Insurance companies often struggle against the perception of being conservative institutions that are slow to change. Nothing could be further from the truth.

Since the 1960s, the insurance industry has embraced so many new technologies, from punch cards and mainframes to tablets and mobile phones. Technology is the backbone of the modern insurance industry.

Here’s an example of the industry’s technology commitment. In 2002, the life-annuity sector spent $1.4 billion on IT, and the P&C sector spent just under $3 billion. In 2022, those expenses were $5.7 billion for life and $9.3 billion for P&C. In our view, this investment is about industry transformation and platform modernization, not just administering business growth.

In 2024, insurers are embracing AI (artificial intelligence) to manage data, uncover opportunities and improve productivity.

AI Deployed Across the Value Chain

At Conning, understanding what’s driving insurer profitability is a crucial part of helping our clients develop effective investment strategies. Given 2023’s media storm around generative AI, we wanted to understand the state of AI within the industry. In addition to engaging in numerous conversations with insurers, AI experts, and technology firms, we conducted a survey in the fall of 2023 that looked at AI deployment across the insurance value chain.

This is the second year of our annual survey on AI and technology adoption in the insurance industry. We surveyed senior insurance chief technology officers, chief operational officers and chief innovation officers, along with a select few senior insurance technology vendor executives.

Three Parts of the Value Chain

Our survey focused on three broad areas of the value chain in which AI is already showing some promise.

Sales and Underwriting: By analyzing vast amounts of data, including customer information and external factors, AI is helping insurers make better-informed decisions when assessing underwriting risks, speeding up the underwriting process and reducing the likelihood of human error.

Operations (Claims Processing and Fraud Detection): AI-powered systems are improving claims processing by automating mundane tasks and streamlining the workflow, analyzing claim documents, assessing damage and even calculating payouts, all with minimal human intervention. AI is playing a crucial role in fraud detection by flagging suspicious claims and patterns that may indicate fraud.

Risk Control and Pricing: AI tools are improving insurers' ability to assess risks accurately and set prices accordingly. By analyzing historical data and real-time information, AI algorithms can predict trends and potential losses more effectively, enabling insurers to offer more competitive rates while maintaining profitability.

See also: AI: Beyond Cost-Cutting, to Top-Line Growth

More Than Just LLMs

Since 2023, AI, or more specifically generative AI, has been a significant focus of insurance management teams, but AI encompasses a variety of technologies. Understanding the differences is crucial to thinking through where and when their impact is likely to be felt. Our latest survey looked at three specific types of AI.

Large language models (LLMs) are advanced AI systems designed to understand and generate human language. LLMs are the foundational technology supporting generative AI.

Machine Learning/Predictive Analytics (ML/PA) are quantitative, statistical models using algorithms to make predictions or decisions learning from inputted data, are updated in real time and can improve performance from feedback from objective functions.

Natural Language Processing (NLP) extracts meaning from speech or text. This enables insurers to efficiently process unstructured data from agent and customer phone calls to reports.

