Now that we got you excited based on earlier articles such as this one, and you're ready to start CPCU today, here's some guidance on how to actually get it done and survive the tests. This article is lovingly dedicated to "those poor souls studying for the CPCU designation,"

Please keep in mind that doing CPCU is very much like trying to eat an elephant; there's only one way to do it, one bite at a time.

I asked my friend and all-around Wonder Woman, Carly Burnham, to share the strategies she used in completing the designation. I met Carly in 2011 when she was at a turning point in her career. She felt stuck in her position as a call center sales agent and wasn't sure of the next step. She wasn't even sure whether insurance was an industry she could make a career in. She had an interest in underwriting but had no idea how to get there. We met through the Gen Y Associate Resource Group at Nationwide Insurance.

I could clearly see she was bright and hard-working and was looking for a challenge, so I asked her if she had heard about the CPCU. Over coffee, I told her all about why CPCU is awesome and convinced her to go for it. To make things even more interesting, I challenged her to do it in a year, while working full time and finishing a part-time MBA program. To my surprise, she took me up on it. Even more impressively, she met the goal and finished all eight tests in just short of 12 months.

When I talked to Carly about this article, she shared the following thought with me, "The CPCU is usually done as a self-study program, and if you haven’t tackled online courses or some other self study program, it can be challenging to know where to start. I was lucky to have your mentorship, and, looking back, I'd say these eight strategies were really what helped me meet the audacious goal that we set."

- Set Your Own Timetable

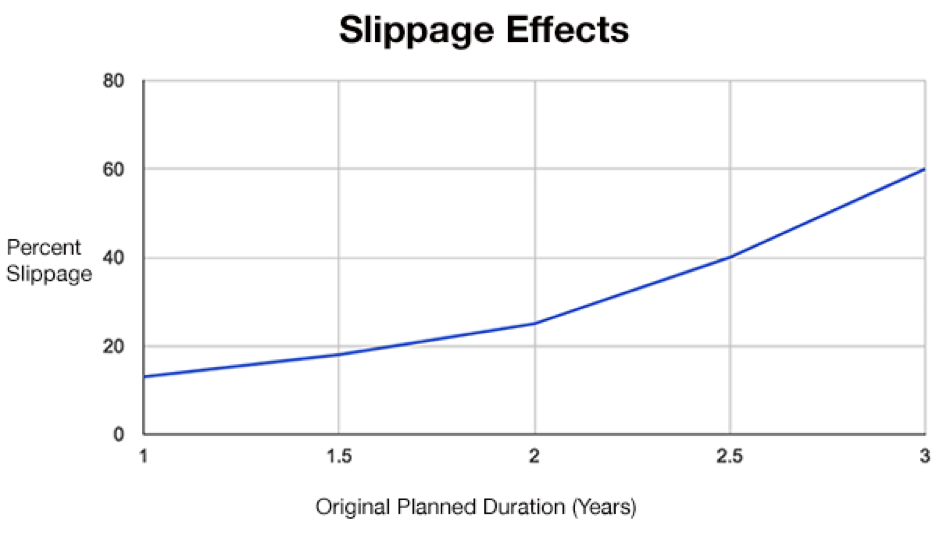

Decide up front when you are going to finish your CPCU. If you don't choose an end date, you could stretch the entire process out for YEARS. On average, people take at least two years to finish, but many insurance professionals have been working on their CPCU for longer than that. Decide when you want to be done and commit to the deadline. If you are trying to finish to advance your career, focus on finishing before you begin to apply for new roles. If you want to finish in time to attend the annual meeting in a certain city, set your end date as the last month that you can qualify for that meeting. Having an end date and an understanding of your motivation will help you push through challenges along the way.

- Find an Accountability Partner

Your accountability partner may be a current CPCU or someone who is also pursuing the designation. He or she should be someone with whom you can share the reason for your pursuit of the CPCU. If he or she understands your motivation, it will be easier to push you to stay the course and finish by your goal date.

- Create a Spreadsheet on Google Drive to Share With Your Accountability Partner

On this spreadsheet, you will want to map out the dates that you will take each exam to achieve your goal date. Once you have mapped out exam dates, you can work backward using the chapter summaries at theinstitutes.org to identify when you will read each chapter of the text for the exam and when you will take your practice exams.

