How to Improve Productivity With Fun

When we bring play into our day, it can energize us and encourage us to give more of ourselves to tasks.

When we bring play into our day, it can energize us and encourage us to give more of ourselves to tasks.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mike de Waal is senior vice president of sales at Majesco.

Look at Ritz-Carlton. Through a lot of effort, it has created a corporate culture almost solely devoted to serving the customer.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

William C. Wilson, Jr., CPCU, ARM, AIM, AAM is the founder of Insurance Commentary.com. He retired in December 2016 from the Independent Insurance Agents & Brokers of America, where he served as associate vice president of education and research.

Simplifying life insurance, especially for the new generation of insurance buyers, is crucial for insurers’ future. Insurtech provides the key.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Zeynep Stefan is a post-graduate student in Munich studying financial deepening and mentoring startup companies in insurtech, while writing for insurance publications in Turkey.

Why wait for special price transparency regulations before requiring medical suppliers to support a normal shopping experience?

Many believe there’s no fix without healthcare price legislation, and recently we have seen some regulations passed and additional measures discussed by our political leaders. But Americans already get consumer-based pricing models in nearly every other industry, and shopping comes naturally to most of us.

See also: Is Transparency the Answer in Healthcare?

So why would anyone wait for the passage of special price transparency regulations before requiring their medical suppliers to support a normal shopping experience?

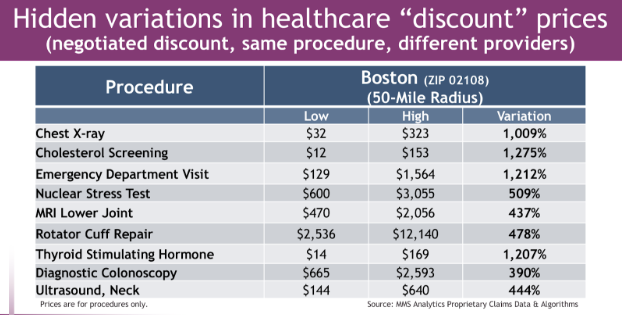

According to the Peterson Center on Healthcare, U.S. residents paid over $352 billion in out-of-pocket healthcare costs—along with another $3 trillion in healthcare premiums and taxes—to pay for commercial and government healthcare programs last year. This represents a staggering 10x, or 1,000% more than, what parents paid when baby boomers were teenagers. Unlike in the mid-‘70s, most medical tests and procedures vary in cost by 5–10x within a short distance of home, but very few of us recognize this. When we consider we’re just as likely to get the best care at the lowest-cost facility, you might think that we’d all take a personal interest in how we choose the providers and locations we use to receive “shoppable” medical tests and procedures. Yet most of us don’t.

The reason is that the continuing rhetoric among suppliers, legislators and payers—created by the combination of the quasi-regulated environment of healthcare with a third-party, indirect, payer system—interferes with normal market dynamics.

Most legislation aiming to mandate some sort of price transparency has simply provided plausible excuses for the industry to say “we use industry best practices” and “we complied.” This provides cover so the industry isn't subjected to the same consumer protection laws that affect goods and services in every other market. What’s actually needed is less regulatory meddling and more free market principles to reward innovations that lead to higher-quality care at lower costs.

Many believe there’s no fix without healthcare price legislation, and recently we have seen some regulations passed and additional measures discussed by our political leaders. But Americans already get consumer-based pricing models in nearly every other industry, and shopping comes naturally to most of us.

See also: Is Transparency the Answer in Healthcare?

So why would anyone wait for the passage of special price transparency regulations before requiring their medical suppliers to support a normal shopping experience?

According to the Peterson Center on Healthcare, U.S. residents paid over $352 billion in out-of-pocket healthcare costs—along with another $3 trillion in healthcare premiums and taxes—to pay for commercial and government healthcare programs last year. This represents a staggering 10x, or 1,000% more than, what parents paid when baby boomers were teenagers. Unlike in the mid-‘70s, most medical tests and procedures vary in cost by 5–10x within a short distance of home, but very few of us recognize this. When we consider we’re just as likely to get the best care at the lowest-cost facility, you might think that we’d all take a personal interest in how we choose the providers and locations we use to receive “shoppable” medical tests and procedures. Yet most of us don’t.

