What Really Matters in Customer Experience

Companies that excel at customer experience recognize that they’re in the business of shaping memories, not just experiences.

Companies that excel at customer experience recognize that they’re in the business of shaping memories, not just experiences.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jon Picoult is the founder of Watermark Consulting, a customer experience advisory firm specializing in the financial services industry. Picoult has worked with thousands of executives, helping some of the world's foremost brands capitalize on the power of loyalty -- both in the marketplace and in the workplace.

A customized model that is fit-for-purpose one day can soon become obsolete if not updated for changing business practices and real-world data.

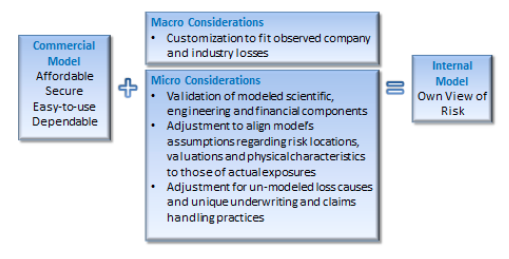

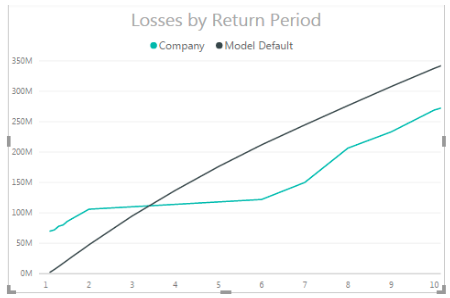

To the extent resources allow, (re)insurers should analyze several macro- and micro-level considerations when evaluating the merits of a given platform. On the macro level, unless a company’s underwriting and claims data dominated the vendor’s development methodology, customization is almost always desirable, especially at the bottom of the loss curve where there is more claim data; if a large insurer with robust exposure and claims data is heavily involved in the vendor’s product development, the model’s vulnerability assumptions and loss payout and developments patterns will likely mirror that of the company itself, so less customization is necessary. Either way, users should validate modeled losses against historical claims from both their own company and industry perspectives, taking care to adjust for inflation, exposure changes or non-modeled perils, to confirm the reasonability of return periods in portfolio and industry occurrence and aggregate exceedance-probability curves. Without this important step, insurers may find their modeled loss curves differ materially from observed historical results, as illustrated below.

To the extent resources allow, (re)insurers should analyze several macro- and micro-level considerations when evaluating the merits of a given platform. On the macro level, unless a company’s underwriting and claims data dominated the vendor’s development methodology, customization is almost always desirable, especially at the bottom of the loss curve where there is more claim data; if a large insurer with robust exposure and claims data is heavily involved in the vendor’s product development, the model’s vulnerability assumptions and loss payout and developments patterns will likely mirror that of the company itself, so less customization is necessary. Either way, users should validate modeled losses against historical claims from both their own company and industry perspectives, taking care to adjust for inflation, exposure changes or non-modeled perils, to confirm the reasonability of return periods in portfolio and industry occurrence and aggregate exceedance-probability curves. Without this important step, insurers may find their modeled loss curves differ materially from observed historical results, as illustrated below.

A micro-level review of model assumptions and shortcomings can further narrow the odds of a “shock” loss. As such, it is critical to precisely identify risks’ physical locations and characteristics, as loss estimates may vary widely within a short distance - especially for flood, where elevation is an important factor. When a model’s geocoding engine or a national address database cannot assign location, there are several disaggregation methodologies available, but each produces different loss estimates. European companies will need to be particularly careful regarding data quality and integrity as the new General Data Protection Regulation, which may mean less specific location data is collected, takes effect.

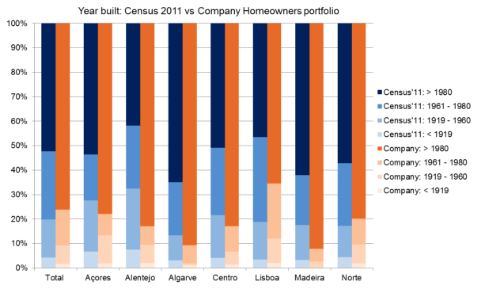

Equally as important as location is a risk’s physical characteristics, as a model will estimate a range of possibilities without this information. If the assumption regarding year of construction, for example, differs materially from the insurer’s actual distribution, modeled losses for risks with unknown construction years may be under- or overestimated. The exhibit below illustrates the difference between an insurer’s actual data and a model’s assumed year of construction distribution based on regional census data in Portugal. In this case, the model assumes an older distribution than the actual data shows, so losses on risks with unknown construction years may be overstated.

A micro-level review of model assumptions and shortcomings can further narrow the odds of a “shock” loss. As such, it is critical to precisely identify risks’ physical locations and characteristics, as loss estimates may vary widely within a short distance - especially for flood, where elevation is an important factor. When a model’s geocoding engine or a national address database cannot assign location, there are several disaggregation methodologies available, but each produces different loss estimates. European companies will need to be particularly careful regarding data quality and integrity as the new General Data Protection Regulation, which may mean less specific location data is collected, takes effect.

Equally as important as location is a risk’s physical characteristics, as a model will estimate a range of possibilities without this information. If the assumption regarding year of construction, for example, differs materially from the insurer’s actual distribution, modeled losses for risks with unknown construction years may be under- or overestimated. The exhibit below illustrates the difference between an insurer’s actual data and a model’s assumed year of construction distribution based on regional census data in Portugal. In this case, the model assumes an older distribution than the actual data shows, so losses on risks with unknown construction years may be overstated.

There is also no database of agreed property, contents or business interruption valuations, so if a model’s assumed valuations are under- or overstated, the damage function may be inflated or diminished to balance to historical industry losses.

See also: How to Vastly Improve Catastrophe Modeling

Finally, companies must also adjust “off-the-shelf” models for missing components. Examples include overlooked exposures like a detached garage; new underwriting guidelines, policy wordings or regulations; or the treatment of sub-perils, such as a tsunami resulting from an earthquake. Loss adjustment difficulties are also not always adequately addressed in models. Loss leakage – such as when adjusters cannot separate covered wind loss from excluded storm surge loss – can inflate results, and complex events can drive higher labor and material costs or unusual delays. Users must also consider the cascading impact of failed risk mitigation measures, such as the malfunction of cooling generators in the Fukushima nuclear power plant after the Tohoku earthquake.

