How to Mitigate Cyber Threats

When companies move toward understanding why humans cause breaches, whether intentionally or by accident, mitigation is more effective.

When companies move toward understanding why humans cause breaches, whether intentionally or by accident, mitigation is more effective.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Byron Acohido is a business journalist who has been writing about cybersecurity and privacy since 2004, and currently blogs at LastWatchdog.com.

Outdated systems result in high costs and make it difficult and costly to act quickly on new customer wishes.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Roger Peverelli is an author, speaker and consultant in digital customer engagement strategies and innovation, and how to work with fintechs and insurtechs for that purpose. He is a partner at consultancy firm VODW.

Reggy de Feniks is an expert on digital customer engagement strategies and renowned consultant, speaker and author. Feniks co-wrote the worldwide bestseller “Reinventing Financial Services: What Consumers Expect From Future Banks and Insurers.”

Billing is core to your business and key to customer experience in today’s digital world. Can you afford it to get it wrong?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Sid Wadhwa is the CEO and co-founder of Cynosure, Inc. and is a BillingCenter Evangelist.

At the risk of over-simplifying the solution, I'm going to over-simplify the solution: Talk to clients who have made introductions.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Julie Littlechild is a speaker, a writer and the founder of AbsoluteEngagement.com. Littlechild has worked with and studied top-producing professionals, their clients and their teams for 20 years.

Nowadays, customer experience is the biggest competitive leverage a business could use to win the market.

We are living in an era of overabundance. Consumers have more choices than ever. To survive, companies have switched from product-centric to customer-centric.

Nowadays, customer experience is the biggest competitive leverage a business could use to win the market. I am a big believer in the customer-centric approach. Companies that put customers at the center of their strategy are winners at this new era. Just think about why Google beats Yahoo in the search engine, why Apple can sell a smartphone twice the average market price or why Uber has taken over the taxi market.

A few months ago, I was invited by Anand Chopra-McGowan of General Assembly to give a talk at Telefonica. The topic was about “Frictionless Customer Experience” (FCX). It was the first time I heard about that term. However, FCX instantly captures my attention, because of the natural fit with what I am trying to do with Landbot.io.

The simplest definition I would give about FCX is:

A mindset of a business that pursues continuously the right product to customers at the right moment and in the right channel.

The three key concepts that define FCX are product, moment and channel. So lets take a close look at each one.

Right product

So what is the “right” product? The mission of every business is to provide a product that can solve a problem and satisfy customer’s need. (By "product," I mean anything material or digital goods that you can packetize with a price and some specifications: A software platform or consulting service both can be considered as a product.)

As human beings, we are easily affected by our bias of what’s best for clients.

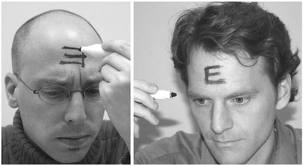

There is a study by Stanford where a group of students was asked to draw a capital letter “E” on their forehead. Below, you can see the result:

[caption id="attachment_27733" align="alignnone" width="303"] Different ways to write “E”[/caption]

Different ways to write “E”[/caption]

It turns out that we can draw this E in one of two ways: one self-focused “E,” like how you are seeing it as you draw it, and another “E” from someone else’s perspective. In this case, more than 90% of the people drew a self-focused “E.”

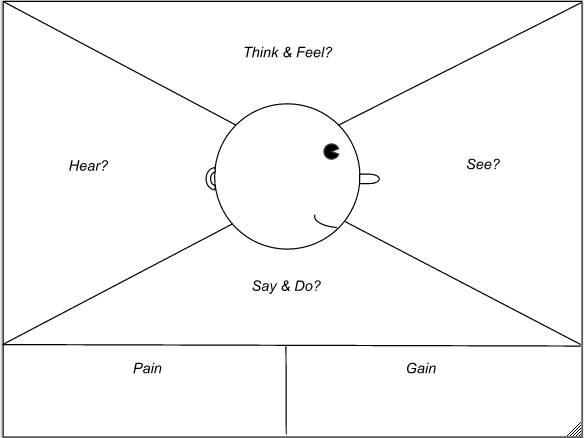

That is what happens most the time when we are designing our product. To provide the right product, we need a clear understanding of our customers: Who are they? What are their pains? What do they usually do?

