This article explores how the emerging "Vibe" paradigm—rooted in intuition, emotion, and seamless interaction—is redefining human-machine collaboration. Extending beyond development, we propose Vibe Insurance: an AI-native model that reduces friction, builds trust, and transforms transactional processes into empathetic, user-centric experiences.

In a world shaped by generative AI, Vibe Insurance reimagines not just what technology can do but how it should feel. Unlike conventional insurtech solutions focused on automation or efficiency, Vibe Insurance centers on emotional resonance, trust-building, and fluid interactions—bridging the gap between digital precision and human warmth.

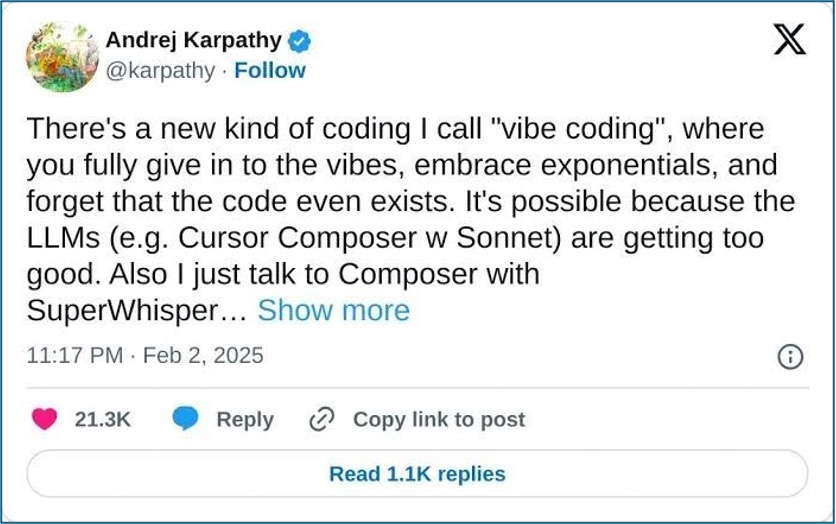

Figure 1: Andrej Karpathy's post on X

The literal meaning of "vibe" refers to a sense of atmosphere or feeling. When combined with terms like "coding," it forms the phrase "Vibe Coding"—a concept introduced by Andrej Karpathy earlier this year (Figure 1). While the term is gaining attention, its translation and interpretation in different languages remain fluid. Instead of focusing on a literal translation, many highlight its defining features: It is intuition-driven, free-form, and centered on creativity. As a result, it is sometimes referred to more descriptively as "intuitive coding," "freeform coding," or "spontaneous coding."

Some interpret Vibe Coding as a new development paradigm: Developers focus on application functionality and architecture design, while AI coding agents assist in writing the actual code. This interpretation highlights a new "human-machine collaboration" model, involving clear module division, precise prompt design, and iterative testing and refinement.

But "Vibe" isn't limited to coding. For example, when filling out online forms, traditional static, linear, and generic tools—such as dropdown menus, radio buttons, and one-way workflows—often feel tedious and frustrating, sometimes even causing users to abandon the process. The alternative is "Vibe Survey." Other extensions include Vibe Design and Vibe Marketing.

The concept of "Vibe" represents atmosphere, freedom, intuition, flexibility, and creativity. It emphasizes breaking away from mechanical interactions, striving for more natural and fluid experiences, dynamic process adjustments, and even the ability to perceive emotions. Compared with traditional methods, Vibe is faster, more efficient, and capable of meeting personalized needs while delivering a pleasant user experience.

People don't fill out forms to meet the demands of a company or individual; they do so because they have a need—whether for a job, a service, or a connection. This process is essentially about "matching." Surveys match potential customers with products, job applications match candidates with ideal roles, and event registrations match consumers with their preferred activities.

In this sense, Vibe is a mindset, a "human-centric" methodology. Its goal isn't to pursue speed but reducing unnecessary friction in user interface (UI) design, or human-AI coding collaboration, thereby enhancing user experience (UX) and achieving seamless integration between the virtual and real worlds.

Darren Yeo, in his article "The Hype and Risks of Vibe Coding," writes about Vibe and design: "For now, I'll keep those vibes in check and continue to treasure what remains valuable to me. Because at the end of the day, design isn't just about speed—it's about humanity." Indeed, the focus of evolution is never speed but "humanity."

Large language models (LLMs) are making this vision (Vibe Everything) a reality. With the right models and prompts, we can present content in a Vibe format to users. Achieving this isn't about retrofitting static products with AI features but rethinking the experience users desire when performing simple tasks like filling out forms.