If an insurer performs regular, macro-level analyses of its model, validating estimated losses against historical experience and new views of risk, while also supplementing missing or inadequate micro-level components appropriately, it can construct a more resilient modeling strategy that minimizes the possibility of model failure and maximizes opportunities for profitable growth.

The views expressed herein are solely those of the author and do not reflect the views of Guy Carpenter & Company, LLC, its officers, managers, or employees.

You can find the article originally published on Brink.

There is also no database of agreed property, contents or business interruption valuations, so if a model’s assumed valuations are under- or overstated, the damage function may be inflated or diminished to balance to historical industry losses.

See also: How to Vastly Improve Catastrophe Modeling

Finally, companies must also adjust “off-the-shelf” models for missing components. Examples include overlooked exposures like a detached garage; new underwriting guidelines, policy wordings or regulations; or the treatment of sub-perils, such as a tsunami resulting from an earthquake. Loss adjustment difficulties are also not always adequately addressed in models. Loss leakage – such as when adjusters cannot separate covered wind loss from excluded storm surge loss – can inflate results, and complex events can drive higher labor and material costs or unusual delays. Users must also consider the cascading impact of failed risk mitigation measures, such as the malfunction of cooling generators in the Fukushima nuclear power plant after the Tohoku earthquake.

If an insurer performs regular, macro-level analyses of its model, validating estimated losses against historical experience and new views of risk, while also supplementing missing or inadequate micro-level components appropriately, it can construct a more resilient modeling strategy that minimizes the possibility of model failure and maximizes opportunities for profitable growth.

The views expressed herein are solely those of the author and do not reflect the views of Guy Carpenter & Company, LLC, its officers, managers, or employees.

You can find the article originally published on Brink.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Imelda Powers has advised worldwide (re)insurers on catastrophe exposure management for more than 20 years. Her works include model development, statistical simulation and insurance-linked securities.

Agents who give personalized advice and advocacy when needed represent the great upside and the future of the agency channel.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Sam Fleming is vice president of product marketing with Imprezzio. A true visionary and leader, Fleming’s enthusiasm and passion for discovering new applications of technology fuels a creativity that translates to incredible business solutions.

A core system that was top of the line in 2013 may be showing its age. Systems now need to be “digitally native."

Insurers, I have some good news and some bad news. Insurers have made tremendous progress in core modernization, purchasing and implementing new core systems and beginning to adapt their businesses to take full advantage of modern core systems’ capabilities. This is genuine cause for celebration – insurers that have made or are making these efforts are advancing their companies and our industry in general.

As insurers were engaged in these core modernization efforts, though, the personal lines market and technology itself have kept moving forward. A core system that was top of the line in 2013 may be showing its age unless it has been continually upgraded to serve the capabilities needed in 2018 and beyond. This may not be the most welcome news for those still thinking about core systems with an average lifespan of 10 years or more, but this is our new reality.

This is especially true for personal lines insurers, which are typically the first to catch the core modernization wave. They have also tended to be the leaders regarding new computing capabilities. It was true for mainframe systems, client servers, web-based applications. Now, heading into the new era of computing, it is true with computing trends like microservices and serverless computing coming to the fore. This is not technology for technology’s sake – insurers need to be able to handle an increasing number of transactions, including multi-threaded calls, and that increase is approaching an infinite number.

See also: 2018’s Top Projects in Personal LinesFurther pressure comes from the insurtech startups active in the personal lines market. The original, widely known insurtech startups in P&C insurance were focused on personal lines. As the insurtech movement has matured, startups’ focus has widened to commercial lines and workers’ comp as well as crossing product lines. However, startups have been active in personal lines the longest, and those insurtechs that have thrived have gained market experience and are beginning to focus on organizational maturity. That means that for incumbent personal lines insurers, their insurtech counterparts tend to be comparatively robust and mature when compared with the commercial lines insurtechs I discussed in my earlier blog.

A key characteristic of insurtechs is that they are digitally native companies. That means that they are natively fluent, with enormous quantities of data and digital interactions, and their technology is geared toward this.

Core systems that can be described as “digitally native” have an edge in the digital market going into the future. Even though digital has been a crucial focus area for years, the insurance industry is still learning what a truly digital business entails – and what technology is needed to support it. Insurtech startups have given the insurance industry new examples of how to operate in the digital world.

Few core systems are built with the digitally native characteristics, but the core systems marketplace is beginning to adapt. Continued evolution toward open APIs and new data sources will provide insurers with the opportunity to interoperate with the new distribution channels and directly with the customer.

Whether you are a large insurer that is trying to support new digital brands and new product models (on-demand, telematics and others dependent on high amounts of data) or a small regional insurer trying to power consumer service portals, the key question is data availability and digital connectivity with the consumer and agent.

So, for insurers asking themselves: “Do we really need to think about modernizing our modern core systems?” the better question may be this: “Are your modern core systems digitally native?”

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Karen Furtado, a partner at SMA, is a recognized industry expert in the core systems space. Given her exceptional knowledge of policy administration, rating, billing and claims, insurers seek her unparalleled knowledge in mapping solutions to business requirements and IT needs.

The Amazon/Berkshire Hathaway/JPMorganChase health care partnership known as ABC announced last week that it had hired as CEO the well-known innovator, author and surgeon Atul Gawande. Count me a fan.

While some note that he has never run an organization anywhere close to the size that will be needed to coordinate the health care of the roughly one million people covered in the partnership, I believe he brings just the right qualities to a job that could create great change in U.S. health care in five to 10 years, slashing costs while improving care.

He has shown an ability to look at problems through beginner's eyes, even when he has been immersed in the issue for years. His 2009 article in The New Yorker comparing care in two Texas towns showed just how destructive the profit-maximizing culture of his industry has become.