The reason is that the continuing rhetoric among suppliers, legislators and payers—created by the combination of the quasi-regulated environment of healthcare with a third-party, indirect, payer system—interferes with normal market dynamics.

Most legislation aiming to mandate some sort of price transparency has simply provided plausible excuses for the industry to say “we use industry best practices” and “we complied.” This provides cover so the industry isn't subjected to the same consumer protection laws that affect goods and services in every other market. What’s actually needed is less regulatory meddling and more free market principles to reward innovations that lead to higher-quality care at lower costs.

Rhetoric around “personal mandates,” “lifetime caps,” “pre-existing conditions,” “market stabilization,” “Cadillac tax” and other things that relate only to who will pay for healthcare coverage create a smokescreen that ensures that we never talk about the most basic issue in delivering services to this mass-market – price of medical procedures.

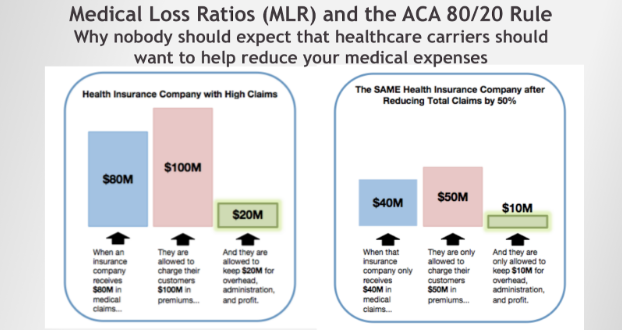

Unfortunately, severe unintended consequences were created when many of our state legislators created a set of rules known as Medical Loss Ratio (MLR) rules, and, more recently, these rules have been codified in federal law known as the 80/20 rule. The intended effect was to limit the amount a healthcare carrier could charge a customer in insurance premiums to no more than the actual medical charges plus a fixed percentage to operate the business and provide a reasonable return to shareholders. This type of rule or contract is often referred to as “cost plus.”

The unintended consequence is that carriers have no incentive to reduce medical claims, and therefore premiums and out-of-pocket expenses. Regardless of the carrier’s wish to help you, as long as there are MLR rules (a.k.a. 80/20, "cost plus"), carriers have a financial disincentive that makes them likely unable to survive if the amount of spending on medical procedures and drugs dropped substantially.

Because research has shown that medical price transparency alone (shopping) could knock more than 50% out of healthcare expense, you can see why some might want to slow the movement to consumerism by continuing to maintain secrecy on procedure prices, while beating the drums of healthcare rhetoric. This approach will keep us ignorant of the root cause of the outrageous cost of care in the U.S. – overpaying for medical procedures.

See also: The Search For True Healthcare Transparency

The good news is that more and more individuals have high-deductible health insurance plans, with roughly 36% of all people under the age of 65 currently enrolled in an HDHP. Now there’s a grassroots movement, debunking lies and empowering patients and employers—not lobbyists—to take action.

Intuitive decision support tools continue to be adopted by those who want to be able to compare their options for healthcare based on price, in addition to quality and convenience. Eventually, as price-elasticity is restored to our broken healthcare market, we will see a full reversal of the unsustainable cost trends we’ve experienced over the last decade.

Rhetoric around “personal mandates,” “lifetime caps,” “pre-existing conditions,” “market stabilization,” “Cadillac tax” and other things that relate only to who will pay for healthcare coverage create a smokescreen that ensures that we never talk about the most basic issue in delivering services to this mass-market – price of medical procedures.

Unfortunately, severe unintended consequences were created when many of our state legislators created a set of rules known as Medical Loss Ratio (MLR) rules, and, more recently, these rules have been codified in federal law known as the 80/20 rule. The intended effect was to limit the amount a healthcare carrier could charge a customer in insurance premiums to no more than the actual medical charges plus a fixed percentage to operate the business and provide a reasonable return to shareholders. This type of rule or contract is often referred to as “cost plus.”

The unintended consequence is that carriers have no incentive to reduce medical claims, and therefore premiums and out-of-pocket expenses. Regardless of the carrier’s wish to help you, as long as there are MLR rules (a.k.a. 80/20, "cost plus"), carriers have a financial disincentive that makes them likely unable to survive if the amount of spending on medical procedures and drugs dropped substantially.

