I recently had an opportunity to experience one of the benefits of pressing pause.

While presenting to over 30 Chinese non-English-speaking executives, I learned when to pause for my translator. She was excellent and taught me how long to speak before pausing for her translation.

(It’s longer than you might think, as she needed context to translate meaning not just words).

The context of my talk was a visit by a leading Chinese insurer, to

Cass Business School. To aid the executive education, that prestigious business school invited a number of leading thinkers (plus me) to present to them.

Thanks to an invitation from our regular guest blogger,

Tony Boobier, I was asked to educate the group on

data science and

customer insight. It was a good opportunity to build on the presentation that I recently gave to a

non-technical audience at the University of South Wales.

Anyway, the point of this blog is that I experienced a couple of benefits from needing to pause regularly. So much so that it got me thinking about the wider principle of pausing, prompting me to recall three aspects of leadership that can benefit from more intentional pauses.

Benefit 1: Pause when speaking (for insight and hearing)

The first benefit I want to highlight is the one I experienced when speaking to that audience. I mentioned when

reviewing an excellent book for publc speakers that I spend part of my working life as a speaker. I could definitely improve, but attendees tell me they enjoy my talks and benefit from them.

However, being forced to pause for my Chinese translator improved my effectiveness in a surprising way.

First, I experienced so much more

time to think. Not just remembering what I was planning to say next, but enabling me to reassess what was most important or relevant given context.

Second, I spent more time observing the audience and having time to think up questions or tailor my content as a result. A couple of times, I even had new

insights or ideas as a result from this greater reflection.

See also: Key Difference in Leaders vs. Managers

At times, it was almost like the benefit of spending most of your time

listening as a leadership coach. When you do speak, you are much more confident that what you will say is relevant for your audience.

Without a translator, such long pauses would seem stilted in a conversation. However, I’d like to encourage us all (including me) to pause more in our conversations. Work at developing your ability to pause and just

listen for understanding, rather than spending all the time you are not speaking just thinking about what you will say next.

Benefit 2: Pause for self care (to have more energy for your work)

Reflecting on my speaking experience, I ruminated on the other ways pausing can help my in my life. I recalled enjoying reading

“In Praise of Slow,

“ and although I think there are flaws in Carl’s argument, it’s a useful challenge to assuming fast is better.

One aspect of this is the need to balance a modern obsession with “

fail fast” with a valuing of taking time to think and

hone your craft. As I shared when reviewing Cal Newport’s seminal book, it is well worth analysts

protecting time for Deep Work. That includes pausing distractions.

Another spin on this is the need for more focus on self-care. Too many leaders have bought into the

Elon Musk myth of workaholic overwork being viable. In reality, we can neither cheat our

need for sleep nor create more time. Most of us will be more productive by managing our energy, and part of that is taking more pauses.

I’ve shared before on the importance of you taking a

complete break from work when on holiday. A great build on that blog post is this podcast episode from Michael Hyatt. In this recorded live talk, to over 3,500 leaders, he explains the critical need for self-care and how busy leaders can pause.

Benefit 3: Pausing from your current role (to prepare for your career)

Reflecting further, I also remembered the importance of another type of career break. That is changing the work that you do. A number of times in my own career I have discovered it is powerful to pause one role, to try something else.

