What’s in a Name? Art of Insurtech Naming

Insurtech names could provide a whole meal (Oyster, Pineapple, Cake, Pie) or fill a zoo (Blue Zebra, Bold Penguin, Rhino, Hippo).

Insurtech names could provide a whole meal (Oyster, Pineapple, Cake, Pie) or fill a zoo (Blue Zebra, Bold Penguin, Rhino, Hippo).

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Breading is a partner at Strategy Meets Action, a Resource Pro company that helps insurers develop and validate their IT strategies and plans, better understand how their investments measure up in today's highly competitive environment and gain clarity on solution options and vendor selection.

There is one answer that keeps coming up to the question of "What makes an insurtech initiative a success?" That answer – the team.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Stephen Goldstein is a global insurance executive with more than 10 years of experience in insurance and financial services across the U.S., European and Asian markets in various roles including distribution, operations, audit, market entry and corporate strategy.

The lack of original copy from agents—the general absence of creativity—is a symptom of personal laziness and professional indifference.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

When asked, “Why should I do business with you/your agency?” most will respond with the same standard, boring, "Generic Five" lines.

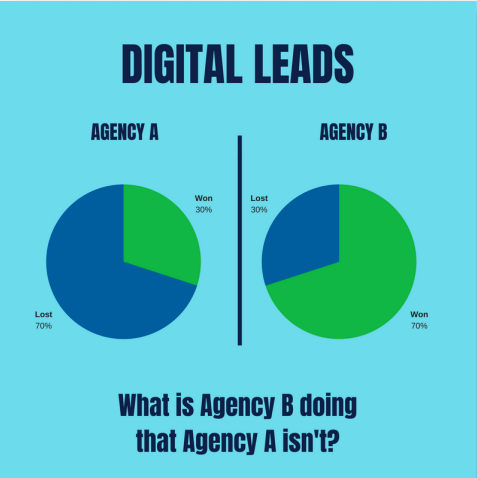

What is one doing to get the prospect’s business that the other one isn’t? When an opportunity arrives, what are you/your producers doing and saying to connect with the prospect and close the deal? What’s your process, and how do you follow up on it?

What is one doing to get the prospect’s business that the other one isn’t? When an opportunity arrives, what are you/your producers doing and saying to connect with the prospect and close the deal? What’s your process, and how do you follow up on it?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Yes, AI will change everything. But that doesn't mean the technology need be daunting, or that insurers lack the skills to tackle the challenge.

Data: AI might be considered the key that unlocks the door of big data. Many of the modeling techniques that fall under the AI umbrella are classification algorithms that are data hungry. Unlocking the power of these methods requires sufficient volume of training data. Data takes several forms. First, there are third party data sources that are considered external to the insurance industry. Aerial imagery (and the processing thereof) to determine building characteristics or estimate post-catastrophe claims potential are easy examples. Same with the vast quantities of behavioral data built on the interactions of users with digital platforms like social media and web search. Closer to home, insurance has long been an industry of data, and carriers are presumed to have meaningful datasets in claims, applications and marketing, among others.

Infrastructure: Accessing the data to feed the AI requires a working infrastructure. How successfully can you ingest external data sources? How disparate and unstructured can those sources be? Cloud computing is not necessarily a prerequisite to successful AI, but access to vast, scalable infrastructure is enabling. Are your information systems equipped, including security vetting, to do modeling in the cloud? Can you extract your internal data into forms that are ready to be processed using advanced modeling techniques? Or are you running siloed legacy systems that prevent using your proprietary data in novel ways?

Talent: Add data science to the list of AI-related buzzwords. We claimed earlier that many of the advancements attributed to narrow AI are predictive models conceptually like modeling techniques already used in the insurance industry. However, the fact that your pricing actuary conceptually appreciates an artificial neural net built for fraud detection using behavioral data does not mean you have the in-house expertise to build such a model. Investments in recruiting, training and retaining the right talent will provide two clear benefits. The first benefit is being better equipped to do the risk-cost-benefit analysis of which data and methods to explore. The second is having the ability to test and, ultimately, implement.

See also: 4 Ways Connectivity Is Revolutionary

In Aon’s 2017 Global Insurance Market Outlook we explored the idea of the third wave of innovation as propounded by Steve Case, founder of AOL, in his book, “The Third Wave: An Entrepreneur’s Vision of the Future.” The upshot of the third wave for insurers was that partnership with technology innovators, rather than disruption by them, would be the norm. This approach applies now more than ever as technological innovators continue to unlock the potential of AI. If you don’t have the data, or the infrastructure, or the talent to bring the newest technologies to bear, you can partner with someone that does. Artificial intelligence is real. While the definitions are somewhat vague - is it software, predictive models, neural nets or machine learning - and the hype can be difficult to look past, the impacts are already being felt in the form of chatbots, image processing and behavioral prediction algorithms, among many others. The carriers that can best take advantage of the opportunities will be those that have a pragmatic ability to evaluate tangible AI solutions that are incremental to existing parts of their value chain.

