The New Cyberthreat You Face at Work

Cyberthreats are becoming far more sophisticated, using insider knowledge to fool senior executives into giving up access to their computers.

Cyberthreats are becoming far more sophisticated, using insider knowledge to fool senior executives into giving up access to their computers.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Insurers have important misconceptions about Millennials as customers. They are not all technology geeks with blind trust in social media.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Nigel Walsh is a partner at Deloitte and host of the InsurTech Insider podcast. He is on a mission to make insurance lovable.

He spends his days:

Supporting startups. Creating communities. Building MGAs. Scouting new startups. Writing papers. Creating partnerships. Understanding the future of insurance. Deploying robots. Co-hosting podcasts. Creating propositions. Connecting people. Supporting projects in London, New York and Dublin. Building a global team.

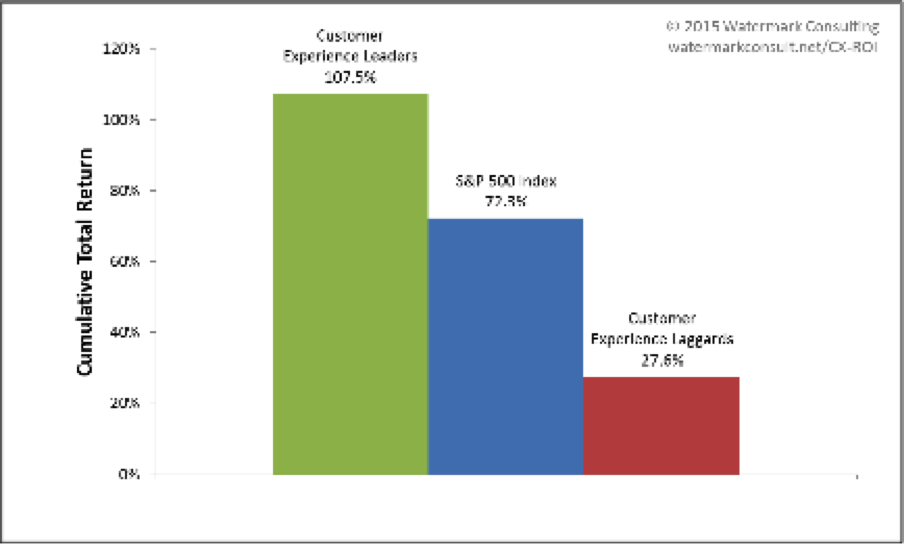

Shares of companies that did the best job on customer experience outperformed average companies by 35 percentage points.

Six years ago, we launched the Customer Experience ROI Study in response to a sad but true reality: Many business leaders pay lip service to the concept of customer experience – publicly affirming its importance, but privately skeptical of its value. We wondered... how could one illustrate the influence of a great customer experience, in a language that every business leader could understand and appreciate?

And so the Customer Experience ROI Study was born, depicting the impact of good and bad customer experiences, using the universal business “language” of stock market value. It’s become one of the most widely cited analyses of its kind and has proven to be an effective tool for opening people’s eyes to the competitive advantage accorded by a great customer experience.

This year’s study provides the strongest support yet for why every company – public or private, large or small – should make differentiating their customer experience a top priority. Thank you for the interest in our study. I wish you the best as you work to turn more of your customers into raving fans.

THE CHALLENGE

What’s a great, differentiated customer experience really worth to a company? It’s a question that seems to vex lots of executives, many of whom publicly tout their commitment to the customer, but then are reluctant to invest in customer experience improvements. As a result, companies continue to subject their customers to complicated sales processes, cluttered websites, dizzying 800-line menus, long wait times, incompetent service, unintelligible correspondence and products that are just plain difficult to use.

To help business leaders understand the overarching influence of a great customer experience (as well as a poor one), we sought to elevate the dialogue. That meant getting executives to focus, at least for a moment, not on the cost/benefit of specific customer experience initiatives but, rather, on the macro impact of an effective customer experience strategy. We accomplished this by studying the cumulative total stock returns for two model portfolios – composed of the Top 10 (“Leaders”) and Bottom 10 (“Laggards”) publicly traded companies in Forrester Research’s annual Customer Experience Index rankings. As the following vividly illustrates, the results of our latest analysis (covering eight years of stock performance) are quite compelling:

THE RESULTS

8-Year Stock Performance of Customer Experience Leaders vs. Laggards vs. S&P 500 (2007-2014)  Comparison is based on performance of equally weighted, annually readjusted stock portfolios of Customer Experience Leaders and Laggards relative to the S&P 500 Index. Leaders outperformed the broader market, generating a total return that was 35 points higher than the S&P 500 Index. Laggards trailed far behind, posting a total return that was 45 points lower than that of the broader market.