Gawande has consistently shown the sort of empathy that often gets lost when care collides with dollars and cents. His latest book, "Being Mortal," on how life draws to a close, is remarkable. (Here is an interview that provides a look into his thinking: https://onbeing.org/programs/atul-gawande-what-matters-in-the-end-oct2017/)

He has also seen both how important and how hard it is to implement innovation. He devised a checklist for surgeons that is now used in hospitals around the world and that has greatly reduced post-operative infections. But surgeons, as dedicated as they are, bristle when told what to do, especially via something as rudimentary as a checklist, so progress hasn't exactly moved in a straight line.

Even if Gawande succeeds—a big if, given the size and complexity of the issue—you have to figure that progress will take years. First, ABC will have to figure out how to take better care of the million souls in its care. Then the problem really gets hard, as ABC will have to figure out how to roll out its solutions into remote parts of the country, to small businesses, to people older than employees at the ABC companies and so on, or others will have to figure out how to pull ideas out of ABC and implement them more broadly.

A million people is a lot, but it isn't 330 million. And the antibodies working against Gawande will be stronger than any he's ever seen. People will do a lot to protect the going-on $4 trillion spent on health care in the U.S. each year.

Still, I can't think of a better person to tackle the issue.

Have a great week.

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

Traditional operating levers for executing strategy no longer work. 20th-century structures don't work in 21st-century conditions.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Bruce Brodie is a managing director for PwC's insurance advisory practice focusing on insurance operations and IT strategy, new IT operating models and IT functional transformation. Brodie has 30 years of experience in the industry and has held a number of leadership positions in the insurance and consulting world.

The sheer volume of repetitive, rule-driven work sets insurers apart from many other industries -- and creates big opportunities.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Tom Hammond is the chief strategy officer at Confie. He was previously the president of U.S. operations at Bolt Solutions.

Ten or 15 years ago, no companies had a chief risk officer. Risk was barely mentioned. Today, risk has to be on every board's agenda.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Howard C. Kunreuther is professor of decision sciences and business and public policy at the Wharton School, and co-director of the Wharton Risk Management and Decision Processes Center.

Robotics process automation (RPA) lets insurers handle high-volume and complex data actions at exponentially greater speed than in the past.

Suggested approach and lessons learned: following the leaders

Significant numbers of insurers are already using RPA in their claims organizations. In designing the business case for robotics, claims leaders should seek an incremental approach, adopting more ambitious use cases once they have built momentum and demonstrated results through initial and targeted deployments. With RPA, there’s no need to try do too much too fast, which may be attractive for insurance executives seeking to minimize risk and disruption in their adoption of enabling technologies. Further, an incremental approach can help organizations overcome their natural wariness toward RPA in terms of its workforce impacts.

See also: Robots and AI—It’s Just the Beginning

The following lessons learned come from early adopters:

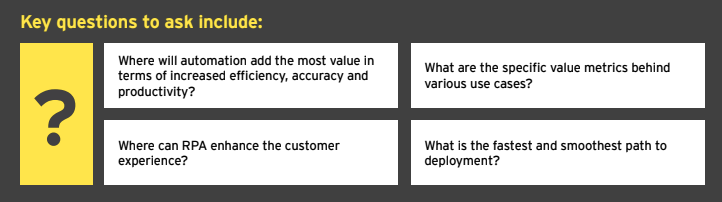

Target the opportunities: In developing a business case and tangible ROI model, specific tactical questions can lead to the right strategy as well as clarify the highest priorities for near-term automation. Finding answers may require a robust assessment of current capabilities and the completion of a cost-benefit analysis, given that the candidates for automation may number into the dozens.

Engage IT early and often: To ensure a smooth implementation and integration with other systems, there are many important infrastructure, governance and security questions to address. IT leaders reluctant to deploy another technology in the claims “stack” should consider how RPA can support strategic platform upgrades and those mandated by regulatory change. Most RPA tools are product- and platform-agnostic and work with existing IT architecture.

Find the right partner: External vendors and suppliers – including insurtechs, consultants and systems integrators – will be part of the solution, so it’s important to choose wisely. Beyond technical expertise, look for those firms with deep technical and operational claims knowledge, including a clear understanding of how it affects the customer experience.

Don’t overlook the organizational factors: As with other “digital” initiatives, claims leaders must invest time and resources in education and, if necessary, evangelization regarding the use of RPA. The delicate matter of robots taking over jobs should be addressed, most likely in the context of the need to reskill claims workers, as the role will evolve to become more analytical and more focused on customer needs and the most complex claims.

The bottom line: RPA is critical to the evolving claims process

The time for adopting robotics in claims has come, due primarily to the compelling business case and imperative for claims leaders to enhance performance and contribute more value to the business. Robotics can serve as a foundation in supporting true, end-to-end automation when integrated with other advanced technologies, such as OCR, chatbots, machine learning and NLP.

Indeed, as multiple early adopters have made clear, RPA is ready to help claims organizations advance and enhance outcomes in the digital era through increased automation, higher productivity and increased capacity and strategic focus for claims professionals.

RPA is among the top enabling technologies insurers should consider adopting in claims, as well as other parts of the organization, due to:

Suggested approach and lessons learned: following the leaders

Significant numbers of insurers are already using RPA in their claims organizations. In designing the business case for robotics, claims leaders should seek an incremental approach, adopting more ambitious use cases once they have built momentum and demonstrated results through initial and targeted deployments. With RPA, there’s no need to try do too much too fast, which may be attractive for insurance executives seeking to minimize risk and disruption in their adoption of enabling technologies. Further, an incremental approach can help organizations overcome their natural wariness toward RPA in terms of its workforce impacts.

See also: Robots and AI—It’s Just the Beginning

The following lessons learned come from early adopters:

Target the opportunities: In developing a business case and tangible ROI model, specific tactical questions can lead to the right strategy as well as clarify the highest priorities for near-term automation. Finding answers may require a robust assessment of current capabilities and the completion of a cost-benefit analysis, given that the candidates for automation may number into the dozens.