“If you don’t have an AI strategy, you are going to die in the world that’s coming.” Devin Wenig CEO, eBay

Maybe true, but that does not make it daunting. The core of insurance is this: Hire the right people, give them the infrastructure they need to evaluate risk better than the competition and curate the necessary data to feed the classification models they build. AI hasn’t, and won’t, change that.

Data: AI might be considered the key that unlocks the door of big data. Many of the modeling techniques that fall under the AI umbrella are classification algorithms that are data hungry. Unlocking the power of these methods requires sufficient volume of training data. Data takes several forms. First, there are third party data sources that are considered external to the insurance industry. Aerial imagery (and the processing thereof) to determine building characteristics or estimate post-catastrophe claims potential are easy examples. Same with the vast quantities of behavioral data built on the interactions of users with digital platforms like social media and web search. Closer to home, insurance has long been an industry of data, and carriers are presumed to have meaningful datasets in claims, applications and marketing, among others.

Infrastructure: Accessing the data to feed the AI requires a working infrastructure. How successfully can you ingest external data sources? How disparate and unstructured can those sources be? Cloud computing is not necessarily a prerequisite to successful AI, but access to vast, scalable infrastructure is enabling. Are your information systems equipped, including security vetting, to do modeling in the cloud? Can you extract your internal data into forms that are ready to be processed using advanced modeling techniques? Or are you running siloed legacy systems that prevent using your proprietary data in novel ways?

Talent: Add data science to the list of AI-related buzzwords. We claimed earlier that many of the advancements attributed to narrow AI are predictive models conceptually like modeling techniques already used in the insurance industry. However, the fact that your pricing actuary conceptually appreciates an artificial neural net built for fraud detection using behavioral data does not mean you have the in-house expertise to build such a model. Investments in recruiting, training and retaining the right talent will provide two clear benefits. The first benefit is being better equipped to do the risk-cost-benefit analysis of which data and methods to explore. The second is having the ability to test and, ultimately, implement.

See also: 4 Ways Connectivity Is Revolutionary

In Aon’s 2017 Global Insurance Market Outlook we explored the idea of the third wave of innovation as propounded by Steve Case, founder of AOL, in his book, “The Third Wave: An Entrepreneur’s Vision of the Future.” The upshot of the third wave for insurers was that partnership with technology innovators, rather than disruption by them, would be the norm. This approach applies now more than ever as technological innovators continue to unlock the potential of AI. If you don’t have the data, or the infrastructure, or the talent to bring the newest technologies to bear, you can partner with someone that does. Artificial intelligence is real. While the definitions are somewhat vague - is it software, predictive models, neural nets or machine learning - and the hype can be difficult to look past, the impacts are already being felt in the form of chatbots, image processing and behavioral prediction algorithms, among many others. The carriers that can best take advantage of the opportunities will be those that have a pragmatic ability to evaluate tangible AI solutions that are incremental to existing parts of their value chain.

“If you don’t have an AI strategy, you are going to die in the world that’s coming.” Devin Wenig CEO, eBay

Maybe true, but that does not make it daunting. The core of insurance is this: Hire the right people, give them the infrastructure they need to evaluate risk better than the competition and curate the necessary data to feed the classification models they build. AI hasn’t, and won’t, change that.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

A “Spotify moment” will see products simplified to their core coverages and then embedded frictionlessly into a digital ecosystem.

Opening Act of Insurtech

Insurtech had emerged in 2012, and over the last six years the insurance industry has started to embrace it. While there’s been a lot of excitement about insurtech, most of the digital efforts so far have been largely incremental—insurance products are becoming slightly cheaper, their distribution becoming a little bit more digitally enabled and the back-office becoming marginally more efficient. The “opening act” focused on the low hanging opportunities that kickstarted the insurtech wave globally.

Now as opportunities susceptible to incremental tech solutions quickly dry up, many insurance managers are concluding that insurtech might have run its course, and, going forward, it will be back to business as usual for insurance. They will be in for a surprise!

