We’ve all read the headlines about major insurance carriers reducing their presence in certain markets. In California alone, 90% of companies either are not offering property insurance or have heavy restrictions, while 70% are not currently offering new plans. This trend raises important questions about how insurers can navigate profitability challenges without limiting customer options. The term double inflation is being heard, where not only is inflation causing continuing uncertainty, the industry’s pains have been exacerbated by social inflation.

Rising costs, unprecedented claims payouts, and consumer expectations are posing challenges for insurers. Many are struggling to navigate the combined pressures of macroeconomic issues alongside escalating frequency and severity losses in personal lines. The situation demands P&C insurers adapt, focusing on profitability while delivering the relevant experiences consumers deserve and require.

One lever carriers have attempted to utilize in addressing profitability is filing for rate increases. However, there comes a point when requested rate increases are limited or denied by regulators, forcing carriers to make the difficult decision to stop offering policies. This leaves consumers with fewer choices, driving premiums up for those that remain - a death spiral by adverse selection.

Next Era Risk Identifier

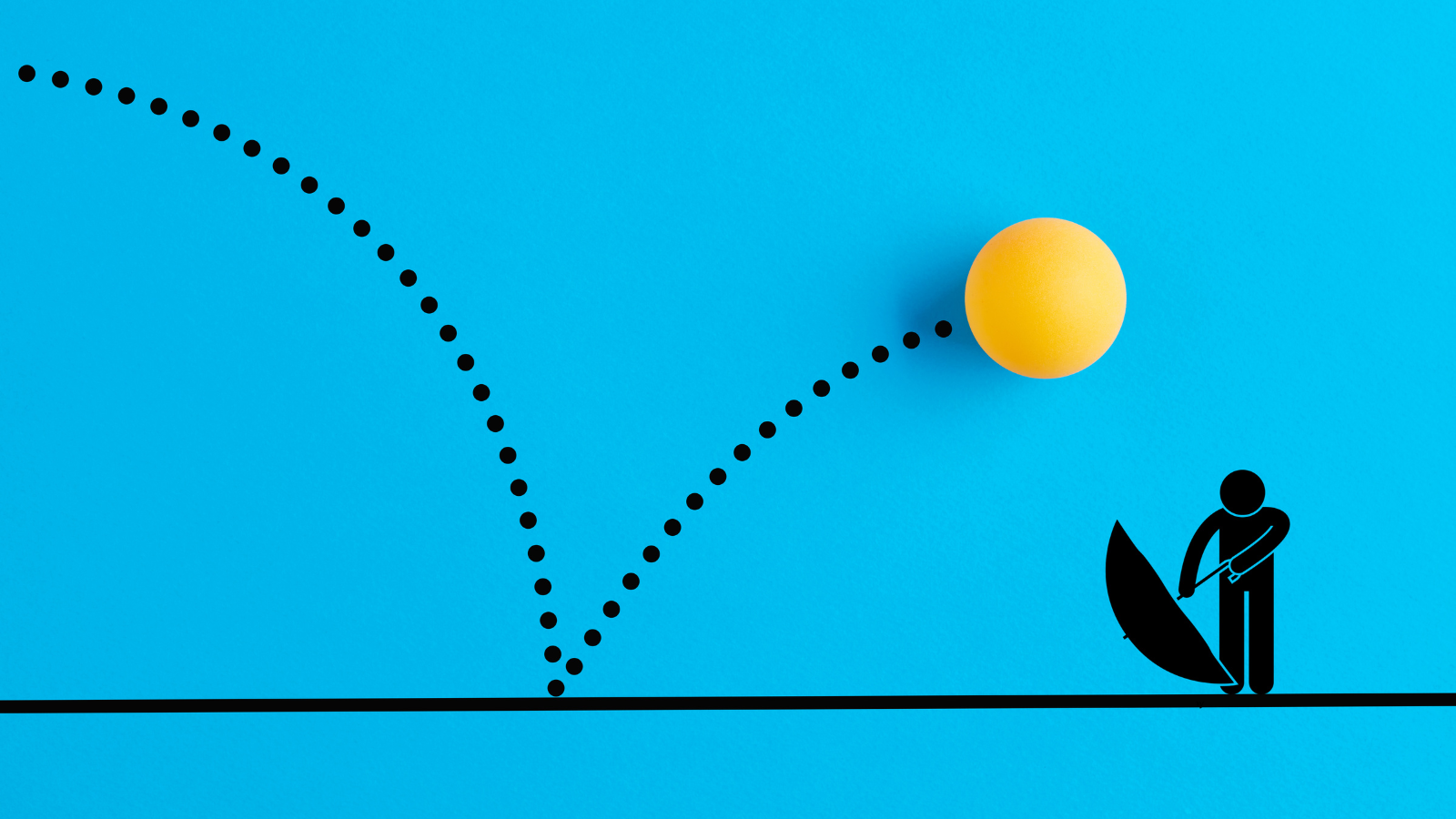

A better approach is to leverage risk intelligence at an individual level, powered by behavioral deep learning. This type of predictive intelligence helps carriers prepare more effectively and avoid future profitability issues or adverse selection as more people shop for insurance. By incorporating individual-level risk selection insurers can identify consumers with the highest risk propensity before they even become policyholders.

In the latest report, AM Best projects a combined ratio of 100.7 for all P&C underwriting lines in 2024. With advanced intelligence available earlier in the buying process, insurers can guide consumers down different underwriting and pricing paths, evaluate critical financial implications and avoid the potential damage caused by the lack of early intelligence.

Enhancing Fairness Through Advanced Risk Selection

Fairness in insurance goes beyond industry standards to include a deeper understanding of the individual. Even if a customer is unbanked or has no credit history, carriers can still leverage behavioral data. Insuring people more appropriately, rather than exiting a market to alleviate profitability and rating constraints, is fairer and better serves all stakeholders, including customers..