Older AI Technologies More Widely Adopted

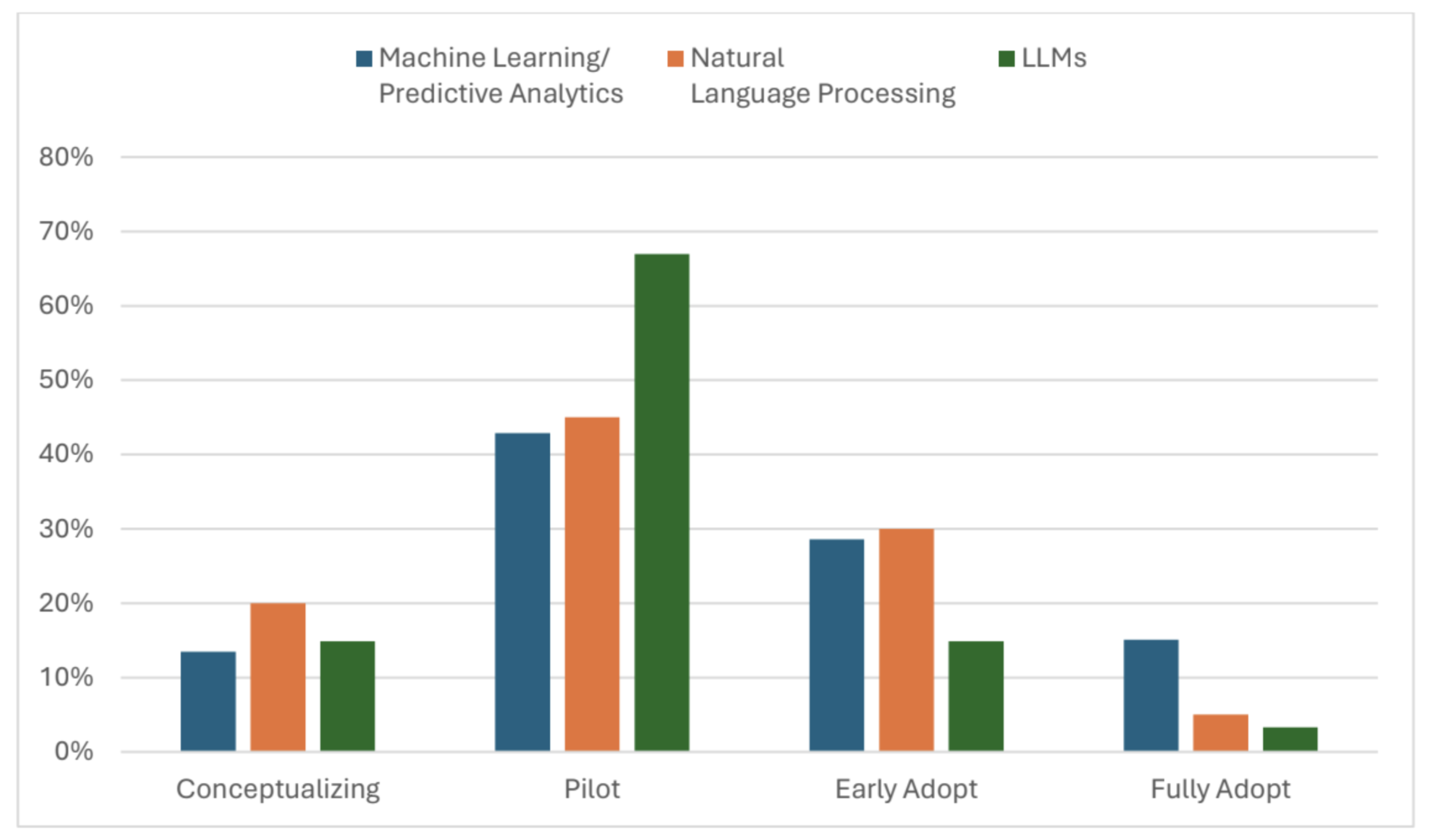

In this survey, we asked how AI is reshaping the insurance industry and the opportunities and challenges that come with this technological transformation. At a high level, we found that, while there were varying degrees of adoption for all three technologies across the value chain, ML/PA and NLP had higher rates of adoption and deployment. Survey results suggest, however, that LLMs show great potential.

This year’s survey results show 77% of the respondents indicated that they are in some stage of adopting AI, a 16-percentage-point increase from our 2023 survey.

The survey found that 67% reported they were already piloting LLMs, which was the largest technology in the piloting stage. Given the relatively recent awareness of generative AI, this high percentage of piloting the underlying technology is a strong indicator of future adoption.

Across the overall value chain, ML/PA was either in the early stages of adoption or had been fully adopted by 44% of responding firms. Sales and underwriting reported the highest adoption among components, at 54% of respondents.

Our report, “Transformative AI Technology: Insights from Conning’s Executive Survey” provides a deeper analysis of the three technologies’ use within each part of the value chain.

See also: Can AI Solve Underlying Data Problems?

Outlook and Challenges

The surveys and discussions we’ve had strongly indicate that AI is helping insurers manage complexity and data diversity. We see its deployment increasing, and management teams will be spending time figuring out the best AI solutions for their company.

However, regulations will significantly influence the speed of adoption. Already state regulators are restricting the types of data insurers can use in their AI systems. Additional regulations are being proposed and enacted at the national and international levels. Beyond regulations, insurers need to be mindful of potential litigation surrounding the use of generative AI.

While regulation and litigation may slow AI’s continued adoption within the insurance industry, they are unlikely to stop it. If history has proven anything, when it comes to new technology, insurance is an industry where embracing new technology never stops. In 2024, nothing suggests to us that will change.