Lessons Culled From Early Innings of AI

AI is transforming claims, but there are pitfalls. Success requires extreme discipline about identifying and addressing a single problem.

AI is transforming claims, but there are pitfalls. Success requires extreme discipline about identifying and addressing a single problem.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Many industries are criticized because they talk the talk but don't walk the walk. Well, insurers don't even talk the talk yet.

Lots of industries face criticism because they talk the talk but don't walk the walk. But the insurance industry doesn't even talk the talk yet.

Sure, everyone is talking about improving the insurance customer experience, but look at the words we use. Many are opaque—the industry talks to itself, somehow unaware that customers are listening and are turned off by the gobbledygook. Some words are even offensive—we're saying things to customers that we really don't want to be saying.

We have to at least get our talk—our vocabulary—straight before we can figure out to really engage customers and address their evolving needs.

My least-favorite word is one so widely used that few will find it offensive: "adjuster." My problem: If I'm filing a claim, I don't want it adjusted. I want it paid.

Yes, I realize that processing claims is complicated and that all sorts of adjustments need to be made. I also realize that no industry simply pays when a claim is made against a company. But if you send me an "adjuster," you're telling me right off the bat that you don't trust me, and that's a lousy way to start an interaction. It certainly isn't any way to start a relationship, which is what insurers insist they want with customers these days. Don't trust me, if you must, but send me a "claims professional" or simply a "customer service representative." Don't send me an "adjuster."

Almost as bad is "losses," as in "cat losses" or "medical losses." How about, instead: "payments to highly valued customers in their time of need, after years of premium payments on their part"? Does Amazon record a loss when it ships me something? Of course not. And those payments on health or cat insurance aren't losses, either; they're just the cost of doing business—people don't pay those premiums simply because they like us. So, let's look at our business through the customer's eyes and book "payments" or somesuch, not "losses."

Less offensive but still unnecessarily bad are words like "excess" and "surplus." The insurance may be categorized as excess and surplus to the industry, but not to me, the customer.

Some words already have meanings—and they aren't the meanings assigned by the insurance industry. A binder is a plastic cover with three rings that you buy for your kids as they head back to school; it is not temporary insurance. An endorsement is something you put on the back of a check—or at least used to, before banks simplified deposits. An endorsement is not an amendment to an insurance policy.

Many terms are opaque, even archaic:

While we're at it, let's do away with the acronyms. All of them—at least on first reference, and mostly in subsequent references, too.

Changing the language will be hard because so many in the industry subscribe to what I think of as a 19th century sort of approach to business: Let's make things seem as complicated as possible to justify the existence of lots of experts and intermediaries and to demand nearly blind faith by clients. This is sort of the "don't try this at home, folks," approach to business. Leave the complicated terms to us.

The approach has worked for insurers for a very long time. It has worked for doctors and lawyers. If a cynical T.A. in a philosophy class in college way back when is to be believed, it worked for Hegel, too—he supposedly wrote a short, clear version of his big idea (thesis/antithesis/synthesis), and no one took him seriously; he then wrote a 1,000-page, nearly impenetrable version, called it merely the introduction to his ideas and found lasting fame.

But things have changed since Hegel wrote in the early 1800s. Now, if I want to remind myself about Hegel, I turn to Wikipedia and its clear, little summary; I don't crack open The Phenomenology of Spirit. Change has accelerated in recent years, to the point where even doctors find themselves having to communicate more with patients in plain English.

If doctors can simplify how they communicate about the mind-boggling issues involved in medicine, then the rest of us can figure out how to talk the talk in insurance. We need to begin by taking a hard look at every term we use and revising many of them, from the perspective of a total newbie customer, so we talk to customers the way they expect us to talk to them.

That's the only way to lay the groundwork for the broad improvements in the customer experience that we all want to deliver and that customers are increasingly demanding.

Cheers,

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

Application programming interface (API) protocols let agencies' software seamlessly move data and tasks from one step of a process to the next.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Online health benefits marketplaces make shopping by small businesses as straightforward as buying an automobile.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Sally Poblete has been a leader and innovator in the health care industry for over 20 years. She founded Wellthie in 2013 out of a deep passion for making health insurance more simple and approachable for consumers. She had a successful career leading product development at Anthem, one of the nation’s largest health insurance companies.

Insurers that focus on second homes, vacant homes or certain commercial properties should be developing strategies now.

There are so many great advances in the area of "smart homes" and buildings that it makes me wonder what the actual impact has been, or what I might have had to deal with, without all the smart features. The “smart” concept is to be able to secure a building with sensors that can provide safety features and collect information to reduce the risk of water damage, fire damage or other hazards.