Engage IT early and often: To ensure a smooth implementation and integration with other systems, there are many important infrastructure, governance and security questions to address. IT leaders reluctant to deploy another technology in the claims “stack” should consider how RPA can support strategic platform upgrades and those mandated by regulatory change. Most RPA tools are product- and platform-agnostic and work with existing IT architecture.

Find the right partner: External vendors and suppliers – including insurtechs, consultants and systems integrators – will be part of the solution, so it’s important to choose wisely. Beyond technical expertise, look for those firms with deep technical and operational claims knowledge, including a clear understanding of how it affects the customer experience.

Don’t overlook the organizational factors: As with other “digital” initiatives, claims leaders must invest time and resources in education and, if necessary, evangelization regarding the use of RPA. The delicate matter of robots taking over jobs should be addressed, most likely in the context of the need to reskill claims workers, as the role will evolve to become more analytical and more focused on customer needs and the most complex claims.

The bottom line: RPA is critical to the evolving claims process

The time for adopting robotics in claims has come, due primarily to the compelling business case and imperative for claims leaders to enhance performance and contribute more value to the business. Robotics can serve as a foundation in supporting true, end-to-end automation when integrated with other advanced technologies, such as OCR, chatbots, machine learning and NLP.

Indeed, as multiple early adopters have made clear, RPA is ready to help claims organizations advance and enhance outcomes in the digital era through increased automation, higher productivity and increased capacity and strategic focus for claims professionals.

RPA is among the top enabling technologies insurers should consider adopting in claims, as well as other parts of the organization, due to:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Blockchain can accelerate insurance transformation and steer the industry toward digital collaboration and interoperability.

Blockchain can drive the insurance industry shift toward digitizing industry processes, encouraging cross-industry collaboration for visibility and compliance and collectively fighting fraud. Paired with additional emerging technologies such as IoT and smart sensors, blockchain can be a facilitator for increased automation in capturing and acting on claims data, analyzing risk more thoroughly and streamlining payment processing.

Let's dive into some areas of impact:

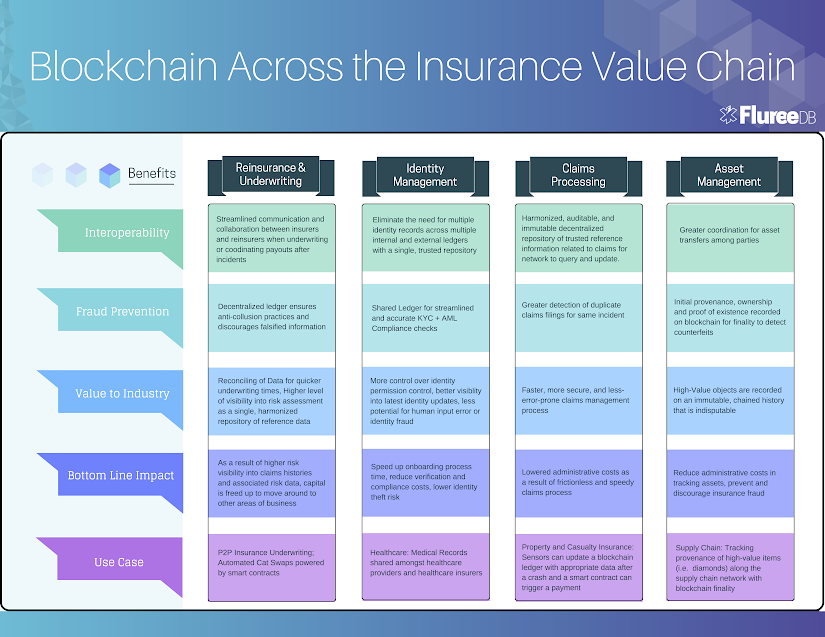

Reinsurance & underwriting

Streamline Reinsurance and Underwriting Times

In reinsurance, each risk in a contract requires individual underwriting — and in many cases, insurers engage with multiple reinsurance parties to secure the best negotiation for each contract item. Each institution has its own data system and standards — and these differences in process can lead to discrepancies in interpretation of the contract. Thus, currently, reinsurance and insurance institutions need to constantly engage in reconciling their books to ensure consistency in interpretation for each individual claim.

In sum, the complexity of different data systems and consequent wrangling between multiple third parties to secure individual risk reinsurance leaves the reinsurance process slow, expensive and subject to misinterpretation.

Blockchain technology should be leveraged in the reinsurance process to increase interoperability. With a shared digital ledger, no longer can there be the discrepancy in data format, process and standards that currently plague the industry.

A permissioned blockchain ledger can be used to streamline communication, flow of information and data sharing between insurers and reinsurers as an available and trusted repository of contract information. This becomes a faster, more efficient and less-risky process as data related to loss records, asset ownership or transaction histories is recorded on a blockchain that is trusted to be authentic and up-to-date. Access to this information can be heavily permissioned with granular access controls, with exhaustive rules governing read and write capabilities per user. Reinsurers can query a blockchain to retrieve updated, real-time and trusted information rather than rely on a centralized insurance institution to report on data relevant to items (i.e. losses or transfer of ownership). This can massively expedite underwriting times.

The risk transfer process is delicate: Insurers need to ensure they are appropriately rebalancing capital exposures against specific risks and be confident and calculated in offloading their contracts. The newfound visibility from participating in a permissioned blockchain ledger provides confidence and flexibility in moving capital to other areas of business, as well as a more accurate and expedited risk assessment. If blockchain is leveraged to provide more visibility into risk information, reinsurers can more accurately and confidently take on the calculated risk.

