While the past few years have been marked by rapid digital acceleration and shifting customer expectations, 2026 will be defined by a more measured, strategic approach. It will be a time of consolidation, recalibration, and targeted investment—especially in health insurance and technology.

Health Insurance: The Growth Engine of 2026

Among all insurance segments, health insurance stands out as the most dynamic. Across the globe, public healthcare systems are under increasing strain, and private insurers are stepping in to bridge the gap. This trend is not only a response to demographic pressures and rising healthcare costs but also a reflection of changing consumer expectations. In 2026, I anticipate health insurance to be the fastest-growing segment, driven by demand for better access, personalized care, and digital health services.

In contrast, P&C insurance will likely remain stable. Economic uncertainty and subdued global growth are limiting expansion in this area. Corporate insurance may see modest gains, while personal lines are expected to plateau. Specialty lines—those tailored, niche products—will continue to grow, offering insurers opportunities to differentiate and innovate. Life insurance will remain steady, with annuities maintaining their appeal due to favorable tax treatment and predictable returns.

Consolidation: A Global Phenomenon

We are witnessing a wave of consolidation across key markets. In Europe, Australia, and Canada, insurers are merging to achieve scale and operational efficiency. Japan's market is already highly concentrated, with three players controlling 80% of the market. Australia follows closely, with over 60% of the market in the hands of just three insurers. In Europe, motor insurance remains fiercely competitive, prompting further consolidation. The UK has seen major moves, such as Aviva acquiring Direct Line and Ageas purchasing Saga. Similar dynamics are unfolding in Germany, France, and the Nordics. In the United States, however, fragmentation persists.

The U.S. insurance sector faces a more difficult phase in 2026. Tariffs are expected to have a moderately negative effect on claims inflation in motor insurance and increase pressure on cost structures. Premiums for commercial insurance are likely to remain unchanged or decline slightly, while premium growth in the private customer business will continue but at a slower pace.

The Strategic Imperative: Efficiency and Scale

In 2026, insurers will prioritize efficiency and scale – particularly in property insurance for private individuals. Cost control will be the key to competitiveness. This means investing in automation, simplified standard architectures, modern rating systems and intelligent risk selection. Insurers will need to focus on retaining profitable customers while steering clear of unattractive risks.

In commercial insurance, the emphasis will be on speed and collaboration. Brokers will play a central role, and underwriters will need to respond faster and more flexibly. However, this shift toward a more sales-oriented underwriting approach must be balanced carefully to avoid compromising underwriting discipline.

Health insurance, meanwhile, will demand the most investment. Insurers are increasingly building proprietary medical networks or forming strategic partnerships to enhance service delivery and control costs. This segment will be the most capital-intensive, but also the most promising.

Technology: The Engine of Transformation

The digital transformation of the insurance industry is in full motion, but it is far from complete. The modernization of core systems remains the largest area of investment in countries such as Japan, Germany and France. Commercial lines are adopting underwriting workbenches and automation tools, while retail insurers are focusing on self-service and process automation to reduce call center costs.

Cloud adoption is progressing at varying speeds. Markets like Australia, New Zealand, and the UK are moving quickly, while Japan and continental Europe remain more cautious. Cloud infrastructure offers flexibility and security, but many insurers are still learning how to unlock its full economic potential.

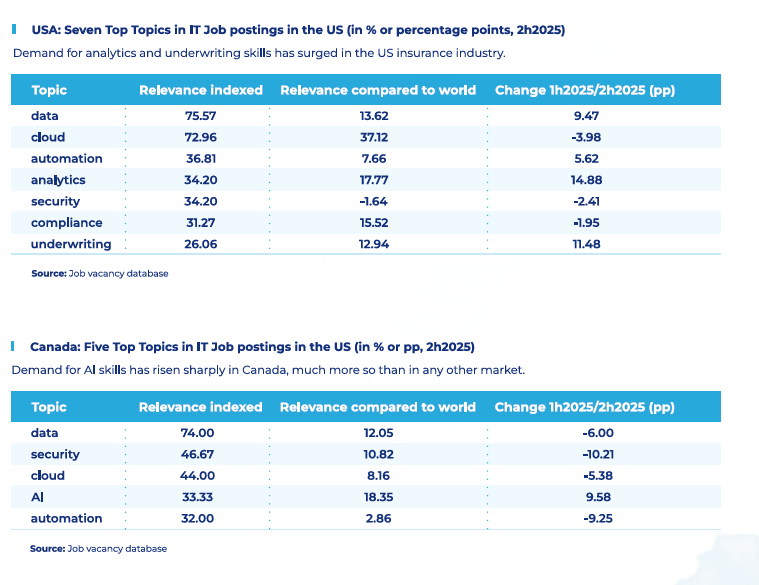

The insurance industry in the United States and Canada will focus heavily on artificial intelligence. Insurers in both markets are currently expanding their AI capabilities with a strong focus on claims management. However, underwriting is likely to receive more attention in connection with AI. Underwriting technology has become a key issue in insurance IT, and in 2026 more insurers will implement digital solutions in this critical area of the insurance value chain.

The cloud has become an essential enabler of innovative insurance technology, and there is no other market where the demand for cloud skills is stronger than in North America. The cloud will play a central role in the expansion of AI use by insurers. Cybersecurity remains an important issue, especially after last year's three major cyber-attacks, which prompted insurers to strengthen their defense and response capabilities.

Broker consolidation is another area with significant potential. Seamless integration between insurer and broker platforms is becoming essential. This trend is already well established in the UK, Canada, and the U.S., and is now gaining traction in continental Europe.

Final Thoughts

The insurance industry in 2026 will not be defined by dramatic upheaval, but by strategic evolution. The winners will be those who embrace scale, prioritize efficiency, and invest wisely in technology.