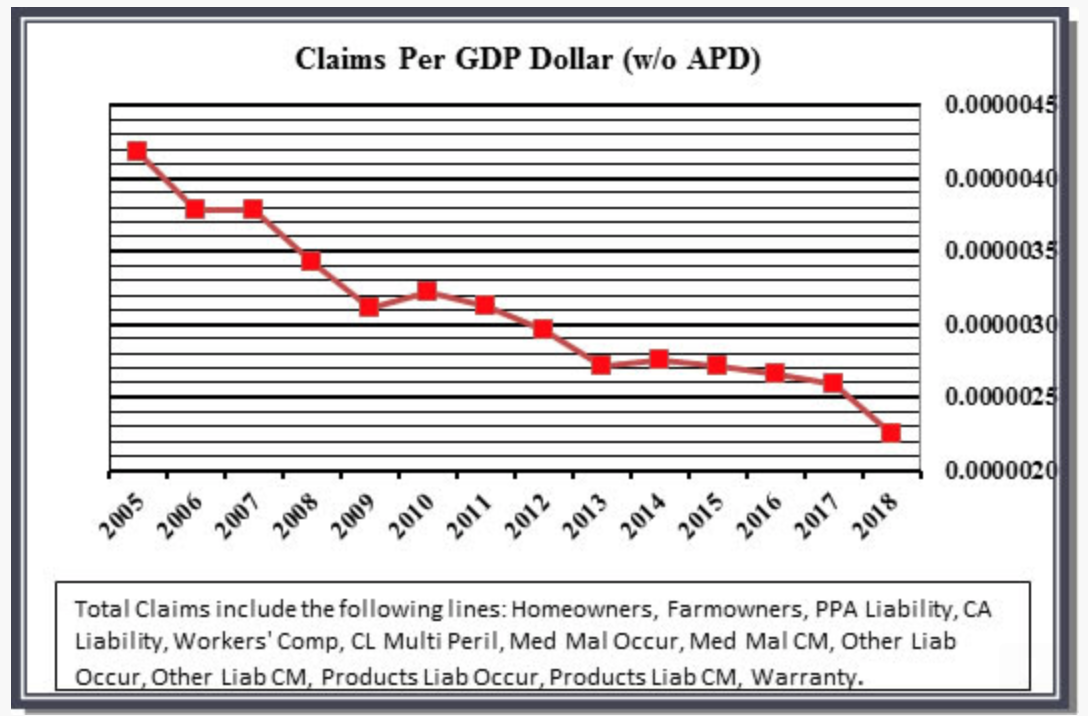

The chart below clearly shows that claims relative to GDP are in a steady decline. Even if auto physical damage claims are added to these charts, the overall trend does not change. The difference is that the steepness of the decline moderates.

