3 Keys to Controlling Litigation Spending

Legal departments can take advantage of advanced analytics, cloud technology and other strategies to manage costs.

Legal departments can take advantage of advanced analytics, cloud technology and other strategies to manage costs.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Daniel Gold is a senior enterprise director for Catalyst (an OpenText company), where he advises corporations on technology-driven strategies.

Four out of five dentists recommend twice-a-year teeth cleaning. Here’s why the fifth dentist is right.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Al Lewis, widely credited with having invented disease management, is co-founder and CEO of Quizzify, the leading employee health literacy vendor. He was founding president of the Care Continuum Alliance and is president of the Disease Management Purchasing Consortium.

Insurance companies that commit to AI to the same extent as top-performing businesses could boost their revenue by an average 17%.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Ira Sopic is currently focused on how insurance carriers are integrating AI and advanced analytics into their existing processes to increase efficiency and revolutionize the way they work. This includes the key partnerships that the industry is creating and a clear picture of how the future will be shaped.

The frequency of air disasters has been publicly acceptable for a long time, but the safety margin of “smart” jet transports needs attention.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Byron Acohido is a business journalist who has been writing about cybersecurity and privacy since 2004, and currently blogs at LastWatchdog.com.

Without a clear vision of the problem to be solved, AI can take an organization down a long and unnecessarily winding road.

As the uses for and ultimate value of artificial intelligence (AI) become more widely understood, organizations across numerous verticals, be they insurtech, fintech or healthcare, are seeking ways to implement AI to their advantage — and vendors are lining up to tell them exactly how to do it. But without a clear vision of the problem to be solved, compounded with a lack of experience in that specific function, AI can take your organization down a long and unnecessarily winding road. It may seem pretty; it may be exciting; but it probably won’t take you where you want to go.

To help your organization find the right match for its needs, here are my top tips to consider when choosing an AI partner: Gain Alignment on the Objective You know you want to use AI and data science within your organization — whether to improve outcomes, achieve greater efficiency, drop operational costs or for another reason altogether. This is a great start, forward progress, but it is sort of like the act of bringing the ball onto the field or the court before the start of a game. AI has permeated marketing speak over the past few years. As a result, many solutions come across as generic or just scratch the surface of what is possible. For this reason, it is imperative that you know what your organization needs and why. Where exactly are the problems? What is the source of leakage? Which bottlenecks do you want to address? What are customers not currently delighted with? Furthermore, think about what metrics you are going to use to measure success and how you are planning to track them. Make a game plan for your team — and remember that you are actually a team with strengths and weaknesses. Understand where they exist and how an AI solution can mitigate those weaknesses. Everyone must be aligned on objectives and strategy for the team to function optimally. Address THE Problem Now that your organization is aligned on objectives internally, it’s time to seek out the vendors that demonstrate a high level of focus on a particular problem and a clear view of how solving that problem creates value. If a company spends its time and resources explaining all about how blockchain, AI and IoT work with its products — and it is being presented broadly as a technology player — this vendor is probably not ready to address your particular organization’s needs. Good AI providers shouldn’t offer an all-you-can-eat buffet. Instead, they should deliver a very precise statement of capabilities. See also: 3 Steps to Demystify Artificial Intelligence If they can’t dive deep into their problem statement, it doesn’t necessarily mean it is a bad company, but it is a sign of the company’s immaturity. The more the company professes about what its technology can do and the more issues it can address, the more you need to think the company is perhaps a little early in product evolution. Expertise Is a Must Focus is not always enough. Does your potential partner have the expertise to actually solve your particular problem? Expertise is a complicated issue. Partners need a certain level of domain knowledge. The team assigned to your organization must possess an understanding of your unique pain points and overall business. The understanding doesn’t have to be exhaustive, but every industry is unique in some way, whether it’s in terms of regulations or customer profiles or something else, and, if your team is not familiar, it can lead to big problems later. At the same time, deep data science experience is also essential. The models are the foundation of every AI solution. They must be carefully constructed, and now for the super challenging part: They need to be packaged in consumer-grade software and delivered through services that can drive operational impact in a manner applicable to your domain. And expertise does not stop there. Your chosen partner needs to be able to map out a clear path to implementation. Does the partner have a plan for how its solution will be rolled out and who should be involved? Your prospective partner should be able to detail exactly how it will put its solution to work. Ask the partner to walk through how it operationalized its solution within similar environments. Look for a Proven Track Record of Delivering Value When you consider the ultimate value you hope to derive from a new AI solution, you and your AI partner should be aligned — and the partner should be able to show how it will gauge that value. For example, the partner needs to define the specific metrics it is targeting. It’s not enough to say the partner is going to show cost savings and identify lost revenue. How is the company going to do that? What are the methodologies and indicators it will use to quantify, track and analyze? Specifics matter. In this regard, case studies can be particularly helpful because you learn what was done in the real world, why and the specific outcomes of those decisions. The partners that can show discernable evidence of value have a leg up. Interestingly, I have found that one of the things no one tells you is that only part of the value is derived from technology itself. Critical contributions come from those who can identify a very specific problem, see how technology can be applied to solve it and then get the right technology into the hands of people who will put it to work effectively — before they track and calculate its value. There is so much that goes into the entire process, and it’s hard work. So, the challenge is not in finding great technology, the real challenge is in packaging that technology within the context of a business problem and getting a concrete view of how well it’s attacking that problem. An Aside: Set Your Expectations Accordingly If you believe implementing a compelling AI solution will be a quick add-on, you will likely find yourself disappointed. To get it right, to yield the outcomes that matter to your organization, requires an iterative process, just like AI itself. AI partners should be honest about this. While some offer clear advantages and make things as easy as possible based on their expertise and maturity, expect a journey. See also: Chatbots and the Future of Insurance Also, to ensure expectations are met over the long term, take a long view. Develop a road map for what you want to accomplish in the future, and don’t just solve for where you are today. Because you are looking long-term, let the thought settle in that you are probably going to work with the same AI partner for a considerable period (years, in fact). Transparency becomes very important. The partner's road map matters, as well, in terms of how it will be able to support your continuing objectives. The more of a black box the partner creates around its future plans, the more concerns about maturity this should raise. Although there is a lot to consider when selecting an AI partner, know that selecting the right partner will be worth it. AI’s capabilities and benefits are truly transformative when applied in a thoughtful way. Best of luck to you as you embark on your AI journey. As first published in InsideBigData.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Gaby Olazabal is a senior vice president at Clara analytics, where she leads all product delivery.

