Many insurance organizations share common pain points when it comes to collecting premium payments – but what’s the biggest, top-of-mind challenge that keeps insurers up at night? We wanted to know, so we asked 106 insurers who attended a recent live webinar the following question:

Which objective is most important for your insurance organization?

- Decrease payment-related phone calls

- Decrease inbound paper checks

- Decrease print and mailing fees

- Reduce late premium payments and cancellations

With 62% of the vote, the majority of insurers asked selected “reduce late payments and cancelations” as their most critical organizational goal. This makes perfect sense, considering that late or delinquent payments often lead to policy cancellations, spikes of policyholder churn, and a negative impact on your organization’s revenue flow.

How can you reduce late premium payments and cancellations?

Since delayed payments are such a major concern for so many insurers – perhaps yourself included! – we wanted to offer 4 ways your organization can utilize online payment technology to combat late premium payments and prevent policy cancellations.

1. Provide flexible payment options

The past year has seen a tremendous shift if the way customers are making payments, and it’s more important than ever to offer policyholders flexible payment options.

For example, “pay later” mobile wallet options enable your customers to pay their bill over time and can even safeguard your collections in the process. Options like PayPal’s Pay in 41 and PayPal Credit2 allow your organization to get paid upfront while offering your customers the flexibility they need. Giving customers the ability to schedule payments in advance can help drastically, too. While this feature may not be right for all customers, for payers who are experiencing a sporadic flow of income, scheduling payments ahead of time may allow them to make payments while income is consistent.

2. Prioritize communication with policyholders

In all relationships, communication is key. This is especially true for insurance organizations and their policyholders. Clear communication doesn’t just ensure for consistent collections, but can also greatly improve your customer’s experience, which can boost CSAT scores and online adoption rates.

One great way to communicate with your customers is through Outbound Campaigns —messages that your organization can send to customers to remind them of upcoming bills, late payment notices, and much more. These campaigns not only establish a consistent channel to communicate with your customers but also are critical to preventing late and/or canceled premium payments.

3. Remove roadblocks from the payment process

A stellar policyholder experience is critical to the success of your organization, so making the premium payment process a simple and seamless is one easy way to reduce late premium payments. Your organization can simplify the payment process by removing any roadblocks to an effortless, completed payment.

For instance, not requiring customers to log-in or register each time they need to make a payment; an optimized guest checkout route is not only efficient, but can encourage your customers to pay online more frequently. In fact, a recent Invoice Cloud survey found that 38% of respondents said ‘convenience’ was the number one reason they chose to make a payment online, and forcing your customers to register or log-in is the opposite of convenience.

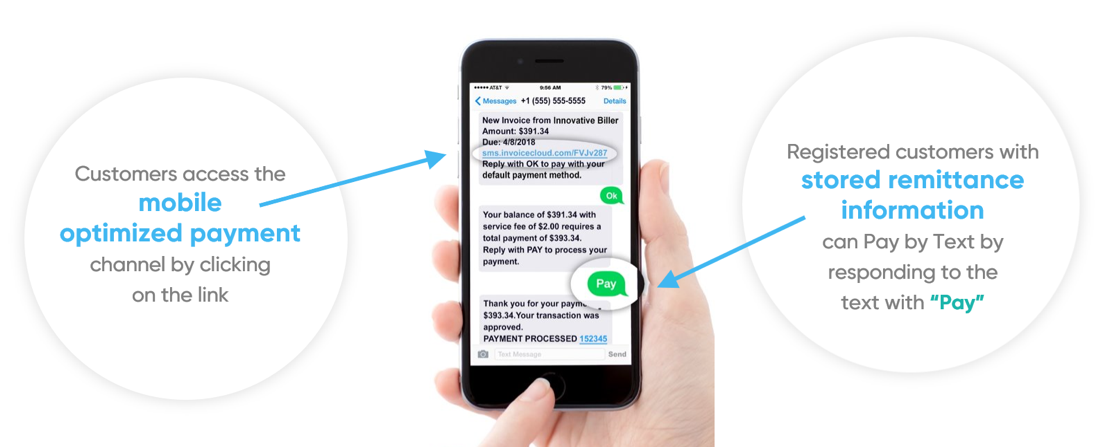

Pay by text and “one click” payment options (like Invoice Cloud’s OneClickPay) are also great for streamlining the payment process.

These features not only increase online adoption rates but result in more consistent payments overall. If customers are offered a simple way to pay a bill, they’re more likely to make a payment sooner than later — improving internal efficiencies and giving your organization peace of mind knowing most premium payments will be paid on time each billing cycle.

4. Drive to self-service enrollment

Encouraging policyholders to enroll in self-service payment options like AutoPay and paperless billing are key for locking in consistent payments. Your organization can do this effectively by offering customers a payment solution that is designed to encourage policyholders to enroll in these options at every customer touchpoint, including:

- On their bill

- On the payment screen

- In the confirmation email after a payment has been made

Ready to get started?

Evaluating and, subsequently, innovating your organization’s premium payment experience is undoubtedly the quickest way to improve premium consistencies and reduce cancelled policies.

Luckily, Invoice Cloud has everything you need to start offering a better premium payment experience. Download our free content package, The CIO Toolkit: Resources for Insurance Chief Innovation Officers, and you’ll receive:

- Research report: Keeping Up with Millennial Policyholders

- Podcast: PC360’s Insurtech Center Podcast Series – How technology is supercharging CX in the insurance industry

- Infographic: Customer Experience in Insurance

- On-demand webinar: Novarica + Invoice Cloud – Embracing Positive Disruption: How Technology is Transforming the Insurance Industry

- Case study video: California Mutual Insurance Company

- BONUS WORKSHEET: The Insurance Innovation Checklist

Sponsored by ITL Partner: InvoiceCloud