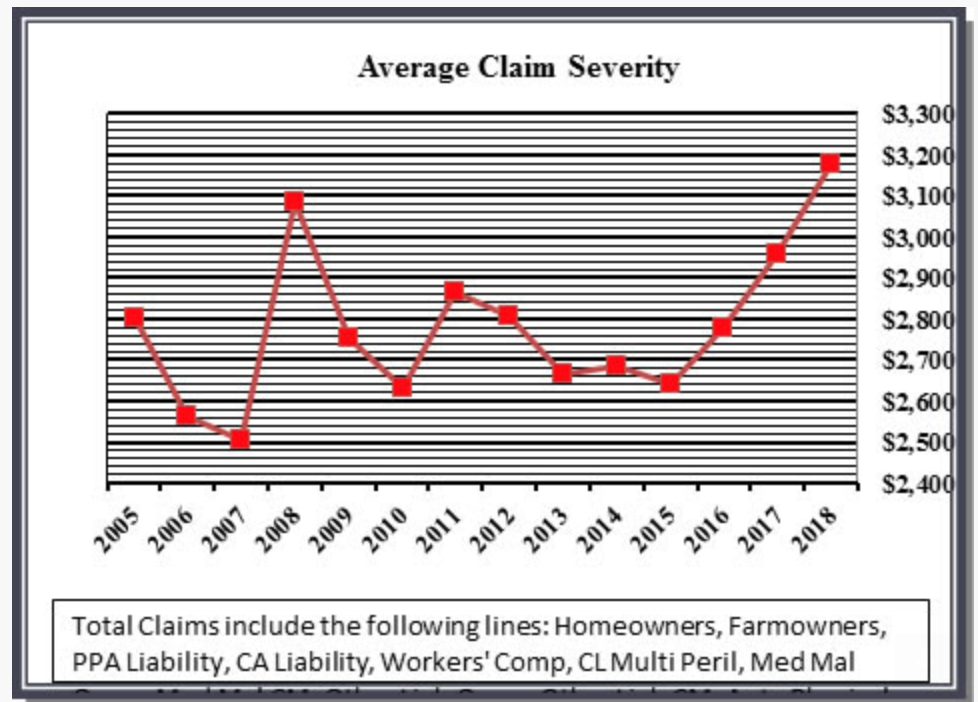

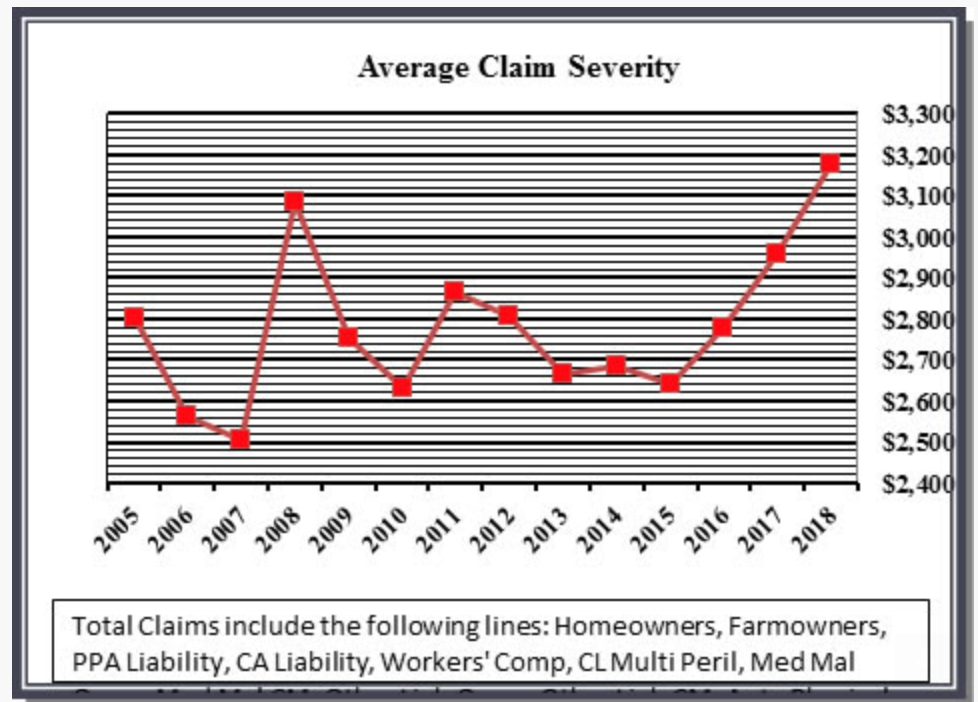

If it was not for severity increasing in pure dollar terms, which should be expected, the decrease would be even more pronounced. I do not have the definitive data, but my guess is the severity increase over the last three years is due to the hail storms and the horrible California fires. I can personally testify to hail claims totaling cars -- if you don't live in a severe hail state, it is difficult to appreciate the damage a hail stone the size of a golf ball, much less a tennis ball, can do.

The increasing safety of the insured world is a threat to carriers' and agents' existence because the problem is likely to grow. The safety improvements in vehicles, blue collar work environments and, perhaps especially, water shut-off devices, along with technology that will reduce exposures, means insurance will become even less valuable soon.