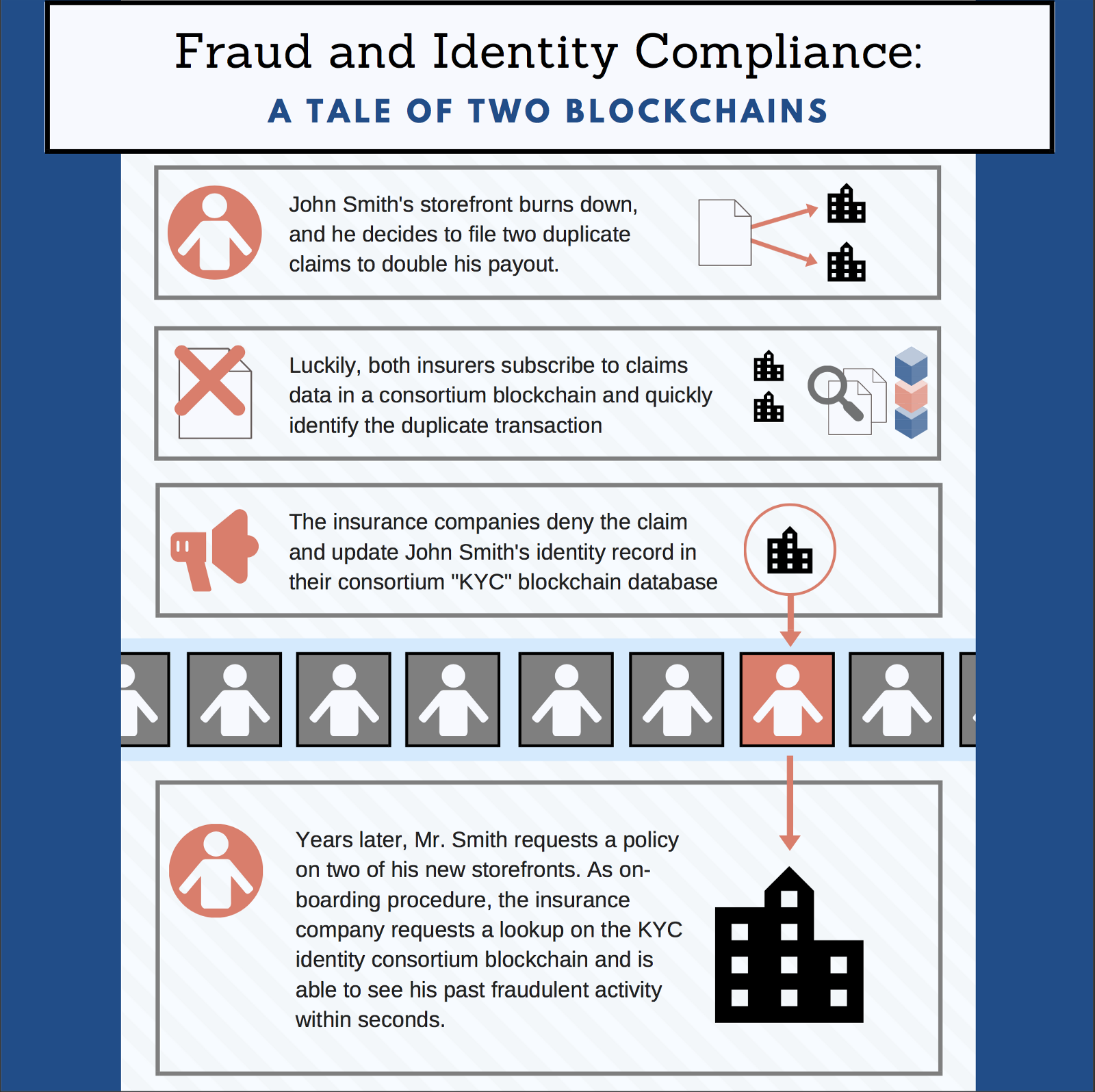

Fraud Detection & Prevention

The total cost of insurance fraud (non-health insurance) is estimated to be more than $40 billion per year. That means insurance fraud costs the average U.S. family between $400 and $700 per year in the form of increased premiums.

The lack of interoperability within the insurance industry doesn’t just kill efficiency — it also hinders progress toward the digital collaboration required to identify patterns, trends and known actors in preventing fraud. These gaps in visibility leave consistent vulnerabilities for fraudulent activity, where brokers can pocket premiums, individuals can make multiple claims for the same loss or capital can illegally move offshore. The centralization of data within the four walls of each institution leaves little room for the industry to collectively fight these common insurance crimes.

Blockchain implementation could support this needed coordination, while also providing granular access controls to ensure data security. As an immutable ledger decentralized among all parties in the insurance process, blockchain closes the paperwork gaps and bridges the data silos, allowing for fewer potential areas for exploitation.

Blockchain within a consortium of insurance entities could facilitate the sharing of fraudulent claims for heightened visibility into known actors and for better preparedness. Blockchain provides validation and verification on an unalterable ledger, which can be leveraged for the identification of duplicate transactions, repeat actions by suspicious parties, fraudulent movement of funds across borders and more. Pairing this technology with machine learning would make an excellent fraud detection strategy.

Blockchain can also be used as a ledger to track ownership of assets through digital certificates, and then be queried to validate their authenticity, ownership and provenance. This can reduce counterfeiting while also improving the efficiency of the entire claims management process.

As a shared, transparent and decentralized ledger, blockchain will inevitably discourage future attempts at fraud, as the opportunity for exploitation is smaller and the potential for detection greater.

Less fraud = higher margins = cheaper premiums for consumers. A win-win situation, indeed.