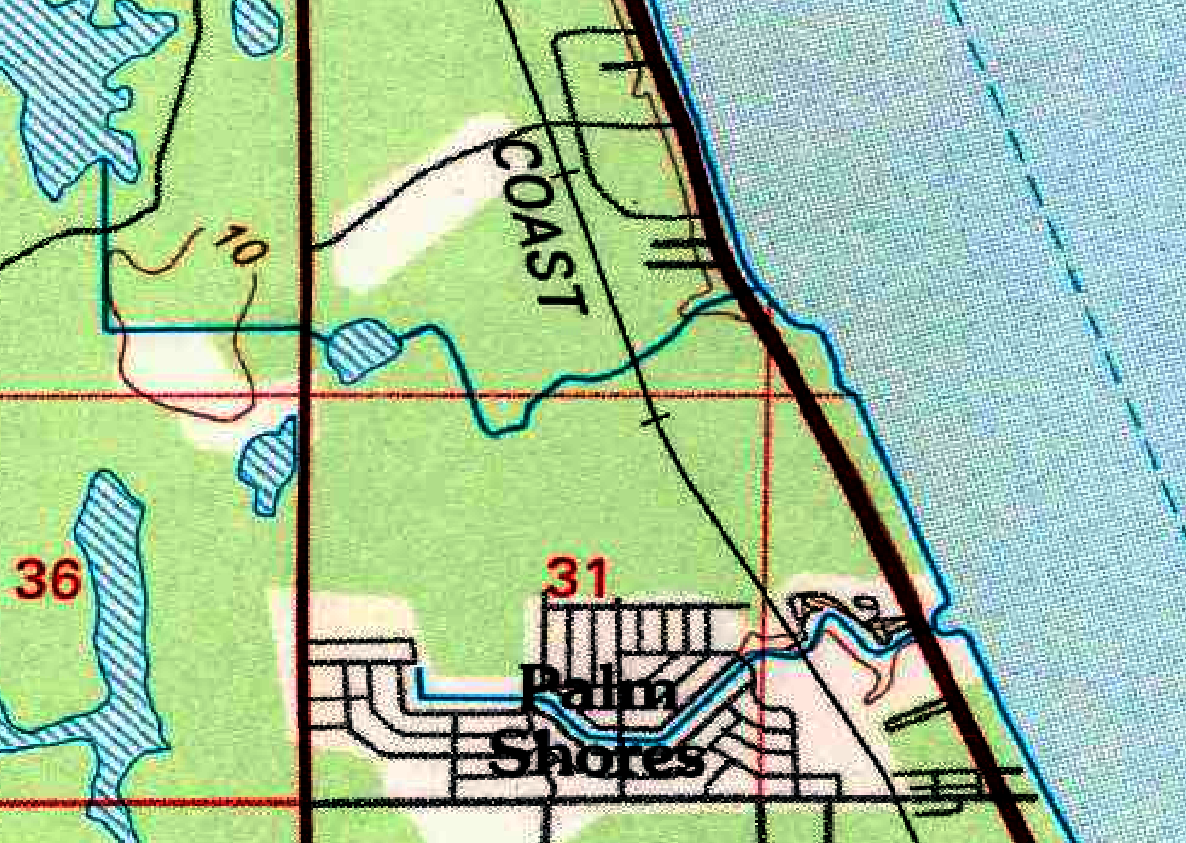

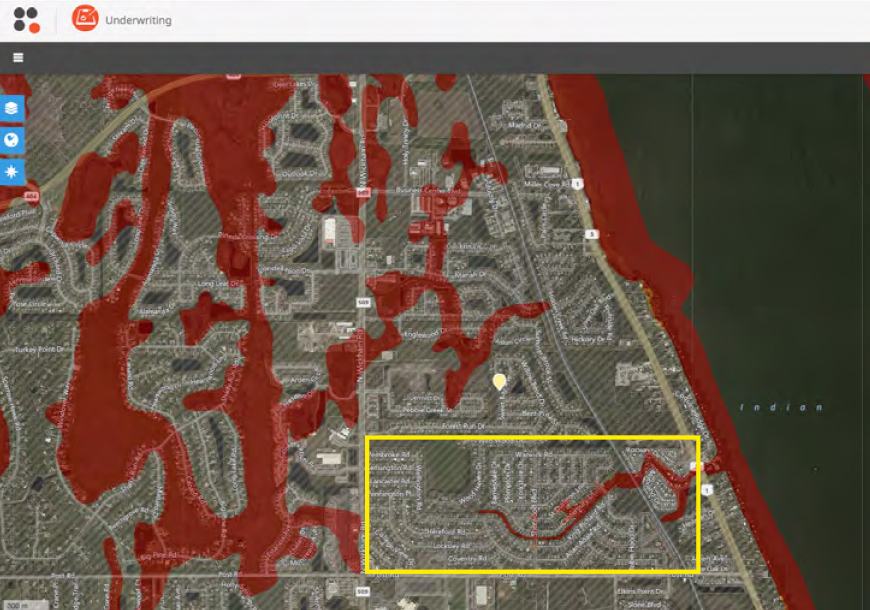

Having spent the first decade of my working life doing almost every different

IT role, I had the opportunity to pivot and try a role in underwriting. My line manager at the time,

William Buist, encouraged me to see past traditional barriers and discover that I could master reinsurance recommendation.