The above charts show obvious points. Improved regulations involving better zoning distances, airbags and even OSHA have all made our world safer. I am glad many of the tort reforms seem to have minimized or at least in some states reduced some of the ludicrous litigation that seems to benefit no one but a few plaintiff attorneys and the defense attorneys hired to defend against those nebulous suits. The fewer the losses, the less important insurance is. The less important insurance is, the less people will pay for it. Add record surplus, and talk of a true hard market becomes obvious wishful thinking unless some key carriers have managed to underestimate their reserves by large amounts.

The increasing safety of the world is out of the industry's control. We must adjust. Two other factors affecting the results shown in these charts are within our control. The first is how carriers adjust claims and underwrite. Based on real world experience with agents every day and some interesting published articles, some of which are more direct in their accusations, it is thought that some carriers have taken approaches that make getting a payout for a legitimate claim so difficult that frequency and severity are depressed. Similarly, some of the public has become aware, and agents definitely are aware and often educate their customers, that filing small claims should be avoided. These claims should be avoided because the pricing penalties assessed for minor claims are far too high.

This situation presents an opportunity in my mind for carriers that don't suppress claims or make processing claims inordinately difficult to let the world know they are easier to deal with in a claim situation. It is also an opportunity for agents to educate clients on the differences in claims-paying behaviors. Every agent knows different companies' tendencies with regard to claims, but many agents are reluctant to discuss those tendencies. Just as with any situation where full disclosure is limited, those with more dubious practices get the benefit, and those with the best practices fail to get full credit. Maybe use one of the publicly published claims satisfaction surveys or create your own.

The second way in which the industry almost certainly needs to change to offset the safer insured world is to change its current focus on insuring 1950s America. 1950 was about manufacturing. 2020 is about services and data. It seems every insurance company is telling every agency that their target market is manufacturers, which is proof of 1950s thinking. The industry needs to insure today’s economy.

Ever try to buy a full data policy for self-created data (which obviously is the most valuable data for a huge proportion of businesses)? Ever try to buy a policy providing coverage for intangible assets? How about intellectual property? Today’s economy is built on intangible assets, data and intellectual property. Most machines and buildings are almost unimportant because most are fairly easily replaced, or substitutes can often be easily identified (excluding highly specialized firms). Companies and governments run on data, not lathes. Few companies go out of business because they can't find a temporary building following a fire. Businesses do go out of business after cyber-attacks, reputational damage, theft of data and theft of intellectual property. In fact, think of it this way: What is the bigger danger even to a manufacturer -- the building burning down or someone in another country stealing the company's design and then undercutting the price by 50%? There is only one answer to that question.

See also: Provocative View on Future of P&C Claims

The Hartford did a study in 2015 showing reputational harm was the most severe small business claim (40% more than the average fire claim). I can only imagine that the spread has increased. In 2017, Deloitte published a study that reputation was more important than getting the strategy wrong for 87% of executives. A CNBC article from Oct. 13, 2019, reported on a study by Hiscox stating that 60% of small businesses go out of business within six months of a cyber-attack. Many other studies support the same statistics but carriers and agents continue to focus on $x liability limits, $x property and workers' comp.

Some readers may be thinking that policies exist for cyber, reputational harm, etc. (notwithstanding the fact that many cyber policies are arguably worse than no policy at all because at least not having a policy is free). Those readers are missing the point. A BOP or package policy provides coverage if a machine or building burns or is stolen or is blown away. Where is the same property coverage for a destroyed reputation or the theft of self-created data? I know Lloyd's has some coverages available, but 99% of carriers are focused on what was important in 1950. Customers are concerned with what is important today. Carriers and agents that continue trying to insure the needs of 1950 will have a short life.

Another reason today's exposures are not covered is that many agents do not understand business income coverage, so they either don't sell it or they don't sell it correctly. Next to cyber, business income is arguably the most difficult coverage to understand. Furthermore, the simplified solution that many agents choose to follow is offering the same business income solution to every client, as if all insureds were identical (and if you are thinking ALS is a universal solution, you are wrong). This is just bad thinking. Business income coverage in and of itself is far more important for many insureds, especially if one includes true contingent business income that goes beyond standard forms.