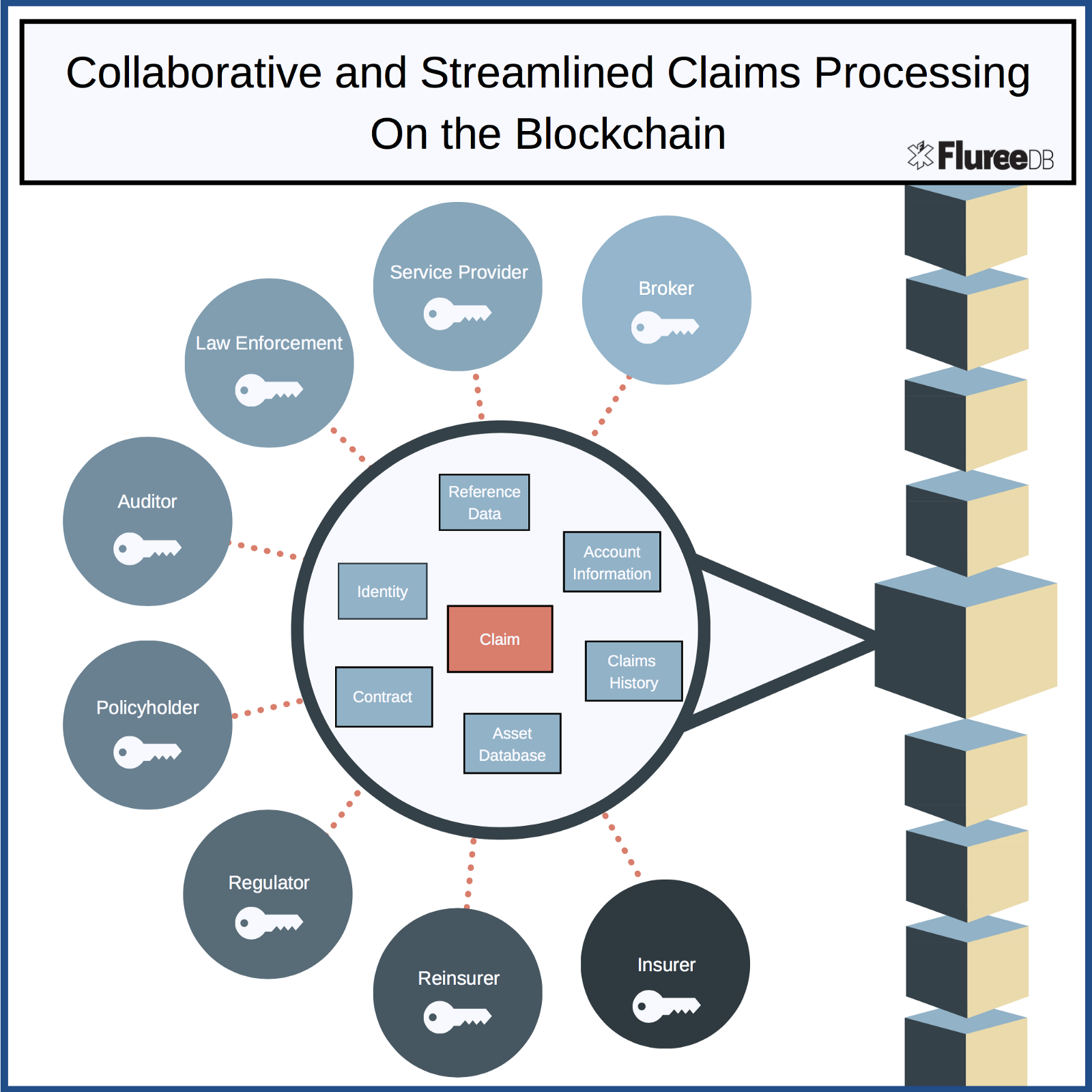

Claims processing

Improve Claims Processing for Property and Casualty Insurance

Processing a claim in today’s insurance environment is a complex, multi-party task. To evaluate and process an insurance claim, insurers, regulators and third parties (like a private healthcare institution or an auto repair shop) need to coordinate and arrive at consensus across a host of data points. For example, a car accident between two drivers necessitates a loss assessment that assembles information from an asset database, weather statistics, credit reports, inspections providers, authorities report and other sources. Each driver’s insurance company likely collects and analyzes this data in an entirely different system and process.

Because each entity has its own data standards and processing technique, the claims process typically involves significant manual data re-entry and duplication across the value chain. This not only increases needless redundancies and inefficiency, but also widens the opportunity for human error and even fraud.

Blockchain can drive the insurance industry shift toward digitizing industry processes, encouraging cross-industry collaboration for visibility and compliance and collectively fighting fraud. Paired with additional emerging technologies such as IoT and smart sensors, blockchain can be a facilitator for increased automation in capturing and acting on claims data, analyzing risk more thoroughly and streamlining payment processing.

Let's dive into some areas of impact:

Reinsurance & underwriting

Streamline Reinsurance and Underwriting Times

In reinsurance, each risk in a contract requires individual underwriting — and in many cases, insurers engage with multiple reinsurance parties to secure the best negotiation for each contract item. Each institution has its own data system and standards — and these differences in process can lead to discrepancies in interpretation of the contract. Thus, currently, reinsurance and insurance institutions need to constantly engage in reconciling their books to ensure consistency in interpretation for each individual claim.

In sum, the complexity of different data systems and consequent wrangling between multiple third parties to secure individual risk reinsurance leaves the reinsurance process slow, expensive and subject to misinterpretation.

Blockchain technology should be leveraged in the reinsurance process to increase interoperability. With a shared digital ledger, no longer can there be the discrepancy in data format, process and standards that currently plague the industry.

A permissioned blockchain ledger can be used to streamline communication, flow of information and data sharing between insurers and reinsurers as an available and trusted repository of contract information. This becomes a faster, more efficient and less-risky process as data related to loss records, asset ownership or transaction histories is recorded on a blockchain that is trusted to be authentic and up-to-date. Access to this information can be heavily permissioned with granular access controls, with exhaustive rules governing read and write capabilities per user. Reinsurers can query a blockchain to retrieve updated, real-time and trusted information rather than rely on a centralized insurance institution to report on data relevant to items (i.e. losses or transfer of ownership). This can massively expedite underwriting times.

The risk transfer process is delicate: Insurers need to ensure they are appropriately rebalancing capital exposures against specific risks and be confident and calculated in offloading their contracts. The newfound visibility from participating in a permissioned blockchain ledger provides confidence and flexibility in moving capital to other areas of business, as well as a more accurate and expedited risk assessment. If blockchain is leveraged to provide more visibility into risk information, reinsurers can more accurately and confidently take on the calculated risk.

Fraud Detection & Prevention

The total cost of insurance fraud (non-health insurance) is estimated to be more than $40 billion per year. That means insurance fraud costs the average U.S. family between $400 and $700 per year in the form of increased premiums.