Insurers now have access to an unprecedented quantity of image and video data and are beginning to invest in machine vision to process it.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jeff Goldberg is head of insurance insights and advisory at Aite-Novarica Group.

His expertise includes data analytics and big data, digital strategy, policy administration, reinsurance management, insurtech and innovation, SaaS and cloud computing, data governance and software engineering best practices such as agile and continuous delivery.

Prior to Aite-Novarica, Goldberg served as a senior analyst within Celent’s insurance practice, was the vice president of internet technology for Marsh Inc., was director of beb technology for Harleysville Insurance, worked for many years as a software consultant with many leading property and casualty, life and health insurers in a variety of technology areas and worked at Microsoft, contributing to research on XML standards and defining the .Net framework. Most recently, Goldberg founded and sold a SaaS data analysis company in the health and wellness space.

Goldberg has a BSE in computer science from Princeton University and an MFA from the New School in New York.

Why have attempted fixes via legislation and technology failed to fulfill promises for decades, for almost a generation of workers?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

John Bobik has actively participated in establishing disability insurance operations during an insurance career spanning 35 years, with emphasis on workers' compensation in the U.S., Argentina, Hong Kong, Australia and New Zealand.

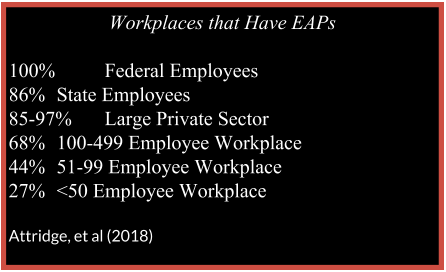

Here are the questions to ask to ensure that your employee assistance program provides robust help for employees' mental health.

Are EAPs Effective?