Whether you are working for a carrier or an agency, you need to insure the economy of today and tomorrow. You have complete control over this aspect of the insurance industry's diminishing in economic importance. If you focus on what is important in today's economy, you become a hero with a much more secure future by using the tools that are already invented such as business income coverages, much less creating tools to insure data and intangible assets. Let’s finally let go of 1950s thinking.

Find out more at www.burandeducation.com/3d-learn-more.

These charts exclude physical damage to autos because that one single line defies other trends. In other words, hail and flood auto claims are not becoming less frequent. The charts above do consider non-auto property hail claims, however, and, even with those claims, which include damage to hundreds of thousands of properties over the last few years (primarily in four states), the absolute number of claims is less. Considering that there are hundreds of thousands more businesses, people, homes and drivers, claims have decreased from around 54 million per year to, even in a cat year like 2017 (2018 numbers have not fully developed), only 50 million. The insured world is safer.

See also: Road to Success for P&C Insurers

The chart below clearly shows that claims relative to GDP are in a steady decline. Even if auto physical damage claims are added to these charts, the overall trend does not change. The difference is that the steepness of the decline moderates.

If it was not for severity increasing in pure dollar terms, which should be expected, the decrease would be even more pronounced. I do not have the definitive data, but my guess is the severity increase over the last three years is due to the hail storms and the horrible California fires. I can personally testify to hail claims totaling cars -- if you don't live in a severe hail state, it is difficult to appreciate the damage a hail stone the size of a golf ball, much less a tennis ball, can do.

The increasing safety of the insured world is a threat to carriers' and agents' existence because the problem is likely to grow. The safety improvements in vehicles, blue collar work environments and, perhaps especially, water shut-off devices, along with technology that will reduce exposures, means insurance will become even less valuable soon.

These charts exclude physical damage to autos because that one single line defies other trends. In other words, hail and flood auto claims are not becoming less frequent. The charts above do consider non-auto property hail claims, however, and, even with those claims, which include damage to hundreds of thousands of properties over the last few years (primarily in four states), the absolute number of claims is less. Considering that there are hundreds of thousands more businesses, people, homes and drivers, claims have decreased from around 54 million per year to, even in a cat year like 2017 (2018 numbers have not fully developed), only 50 million. The insured world is safer.

See also: Road to Success for P&C Insurers

The chart below clearly shows that claims relative to GDP are in a steady decline. Even if auto physical damage claims are added to these charts, the overall trend does not change. The difference is that the steepness of the decline moderates.

If it was not for severity increasing in pure dollar terms, which should be expected, the decrease would be even more pronounced. I do not have the definitive data, but my guess is the severity increase over the last three years is due to the hail storms and the horrible California fires. I can personally testify to hail claims totaling cars -- if you don't live in a severe hail state, it is difficult to appreciate the damage a hail stone the size of a golf ball, much less a tennis ball, can do.

The increasing safety of the insured world is a threat to carriers' and agents' existence because the problem is likely to grow. The safety improvements in vehicles, blue collar work environments and, perhaps especially, water shut-off devices, along with technology that will reduce exposures, means insurance will become even less valuable soon.

The above charts show obvious points. Improved regulations involving better zoning distances, airbags and even OSHA have all made our world safer. I am glad many of the tort reforms seem to have minimized or at least in some states reduced some of the ludicrous litigation that seems to benefit no one but a few plaintiff attorneys and the defense attorneys hired to defend against those nebulous suits. The fewer the losses, the less important insurance is. The less important insurance is, the less people will pay for it. Add record surplus, and talk of a true hard market becomes obvious wishful thinking unless some key carriers have managed to underestimate their reserves by large amounts.

The increasing safety of the world is out of the industry's control. We must adjust. Two other factors affecting the results shown in these charts are within our control. The first is how carriers adjust claims and underwrite. Based on real world experience with agents every day and some interesting published articles, some of which are more direct in their accusations, it is thought that some carriers have taken approaches that make getting a payout for a legitimate claim so difficult that frequency and severity are depressed. Similarly, some of the public has become aware, and agents definitely are aware and often educate their customers, that filing small claims should be avoided. These claims should be avoided because the pricing penalties assessed for minor claims are far too high.