Because research has shown that medical price transparency alone (shopping) could knock more than 50% out of healthcare expense, you can see why some might want to slow the movement to consumerism by continuing to maintain secrecy on procedure prices, while beating the drums of healthcare rhetoric. This approach will keep us ignorant of the root cause of the outrageous cost of care in the U.S. – overpaying for medical procedures.

See also: The Search For True Healthcare Transparency

The good news is that more and more individuals have high-deductible health insurance plans, with roughly 36% of all people under the age of 65 currently enrolled in an HDHP. Now there’s a grassroots movement, debunking lies and empowering patients and employers—not lobbyists—to take action.

Intuitive decision support tools continue to be adopted by those who want to be able to compare their options for healthcare based on price, in addition to quality and convenience. Eventually, as price-elasticity is restored to our broken healthcare market, we will see a full reversal of the unsustainable cost trends we’ve experienced over the last decade.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Galvin is CEO of MyMedicalShopper. He has played key roles in 14 New England startups. Although his start was as a software engineer, eight of those companies he founded and operated as president and CEO.

Only 27% of executives felt that their key performance indicators (KPIs) drove their businesses toward their strategic goals—leaving a lot of room for improvement.

Peter Drucker famously said that we can't manage what we can't measure. Now that so many of us are trying to innovate in a predictable and sustainable (in other words, manageable) way, what should we measure? What metrics will let us know whether we're on the right path, while there's still time to pick a different one?

Some smart people weighed in on the topic recently, and I'll summarize them here.

Michael Schrage and David Kiron published a study in MIT's Sloan Management Review that found that only 27% of executives felt that their key performance indicators (KPIs) drove their businesses toward their strategic goals—leaving a lot of room for improvement. The two said many KPIs, having been used for decades, are out of date in today's environment. The authors also said too many are like profitability and market share, which tell you if you met targets in the past but don't help you understand the future.

They suggested a heavy dose of machine learning, sifting through big data, to identify new KPIs that will really move the needle for a business. They speculated that Netflix had no idea that binge watching would become such a phenomenon but quickly spotted the trend and came up with ways to measure bingeing, which led to KPIs that drove efforts to continually make Netflix more addictive.

Here is an interview with my old friend Michael, with a link to the full report.

Amy Radin also weighed in, in this article at ITL, based on her long experience leading innovation efforts at major corporations and on the work she did for her book, "The Change Maker's Playbook," coming out in September. (I'm such a fan, I wrote the Foreword.)

She notes that traditional financial planning can smother innovation efforts. How can an innovator be expected to produce the precise forecasts that you can insist on from someone running an existing business in a well-understood market? Why would you even ask for such a forecast, given that it provides the corporate antibodies—those that like the world just the way it is—a chance to discredit an innovative effort?

Instead, Amy suggests five questions, including:

In a cynical moment, my frequent co-author Chunka Mui and I once wrote in a book that "marketing is how you lie to your customers; market research is how you lie to yourself." Market research—whatever the reason for its failings—simply can't be as far off as it is now if our innovation efforts are to succeed. Spending a bit of time with Michael's and Amy's work will, I'm confident, help you zero in better on the right questions and the right indicators. You'll measure your innovation work better, and you'll manage it better.

Have a great week.

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

Being methodical, teams can achieve a hybrid IT cloud infrastructure that allows for improved operations at manageable costs.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Richard Dresden leads a team of sales, consulting, channel and solution architecture professionals who partner with Ensono clients on their IT transformation needs.

Executives who can reframe metrics will energize employees and increase their organizations’ innovation effectiveness.

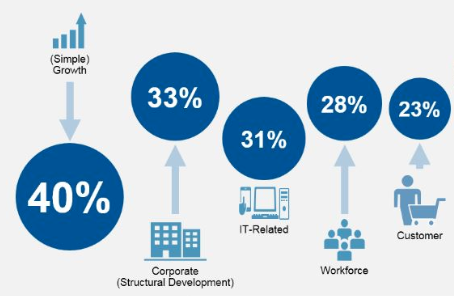

Responders are taking some measure of credit for moving their organizations ahead of competitors in the race for growth and relevance. The Gartner survey findings further reveal that the priorities ranked two through five – including new partnerships and M&A (part of corporate development), new technologies, workforce capabilities and the customer – all presumably enable the No. 1 priority on the C-suite list, which is, no surprise, growth.