Comparison is based on performance of equally weighted, annually readjusted stock portfolios of Customer Experience Leaders and Laggards relative to the S&P 500 Index. Leaders outperformed the broader market, generating a total return that was 35 points higher than the S&P 500 Index. Laggards trailed far behind, posting a total return that was 45 points lower than that of the broader market.

THE OPPORTUNITY

It’s worth reiterating that this analysis reflects nearly a decade of performance results, spanning an entire economic cycle, from the pre-recession market peak in 2007 to the post-recession recovery that continues today. It is, quite simply, a striking reminder of how a great customer experience is rewarded over the long term, by customers and investors alike. The Leaders in this study are enjoying the many benefits accorded by a positive, memorable customer experience:

In contrast, the Laggards’ performance is being weighed down by just the opposite – a poor experience that stokes customer frustration, increases attrition, generates negative word of mouth and drives up operating expenses. The competitive opportunity implied by this study is compelling, because the reality today is that many sources of competitive differentiation can be fleeting. Product innovations can be mimicked, technology advances can be copied and cost leadership is difficult to achieve let alone sustain. But a great customer experience, and the internal ecosystem supporting it, can deliver tremendous strategic and economic value to a business, in a way that’s difficult for competitors to replicate.

LEARN FROM THE LEADERS

How do these Customer Experience Leading firms create such positive, memorable impressions on the people they serve? It doesn’t happen by accident. They all embrace some basic tenets when shaping their brand experience – principles that can very likely be applied to your own organization:

To download a copy of the complete Watermark Consulting 2015 Customer Experience ROI Study, please click here.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jon Picoult is the founder of Watermark Consulting, a customer experience advisory firm specializing in the financial services industry. Picoult has worked with thousands of executives, helping some of the world's foremost brands capitalize on the power of loyalty -- both in the marketplace and in the workplace.

In the past, competition came from within the industry. Now, pressure is coming from outside forces like digitization. The only option is to transform.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

William Freitag is executive vice president and leads the consulting business at Majesco. Prior to joining Majesco, Freitag was chief executive officer and managing partner of Agile Technologies (acquired by Majesco in 2015). He founded the company in 1997.

Accurate provider ratings can be found in workers' comp claims data, but it must be integrated, not left in the silos where it typically exists.

With the tongue-in-cheek title, "When Yelp reviews are better than hospital rating systems" Jason Beans of Rising Medical Solutions discloses the inconsistencies of standard hospital reviews. He cites a Health Affairs study that points out that traditional rating systems, those that have been relied upon in the healthcare industry for years, rarely come up with the same results for the same hospital.

Provider ratings score hospital performance in an effort to determine quality and safety in hospitals. The Health Affairs study concludes that discrepancies among provider ratings systems are likely explained by the fact that each uses its own rating methods, defines quality differently and stresses different measures of performance. Apparently, no standards for quality and safety in hospitals are available.

This raises the question of how scoring systems for rating other medical providers differ from those of hospital scoring systems. More specifically, what about those used to score provider performance in workers' compensation?

Lest the conclusion be that all provider performance scoring systems lack credibility, it might be instructive to at least loosely compare hospital rating systems with physician scoring in workers' compensation.

Not Similar

The conditions, methodology and approaches are significantly different. The hospital rating systems cited by Health Affairs evaluate general health in acute care settings. To measure cost, they measure an episode of care on a per diem (per day) basis for individual hospital stays, adjusted by diagnosis and procedures. Often, subjective reports are used, as well.

On the other hand, measures of quality performance in workers' compensation are unique to the industry, and the number of measurable variables is numerous. How a medical provider acknowledges and influences distinctive industry factors along with success of the medical treatment procedures are indicators of quality performance.

Episode of Care

One major difference is that the episode of care in workers' compensation is not per diem, but is defined by the scope of the claim. An episode of care (claim) is from the date of injury to claim closure and includes all treatment, medical providers, vendors, events and outcomes that occur during that time. An episode may or may not include hospitalization, but when it does, those costs and events are included with total claim. In other words, the episode of care is highly definable in workers' compensation. It is broad and comprehensive.

Quality Indicators

A number of non-medical indicators found in the data reflect unique conditions in workers' compensation that are influenced by treating providers. Measures of quality include return to work and indemnity costs, neither of which is medical treatment precisely, but is strongly influenced by the treating provider and affects the cost of the claim. Consequently, these factors must be included in evaluating performance.

Frequency and duration of treatment, as well as duration of the claim, are indicators of provider performance. Providers can contain or increase costs described by these factors. Functional outcome described in the data as disability ratings at the conclusion of the claim are also measures of treatment success.

Clinical factors and treatment processes are important quality indicators, of course, and must be included in the evaluation and scoring. Abuse of Schedule II drugs are, for example, a major cost driver in workers' compensation. Dispensing medications is another.

Source Data

Each data-rich claim contains the information necessary to evaluate medical provider performance for workers' compensation. Importantly, the data must be integrated from the silos of bill review, claims system and PBM (pharmacy) to achieve a comprehensive picture of the claim and medical providers' involvement.