The perfect analogy for the current stage of the insurance industry is a record label in the age before digital music. Record labels erroneously believed they were in the business of CDs, which drove them to focus on pushing pre-packaged products with a single feature that consumers wanted, delivered to customers via expensive and inefficient distribution music store networks.

See also: Digital Insurance 2.0: Benefits

The valuable lesson being that the full force of disruption did not come when records started selling CDs online but when Napster hacked through the oligopoly of record labels and force-unbundled their products. While Napster ultimately didn’t survive, it disrupted the status quo by pushing record labels to finally unbundle their products and make them available to digital-music distribution platforms such as iTunes and Spotify.

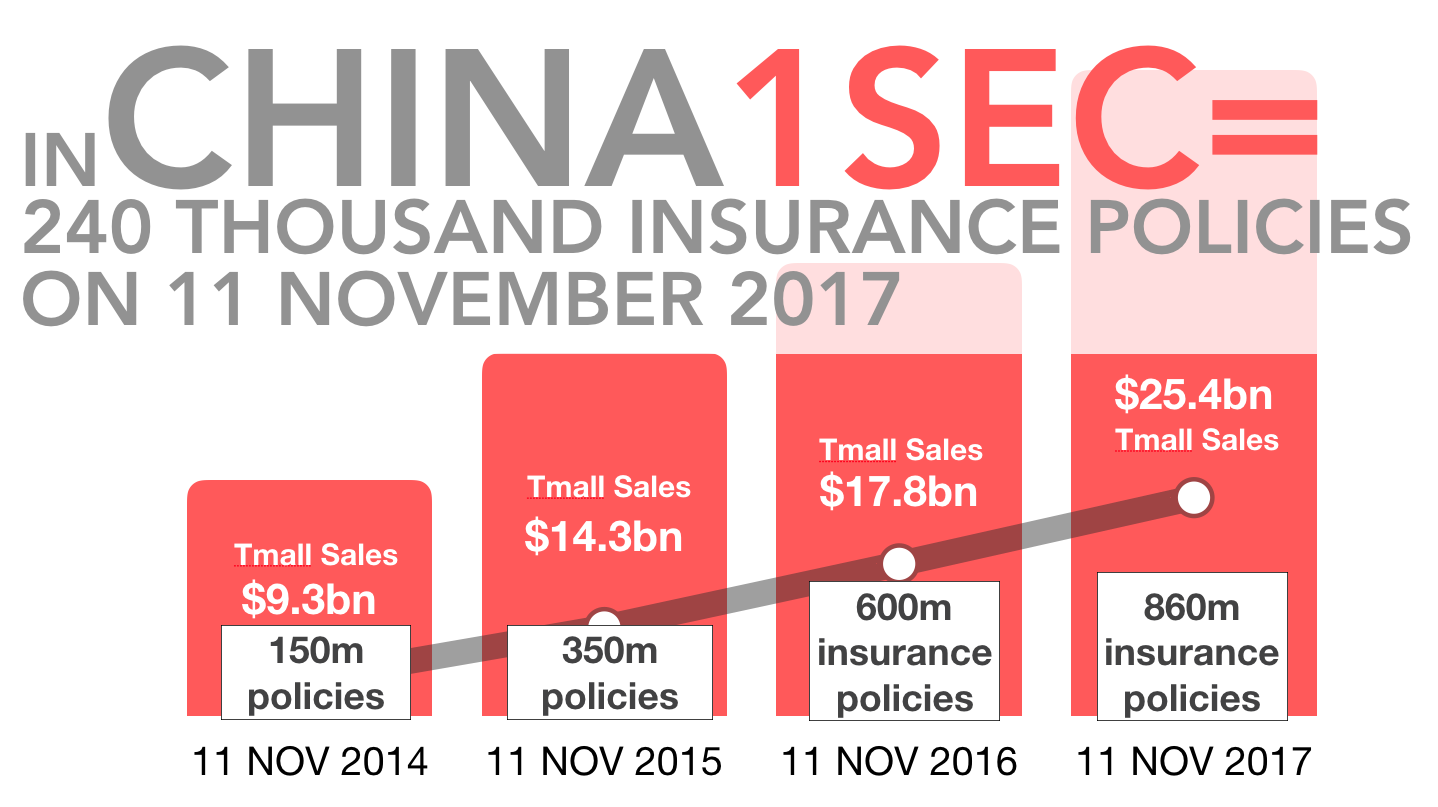

The latest trends coming out of China are pointing to an early shift in insurance fundamentals. So the current slowdown in insurtech is not an end, but the beginning of the ecosystem transition toward the "Spotify moment” for the insurance industry.