This situation presents an opportunity in my mind for carriers that don't suppress claims or make processing claims inordinately difficult to let the world know they are easier to deal with in a claim situation. It is also an opportunity for agents to educate clients on the differences in claims-paying behaviors. Every agent knows different companies' tendencies with regard to claims, but many agents are reluctant to discuss those tendencies. Just as with any situation where full disclosure is limited, those with more dubious practices get the benefit, and those with the best practices fail to get full credit. Maybe use one of the publicly published claims satisfaction surveys or create your own.

The second way in which the industry almost certainly needs to change to offset the safer insured world is to change its current focus on insuring 1950s America. 1950 was about manufacturing. 2020 is about services and data. It seems every insurance company is telling every agency that their target market is manufacturers, which is proof of 1950s thinking. The industry needs to insure today’s economy.

Ever try to buy a full data policy for self-created data (which obviously is the most valuable data for a huge proportion of businesses)? Ever try to buy a policy providing coverage for intangible assets? How about intellectual property? Today’s economy is built on intangible assets, data and intellectual property. Most machines and buildings are almost unimportant because most are fairly easily replaced, or substitutes can often be easily identified (excluding highly specialized firms). Companies and governments run on data, not lathes. Few companies go out of business because they can't find a temporary building following a fire. Businesses do go out of business after cyber-attacks, reputational damage, theft of data and theft of intellectual property. In fact, think of it this way: What is the bigger danger even to a manufacturer -- the building burning down or someone in another country stealing the company's design and then undercutting the price by 50%? There is only one answer to that question.

See also: Provocative View on Future of P&C Claims

The Hartford did a study in 2015 showing reputational harm was the most severe small business claim (40% more than the average fire claim). I can only imagine that the spread has increased. In 2017, Deloitte published a study that reputation was more important than getting the strategy wrong for 87% of executives. A CNBC article from Oct. 13, 2019, reported on a study by Hiscox stating that 60% of small businesses go out of business within six months of a cyber-attack. Many other studies support the same statistics but carriers and agents continue to focus on $x liability limits, $x property and workers' comp.

Some readers may be thinking that policies exist for cyber, reputational harm, etc. (notwithstanding the fact that many cyber policies are arguably worse than no policy at all because at least not having a policy is free). Those readers are missing the point. A BOP or package policy provides coverage if a machine or building burns or is stolen or is blown away. Where is the same property coverage for a destroyed reputation or the theft of self-created data? I know Lloyd's has some coverages available, but 99% of carriers are focused on what was important in 1950. Customers are concerned with what is important today. Carriers and agents that continue trying to insure the needs of 1950 will have a short life.

Another reason today's exposures are not covered is that many agents do not understand business income coverage, so they either don't sell it or they don't sell it correctly. Next to cyber, business income is arguably the most difficult coverage to understand. Furthermore, the simplified solution that many agents choose to follow is offering the same business income solution to every client, as if all insureds were identical (and if you are thinking ALS is a universal solution, you are wrong). This is just bad thinking. Business income coverage in and of itself is far more important for many insureds, especially if one includes true contingent business income that goes beyond standard forms.

Whether you are working for a carrier or an agency, you need to insure the economy of today and tomorrow. You have complete control over this aspect of the insurance industry's diminishing in economic importance. If you focus on what is important in today's economy, you become a hero with a much more secure future by using the tools that are already invented such as business income coverages, much less creating tools to insure data and intangible assets. Let’s finally let go of 1950s thinking.

Find out more at www.burandeducation.com/3d-

The above charts show obvious points. Improved regulations involving better zoning distances, airbags and even OSHA have all made our world safer. I am glad many of the tort reforms seem to have minimized or at least in some states reduced some of the ludicrous litigation that seems to benefit no one but a few plaintiff attorneys and the defense attorneys hired to defend against those nebulous suits. The fewer the losses, the less important insurance is. The less important insurance is, the less people will pay for it. Add record surplus, and talk of a true hard market becomes obvious wishful thinking unless some key carriers have managed to underestimate their reserves by large amounts.