While the research on the effectiveness of EAPs is limited, studies have found that employees' use of EAPs enhanced outcomes, especially in "presenteeism" (how healthy and productive employees are), life satisfaction, functioning and often absenteeism (Joseph, et al., 2017; Frey, Pompe, Sharar, Imboden, & Bloom 2018; Attridge et al., 2018; Richmond, et al., 2017). In one longitudinal, controlled study, EAP participants were more likely than non-EAP participants to see a reduction in anxiety and depression (Richmond, et al, 2016). Another matched control study found that users of EAP services often reduced their absenteeism more quickly than non-EAP users experiencing similar challenges (Nunes, 2018). In another longitudinal study (Nakao, et al, 2007), 86% of people who were suicidal when they engaged with their EAP were no longer suicidal at two years follow-up. Researchers have concluded that, while not all EAPs are created equal, they often provide accessible services that are effective at improving employee mental health and well-being.

See also: Impact on Mental Health in Work Comp

Are EAPs Prepared to Support an Employer Facing an Employee Crisis With Suicide?

When it comes to the life-and-death issue of suicide, EAPs have the potential to provide evidence-based suicide prevention, intervention and postvention services to employers. The EAPs’ contribution to the comprehensive workplace suicide prevention strategy is essential, and many would benefit from annual state-of-the-art training in evidence-based methods of suicide risk formulation and treatment to help distressed employees get back on their feet. Social workers, who provide the majority of EAP clinical services in the U.S., often report having no formal training in suicide formulation, response and recovery (Feldman & Freedenthal, 2006; Jacobson et al., 2004), so annual continuing education on suicide intervention and suicide grief support is often helpful to providers. Once trustworthy and credentialed providers have been identified, they should be highlighted in the “suicide crisis” protocol, so that companies are not trying to do this leg work in the midst of a crisis.

If one of the main messages in suicide prevention is “seek help,” we need to make sure the providers are confident and competent with best practices approaches to alleviating suicidal despair and getting people back on track to a life worth living. Thus, dedicated employers will evaluate and even challenge their EAP providers to demonstrate continuing education in the areas of suicide prevention, intervention and postvention skills. In fact, some states are mandating that all mental health professionals, including licensed providers of EAP services, have some sort of continuing training in suicide risk formulation and recovery.

Do Employees Know About the Benefit of Their EAP?

In addition to making sure the providers have the needed skills, companies need to make sure that their employees know when and how to access the care. Recently, the American Heart Association and CEO Roundtable worked with experts in the behavioral health field to develop a white paper for employers, which includes seven specific actions employers can take to improve the mental health of their employees (Center for Workplace Health, American Heart Association, 2019). The report can be viewed online here. Dr. Jodi Frey, expert panelist for the report and internationally recognized expert in the EAP and broader behavioral health field recommends that “employers need carefully consider their workplace’s needs when selecting an EAP, and then should work with their EAP as a strategic partner to develop programs and communications that encourage utilization of the program and continued evaluation to improve services over time.” (Dr. Jodi Frey, personal communication, March 18, 2019).

Employers that are mindful of their workers’ well-being will continually promote well-vetted and employee-backed resources throughout the career of the workers. Leadership testimonials of the efficacy of the resources after the leaders have used them for their own mental health would bring credibility to the resources and model appropriate self-care to the employees. Bringing the resources on-site to the workers (and not waiting until the workers stumble upon the resources) is another way to break through the barriers to care. The Employee Assistance Society for North American (EASNA) developed a guide to help employers evaluate EAPs and determine appropriate vendors. The guide also can be used to help employers evaluate their current EAP and decide if needs are being met or if more attention to what services should be offered needs to be addressed. The guide can be downloaded free.

Are There Different Types of EAPs?

Much diversity exists in EAP structure and quality (Frey, et al, 2018). Some companies use internal EAPs, where providers are also employees of the company. This arrangement often provides the benefit of having an immediate resource that has clear knowledge of the company and industry culture. Evaluation of internal EAPs has found increased utilization, customization and supervisor referrals (Frey, et al, 2018); however, there are some drawbacks. Internal EAPs, because they are so closely connected to the company, run the risk of being perceived as having blurred lines of confidentiality and objectivity. By contrast, external EAPs are often more diverse and can respond 24/7 across a vast geography. Because of these benefits and consequences, many companies have moved to a hybrid model to get the best of both models.