- Devote Certain Hours of Your Day to Studying

When studying, consistency is key. If you focus best at the beginning of the day, set aside an hour or two in the morning and commit to showing up the same place each day to read the chapters that you laid out in your spreadsheet for this day. Choose the time that works best for you, but aim to make it a routine, so that you don't have to decide every day that you are going to stay at the office an extra hour or go to the coffee shop before work starts. If it's part of your daily rituals, you won't have to use willpower to get your studying done.

- Read the Entire Book

First, read The Institutes' guide to preparing for their exams. As they mentioned, there is no single way to prepare. But I found that reading the entire book first helped me establish a base level of knowledge. Next, I would take a practice exam, as a sort of pre-test. The practice exam would let me know which chapters I was weak on. With this information, I could pinpoint the best way to spend my time. If I needed to, I could re-read chapters and test on those individual chapters until I felt comfortable moving on to the next chapter.

- Use the Mobile App

The Institutes have created a mobile app called Smart QuizMe for Apple and Android phones. Using this in any spare time you have will also help you feel confident with the information and the style of questions on the practice exams. You can set the app to run through certain chapters or the whole book depending on what you want to focus on. Because it's on your phone, you can use it even if you only have five or 10 free minutes. The questions on the app tend to be clustered, so question 100, 101, 102 and 103 might be the same question with only one word changed. This really teaches you how changing a small part of a question can result in a different answer. The app is particularly helpful for the most detail-oriented tests, especially 520. One word of warning: Don't depend entirely on the app without doing the online practice exams; you could easily fool yourself into thinking you're ready when there are significant parts you haven't yet mastered.

- Pass the Practice Exams a Few Times

Leave at least at least four and preferably a full seven days before the real test to take the online practice exams. Passing the exams will give you the confidence you need to take the exam without feeling rushed or unsure of your answers. The practice exams are very similar and sometimes harder than the actual exams. You will also have the opportunity to research any questions you missed and make sure you understand the concept before test day. Nothing beats going into the real test feeling confident, and nothing gets you more confident that the online practice exams. The practice exams are the key to the kingdom!

- Get the Proper Support

Make sure your family, close friends and other support systems fully understand that the CPCU is a BIG DEAL and that you will require lots of support while you get through it. Make sure they know this isn't just another license or minor designation but a serious commitment that only 4% of people in our industry have gotten through.

To help my family understand, I explained that I was pursuing something akin to a master's degree in insurance, and I was doing it in a year, while working 40 hours a week -- most people outside the industry will need the designation explained in a similar way to fully understand the commitment you've made. Also, join the CPCU Candidates Facebook Group; they'll provide you with tons of encouragement and answer your questions. Most importantly, you won't feel like you're the only person in the world putting yourself through the challenge of CPCU.

One Bonus Tip:

Know ahead of time that 540 - Finance and Accounting for Insurance Professionals is a special beast of a test (see artist's rendering below). To ensure proper preparation for this one, allow yourself 50% more time than usual; so if you have given yourself two months for 500, 520 and 530, give yourself three months for 540. Buy a financial calculator (preferably the Texas Instruments BA-II Plus) and learn how to use it. The book won't teach you how to use it, so you have to get help from someone who knows how to use it - if you have a hard time finding someone, there are decent tutorials on YouTube or at Atomic Learning. Use the calculator for all the practice tests, and then don't forget to bring it on exam day!

I am passionate about spreading the word about the CPCU, and I was glad to have met Carly at that turning point in her career. Her commitment has paid off, and she has recently became a commercial lines underwriter at Erie Insurance; she's loving the new job, and she's fully committed to the industry. She credits her designation with helping her get the interview but says it goes even further than that: "The knowledge that I gained in earning my CPCU gave me the confidence to pursue a true career in the industry, and I now use the knowledge every day in my role as an underwriter. This designation gives you a broad understanding of the industry, but it also gives you practical, technical information that is essential to being a successful insurance professional."

If you've had similar experiences, share them in the comments. If you have questions about the pursuit of your CPCU, message me. There are really no excuses left. Let's get going and get your CPCU. You will never regret it.

Good job making it to the end of our longest post yet; as a reward, here is another image for the awesome metaphor of eating an elephant one bite at a time.