I had a second home built and made it smart and connected in as many ways as possible. And my experience has been that I am generally more aware of all aspects of my home. I receive mobile alerts when there is motion on my front porch. I know the temperature in all areas of the house. Water sensor devices provide peace of mind in knowing that there have been no water leaks – if there is a leak, the sensors are connected to the auto shut-off valve in the basement. The SimpliSafe security system is connected to fire and police through the connected security system and fire alarm.

In essence, I know the health of my home at all times – which has been very handy to the owner of a second home.

See also: Smart Home = Smart Insurer!

From the homeowner’s viewpoint, I can see the value for an insurance carrier. My insurer worked with me by providing a discount. The process was interesting. To obtain the discount, we correlated the capabilities of new devices we installed to the older discount program that was in already place.

A connected home can be considered an asset both in the sense that it has early detection and prevention capabilities and also that it is being actively managed. However, several barriers need to be overcome. The property owner needs education and access to the combination of devices that can assist with the management of the home or building.

To address these issues, many insurers have ventured into partnerships with companies such as Amazon (Travelers) and Roost (Aviva and Erie), to name a few. But there are big challenges involved here: How do you increase the knowledge of millions of policy holders or commercial property owners? And, how do you make available the key connected devices that can, at a minimum, detect water and fire to mitigate the risk of each?

See also: How Smart Is a ‘Smart’ Home, Really?

In our most recent report, Smart Homes and Buildings: Ten Strategic Considerations for Insurers, we discuss the key considerations for insurers when developing the best value propositions, including the need to develop a deep understanding of specific customer segments, their needs and their adoption of smart devices.

For some, it may still be a few years away; for other insurers and customer segments, the time to engage in this area is now. For example, insurers that focus on segments such as second homes, vacant homes or specific types of commercial properties should be developing strategies now. But every insurer that writes property insurance must be engaged and following the developments in the smart home/property area. And they must maintain a conversation with agents and policyholders about their needs.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Karen Furtado, a partner at SMA, is a recognized industry expert in the core systems space. Given her exceptional knowledge of policy administration, rating, billing and claims, insurers seek her unparalleled knowledge in mapping solutions to business requirements and IT needs.

Companies often spend months creating bots that deliver little real efficiency because they don't reengineer the overall process.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Scott McConnell serves as the divisional president, insurance, for NTT Data Services, a top 10 global business and IT services provider.

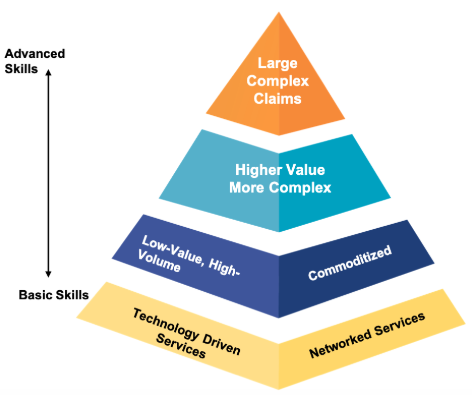

High-volume, low-complexity claims take one technological approach, but complex, high-dollar claims need a very different one.

At the moment, the insurance industry is aware that the claims experience is often the only contact a policyholder ever has with the insurer, so the claims journey must be completed correctly. Around the world, policyholders are demanding the same amount of transparency and oversight in the claims process that they get as consumers when they order something from Amazon or another online retailer. Many personal lines policyholders expect to be able to track and interact with their insurance carrier via an app or mobile portal.

Similarly, if they have an app to see their policy details, renew coverage, etc., then consumers expect to be able to make a claim in that app and track or manage it to completion. It is apparent, though, that many prefer a mobile portal because they rarely make a claim and don’t want to install an app they may never use again. They don’t want to have to remember login details for the portal, so they need an encrypted link that will take them straight to their claim, just like a FedEx tracking number. They expect to be able to communicate with all parties via the portal using messaging, not email, but if they need to send in photos or documentation, they may transmit those through the portal without necessarily knowing or caring who is handling the claim.

See also: Visual Technology Is Changing Claims

For large complex/technical claims, however, policyholders and other stakeholders have different expectations as to how their claims are handled, and how the communication works. Many insurtech startups don’t seem to differentiate in this claims segment – to many of them, “a claim is a claim.” In some cases, they clearly don’t understand the distinction between simple, low-value claims with repeatable steps, and larger, more complex claims where multiple, detailed narrative reports are needed to settle the claim. Either that or they have chosen to focus in the volume claims space for commercial reasons. Large complex claims are expertise-driven. Technology can support highly experienced adjusters, but technology for the foreseeable future will not replace the skill sets or expertise needed on such claims.

