There's nothing like starting the year off with some good news. Conning's Year-End Life-Annuity forecast for 2025-2027 certainly has a lot of that. For life-annuity industry executives, statutory net operating results, after tax and dividends, are forecast to increase from $27 billion in 2025 to $30 billion in 2027.

Those strong results start with premiums, of course. Due to an increasing number of individuals saving for retirement and pension risk transfers, annuity premiums are projected to increase 16% from 2025 to 2027. Meanwhile, life insurance remains a key financial need for younger generations starting or building their families. As a result, life insurance premiums are forecast to increase 8% from 2025 to 2027.

While premium headlines grab attention, life-annuity insurance executives know profitability depends on successfully managing investment returns, reserves and capital. At the same time, both life and annuity insurers need to begin grappling with the potential impact of GLP-1 drugs on claims and pricing.

Investment performance drives sales and profitability

Life-annuity sales and profitability are sensitive to General Account investment performance. That performance depends on two broad factors: the external rate environment and asset allocation strategy. As we look out to 2027, we see the continuation of a favorable external interest rate environment. We also expect insurers to continue diversifying their asset strategies to achieve higher portfolio yields.

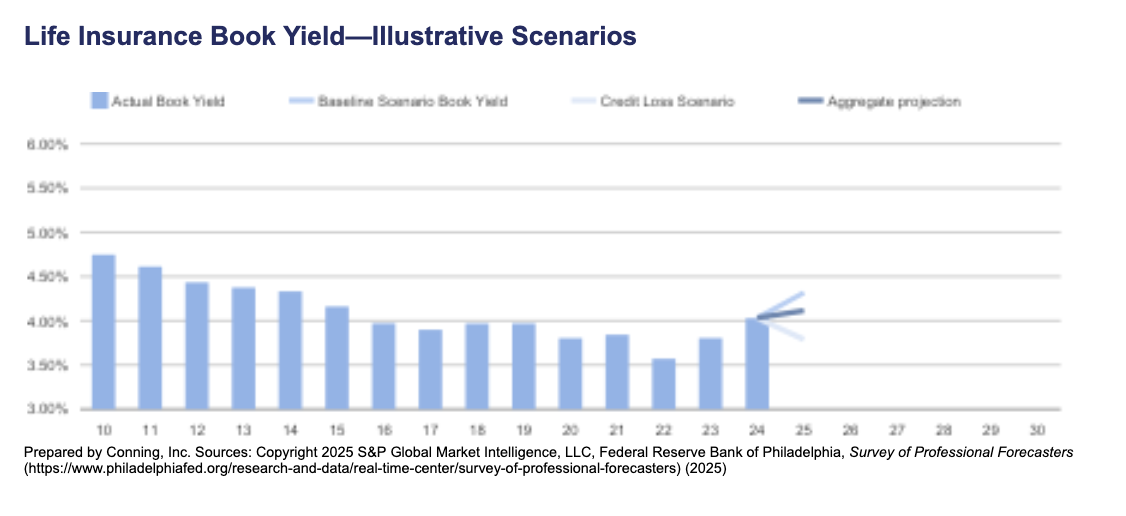

Portfolio yields forecast to increase through 2030

Even if the Federal Reserve cuts rates over the forecast period, we project life-annuity insurers will benefit from higher portfolio yield. Higher portfolio yields support fixed annuity and universal life interest-crediting rates, which are favorable for more sales over our forecast period.

Our portfolio projection uses the moving average ten-year Treasury rate and models three scenarios. The first is based on the third quarter of 2025 Philadelphia Federal Reserve's Survey of Professional Forecasters. The second assumes credit losses reduce the spread over Treasuries achieved in insurer portfolios. The third is an aggregate blend of one and two. By 2027, our aggregate projection is for the portfolio yield to reach 4.22%, up from 4.03% in 2024.

Continued asset diversification supports higher portfolio yields

During the longer-for-lower interest rate period of 2015 through 2021, life and annuity insurers began diversifying their assets to generate higher General Account portfolio yields. They decreased allocations to bonds and redistributed to mortgages and Schedule BA assets (alternative assets such as joint ventures, hedge funds, and private equity investments) to gain yield. In addition, there has been a marked shift within the bond portfolio towards private credit.

Even with the recovery of interest rates, we anticipate that diversification efforts will continue through our forecast period.

Reinsurance Continues to Support Growth

Whether onshore or offshore, reinsurance remains a key reserve and capital management tool for life annuity insurers. For example, in 2024, 21% of direct and assumed premiums were ceded. In 2025 and through 2027, we expect that key role will continue. What will be noticed, however, is the growing use of sidecars to support life-annuity reinsurance transactions.

Since 2019, over 15 new sidecars have formed. Looking ahead, we believe sidecars will continue to bring more capital to support life and annuity reinsurance growth. This is a strong positive for the life and annuity industry's forecast capital strength and profitability through 2027.

GLP-1s Affect Claims and Pricing

When we think about claims through 2027, the good news is that excess mortality has receded from the COVID-19 pandemic peak. At the same time, an increasing number of retirees use annuities to generate retirement income and increase annuity benefits. However, the impact of GLP-1 drugs on mortality, morbidity, and longevity is a new factor we and insurers need to consider. These drugs hold the potential to affect life insurance underwriting as well as life insurance and annuity pricing.

There is a concern that applicants may be using the drugs when underwritten for new policies, but then later stop using the drugs, leading to a return of weight and/or other health conditions the drugs treat. On the annuity side, longevity improvements due to GLP-1 change longevity expectations and strain original annuity pricing assumptions. The current impact of GLP-1 on life-annuity profitability may not be large. That said, these drugs may have a long-term effect on claims and pricing beyond 2027.

A Forecast for Strategic Adaptation

How should life-annuity executives respond to the good news in this forecast? The next three years give insurers a rare alignment of strong earnings, improving yields, new sources of third-party capital, and a return to more normal mortality. The companies that use this period to adapt and realign strategy, instead of simply enjoying favorable conditions, will be the ones that lead the industry in the decade ahead.

To position for continued growth and success, life-annuity insurers should accelerate product innovation. Developing flexible products that can adapt to shifting longevity and morbidity trends will help address emerging customer needs and market dynamics.

At the same time, enhancing the investment strategy remains essential. Continued diversification of the General Account portfolio, with a focus on private credit, mortgages, and alternative assets, will help optimize yields. Partnering with key asset management partners will be crucial to executing successful diversification strategies.

Leveraging reinsurance and third-party capital is another strategic priority. Expanding the use of reinsurance, including innovative structures like sidecars, can help manage capital efficiently and support growth objectives.

Driving operational excellence is crucial for sustainable growth. Investing in technology and analytics can improve underwriting, claims management, and customer engagement, while streamlining operations will enhance efficiency and scalability.

Finally, strengthening regulatory and capital management practices will help companies stay ahead of evolving requirements, maintain robust capital buffers, and support business expansion in a volatile market environment.

By executing on these strategic priorities, life-annuity insurers can capitalize on favorable market conditions, manage emerging risks, and position themselves for sustainable growth through 2027 and beyond.