This represents a natural evolution of interaction between AI-native products—those built with AI capabilities from the ground up—and users in the age of generative AI (GenAI). It discards rigid rules in favor of algorithm- and model-driven interactions, enabling dynamic workflows, multi-role collaboration, multimodal formats, and multi-channel touchpoints.

For example, if a user says, "Your interface is great, but the price is too high," the LLM can identify: "Positive: UI design; Negative: Price sensitivity," and respond with a thank-you message from the design team and a discount coupon. Prompts must define clear objectives (e.g., role + task instructions), and contextual memory ensures interaction consistency. LLMs are ideal for realizing Vibe interactions, transforming mechanical processes into warm conversations—whether in forms or code, natural language becomes the new human-machine interface.

However, challenges remain. For instance, freeform outputs may deviate from expectations, contextual memory limitations can disrupt interactions, and emotional/affective cognition is still underdeveloped. Other issues include reasoning for complex problems, latency, multimodal processing, security, and privacy. Despite these limitations, technologists are gradually improving these models through human-AI collaboration and fine-tuning for vertical-scenarios.

Emotional/affective cognition is essential to natural interactions and user engagement. However, current technology has significant gaps, including insufficient multimodal fusion for emotion recognition, poor contextual emotional coherence, and weak generalization across different cultures and individuals. In the Vibe interaction paradigm, user demand for anthropomorphic interactions (questioners) and the solutions provided by tech teams (solvers) forms a dynamic cycle, reshaping the foundation of human-machine collaboration.

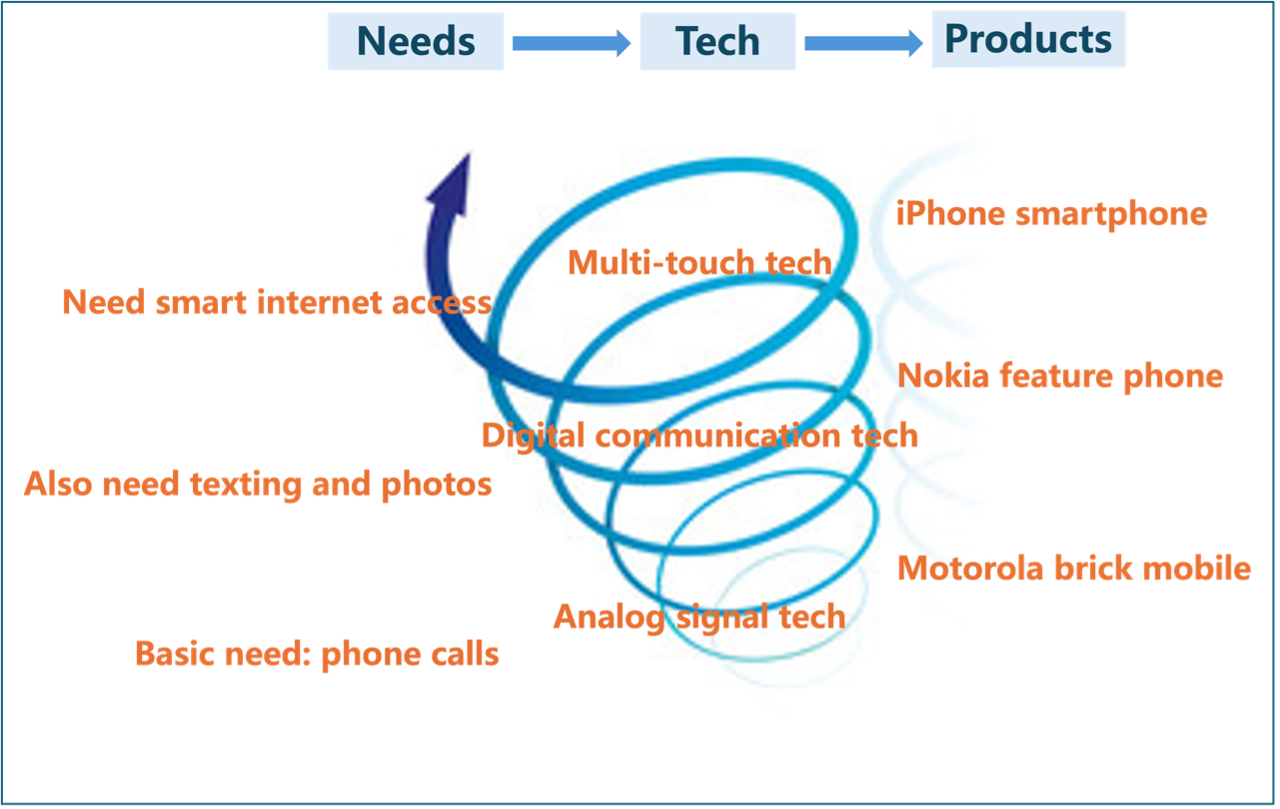

This dynamic cycle resembles a "spiral causality diagram of demand-driven innovation." When people ask, "Why can't this be simpler/smarter?" (questioners), it exposes technological shortcomings. Engineers then develop tools to address them (solvers). As people enjoy the benefits of these innovations, they naturally ask, "Can it be even better?" This creates a self-reinforcing cycle of technological advancement. From touchscreen phones to voice assistants to emotion-aware devices, each breakthrough redefines how humans interact with technology.