Main Act of Insurtech

The “Spotify moment” happens when a discretionary spending item, like music, gets transformed from an occasional luxury into a utility that millions of customers rely on as their trusted daily tool. The key trigger for a “Spotify moment” is a combination of frictionless customer experience, mass-customization that closely matches consumer’s needs, perceived value for money and access to wide variety of choices.

The “Spotify moment” will see insurance products simplified down to their core coverages and then embedded frictionlessly into digital ecosystem. This moment is now fast approaching, and it will bring with it the “main act” of insurtech.

In the main act, insurance will move closer to becoming a risk transfer utility and a seamless part of consumers’ day to day digital service consumption. Digital businesses will start to dynamically pick the coverages that are relevant to the specific “worry profile” of their users and allow users to add those alongside their core services.

Insurers have a narrowing window of opportunity to prepare or risk being sidelined into niche segments. Key strategic activities should include the following:

Product Sprints. Cross-functional teams will need to start executing rapid product unbundling and creation of digital-oriented stand-alone coverages. Currently, it takes insurers on average six to 12 months to launch a consumer insurance product. In the future, product design will need to happen in five-day sprints and become iterative, to identify best product-market fits within the digital ecosystem.

See also: Stretching the Bounds of Digital Insurance

Opportunity Management. Evaluating digital opportunities by the same metrics as legacy business is a sure way to destroy any sign of innovation. Digital requires a strategic “VC” approach to opportunity selection and management. Placing many strategic bets will let organization learn and iterate quickly from both mistakes and successes.

Dedicating investment pool and digital P&L will keep accountability and ownership clear. Lastly, providing the best support for digital opportunities will maximize the probability of success. After all, would you rather lose your best resources to your self-disrupting digital team or to Amazon?

Startup Collaboration. Working with startups and approaching them as high-potential partners will give the organization the right cultural compass and position it well for the dynamic digital insurance ecosystem.

The future of insurance is digital; resistance is futile!

Opening Act of Insurtech

Insurtech had emerged in 2012, and over the last six years the insurance industry has started to embrace it. While there’s been a lot of excitement about insurtech, most of the digital efforts so far have been largely incremental—insurance products are becoming slightly cheaper, their distribution becoming a little bit more digitally enabled and the back-office becoming marginally more efficient. The “opening act” focused on the low hanging opportunities that kickstarted the insurtech wave globally.

Now as opportunities susceptible to incremental tech solutions quickly dry up, many insurance managers are concluding that insurtech might have run its course, and, going forward, it will be back to business as usual for insurance. They will be in for a surprise!

The perfect analogy for the current stage of the insurance industry is a record label in the age before digital music. Record labels erroneously believed they were in the business of CDs, which drove them to focus on pushing pre-packaged products with a single feature that consumers wanted, delivered to customers via expensive and inefficient distribution music store networks.

See also: Digital Insurance 2.0: Benefits

The valuable lesson being that the full force of disruption did not come when records started selling CDs online but when Napster hacked through the oligopoly of record labels and force-unbundled their products. While Napster ultimately didn’t survive, it disrupted the status quo by pushing record labels to finally unbundle their products and make them available to digital-music distribution platforms such as iTunes and Spotify.

The latest trends coming out of China are pointing to an early shift in insurance fundamentals. So the current slowdown in insurtech is not an end, but the beginning of the ecosystem transition toward the "Spotify moment” for the insurance industry.

Main Act of Insurtech

The “Spotify moment” happens when a discretionary spending item, like music, gets transformed from an occasional luxury into a utility that millions of customers rely on as their trusted daily tool. The key trigger for a “Spotify moment” is a combination of frictionless customer experience, mass-customization that closely matches consumer’s needs, perceived value for money and access to wide variety of choices.

The “Spotify moment” will see insurance products simplified down to their core coverages and then embedded frictionlessly into digital ecosystem. This moment is now fast approaching, and it will bring with it the “main act” of insurtech.

In the main act, insurance will move closer to becoming a risk transfer utility and a seamless part of consumers’ day to day digital service consumption. Digital businesses will start to dynamically pick the coverages that are relevant to the specific “worry profile” of their users and allow users to add those alongside their core services.

Insurers have a narrowing window of opportunity to prepare or risk being sidelined into niche segments. Key strategic activities should include the following:

Product Sprints. Cross-functional teams will need to start executing rapid product unbundling and creation of digital-oriented stand-alone coverages. Currently, it takes insurers on average six to 12 months to launch a consumer insurance product. In the future, product design will need to happen in five-day sprints and become iterative, to identify best product-market fits within the digital ecosystem.