Add to the priority to-dos an additional leverage point that may be too buried to get well-deserved attention: to develop innovation metrics that monitor and accelerate the conversion of insights and ideas to sources of value for all stakeholders.

Neither attempts at defining surgically precise metrics nor peering into one’s crystal ball will lead to helpful innovation metrics.

Using legacy performance measures to assess concepts that may have little resemblance to established products and services, or treating innovation as an immeasurable, both turn out to undermine potential opportunities. Only the C-suite is empowered to assign new metrics that can nurture these investments and judge them appropriately, and that may not conform to the standards the entire organization has been taught are right. Choices should have rigor, be reasonable for the evaluation of potentially unprecedented products and services, and be able to hold their own even in zero-sum resource allocation processes.

See also: Innovation — or Just Innovative Thinking?

Early in my career, an executive gave me valuable advice, more recently reinforced in conversations with corporate leaders, startup founders and investors as I undertook the research for my book, The Change Maker’s Playbook. Back then, my team and I were seeking seed funding for a new concept. In a presentation to this particular executive, we shared copious financial analyses, including five years’ worth of P&Ls carried out to the penny. He waved aside our spreadsheets and told us, “Don’t seek a level of precision that cannot be possible when you are looking at something so new.”

Growth opportunities are put at risk when overly precise and backward-looking metrics, from old business models, are applied to gauge potential impact and measure their worthiness to be moved forward.

Instead, executive teams can adopt common-sense approaches to ensure discipline – the right kind of discipline — for evaluating emerging business models.

For an early-stage, new-to-market concept, what is most important is to ask the right questions, rely on judgment where facts simply do not exist, seek metaphors from other sectors or markets and accept good enough data that can be refined along the way. Smart questions answered in fast test-and-learn cycles can lead to relevant metrics and keep innovation projects moving closer to success or the set-aside file.

Here are five suggested questions to find the right metrics for your innovation initiatives:

Responders are taking some measure of credit for moving their organizations ahead of competitors in the race for growth and relevance. The Gartner survey findings further reveal that the priorities ranked two through five – including new partnerships and M&A (part of corporate development), new technologies, workforce capabilities and the customer – all presumably enable the No. 1 priority on the C-suite list, which is, no surprise, growth.

Add to the priority to-dos an additional leverage point that may be too buried to get well-deserved attention: to develop innovation metrics that monitor and accelerate the conversion of insights and ideas to sources of value for all stakeholders.

Neither attempts at defining surgically precise metrics nor peering into one’s crystal ball will lead to helpful innovation metrics.

Using legacy performance measures to assess concepts that may have little resemblance to established products and services, or treating innovation as an immeasurable, both turn out to undermine potential opportunities. Only the C-suite is empowered to assign new metrics that can nurture these investments and judge them appropriately, and that may not conform to the standards the entire organization has been taught are right. Choices should have rigor, be reasonable for the evaluation of potentially unprecedented products and services, and be able to hold their own even in zero-sum resource allocation processes.

See also: Innovation — or Just Innovative Thinking?

Early in my career, an executive gave me valuable advice, more recently reinforced in conversations with corporate leaders, startup founders and investors as I undertook the research for my book, The Change Maker’s Playbook. Back then, my team and I were seeking seed funding for a new concept. In a presentation to this particular executive, we shared copious financial analyses, including five years’ worth of P&Ls carried out to the penny. He waved aside our spreadsheets and told us, “Don’t seek a level of precision that cannot be possible when you are looking at something so new.”

Growth opportunities are put at risk when overly precise and backward-looking metrics, from old business models, are applied to gauge potential impact and measure their worthiness to be moved forward.

Instead, executive teams can adopt common-sense approaches to ensure discipline – the right kind of discipline — for evaluating emerging business models.

For an early-stage, new-to-market concept, what is most important is to ask the right questions, rely on judgment where facts simply do not exist, seek metaphors from other sectors or markets and accept good enough data that can be refined along the way. Smart questions answered in fast test-and-learn cycles can lead to relevant metrics and keep innovation projects moving closer to success or the set-aside file.

