Claims Lessons From the Feds (Truly)

FEMA, in particular, is starting to use data following disasters in ways that can provide valuable lessons for insurers handling claims.

FEMA, in particular, is starting to use data following disasters in ways that can provide valuable lessons for insurers handling claims.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Karen Furtado, a partner at SMA, is a recognized industry expert in the core systems space. Given her exceptional knowledge of policy administration, rating, billing and claims, insurers seek her unparalleled knowledge in mapping solutions to business requirements and IT needs.

Clueless employers don't understand that they can control their workers' comp costs -- and not just complain about them.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Rebecca Shafer is an attorney and risk consultant who is an acknowledged thought leader in cost containment. She is the author of "2014 Your Ultimate Guide to Mastering Workers Comp Costs." She specializes in training employers and has collaborated with companies — large and small — to help them reduce their workers’ comp costs by as much as 50%.

Some nations, including Iran, are taking the law of the sea into their own hands -- posing threats to global shipping.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Chris Ketcham is the former visiting assistant professor of risk management and insurance at the University of Houston Downtown. He has an earned a doctorate from the University of Texas at Austin. With co-editor Jean Paul Louisot, Ph.D. he has written two books on enterprise risk management.

Exoskeletons, autonomous vehicles, surveillance and wearable biometrics and robotics are changing risk in profound but uncertain ways.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

As a renown workers’ compensation expert and industry thought leader for 40 years, Jeff Pettegrew seeks to promote and improve understanding of the advantages of the unique Texas alternative injury benefit plan through active engagement with industry and news media as well as social media.

Digital insurance can build on the capabilities of the Internet of Me, the Outcome Economy and much more.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

John Cusano is Accenture’s senior managing director of global insurance. He is responsible for setting the industry group's overall vision, strategy, investment priorities and client relationships. Cusano joined Accenture in 1988 and has held a number of leadership roles in Accenture’s insurance industry practice.

Usage-based insurance started with a simple promise -- rates could only go down. It's time to unleash the many other capabilities.

And why not? As the pioneer of UBI in the U.S., Progressive has accumulated the trip data of millions and millions of customers over a number of years – tens of billions of miles of journey data coupled with hundreds of thousands of claims – giving the company unique insights into the behaviors that cause accidents. Based on listening to customers, the marketing program has now shifted from “Plug it in. Drive. Save.” to the concept of “Rate suckers” – bad drivers getting a free ride on the premium that safe drivers pay.

Progressive’s research showed that 89% of drivers would be upset to find out that their premiums were subsidizing bad drivers. So loading the premiums of bad drivers backs up the marketing message and should further fuel the positive selection of good drivers moving to Progressive, while chasing away the bad drivers to cheaper, less-data-savvy carriers. This adverse selection for Progressive’s competitors will eventually move the market to fully data-driven underwriting over the medium term.

All this goes to show is that UBI is not your typical Insurance product. Key to success for Progressive has been:

And why not? As the pioneer of UBI in the U.S., Progressive has accumulated the trip data of millions and millions of customers over a number of years – tens of billions of miles of journey data coupled with hundreds of thousands of claims – giving the company unique insights into the behaviors that cause accidents. Based on listening to customers, the marketing program has now shifted from “Plug it in. Drive. Save.” to the concept of “Rate suckers” – bad drivers getting a free ride on the premium that safe drivers pay.

Progressive’s research showed that 89% of drivers would be upset to find out that their premiums were subsidizing bad drivers. So loading the premiums of bad drivers backs up the marketing message and should further fuel the positive selection of good drivers moving to Progressive, while chasing away the bad drivers to cheaper, less-data-savvy carriers. This adverse selection for Progressive’s competitors will eventually move the market to fully data-driven underwriting over the medium term.

All this goes to show is that UBI is not your typical Insurance product. Key to success for Progressive has been:

Let’s face it, in the past a customer usually shopped for the cheapest price of motor insurance, bought it and then tucked the policy away in the glove compartment of the vehicle with little or no contact with the insurer until it came time to claim or renew. With UBI, the insurer provides customers with a companion mobile app (and website) that gives daily feedback on their driving skills and opens up a range of value-added services like:

Let’s face it, in the past a customer usually shopped for the cheapest price of motor insurance, bought it and then tucked the policy away in the glove compartment of the vehicle with little or no contact with the insurer until it came time to claim or renew. With UBI, the insurer provides customers with a companion mobile app (and website) that gives daily feedback on their driving skills and opens up a range of value-added services like:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Andrew Dart is a partner with The Digital Insurer. He was previously the sole insurance industry strategist for CSC in AMEA and one of CSC’s “ingenious minds” globally. With more than 30 years of international insurance experience, Dart has worked in Asian cities, including Tokyo, Jakarta, Singapore and Hong Kong.

A new cyber threat: In "phone spoofing," people fake the originator of a call to avoid Do Not Call laws or to try to work a scam.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Scott Aurnou is a cyber security consultant, attorney and vice president at Soho Solutions, an IT consulting and managed services company based in New York. He helps organizations identify and address the kind of critical technology-related risk and market exposure that keep executives, management committees and corporate boards awake at night.

There isn't enough attention being paid to cyber security in "smart cities," leaving them vulnerable to orchestrated power outages -- and worse.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Byron Acohido is a business journalist who has been writing about cybersecurity and privacy since 2004, and currently blogs at LastWatchdog.com.

"Bucketing" looks at the expense of drugs and treatments individually, not as part of the entire course of care, and inflates costs.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Scott Wallace is a visiting professor of family and community medicine at the Geisel School of Medicine at Dartmouth and a batten fellow at the University of Virginia’s Darden School of Business, Wallace has also served on the faculty for Harvard Business School’s executive education program on healthcare strategy.

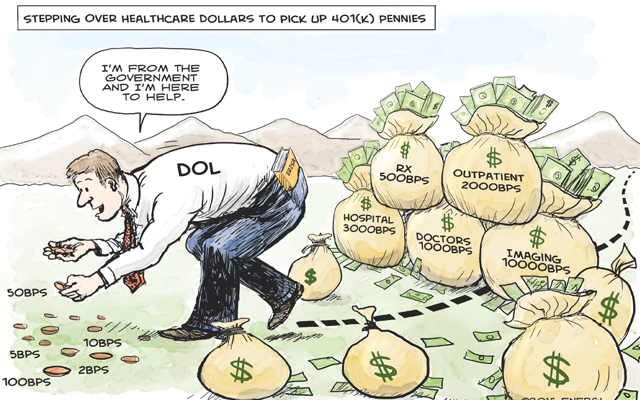

Regulators worry about overcharges on investment plans but ignore issues with healthcare that can be 10 times as bad. That will change.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Craig Lack is "the most effective consultant you've never heard of," according to Inc. magazine. He consults nationwide with C-suites and independent healthcare broker consultants to eliminate employee out-of-pocket expenses, predictably lower healthcare claims and drive substantial revenue.