See also: Why Customer Experience Is KeyOnly when we truly comprehend the context of our customers can we design, build and ultimately deliver a product that best fits with their need. A handy tool that can help us understand our customer is the Customer Empathy Map. It’s a collaborative tool we can use to gain a deeper insight into their clients. Below is an example. More information is here

To fill out all the info in the canvas, you can do lots of online research, but the most efficient way would be doing customers interviews. Only by getting out of the building and talking face to face with potential customers can you get all the data needed to understand them.

An excellent example of this is how Snapchat designed its video sharing feature. Before, the videos you saw on the mobile were always in landscape mode. However, Snapchat realized that the natural position for people to use their phone is in the vertical position, so the company designed the whole user experience around vertical videos, which turns out to be a huge success. Now, many camera-related applications have followed this new design paradigm.

Right momentOnce we have built the right product, we have to deliver it to the customer at the right moment. When is that?

Conventional wisdom would say we should provide the product whenever our customers need it most. Therefore, the job of marketers has always been building strong connections between the desire and the product. Then the business has just to be there for customers to consume the product. That’s basically how we have been running businesses in the 20 centuries. When you are hungry, you think of McDonald's, or, when youre thirsty, Coca Cola may be the first that comes to your mind.

However, with the increasing competition in today’s market, the old approach is no longer enough. Recent research by Microsoft shows that human attention span has fallen from 12 seconds to 8 seconds, which is shorter than a goldfish!

If everyone is competing to get the attention of consumers, how can you stand out and win? One possible way is to anticipate the users' needs even before they realize it. To offer FCX, we have to bring our customer communication to another level. We need to think deeply about our customer journey and always be one step ahead to help the client getting the product.

As technology advances, many companies start using big data and machine learning to predict user behaviors. This kind of prediction allows companies to take actions either to prevent undesirable behavior (customer churn) or to provide incentives for good behavior (purchase intention).

A good example, in this case, would be Pepephone, a Spanish mobile virtual network operator (MVNO). It’s known mainly for great customer service and user friendliness.

There was one time when Pepephone suffered a major outrage of its network system late at night. The incident was solved quickly; many customers weren’t even aware of it. However, unlike other telco companies would do, Pepephone called all the clients who might be affected. The company offered a discount to these customers as compensation for the outage, regardless of whether they complained. Actions like this demonstrate how Pepephone has always put their customer in the first place, which in turn helped the company to become No. 1 profitability and customer loyalty in the industry.

Right channel

If we did a great job with the previous two points, we should have a clear understanding of what product we should build and when to deliver it to customers. The last but not least thing we have to take into account is the way (channel) we use to interact with customers. “Be where your customers are” has been the first rule of success for every business. History told us that each time a new “channel” emerges, a whole new market could build around it. Those companies that know how to take full advantage of the new medium become winners at a new market. Think about what Microsoft did with the personal computer, Apple the smartphone, Uber with mobile applications, etc.

So what channel should you use? To choose the best channel, we need to keep in mind two important factors:

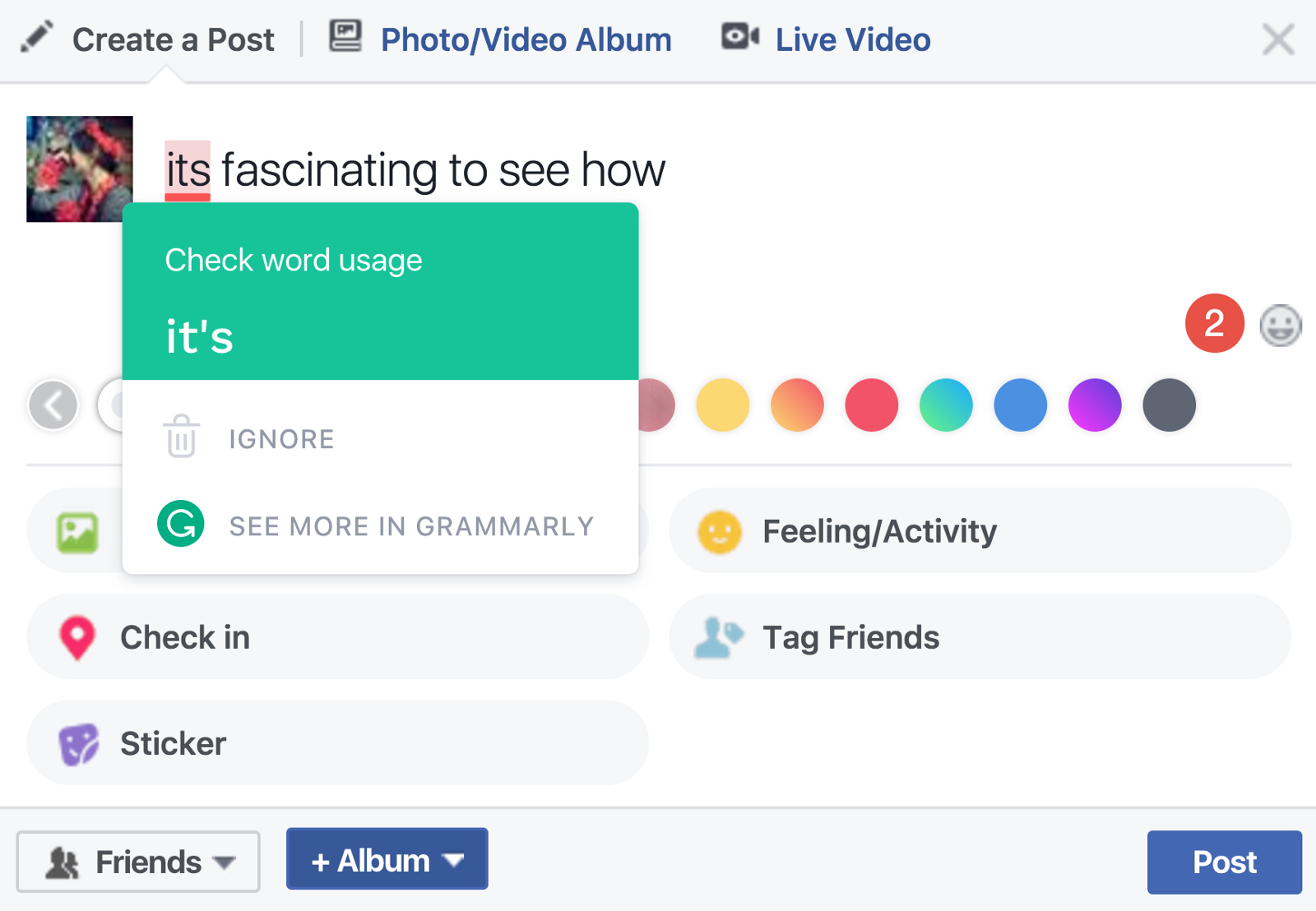

A fascinating case study is Grammarly, the best grammar checking tool on the planet. My friend Hiten Shah wrote a few days ago an in-deep review of how Grammarly grew into millions of users. One key point in the strategy was that the company had designed the product to be where customers are. Grammarly built plugins for Microsoft Office and later as Chrome extensions so people can use it where they need the tool most: when writing a post, filling job forms, editing text documents, etc.

[caption id="attachment_27735" align="alignnone" width="570"] A screenshot of a user editing his facebook post with Grammerly[/caption]

A screenshot of a user editing his facebook post with Grammerly[/caption]

I hope these brief thoughts about FCX could help you design a better product, delivering it to the customer when and where it's needed.

Do you have any thoughts or examples about FCX? Let me know in the comment section. If you enjoy this article and would like to read more about FCX you can support me by giving some claps ? (up to 50 would take less than one minute).

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

We gathered thoughts from injured workers, whose voices are crucial in workers' comp but are too-seldom heard.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Kimberly George is a senior vice president, senior healthcare adviser at Sedgwick. She will explore and work to improve Sedgwick’s understanding of how healthcare reform affects its business models and product and service offerings.

Mark Walls is the vice president, client engagement, at Safety National.

He is also the founder of the Work Comp Analysis Group on LinkedIn, which is the largest discussion community dedicated to workers' compensation issues.

Less than half of the respondents surveyed describe risk management processes as "mature" or "robust."

