White-Collar Crime: Are You Next?

Small businesses lose twice as much per scheme to white-collar crime as larger businesses, and detecting fraud typically took 16 months.

Small businesses lose twice as much per scheme to white-collar crime as larger businesses, and detecting fraud typically took 16 months.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

A Deloitte survey finds a recognition that there has been underinvestment in extended enterprise risk management.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

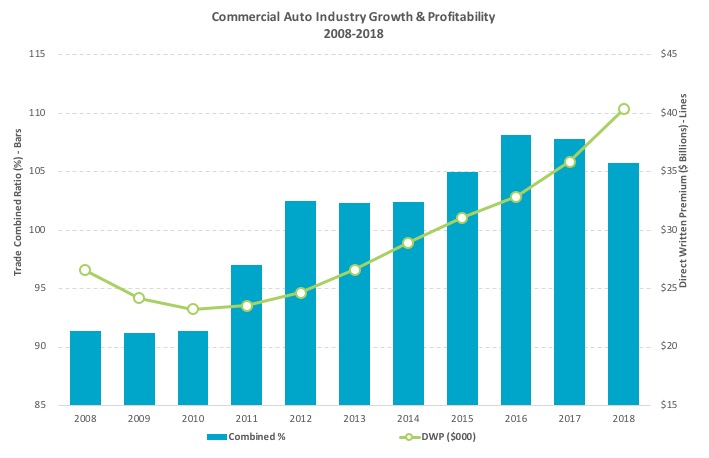

After billions of dollars of underwriting losses in commercial auto, insurers can bend the curve toward profits.

©A.M. Best – used with permission[/caption]

Changes in risk exposure are pressuring insurers to improve pricing and underwriting effectiveness. As macroeconomic fundamentals remain strong, drivers are logging more miles and fleets are steadily growing, resulting in a shortage of experienced drivers, according to the Truck Driver Shortage Analysis conducted by ATA. With increases in exposure due to more miles driven, less-experienced drivers on the road and a rise in distracted driving incidents, it can be difficult to see how we can return to profitability anytime soon.

Choose a Smarter Path to Profitability

Despite these challenges, you can break the money-losing cycle of losses and create profit within your commercial auto book. A simple option is to increase base rates and risk alienating current and prospective clients. Alternatively, you can work more surgically, while improving your underwriting returns by using more data, information and technology.

See also: Cyber Insurance Needs Automated Security

There are a number of ways to improve your underwriting and pricing decision-making process and reclaim commercial auto profits:

©A.M. Best – used with permission[/caption]

Changes in risk exposure are pressuring insurers to improve pricing and underwriting effectiveness. As macroeconomic fundamentals remain strong, drivers are logging more miles and fleets are steadily growing, resulting in a shortage of experienced drivers, according to the Truck Driver Shortage Analysis conducted by ATA. With increases in exposure due to more miles driven, less-experienced drivers on the road and a rise in distracted driving incidents, it can be difficult to see how we can return to profitability anytime soon.

Choose a Smarter Path to Profitability

Despite these challenges, you can break the money-losing cycle of losses and create profit within your commercial auto book. A simple option is to increase base rates and risk alienating current and prospective clients. Alternatively, you can work more surgically, while improving your underwriting returns by using more data, information and technology.

See also: Cyber Insurance Needs Automated Security

There are a number of ways to improve your underwriting and pricing decision-making process and reclaim commercial auto profits:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Patrick Foy is senior director of commercial insurance strategic planning at TransUnion.

How do you make sure customers are truly the focus of your business during every touchpoint with your brand?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Clarke's Third Law, posited by science fiction legend Arthur C. Clarke, says that "any sufficiently advanced technology is indistinguishable from magic." Well, we're going to see some magic, courtesy of the technology that led Google to claim "quantum supremacy" last week, and we should start adapting sooner rather than later.

The underlying technology, quantum computing, is as far from conventional computing as quantum physics is from the Newtonian view of the world and will have important implications for insurance.

Traditional computing is already pretty magical. Right, Siri? But traditional computing depends on a highly prescribed approach: Billions of transistors are in either an on or an off position, and problems are solved through an unbelievably fast manipulation of those 0 or 1 values, mostly in sequence. Quantum mechanics, meanwhile, operates in ways so mysterious that even Einstein was famously wary of the implications, and quantum computing is no different. Values don't have to be binary: they can be both 0 and 1 at the same time. (Told you this was weird stuff.) And all the values work together at the same time, not in sequence.

The Google claim of "quantum supremacy" means it believes it has solved a problem with a quantum computer that could not have been solved with a conventional computer. To be precise, Google says it solved a problem in three minutes and 20 seconds that would have taken the most powerful IBM supercomputer 10,000 years. IBM cried foul, saying its computer could have solved the problem in 2.5 days if the problem was set up right, but, even in the best-case scenario, IBM was 700 times slower.