Hybrid EAPs often have an internal employee to manage the EAP and to work with managers and employees on critical incident response, strategic planning and organizational change, and to provide onsite assessment and problem resolution. They can be an important ally for the employer to understand the potential for an EAP and to help evaluate whether EAP providers are effective in their response and offering high-quality services (Frey, 2017).

See also: What if They Say ‘Yes’ to Suicide Question?

EAPs are most effective when they understand the industry and organizational culture, have business acumen and can adapt to changes in organizational structure (Frey, et al., 2017; Frey, et al., 2018). Thus, employers seeking to find a best fit for their employees will interview mental health providers about their knowledge of the unique stressors and strengths in the industry. Some industries (e.g., emergency responders and aviation) have gone so far as to credential mental health providers as being specialists in their industry to avoid a mismatch.

Case Study From the COO of a Construction Contractor

"We had an issue where our EAP was referring counselors outside of our healthcare providers, so, after the three free sessions, the participant learned they could only continue with the suggested provider at $150 a session; so the employees would drop out. My understanding is that counseling often takes around seven sessions to have a sustained impact, so, I put in a mandate with our HR team to renegotiate our EAP to ONLY refer in-network counselors, or they would pay for the continued care.

"We then incorporated our EAP into our safety program. When there is a serious accident, we deploy counselors and have our EAP involved for post-accident assistance to our employees. Accidents can bring up traumatic responses from our employees, and these experiences bring up memories from other accidents they may have been involved in or around. This cumulation of trauma can be highly distressing for them.

"In the early years, we had to work through the skepticism that the EAP would notify management of anyone that used the service. Since HIPAA came into play, we have less of this skepticism. The employees thought they would get fired or laid off first if they had issues.

"I’ve worked with our safety and wellness groups to actually pick up and call the EAP for someone in distress and get them on the phone. Once they lay the groundwork with the counselor, they hand the phone over and leave and let the employee get the help they need. This helps break down the stigma, and some people just don’t have the courage or have a mental block about picking up the phone for help. This has been VERY effective to get those in need the help they need.

"We promote our EAP in our weekly newsletter, and we also have business cards with the information, and we utilize hard-hat stickers that have all the information. This helps it be available when they need it.

"I’ve also encouraged our managers to use the system so they can promote it from their point of view. This also has helped remove the stigma around using the EAP. I also talk when in front of our employees about the program and educate them so they will use it. Our utilization rate is the highest in our EAP network, and I think this is the reason why."

15 Questions Workplaces Should Ask to Strengthen the Mental Health Safety Net

Employers should remember they are the customers of their EAP, and they should do the due diligence to make sure they are getting the best benefit possible. Here are 15 questions employers should ask their EAP to get the best services possible:

Are EAPs Effective?

While the research on the effectiveness of EAPs is limited, studies have found that employees' use of EAPs enhanced outcomes, especially in "presenteeism" (how healthy and productive employees are), life satisfaction, functioning and often absenteeism (Joseph, et al., 2017; Frey, Pompe, Sharar, Imboden, & Bloom 2018; Attridge et al., 2018; Richmond, et al., 2017). In one longitudinal, controlled study, EAP participants were more likely than non-EAP participants to see a reduction in anxiety and depression (Richmond, et al, 2016). Another matched control study found that users of EAP services often reduced their absenteeism more quickly than non-EAP users experiencing similar challenges (Nunes, 2018). In another longitudinal study (Nakao, et al, 2007), 86% of people who were suicidal when they engaged with their EAP were no longer suicidal at two years follow-up. Researchers have concluded that, while not all EAPs are created equal, they often provide accessible services that are effective at improving employee mental health and well-being.

See also: Impact on Mental Health in Work Comp

Are EAPs Prepared to Support an Employer Facing an Employee Crisis With Suicide?

When it comes to the life-and-death issue of suicide, EAPs have the potential to provide evidence-based suicide prevention, intervention and postvention services to employers. The EAPs’ contribution to the comprehensive workplace suicide prevention strategy is essential, and many would benefit from annual state-of-the-art training in evidence-based methods of suicide risk formulation and treatment to help distressed employees get back on their feet. Social workers, who provide the majority of EAP clinical services in the U.S., often report having no formal training in suicide formulation, response and recovery (Feldman & Freedenthal, 2006; Jacobson et al., 2004), so annual continuing education on suicide intervention and suicide grief support is often helpful to providers. Once trustworthy and credentialed providers have been identified, they should be highlighted in the “suicide crisis” protocol, so that companies are not trying to do this leg work in the midst of a crisis.