The increasing safety of the world is out of the industry's control. We must adjust. Two other factors affecting the results shown in these charts are within our control. The first is how carriers adjust claims and underwrite. Based on real world experience with agents every day and some interesting published articles, some of which are more direct in their accusations, it is thought that some carriers have taken approaches that make getting a payout for a legitimate claim so difficult that frequency and severity are depressed. Similarly, some of the public has become aware, and agents definitely are aware and often educate their customers, that filing small claims should be avoided. These claims should be avoided because the pricing penalties assessed for minor claims are far too high.

This situation presents an opportunity in my mind for carriers that don't suppress claims or make processing claims inordinately difficult to let the world know they are easier to deal with in a claim situation. It is also an opportunity for agents to educate clients on the differences in claims-paying behaviors. Every agent knows different companies' tendencies with regard to claims, but many agents are reluctant to discuss those tendencies. Just as with any situation where full disclosure is limited, those with more dubious practices get the benefit, and those with the best practices fail to get full credit. Maybe use one of the publicly published claims satisfaction surveys or create your own.

The second way in which the industry almost certainly needs to change to offset the safer insured world is to change its current focus on insuring 1950s America. 1950 was about manufacturing. 2020 is about services and data. It seems every insurance company is telling every agency that their target market is manufacturers, which is proof of 1950s thinking. The industry needs to insure today’s economy.

Ever try to buy a full data policy for self-created data (which obviously is the most valuable data for a huge proportion of businesses)? Ever try to buy a policy providing coverage for intangible assets? How about intellectual property? Today’s economy is built on intangible assets, data and intellectual property. Most machines and buildings are almost unimportant because most are fairly easily replaced, or substitutes can often be easily identified (excluding highly specialized firms). Companies and governments run on data, not lathes. Few companies go out of business because they can't find a temporary building following a fire. Businesses do go out of business after cyber-attacks, reputational damage, theft of data and theft of intellectual property. In fact, think of it this way: What is the bigger danger even to a manufacturer -- the building burning down or someone in another country stealing the company's design and then undercutting the price by 50%? There is only one answer to that question.

See also: Provocative View on Future of P&C Claims

The Hartford did a study in 2015 showing reputational harm was the most severe small business claim (40% more than the average fire claim). I can only imagine that the spread has increased. In 2017, Deloitte published a study that reputation was more important than getting the strategy wrong for 87% of executives. A CNBC article from Oct. 13, 2019, reported on a study by Hiscox stating that 60% of small businesses go out of business within six months of a cyber-attack. Many other studies support the same statistics but carriers and agents continue to focus on $x liability limits, $x property and workers' comp.

Some readers may be thinking that policies exist for cyber, reputational harm, etc. (notwithstanding the fact that many cyber policies are arguably worse than no policy at all because at least not having a policy is free). Those readers are missing the point. A BOP or package policy provides coverage if a machine or building burns or is stolen or is blown away. Where is the same property coverage for a destroyed reputation or the theft of self-created data? I know Lloyd's has some coverages available, but 99% of carriers are focused on what was important in 1950. Customers are concerned with what is important today. Carriers and agents that continue trying to insure the needs of 1950 will have a short life.

Another reason today's exposures are not covered is that many agents do not understand business income coverage, so they either don't sell it or they don't sell it correctly. Next to cyber, business income is arguably the most difficult coverage to understand. Furthermore, the simplified solution that many agents choose to follow is offering the same business income solution to every client, as if all insureds were identical (and if you are thinking ALS is a universal solution, you are wrong). This is just bad thinking. Business income coverage in and of itself is far more important for many insureds, especially if one includes true contingent business income that goes beyond standard forms.

Whether you are working for a carrier or an agency, you need to insure the economy of today and tomorrow. You have complete control over this aspect of the insurance industry's diminishing in economic importance. If you focus on what is important in today's economy, you become a hero with a much more secure future by using the tools that are already invented such as business income coverages, much less creating tools to insure data and intangible assets. Let’s finally let go of 1950s thinking.

Find out more at www.burandeducation.com/3d-