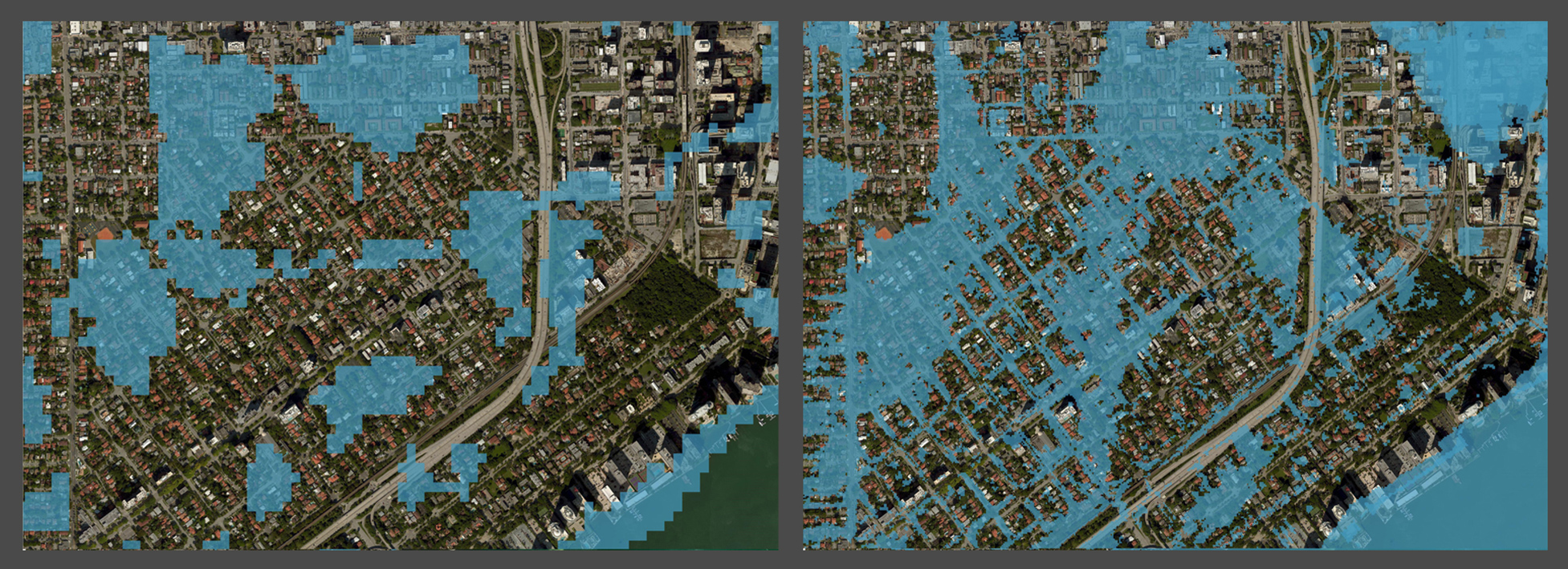

Since then, I’ve had opportunities to change career direction a couple more times. From underwriting to marketing, from data analysis to building a

holistic customer insight team including

data science skills. Then five years ago, taking the risk of leaving corporate life to set up

my own business.

Each change has been worthwhile and built on past different perspectives to improve my effectiveness in each new role. I’ve also seen the same effect in people who work for me. One man left my team to workforce a couple years within a

marketing proposition development role. He later came back to a leadership role in our

analytics team much more capable as a result.

See also: Customer Experience Leaders Widen Edge

Could a

change of tack for your career ship actually help you be stronger at your longer-term career goal?

How could you pause?

So, as always, my final thoughts turn to you, dear reader. If you buy my argument that pausing can bring you many benefits, how could you pause?

In your

leadership or

working life, what are you doing on autopilot? What are you doing fast but

mindlessly? Is that really efficient use of your skills and you as a human being?

I encourage you to pause right now and take some time to think about your next pause. What will it be?