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark S. Beasley, CPA, Ph.D., is the Deloitte professor of enterprise risk management and director of the ERM initiative at NC State University. He specializes in the study of enterprise risk management, corporate governance, financial statement fraud and the financial reporting process. He completed over seven years of service as a board member of the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and has served on other national-level task forces related to risk management issues.

Bonnie Hancock is executive director of enterprise risk management initiative and professor of practice at NC State University.

There are many relatively minor and cost-effective measures that homeowners in the vulnerable coastal areas can take. Why don't they?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Albert J. Slap is president and co-founder of Coastal Risk Consulting, the first company to provide millions of coastal homeowners in the U.S., as well as businesses and local governments, with online, state-of-the-art, climate risk assessments at an affordable price.

An EY survey finds that initial use cases are narrowly defined but that technologies are advancing key capabilities.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Gail McGiffin is a principal in EY’s insurance practice and leads the underwriting, product, policy and billing offerings. Prior to joining EY, McGiffin was the chief information officer at ProSight Specialty Insurance.

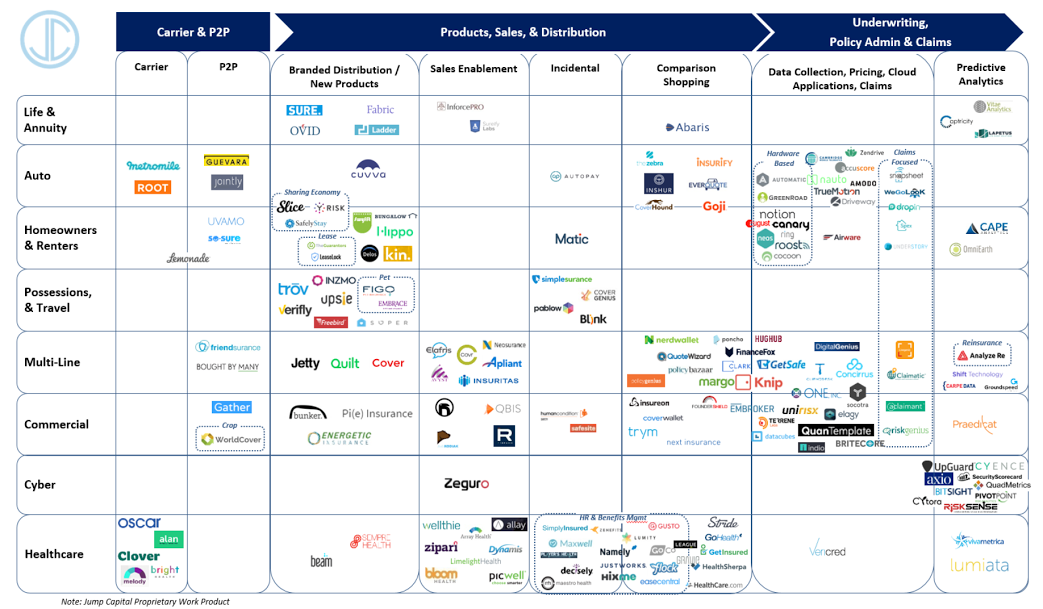

Quality data is driving actionable insights for health insurance innovators to improve choice, transparency and user experience.

These companies are finding different ways to meet consumer demands and remove the complexity associated with the insurance industry. The companies included in the healthcare segment of this infographic are, for the most part, delivering new ways to help consumers find, buy and receive health insurance. Collectively, health insurtech platforms answer a consumer cry for help. But none of these platforms are functional, let alone useful, without a foundational layer of quality data on which to build.

What are the innovators creating?

Health insurtech innovators are working to answer a variety of consumer demands. They’re creating tools that simplify the health insurance shopping experience. Tools that help doctors find prescription drugs that are covered by a patient’s insurance plan. Tools that help consumers find doctors that are in-network. The problems that these platforms solve are many.

Here are just a few examples of innovative tools and features being created to deliver value to health insurance consumers:

1. Decision Support Tools for the Individual Market

A variety of web-based entities (WBEs) have popped up to help individual consumers find and purchase a health insurance plan that is right for them. PolicyGenius is a good example of an innovative platform doing just that. The company prides itself on delivering simple benefits that are personally designed for the individual. A consumer enters a few bits of information, and PolicyGenius recommends health insurance plans for that individual -- all delivered through a seamless digital experience.