The lack of interoperability within the insurance industry doesn’t just kill efficiency — it also hinders progress toward the digital collaboration required to identify patterns, trends and known actors in preventing fraud. These gaps in visibility leave consistent vulnerabilities for fraudulent activity, where brokers can pocket premiums, individuals can make multiple claims for the same loss or capital can illegally move offshore. The centralization of data within the four walls of each institution leaves little room for the industry to collectively fight these common insurance crimes.

Blockchain implementation could support this needed coordination, while also providing granular access controls to ensure data security. As an immutable ledger decentralized among all parties in the insurance process, blockchain closes the paperwork gaps and bridges the data silos, allowing for fewer potential areas for exploitation.

Blockchain within a consortium of insurance entities could facilitate the sharing of fraudulent claims for heightened visibility into known actors and for better preparedness. Blockchain provides validation and verification on an unalterable ledger, which can be leveraged for the identification of duplicate transactions, repeat actions by suspicious parties, fraudulent movement of funds across borders and more. Pairing this technology with machine learning would make an excellent fraud detection strategy.

Blockchain can also be used as a ledger to track ownership of assets through digital certificates, and then be queried to validate their authenticity, ownership and provenance. This can reduce counterfeiting while also improving the efficiency of the entire claims management process.

As a shared, transparent and decentralized ledger, blockchain will inevitably discourage future attempts at fraud, as the opportunity for exploitation is smaller and the potential for detection greater.

Less fraud = higher margins = cheaper premiums for consumers. A win-win situation, indeed.

Claims processing

Improve Claims Processing for Property and Casualty Insurance

Processing a claim in today’s insurance environment is a complex, multi-party task. To evaluate and process an insurance claim, insurers, regulators and third parties (like a private healthcare institution or an auto repair shop) need to coordinate and arrive at consensus across a host of data points. For example, a car accident between two drivers necessitates a loss assessment that assembles information from an asset database, weather statistics, credit reports, inspections providers, authorities report and other sources. Each driver’s insurance company likely collects and analyzes this data in an entirely different system and process.

Because each entity has its own data standards and processing technique, the claims process typically involves significant manual data re-entry and duplication across the value chain. This not only increases needless redundancies and inefficiency, but also widens the opportunity for human error and even fraud.

A distributed ledger can be used by insurers and third parties to digitally access and update data relevant to claims for a faster, more secure and less error-prone claims management process.

Blockchain facilitates the interoperability needed for this level of collaboration without the associated risk of DDos attacks or falsified transactions. This level of visibility is not only advantageous for institutional efficiency and accuracy but also helps consumers firmly trust in the fairness of the claims process.

Paired with streaming data sources, such as sensors, mobile phones or IoT technologies, blockchain can also help significantly streamline a claims submission, reduce settlement time and reduce loss adjuster costs. Adding to the auto wreck example above, an IoT sensor in one of the cars involved could automatically initiate a claim with the necessary reference data. A smart contract could automate coverage confirmation and consequent settlement payouts with programmable code — with essentially no human intervention along the entire payment process. While digital contracts like this exist already, the benefits of a blockchain-power smart contract lies in its transparency and credibility.

Auditing & Trust

Immutability for Efficient Auditing; Trust

Auditors evaluate scores of ledgers — both online and offline — to reconcile reports and data spanning multiple locations and years. Needless to say, the process to ensure consistency and reliability in transactions and generate a compliance certification is lengthy and complicated.

Digital signatures, sequences of events and actors of a particular transaction can be easily and efficiently audited if those events were to be recorded on a blockchain ledger. Institutions need to simply add access for an auditing party to their relevant permissioned blockchains. Blockchain immutability and finality guarantees the integrity of the entire transaction history, all in one place.

Companies like Docsmore have announced pilot programs for recorded signatures on a blockchain.

Identity Management

Increase security and share-ability of identity information

With recent, massive data breaches from some of the largest institutions over the past few years, improving the security of personal data — and thus customer trust — should be the forefront initiative for insurance institutions. Manual data entry — often repeated — should be replaced with a better, decentralized system with no single point of failure

Blockchain is a perfect tool for sharing identity information while ensuring the privacy of consumers. Specifically, KYC (Know your Customer) and AML (Anti-Money Laundering) laws require institutions onboarding new clients to go through expensive and comprehensive steps to ensure compliance with these laws. This is traditionally accomplished internally, with multiple ledgers resulting in multiple certified identity versions across the entire insurance network.

However, blockchain technology could provide a secure, distributed ledger for network participants to engage in cross-institutional client verification for KYC/AML compliance. In addition, a simple query of the blockchain can reproduce an immutable history of identity data, making regular compliance checkups and monitoring for changes an easy and inexpensive process.

Query permissions could be set in place to ensure that consumer privacy is protected and that access to information is appropriately handled. The distributed nature of the blockchain ledger is also attractive for storing sensitive data — like identify information — because it limits the viability of DDos attacks.

A distributed ledger can be used by insurers and third parties to digitally access and update data relevant to claims for a faster, more secure and less error-prone claims management process.

Blockchain facilitates the interoperability needed for this level of collaboration without the associated risk of DDos attacks or falsified transactions. This level of visibility is not only advantageous for institutional efficiency and accuracy but also helps consumers firmly trust in the fairness of the claims process.

Paired with streaming data sources, such as sensors, mobile phones or IoT technologies, blockchain can also help significantly streamline a claims submission, reduce settlement time and reduce loss adjuster costs. Adding to the auto wreck example above, an IoT sensor in one of the cars involved could automatically initiate a claim with the necessary reference data. A smart contract could automate coverage confirmation and consequent settlement payouts with programmable code — with essentially no human intervention along the entire payment process. While digital contracts like this exist already, the benefits of a blockchain-power smart contract lies in its transparency and credibility.

Auditing & Trust

Immutability for Efficient Auditing; Trust

Auditors evaluate scores of ledgers — both online and offline — to reconcile reports and data spanning multiple locations and years. Needless to say, the process to ensure consistency and reliability in transactions and generate a compliance certification is lengthy and complicated.