Here are five suggested questions to find the right metrics for your innovation initiatives:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Amy Radin is a transformation strategist, a scholar-practitioner at Columbia University and an executive adviser.

She partners with senior executives to navigate complex organizational transformations, bringing fresh perspectives shaped by decades of experience across regulated industries and emerging technology landscapes. As a strategic adviser, keynote speaker and workshop facilitator, she helps leaders translate ambitious visions into tangible results that align with evolving stakeholder expectations.

At Columbia University's School of Professional Studies, Radin serves as a scholar-practitioner, where she designed and teaches strategic advocacy in the MS Technology Management program. This role exemplifies her commitment to bridging academic insights with practical business applications, particularly crucial as organizations navigate the complexities of Industry 5.0.

Her approach challenges traditional change management paradigms, introducing frameworks that embrace the realities of today's business environment – from AI and advanced analytics to shifting workforce dynamics. Her methodology, refined through extensive corporate leadership experience, enables executives to build the capabilities needed to drive sustainable transformation in highly regulated environments.

As a member of the Fast Company Executive Board and author of the award-winning book, "The Change Maker's Playbook: How to Seek, Seed and Scale Innovation in Any Company," Radin regularly shares insights that help leaders reimagine their approach to organizational change. Her thought leadership draws from both her scholarly work and hands-on experience implementing transformative initiatives in complex business environments.

Previously, she held senior roles at American Express, served as chief digital officer and one of the corporate world’s first chief innovation officers at Citi and was chief marketing officer at AXA (now Equitable) in the U.S.

Radin holds degrees from Wesleyan University and the Wharton School.

To explore collaboration opportunities or learn more about her work, visit her website or connect with her on LinkedIn.

85% of corporate strategists say innovation is critical for their organizations. Yet the vast majority are focused on incremental changes.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Marty Agather is a proven thought leader and accomplished writer and speaker on insurance innovation. He blogs frequently on insurance topics. In addition, Agather speaks at insurance industry conferences and events on varied topics.

Used separately, e-signature and document management systems are ineffective. But their interplay makes dealing with regulatory changes simple.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jesse Wood is the CEO of document management software vendor, eFileCabinet.

Anyone who thinks innovation is about an "aha" idea, the best partners or great talent should take a look at this article on the history of General Magic.

It had the best idea, essentially designing an iPhone 6 in the early 1990s. It had the best partners: Founded by Apple, the company had all the major telecommunications companies as investors, from AT&T on down. The talent was off the charts. General Magic was run by the stars of the original Macintosh team and included others who went on to develop the iPod, iPhone and the Android and, as if that weren't enough, to found Nest and even eBay.

Yet the company sold only 3,000 units to what executives acknowledged were friends and family and burned a $100 million hole in the ground.

Students of Silicon Valley history will note that this epic bust occurred during the interregnum at Apple, after Steve Jobs was forced out in 1985 and before he returned in 1997. But the genius theory of innovation doesn't explain the problems at General Magic, either. In fact, the problem was that there were too many geniuses at the company.

Guy Fraker, our chief innovation officer, says people often think that innovation means thinking outside the box. In fact, he says, innovation efforts need a box, to focus people on the right customer need, the right technologies, the right costs and so on. The trick is to frame the box the best way possible.

"A disparate innovation collection lacking a clear mandate, shared focus and unifying goals," Guy says, "results in a more chaotic, minimally effective launch and problems with scaling."

And the General Magic effort was as disparate a collection as could be. At a time when WiFi didn't exist, when the Internet was still in its formative stages, when few people were even using email -- and were using faxes that had to somehow be integrated with the mobile phone being designed -- General Magic was trying to do everything at once.

There was no box in sight. In fact, many of the later innovations by team members at General Magic occurred because someone put a box around a particular problem and solved it. The iPod, for instance, occurred because Jobs wondered whether he could put 1,000 songs in someone's pocket.

I still love the General Magic name. It drew on the Arthur C. Clarke quote that "any sufficiently advanced technology is indistinguishable from magic," combined with the belief that in the tradition of General Electric and General Motors there was now room for a General Magic.

But it's a harrowing example of how not to innovate.

Cheers,

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.