2. Analysis Tools for the Small Group Market

Certain broker-facing platforms are starting to build analytical tools that help strengthen group health plan recommendations. These tools allow platforms to compare and contrast different health plans, including each plan’s network, aiding in disruption analysis and delivering value to their employer customers.

3. In-Network Provider Search and Notification Features

Many health insurtech platforms offer customers provider-network search and notification features. Stroll Health, for example, delivers personal recommendations for imaging centers based on a patient’s insurance plan. And some HR and benefits administration platforms now have the ability to notify employees if an employee’s preferred doctor drops out of network. Thoughtful features like these save consumers time and money.

See also: Next Step: Merging Big Data and AI

Why is the data so crucial?

While data may not be the sexiest element of a tech platform, the data layer enables all features. For example, for those broker-facing analysis tools to be useful, the broker platform must have access to accurate and timely data on the benefits and rates of every health plan they’ll compare. For an HR and benefits administration platform to alert an employee when a doctor drops out of network, the platform must first know when that doctor drops out of network. This means the platform must have access to an accurate and extremely granular database of providers in the specific network being tracked. Quality data is what informs today’s innovators, pushing them to take action and build exciting applications that solve real problems.

Health is a complex space, but there are many brilliant minds working to improve the health insurance industry. Putting the right data into the hands of these innovators allows them to do what they do best -- solve problems with creative technology solutions. Continuing to do this will allow today’s innovators to respond to consumer pain points and transform the health insurance industry.

These companies are finding different ways to meet consumer demands and remove the complexity associated with the insurance industry. The companies included in the healthcare segment of this infographic are, for the most part, delivering new ways to help consumers find, buy and receive health insurance. Collectively, health insurtech platforms answer a consumer cry for help. But none of these platforms are functional, let alone useful, without a foundational layer of quality data on which to build.

What are the innovators creating?

Health insurtech innovators are working to answer a variety of consumer demands. They’re creating tools that simplify the health insurance shopping experience. Tools that help doctors find prescription drugs that are covered by a patient’s insurance plan. Tools that help consumers find doctors that are in-network. The problems that these platforms solve are many.

Here are just a few examples of innovative tools and features being created to deliver value to health insurance consumers:

1. Decision Support Tools for the Individual Market

A variety of web-based entities (WBEs) have popped up to help individual consumers find and purchase a health insurance plan that is right for them. PolicyGenius is a good example of an innovative platform doing just that. The company prides itself on delivering simple benefits that are personally designed for the individual. A consumer enters a few bits of information, and PolicyGenius recommends health insurance plans for that individual -- all delivered through a seamless digital experience.

2. Analysis Tools for the Small Group Market

Certain broker-facing platforms are starting to build analytical tools that help strengthen group health plan recommendations. These tools allow platforms to compare and contrast different health plans, including each plan’s network, aiding in disruption analysis and delivering value to their employer customers.

3. In-Network Provider Search and Notification Features

Many health insurtech platforms offer customers provider-network search and notification features. Stroll Health, for example, delivers personal recommendations for imaging centers based on a patient’s insurance plan. And some HR and benefits administration platforms now have the ability to notify employees if an employee’s preferred doctor drops out of network. Thoughtful features like these save consumers time and money.

See also: Next Step: Merging Big Data and AI

Why is the data so crucial?

While data may not be the sexiest element of a tech platform, the data layer enables all features. For example, for those broker-facing analysis tools to be useful, the broker platform must have access to accurate and timely data on the benefits and rates of every health plan they’ll compare. For an HR and benefits administration platform to alert an employee when a doctor drops out of network, the platform must first know when that doctor drops out of network. This means the platform must have access to an accurate and extremely granular database of providers in the specific network being tracked. Quality data is what informs today’s innovators, pushing them to take action and build exciting applications that solve real problems.

Health is a complex space, but there are many brilliant minds working to improve the health insurance industry. Putting the right data into the hands of these innovators allows them to do what they do best -- solve problems with creative technology solutions. Continuing to do this will allow today’s innovators to respond to consumer pain points and transform the health insurance industry.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paige Swanepoel is the director of marketing at Vericred, a leading healthcare data services company based in New York City. Her focus on enabling technologies that propel consumerism has been a driving force in her career and the success of Vericred.