Quantum computing will take an estimated 10 to 15 years to establish itself, which allows time for us to adapt—but not loads of time, in some areas. Quantum computing will render trivial today's approaches to encryption, which count on making problems (related to prime numbers) too hard to solve, and it takes about a decade to broadly replace one encryption scheme with a new one throughout industry. Quantum computing may require ending today's reliance on passwords and other computationally intensive schemes, in favor of sampling of DNA, fingerprints, retinal scans or other biometric evidence, and the switch can't start too early.

Richard Feynman famously said decades ago that chemistry isn't Newtonian, it's quantum, so any tool that's really going to help us understand chemistry needs to be based on quantum mechanics. Et voila. Such a tool is now in sight, and being able to simulate the quantum behaviors of atoms could lead to all sorts of new materials, new medicines and new understanding of the basic behaviors of our bodies—for instance, while we talk about DNA sequences and can define them, how the strands of protein fold up is also hugely important and has been hard for conventional computers to predict.

Quantum computing could also lead to much better models for the development of hurricanes and, more generally, for potential natural disasters. While such disasters occur at a massive scale, not at the subatomic, quantum level, the intricacies of the massive number of interactions lend themselves to a quantum computing approach.

Lots of deep analytics in insurance, such as looking for fraud or identifying patterns that can help mitigate risk, also lend themselves to a quantum approach.

And fundamentally new technologies like quantum computing often produce convergences with other technologies that can rewrite the business landscape. Think, for instance, about quantum computing powering the AI that goes into driverless cars. You don't think Google will hook up its "quantum supremacy" computer with the brain that powers all its autonomous vehicles?

Now, any technology that is expected to arrive some 10 years in the future can turn out to be mere science fiction—I'm still waiting for my flying car. And quantum computing has at least one clear drawback: It doesn't provide a definitely right answer like conventional computers do. The quantum world is probabilistic, so quantum computers just tell you an answer is probably right. If you test the problem enough times—Google tested 1 million times in those 200 seconds in its "quantum supremacy" experiment—you can be highly confident, but you still likely want to check your work with a conventional computer.

So, don't throw away your supercomputer just yet. But do start understanding quantum computing, and even experimenting. It's coming, and it will make today's AI seem like child's play. Quantum computing will pull new companies and even new industries out of the proverbial hat.

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

Innovation comes from risk-taking, and learning and development (L&D) programs need to adapt to support those risks.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

A high-tech boot, together with a mobile app and the cloud, provide a breakthrough for diabetics who suffer from foot ulcerations.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Know who your prospects and customers are, understand when they are shopping and be ready to meet them in the market.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jeff Piotrowski is market leader, insurance, at Jornaya.

The line between professional and personal lives continues to blur, and a focus on employee well-being can let companies stand out.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

One of the best tools for fraud prevention is to let employees know that false claims will not be tolerated and that penalties are stiff.

Workers' compensation fraud creates a financial and administrative burden for employers, while increasing hardship for injured workers with legitimate claims. The early identification of potential fraudulent cases and quick action by workers’ compensation third party administrators can help make sure workers’ compensation programs run as efficiently as possible in providing needed help for injured workers.

The following are some best practices employers can implement to reduce fraud, as well as guidance on what to do if a claim is “not quite right”:

Identify Questionable Claims

Here are some of the “red flags” that may help identify fraudulent claims:

Follow the Process

Even if an employer suspects a claim could be fraudulent, the employer must still follow the process to ensure the claim is submitted appropriately and the worker obtains medical treatment.

See also: Real or Fake? Finding Workers’ Comp Fraud

Investigate Promptly

Once a potential fraudulent claim is identified, it is imperative that investigations are initiated promptly. Investigations should be thorough, impartial and preventative. Using an outside party that specializes in workers’ compensation fraud investigation will ensure that the case is handled in accordance with all regulations and will hold up in court if there is a trial. Remember, only a court of law can determine fraud – not the examiner or the employer. These investigations can include:

Upon the conclusion of the investigation, any relevant findings and evidence should be presented to the district attorney’s office as well as the Department of Insurance.

Increase Awareness

One of the best tools for fraud prevention is to let employees know that false claims will not be tolerated and that there are stiff penalties. It also helps to provide employees with easy ways to report any potential fraud that they see.

One recent example of identifying, investigating and prosecuting a fraudulent claim was in the conviction of a school bus driver in San Mateo County in California in July. The claims examiner identified numerous inconsistencies in the medical reports versus the statements provided by the employee. There were alleged migraines and double vision, but tests did not support these symptoms, and it appeared that they were exaggerated.

Investigations were initiated, and the employee was observed participating in activities that were not consistent with any claimed injury. The investigative evidence was forwarded to the San Mateo County district attorney’s office, which obtained a conviction; the defendant was ordered to serve 60 days in the county jail and pay restitution of $60,000 to his employer.

See also: Workers’ Comp Issues to Watch in 2019

Organizations must implement a comprehensive strategy to curb fraud. Vigilant fraud prevention programs and investigative efforts can save a company hundreds of thousands of dollars by preventing the filing of fraudulent claims and prosecuting those who take advantage of the system.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Stacey Gunn, assistant vice president, is responsible for leading Keenan’s SIU/Fraud Unit, training and development and vendor management. She has more than 20 years of experience and is certified by the Insurance Educational Association.