Figure 2: The demand-innovation spiral in mobile phone technology

As shown in Figure 2, the evolution of mobile phones vividly illustrates the dialogue between human needs and technological innovation. From Motorola's "just make calls" brick phones to Nokia's "texting and cameras" feature phones, to the iPhone's "smart and connected" touchscreen revolution, each generation meets current demands while quietly paving the way for the next breakthrough. Today, as people expect devices to "understand emotions and show warmth," affective computing is opening a new chapter. While phones can't yet interpret frowns or voice tremors, they can infer needs from usage patterns. The best innovations, from functionality to emotional resonance, always respond to humanity's deepest desires.

Given the universality of Vibe as a methodology, what is "Vibe Insurance"? Unlike conventional insurtech solutions focused on automation or efficiency, it centers on emotional resonance, trust-building, and fluid interactions—bridging the gap between digital precision and human warmth. We believe that establishing a new paradigm of human-machine interaction in insurance—Vibe Insurance—requires combining emotional intelligence with dynamic workflow design, reshaping user trust and service experiences through AI-native interactions.

- For users, it reduces mechanical friction, enabling "seamless" experiences.

- For businesses, it rebuilds service value chains through emotional intelligence and trust quantification.

- For technology, it balances data-driven precision with human-centric warmth, achieving "algorithms with empathy."

Vibe isn't just a technological innovation but a mindset revolution—"intuition-driven, experience-first." When Vibe becomes the foundation of design, human-machine interactions will no longer be constrained by rigid rules but will evolve into creative, warm, and algorithm-driven exchanges. From Vibe Coding to Vibe Insurance, the core principle remains: "Reduce mechanical friction, let interactions flow naturally." Whether engineers collaborate with AI on code, users fill out dynamic forms, or policyholders engage in emotionally intelligent insurance planning, Vibe transforms cold processes into warm conversations.

The future of Vibe Everything hinges on balance. We must navigate the boundary between AI's "simulated emotions" and "avoiding overreliance." The ultimate goal of technology isn't to replace humans but to bridge the virtual and real worlds in a more humane way, using natural language as the universal interface. Vibe will redefine how we coexist with the digital world.

References and Notes:

1. Andrej Karpathy: "There's a new kind of coding I call 'vibe coding,' where you fully give in to the vibes, embrace exponentials, and forget that the code even exists. It's possible because the LLMs (e.g., Cursor Composer w/Sonnet) are getting scarily good."

2. Cassius Kiani (April 1, 2025), Freeform Update: Why Vibe Surveys Beat Static Forms, https://every.to/source-code/freeform-update-why-vibe-surveys-beat-static-forms.

3. Darren Yeo (March 9, 2025), The Hype and Risks of Vibe Coding, https://medium.com/user-experience-design-1/the-hype-and-risks-of-vibe-coding-0d1e1ccd71d7.

4. ESCP Business School (Feb. 17, 2025), Artificial Intelligence and Emotional Intelligence: The New Frontier of Human-AI Synergy, https://escp.eu/de/news/artificial-intelligence-and-emotional-intelligence.

5. David E. Nye's "demand-innovation spiral," from Technology Matters: Questions to Live With. The core idea: "New technologies never emerge in a vacuum but respond to the flaws of existing ones—yet every solution becomes the incubator for new demands, creating a self-reinforcing cycle."

6. For explorations of affective computing in insurance, refer to LingXi Technology's articles:

- Emotional Intelligence Breakthrough: How Emotional Prompts Define Next-Gen Insurance Planning https://mp.weixin.qq.com/s/VTZ5S6hOlcRfWY75iSj3OQ.

- The Dual Faces of AI: Role-Playing and Emotion Recognition https://mp.weixin.qq.com/s/4dmkTNjcyUF3pwxsrjgxAw.

- The Paradox of AI Companionship: The Delicate Balance Between Emotional Support and Dependence https://mp.weixin.qq.com/s/loX_Yr3ItXgD0tq81uC7Gw.

- Experiment 23: AI and Trust—The Future of Insurance https://mp.weixin.qq.com/s/cLpa0BSKSkWeb3zlrsjqrQ.