See also: Stretching the Bounds of Digital Insurance

Opportunity Management. Evaluating digital opportunities by the same metrics as legacy business is a sure way to destroy any sign of innovation. Digital requires a strategic “VC” approach to opportunity selection and management. Placing many strategic bets will let organization learn and iterate quickly from both mistakes and successes.

Dedicating investment pool and digital P&L will keep accountability and ownership clear. Lastly, providing the best support for digital opportunities will maximize the probability of success. After all, would you rather lose your best resources to your self-disrupting digital team or to Amazon?

Startup Collaboration. Working with startups and approaching them as high-potential partners will give the organization the right cultural compass and position it well for the dynamic digital insurance ecosystem.

The future of insurance is digital; resistance is futile!

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

George Kesselman is a highly experienced global financial services executive with a strong transformational leadership track record across Asia. In his relentless passion and pursuit to transform insurance, Kessleman founded InsurTechAsia, an industry-wide insurance innovation ecosystem in Singapore.

Finally, after years of requests, CMS is issuing cards that do not have a Social Security number as the Medicare identifier.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jagger Esch is the president and CEO of Elite Insurance Partners and MedicareFAQ, a senior healthcare learning resource center.

Data security and privacy had seemed to be key concerns that would hold back insurtech, but GDPR allays those worries.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Zeynep Stefan is a post-graduate student in Munich studying financial deepening and mentoring startup companies in insurtech, while writing for insurance publications in Turkey.

While so many of us have focused on the transformative possibilities of driverless vehicles, a much simpler technology has popped up and begun to reshape transportation in cities, with lots of potential implications for insurance. The technology is what the experts are calling "micromobility" and what the rest of us know simply as scooters.

The technology isn't totally under the radar, of course. When a scooter-sharing startup like Bird raises capital at a valuation of $2 billion, people notice. But I'm not sure that the threats and opportunities of scooters are being understood just yet. There certainly seemed to be a lot of surprise when the Washington Post last week published an article about the number of people who are ending up in the emergency room following scooter accidents.

They would seem to come with the territory. You have people buzzing down sidewalks at 15mph (and Bird is, unwisely, in my opinion, lobbying against laws that would require helmets) or venturing into streets, where they have to engage with vehicles with a lot more mass and steel protection than the scooters provide. But, so far, people seem to be focusing on the novelty, not the implications.

In the short term, we need to figure out what insurance, if any, covers those in these accidents and whether there are opportunities to sell new forms, as some are doing for Uber/Lyft/Didi drivers and Airbnb hosts. We also need to help find ways to reduce risk. (Hint to Bird: helmets.)

The longer term gets even more interesting if you believe, as I do, that transportation in cities can be rethought from the ground up over the next 10 to 15 years. We accept these days that cars rule the road, but that's only been true for about a century. Through the 1910s, at least, horses, people and carts all shared city streets and only gradually gave way to these loud, smelly, metal contraptions that carried people around. We could well return to a mixed-used environment, with an overlay of information technology that optimizes for speed, convenience, cost, energy use, pollution and many other factors. That environment would be so different that the risks would change considerably, and the insurance and risk management would need to, too.

My working hypothesis is that cities will become bigger and more vibrant, with many more people choosing to live in them. Space will be freed up because driverless cars will so greatly reduce the need for parking, including on streets, and cities can be thoughtful about how to redeploy public thoroughfares among driverless vehicles, mass transit, pedestrians, bikes and scooters, using all sorts of sensors and cameras to manage flow and safety digitally. Today, the first-mile problem (how to get people and goods to mass transit) and the last-mile problem (how to get them to their final destination) are complex, but the problems should yield to a bunch of smart thinking over time both for city dwellers and for those who choose to live in suburbs or even more remote areas.

That's just a hypothesis, of course. As always, I recommend you Think Big, Start Small and Learn Fast so you can find out what the future will actually hold. The time to engage on the mobility transformation is now, but you can do so by testing big ideas in limited, inexpensive ways and only invest real money when an opportunity is clear.

Let us know if we can help with your innovation efforts. In the meantime, you might want to join our discussion in the group, "Inventing the Future of Risk Management and Insurance," on our Innovator's Edge platform. If you haven't already registered on the platform, just click here. (Registering is free and quick.) Once you're registered, click here to join the robust discussion on mobility and a host of other topics.

Have a great week.

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

Just arriving at a reasonable number is inadequate if the report parameters are missing. It is kind of like buying the wrong insurance policy.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Chris Burand is president and owner of Burand & Associates, a management consulting firm specializing in the property-casualty insurance industry.