A few of the new breed of software-as-a-service (SaaS) claims systems put the insured front and center in a collaborative claims process. The vendors say they can handle just about any type of claim, but they are only good for personal auto, volume and third-party administrator claims. Liability claims often entail complex sets of facts and negotiation, beyond the scope of most vendor offerings. The vendors also don’t offer client-driven SLA tracking, document management, co-insurers, multi-currency or billing capabilities. They assume that a claims manager overseeing a $10 million warehouse fire will trawl through an app on the phone to see status updates. Client-driven SLA tracking, such as through dashboards, is important for clients to make sure their claims are handled in the correct way. Vendors and their advisers need to understand their market better.

Lots of insurtech startups are focused on the easy part of the equation – signing up policyholders via chatbots, submitting claims and using artificial intelligence to settle simple claims. Many startups are creating chatbot apps to sign up domestic policyholders and allow them to submit a claim. Every insurer will have this capability soon, as it is simple to build using third-party AI services, so I don’t see this as a market differentiator. We do not see a new breed of agile SaaS claims systems coming to market yet, probably because that is a more difficult system to understand and build. There is also resistance from some suppliers to handing their data and claims process over to a third-party SaaS provider. I haven’t yet seen one of these new-breed claims systems that is built around SLA-driven workflows that drive the claim to completion, though I am aware of some in development, none could support a traditional claim-adjusting business. What some vendors are currently offering is a claims-light system, focusing on collaborating with the various stakeholders via portals and apps instead of email.

In the past, suppliers such as outsourced claims management organizations would each build their own systems to fill these gaps, often because insurers either didn’t see value in owning the claims system or couldn’t successfully bring their own solution to market. This multitude of external systems and processes doesn’t serve policyholders well, because it doesn’t always provide a consistent, positive experience when they make a claim. If I am a homeowner policyholder with ABC Insurance, then I should have an ABC Insurance app on my phone that I can use to manage my policy and any claims arising from it, including all communications with whoever is handling the claim. I should expect any outsourced provider or supplier to be plugged into that same system, either because they are directly using the same system or because their own systems are linked into it via an API.

Traditional insurers need to re-evaluate how they outsource their claims to a third party because they continue to risk getting disintermediated from their relationship with the policyholder when so much of the claims process occurs outside their organization and systems. They should guarantee a great customer experience when a policyholder makes a claim, and to do that they need to control the collaboration space — the communication and data-sharing piece. Other financial services organizations have already solved this problem for the same reason: to reduce customer churn. Traditional insurers should be able to get this right, but many will need to become more agile in the way they deliver technology to do so. In the meantime, new entrants are launching with systems that already provide their policyholders with a better, more seamless claims experience. I’m not sure how well their systems integrate with external suppliers yet, but I suspect they will get there quickly because their organizations and systems were designed from the ground up to be agile and innovative.

See also: Key Technology Trends for Insurers in 2019

Much of the above is already being discussed within the industry. I focus on the claims systems piece because I have been involved in many of these systems over the years, and it is interesting to see the same ideas come up again and again. We were talking about the “shared electronic claim file” in the early days of the internet. Now we are talking about a “collaborative claims workspace” decades later.

I am confident that the technology available today will solve these long-standing problems quickly. I have been involved in discussions with low-code development platforms, and it is incredible what companies can now build and deploy for web, mobile and desktop in a couple of months. At this pace of innovation, advancements in claims technology will bring the industry to a crossroads. Will the industry embrace the opportunity to transform its service through the claims experience? Time will tell.

At the moment, the insurance industry is aware that the claims experience is often the only contact a policyholder ever has with the insurer, so the claims journey must be completed correctly. Around the world, policyholders are demanding the same amount of transparency and oversight in the claims process that they get as consumers when they order something from Amazon or another online retailer. Many personal lines policyholders expect to be able to track and interact with their insurance carrier via an app or mobile portal.

Similarly, if they have an app to see their policy details, renew coverage, etc., then consumers expect to be able to make a claim in that app and track or manage it to completion. It is apparent, though, that many prefer a mobile portal because they rarely make a claim and don’t want to install an app they may never use again. They don’t want to have to remember login details for the portal, so they need an encrypted link that will take them straight to their claim, just like a FedEx tracking number. They expect to be able to communicate with all parties via the portal using messaging, not email, but if they need to send in photos or documentation, they may transmit those through the portal without necessarily knowing or caring who is handling the claim.