Workers' compensation can be more complex than general health because it is a legal system rather than a defined benefit. Every claim has administrative aspects as well as medical assessment and treatment. It's all in the data.

Objective Data

Scores of medical provider quality indicators can be found in workers' compensation data. The beauty is that data describes what actually took place during the course of the claim, not what should have happened or an opinion about it. It is concrete and objective. Yelp can't help.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

After years of discussions and negotiations, ISO is finally closing what can be a catastrophic gap in the coverage of home insurance.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

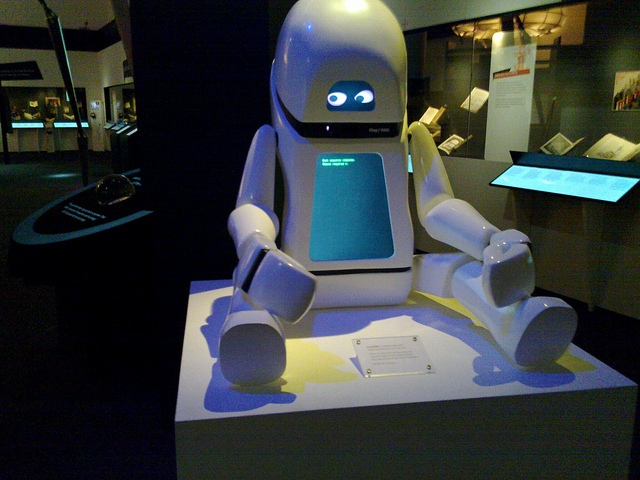

Robo-advisers are winning investment clients and have big implications for financial services firms, including insurers.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Anand Rao is a principal in PwC’s advisory practice. He leads the insurance analytics practice, is the innovation lead for the U.S. firm’s analytics group and is the co-lead for the Global Project Blue, Future of Insurance research. Before joining PwC, Rao was with Mitchell Madison Group in London.

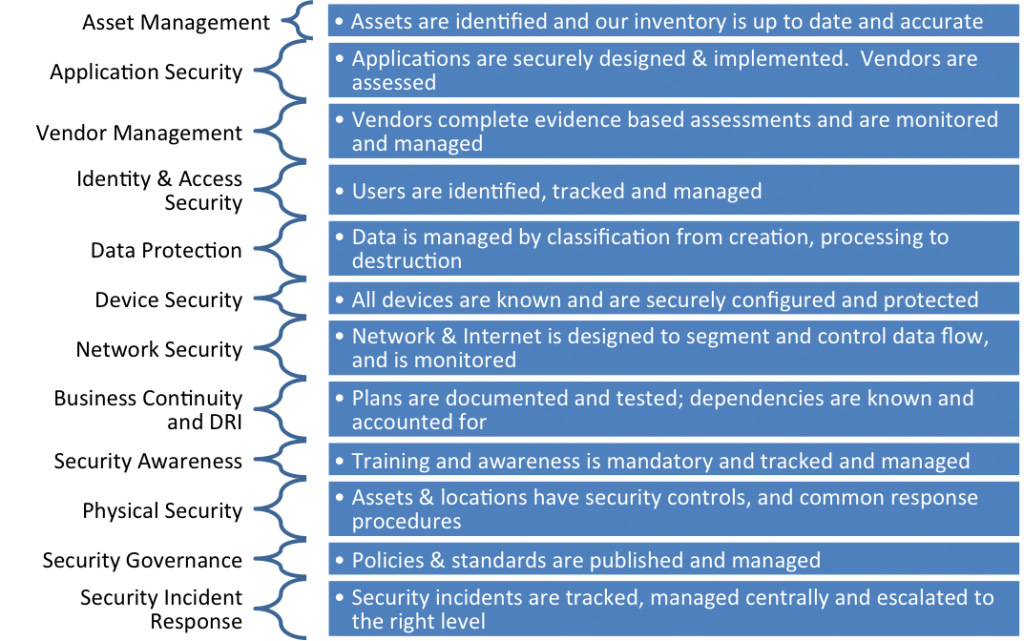

There are numerous frameworks for both IT security and for ERM, but it's important to combine the two initiatives to manage risk better.

For each domain, there will be a strategy:

For each domain, there will be a strategy:

| Domain | Details | Description |

| Vision Value & Scope | Scope & Definition | |

| Policy Mapping | Controls, Standards | |

| Risk Assumptions | Observations & Metrics | |

| Metrics | Baseline, KRI, KPI | |

| Initiatives & Roadmap | Initiatives, plan, 3 yr roadmap | |

| Programs & Services | What is in place | |

| Partners | Up & Downstream |

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

A highly unusual case finds for the insurers but underscores that CGL covers many cyber issues -- if the insureds are willing to do battle.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Work comp payments may expand greatly because of a California decision awarding death benefits related to a drug overdose.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|