A Better Approach for P&C Insurers in Tough Markets

Utilizing individualized predictive intelligence allows carriers to more precisely identify and quantify risks, placing policyholders into the appropriate tiers without the need for continuous premium increases or drastic market exits.

Furthermore, entering a market can also benefit from this cutting-edge individual-level intelligence. For example, a carrier entering a market like California, can use this approach to make informed decisions, identify customers who match their risk profile and gather better intelligence on potential agency partners for both the short and long term.

Conclusion

Insurers have a responsibility to serve all stakeholders, even in volatile times. It’s our duty to keep the company sustainable, uphold promises to consumers, and deliver returns for investors or owners.

The challenges of achieving sustainable profitability amidst rising costs of claims, litigation, and social inflation require adapting to new or growing risks. By failing to utilize new technologies and intelligence, insurers miss the opportunity to build stronger companies and fulfill their obligations to stakeholders..

The key is more effective risk selection and assessment. Planning well and ensuring robust financial management are essential attributes for any company. The insurance industry, at its core, protects people and their dreams, providing peace of mind. By improving our practices and solidifying the industry, we leave a legacy we can all be proud of.

About Scott Ham

| Scott Ham is the CEO of Pinpoint Predictive and was previously the President & CEO of Transamerica’s life, P&C and non-life business, where he provided strategic vision and leadership to global organization. At Transamerica he oversaw day-to-day operations and management of over 6,000 employees, $1.6 billion in new sales and over $6 billion in overall premium. Scott more recently was extensively involved with insurtech startups as a strategic advisor at McKinsey & Co, where he also led a Small Commercial Insurance SaaS platform that made possible real-time underwriting and pricing decisions through cutting-edge machine learning analytics and 3rd party data. Scott is joining Pinpoint to lead the company through a period of unprecedented growth. |

Sponsored by ITL Partner: Pinpoint Predictive