See also: Visual Technology Is Changing Claims

For large complex/technical claims, however, policyholders and other stakeholders have different expectations as to how their claims are handled, and how the communication works. Many insurtech startups don’t seem to differentiate in this claims segment – to many of them, “a claim is a claim.” In some cases, they clearly don’t understand the distinction between simple, low-value claims with repeatable steps, and larger, more complex claims where multiple, detailed narrative reports are needed to settle the claim. Either that or they have chosen to focus in the volume claims space for commercial reasons. Large complex claims are expertise-driven. Technology can support highly experienced adjusters, but technology for the foreseeable future will not replace the skill sets or expertise needed on such claims.

A few of the new breed of software-as-a-service (SaaS) claims systems put the insured front and center in a collaborative claims process. The vendors say they can handle just about any type of claim, but they are only good for personal auto, volume and third-party administrator claims. Liability claims often entail complex sets of facts and negotiation, beyond the scope of most vendor offerings. The vendors also don’t offer client-driven SLA tracking, document management, co-insurers, multi-currency or billing capabilities. They assume that a claims manager overseeing a $10 million warehouse fire will trawl through an app on the phone to see status updates. Client-driven SLA tracking, such as through dashboards, is important for clients to make sure their claims are handled in the correct way. Vendors and their advisers need to understand their market better.

Lots of insurtech startups are focused on the easy part of the equation – signing up policyholders via chatbots, submitting claims and using artificial intelligence to settle simple claims. Many startups are creating chatbot apps to sign up domestic policyholders and allow them to submit a claim. Every insurer will have this capability soon, as it is simple to build using third-party AI services, so I don’t see this as a market differentiator. We do not see a new breed of agile SaaS claims systems coming to market yet, probably because that is a more difficult system to understand and build. There is also resistance from some suppliers to handing their data and claims process over to a third-party SaaS provider. I haven’t yet seen one of these new-breed claims systems that is built around SLA-driven workflows that drive the claim to completion, though I am aware of some in development, none could support a traditional claim-adjusting business. What some vendors are currently offering is a claims-light system, focusing on collaborating with the various stakeholders via portals and apps instead of email.

In the past, suppliers such as outsourced claims management organizations would each build their own systems to fill these gaps, often because insurers either didn’t see value in owning the claims system or couldn’t successfully bring their own solution to market. This multitude of external systems and processes doesn’t serve policyholders well, because it doesn’t always provide a consistent, positive experience when they make a claim. If I am a homeowner policyholder with ABC Insurance, then I should have an ABC Insurance app on my phone that I can use to manage my policy and any claims arising from it, including all communications with whoever is handling the claim. I should expect any outsourced provider or supplier to be plugged into that same system, either because they are directly using the same system or because their own systems are linked into it via an API.

Traditional insurers need to re-evaluate how they outsource their claims to a third party because they continue to risk getting disintermediated from their relationship with the policyholder when so much of the claims process occurs outside their organization and systems. They should guarantee a great customer experience when a policyholder makes a claim, and to do that they need to control the collaboration space — the communication and data-sharing piece. Other financial services organizations have already solved this problem for the same reason: to reduce customer churn. Traditional insurers should be able to get this right, but many will need to become more agile in the way they deliver technology to do so. In the meantime, new entrants are launching with systems that already provide their policyholders with a better, more seamless claims experience. I’m not sure how well their systems integrate with external suppliers yet, but I suspect they will get there quickly because their organizations and systems were designed from the ground up to be agile and innovative.

See also: Key Technology Trends for Insurers in 2019

Much of the above is already being discussed within the industry. I focus on the claims systems piece because I have been involved in many of these systems over the years, and it is interesting to see the same ideas come up again and again. We were talking about the “shared electronic claim file” in the early days of the internet. Now we are talking about a “collaborative claims workspace” decades later.

I am confident that the technology available today will solve these long-standing problems quickly. I have been involved in discussions with low-code development platforms, and it is incredible what companies can now build and deploy for web, mobile and desktop in a couple of months. At this pace of innovation, advancements in claims technology will bring the industry to a crossroads. Will the industry embrace the opportunity to transform its service through the claims experience? Time will tell.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jeffrey T. Bowman is the non-executive chair of Global Risk Solutions, a leading provider of a diverse range of claims adjusting and environmental risk management solutions.

Wearables encourage insureds to become accountable, producing healthier clients--but also concerns on privacy and reliability.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mike de Waal is senior vice president of sales at Majesco.

The winner won't be the first brokerage to go fully online; it'll be the one that doesn't lose its humanity in the face of the digitalization.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Santosh Perumbadi joined Simply Business as chief commercial officer in 2017 and is responsible for launching U.S. operations, as well as managing the relationships with insurer partners and suppliers.

"Connected Claims" goes far beyond reorganizing a single department. It can disrupt – and revitalize – an entire company.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mariana Dumont is the head of U.S. operations at Insurance Nexus and is currently focused on helping carriers to transform claims processes to deliver a seamless claims experience.