If one of the main messages in suicide prevention is “seek help,” we need to make sure the providers are confident and competent with best practices approaches to alleviating suicidal despair and getting people back on track to a life worth living. Thus, dedicated employers will evaluate and even challenge their EAP providers to demonstrate continuing education in the areas of suicide prevention, intervention and postvention skills. In fact, some states are mandating that all mental health professionals, including licensed providers of EAP services, have some sort of continuing training in suicide risk formulation and recovery.

Do Employees Know About the Benefit of Their EAP?

In addition to making sure the providers have the needed skills, companies need to make sure that their employees know when and how to access the care. Recently, the American Heart Association and CEO Roundtable worked with experts in the behavioral health field to develop a white paper for employers, which includes seven specific actions employers can take to improve the mental health of their employees (Center for Workplace Health, American Heart Association, 2019). The report can be viewed online here. Dr. Jodi Frey, expert panelist for the report and internationally recognized expert in the EAP and broader behavioral health field recommends that “employers need carefully consider their workplace’s needs when selecting an EAP, and then should work with their EAP as a strategic partner to develop programs and communications that encourage utilization of the program and continued evaluation to improve services over time.” (Dr. Jodi Frey, personal communication, March 18, 2019).

Employers that are mindful of their workers’ well-being will continually promote well-vetted and employee-backed resources throughout the career of the workers. Leadership testimonials of the efficacy of the resources after the leaders have used them for their own mental health would bring credibility to the resources and model appropriate self-care to the employees. Bringing the resources on-site to the workers (and not waiting until the workers stumble upon the resources) is another way to break through the barriers to care. The Employee Assistance Society for North American (EASNA) developed a guide to help employers evaluate EAPs and determine appropriate vendors. The guide also can be used to help employers evaluate their current EAP and decide if needs are being met or if more attention to what services should be offered needs to be addressed. The guide can be downloaded free.

Are There Different Types of EAPs?

Much diversity exists in EAP structure and quality (Frey, et al, 2018). Some companies use internal EAPs, where providers are also employees of the company. This arrangement often provides the benefit of having an immediate resource that has clear knowledge of the company and industry culture. Evaluation of internal EAPs has found increased utilization, customization and supervisor referrals (Frey, et al, 2018); however, there are some drawbacks. Internal EAPs, because they are so closely connected to the company, run the risk of being perceived as having blurred lines of confidentiality and objectivity. By contrast, external EAPs are often more diverse and can respond 24/7 across a vast geography. Because of these benefits and consequences, many companies have moved to a hybrid model to get the best of both models.

Hybrid EAPs often have an internal employee to manage the EAP and to work with managers and employees on critical incident response, strategic planning and organizational change, and to provide onsite assessment and problem resolution. They can be an important ally for the employer to understand the potential for an EAP and to help evaluate whether EAP providers are effective in their response and offering high-quality services (Frey, 2017).

See also: What if They Say ‘Yes’ to Suicide Question?

EAPs are most effective when they understand the industry and organizational culture, have business acumen and can adapt to changes in organizational structure (Frey, et al., 2017; Frey, et al., 2018). Thus, employers seeking to find a best fit for their employees will interview mental health providers about their knowledge of the unique stressors and strengths in the industry. Some industries (e.g., emergency responders and aviation) have gone so far as to credential mental health providers as being specialists in their industry to avoid a mismatch.

Case Study From the COO of a Construction Contractor

"We had an issue where our EAP was referring counselors outside of our healthcare providers, so, after the three free sessions, the participant learned they could only continue with the suggested provider at $150 a session; so the employees would drop out. My understanding is that counseling often takes around seven sessions to have a sustained impact, so, I put in a mandate with our HR team to renegotiate our EAP to ONLY refer in-network counselors, or they would pay for the continued care.

"We then incorporated our EAP into our safety program. When there is a serious accident, we deploy counselors and have our EAP involved for post-accident assistance to our employees. Accidents can bring up traumatic responses from our employees, and these experiences bring up memories from other accidents they may have been involved in or around. This cumulation of trauma can be highly distressing for them.