Digital signatures, sequences of events and actors of a particular transaction can be easily and efficiently audited if those events were to be recorded on a blockchain ledger. Institutions need to simply add access for an auditing party to their relevant permissioned blockchains. Blockchain immutability and finality guarantees the integrity of the entire transaction history, all in one place.

Companies like Docsmore have announced pilot programs for recorded signatures on a blockchain.

Identity Management

Increase security and share-ability of identity information

With recent, massive data breaches from some of the largest institutions over the past few years, improving the security of personal data — and thus customer trust — should be the forefront initiative for insurance institutions. Manual data entry — often repeated — should be replaced with a better, decentralized system with no single point of failure

Blockchain is a perfect tool for sharing identity information while ensuring the privacy of consumers. Specifically, KYC (Know your Customer) and AML (Anti-Money Laundering) laws require institutions onboarding new clients to go through expensive and comprehensive steps to ensure compliance with these laws. This is traditionally accomplished internally, with multiple ledgers resulting in multiple certified identity versions across the entire insurance network.

However, blockchain technology could provide a secure, distributed ledger for network participants to engage in cross-institutional client verification for KYC/AML compliance. In addition, a simple query of the blockchain can reproduce an immutable history of identity data, making regular compliance checkups and monitoring for changes an easy and inexpensive process.

Query permissions could be set in place to ensure that consumer privacy is protected and that access to information is appropriately handled. The distributed nature of the blockchain ledger is also attractive for storing sensitive data — like identify information — because it limits the viability of DDos attacks.

This standardization in identity management would require collaboration from not only the insurance industry, but also governments, tax authorities, bureaus, banks and other financial corporations. However, the savings for all would be well worth the coordination.

Asset Management

Tracking assets along a supply chain

As demonstrated comprehensively in our previous blog post, insurance fraud can be prevented when assets along a supply chain are verifiably tracked with blockchain finality. Auditing becomes a breeze, and risk provenance can be proven for better estimates, faster claims processing and a reduction in fraudulent underwriting.

See also: Blockchain: the Next Big Wave?

Where FlureeDB fits in

As an enabler of consortium blockchains, FlureeDB can provide a single source of truth for harmonized insurance data to be stored, queried and transacted with blockchain characteristics.

Data-Centric —Most blockchains operate on the “business logic” tier, where enterprises still need to push data and metadata related to blockchain transactions to a static, centralized legacy system. FlureeDB brings blockchain to the data tier — allowing for an entire database to be distributed across its network. Network participants can query at will and know they have the full data set.

This standardization in identity management would require collaboration from not only the insurance industry, but also governments, tax authorities, bureaus, banks and other financial corporations. However, the savings for all would be well worth the coordination.

Asset Management

Tracking assets along a supply chain

As demonstrated comprehensively in our previous blog post, insurance fraud can be prevented when assets along a supply chain are verifiably tracked with blockchain finality. Auditing becomes a breeze, and risk provenance can be proven for better estimates, faster claims processing and a reduction in fraudulent underwriting.

See also: Blockchain: the Next Big Wave?

Where FlureeDB fits in

As an enabler of consortium blockchains, FlureeDB can provide a single source of truth for harmonized insurance data to be stored, queried and transacted with blockchain characteristics.

Data-Centric —Most blockchains operate on the “business logic” tier, where enterprises still need to push data and metadata related to blockchain transactions to a static, centralized legacy system. FlureeDB brings blockchain to the data tier — allowing for an entire database to be distributed across its network. Network participants can query at will and know they have the full data set.

Modern Database Characteristics for Enterprises —FlureeDB is first and foremost a powerful database with familiar, SQL-like syntax. Any development team would be able to set up a blockchain database without having to learn a complex set of new skills. With modern database characteristics like ACID compliance, a RESTful API and a graph-style query structure, FlureeDB is optimized to meet traditional enterprise requirements.

Granular Permission Logic for Access Control —Because insurance information is stored in a decentralized manner as one record, granular and highly functional access/permission models are essential to protecting data security. FlureeDB uniquely builds permission information (both read and write) directly into application data at the most granular of levels. This simple and flexible approach to data accessibility lends itself perfectly to blockchain environments — where a distributed ledger is shared across third parties in a network. Companies using FlureeDB can even hand a customer or vendor a direct line of access to the database without needing to use multiple API endpoints — queries only return the information for which a particular user has explicit read access. Blockchain Immutability —FlureeDB builds every transaction into a block within an immutable, append-only blockchain. This allows for massive auditing savings. Holding a complete and indelible history of transactions also enables institutions to throw highly advanced analytical queries to return increased visibility into practices like fraud prevention measures, internal compliance validation checks or risk assessments. Time Travel —“Time travel” is enabled by the blockchain’s immutable history: Queries can be issued at any point in time, empowering an application to reproduce any instance of the database with no extra development effort. This capability strongly reduces waste in development time and allows for apps to “rewind” to any database state with ease. Composite Consensus —With varying relationships and diverse data, insurers need to partition information to be read by only the appropriate parties. FlureeDB allows data to be segmented onto multiple databases — both publicly and privately held — but join together to query as one set from an application point of view. This means a singular application dealing with insurers, reinsurers, third parties and consumers can keep private information out-of-sight, but still leverage blockchain without having to figure out multiple integrations. Conclusion Blockchain technology, its believers, its vendors and its growth in adoption won’t wipe out the $40 billion-plus fraud, nor will it “fix” the insurance industry in one fell swoop. Such silver bullet claims are overzealous. But blockchain does pose unique characteristics that should be included in the discussion for industry transformation. Blockchain — simply in its very existence — won’t disrupt anything unless it is leveraged by and collaborated on within the insurance industry and with its secondary players and its technological partners. Brokers shouldn’t be paralyzed by blockchain’s potential to disintermediate their industry, but should rather embrace and harness its value to drive costs down and remain competitive. The few entities that take the bold step forward to early adoption will be rewarded with consumer trust, lower margins and larger market share. Now is the time for industry leaders to drive a sweeping transformational agenda with digital collaboration as the key theme and blockchain as the key mechanism.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Kevin Doubleday is a business strategist at Fluree PBC, an award-winning blockchain database company.