"In the early years, we had to work through the skepticism that the EAP would notify management of anyone that used the service. Since HIPAA came into play, we have less of this skepticism. The employees thought they would get fired or laid off first if they had issues.

"I’ve worked with our safety and wellness groups to actually pick up and call the EAP for someone in distress and get them on the phone. Once they lay the groundwork with the counselor, they hand the phone over and leave and let the employee get the help they need. This helps break down the stigma, and some people just don’t have the courage or have a mental block about picking up the phone for help. This has been VERY effective to get those in need the help they need.

"We promote our EAP in our weekly newsletter, and we also have business cards with the information, and we utilize hard-hat stickers that have all the information. This helps it be available when they need it.

"I’ve also encouraged our managers to use the system so they can promote it from their point of view. This also has helped remove the stigma around using the EAP. I also talk when in front of our employees about the program and educate them so they will use it. Our utilization rate is the highest in our EAP network, and I think this is the reason why."

15 Questions Workplaces Should Ask to Strengthen the Mental Health Safety Net

Employers should remember they are the customers of their EAP, and they should do the due diligence to make sure they are getting the best benefit possible. Here are 15 questions employers should ask their EAP to get the best services possible:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Sally Spencer-Thomas is a clinical psychologist, inspirational international speaker and impact entrepreneur. Dr. Spencer-Thomas was moved to work in suicide prevention after her younger brother, a Denver entrepreneur, died of suicide after a battle with bipolar condition.

Last week's announcement by A.M. Best that it will assess and score insurance companies on their ability to innovate means that incumbents either have to build robust capabilities or suffer consequences

As the wave of innovation in insurance has built over the past few years, incumbents have had a choice about whether to swim out and try to surf it or to stay in the shallow water and hope to not get knocked over. No longer.

Last week's announcement by A.M. Best that it will assess and score insurance companies on their ability to innovate means that incumbents either have to build robust capabilities or suffer consequences in the here and now. Best has essentially taken the position that a company cannot do nothing, nor can it really follow the herd or adopt a slow-follower mentality. Innovation is critical to long-term resiliency.

This is great news—at least for the industry as a whole. While some companies will remain incapable of innovating, they will not be able to claim surprise.

With this new focus on innovation, A.M. Best has done the insurance industry a big favor by not only sounding a warning but also offering the industry focus, structure and direction to avoid the danger of inaction.

A.M. Best, which will look both at the innovation process and at the results, is going to peer deeply into what companies do and don't do, so the box-checking that I suspect is going on at many insurance companies will have to end. Companies can no longer go on innovation tours and claim they are "staying on top of insurtechs." Executives will no longer just be able to assure superiors and the board that, "Yeah, yeah, we have an innovation process in place and have X projects planned."

A.M. Best will be comparing companies against each other and will have access to so much data that raters will be hard to fool, and they will double back in subsequent years to see which efforts and which companies delivered the goods. A three-year effort at change management won't cut it with A.M. Best if real innovation doesn't follow. (You can learn more about the A.M. Best methodology here and can offer comments.)

As usually happens when an industry goes through a wave of change, many companies will decide to sell rather than innovate. Selling is the safe bet, if not necessarily the best one.

For those incumbents that opt to bet on their ability to innovate, the process will provide some guardrails. Innovation is, by definition, a step into the unknown. A.M. Best will give companies informed feedback on how they're doing, and there are best practices that can guide companies through the uncertain waters of the innovation process.

A.M. Best at its annual Review and Preview conference this week is going to great lengths to explain its perspective and its proposed process, and is bringing in world-class speakers on innovation – encouraging insurance industry attendees that innovation is not only critical, it’s doable. Another encouraging message is that the size of the company does not matter to how well it can innovate.

Thank you, A.M. Best, for planting the flag firmly. Now it’s up to the insurance industry to get serious about doing what few really want to do, but we all know must be done.

Cheers,

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

Do not start with fashionable technology trends or the most passionate speaker at that conference. What do your customers want?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Laughlin is the founder of Laughlin Consultancy, which helps companies generate sustainable value from their customer insight. This includes growing their bottom line, improving customer retention and demonstrating to regulators that they treat customers fairly.