1. Automated Underwriting Will Grow

The benefits of saving time and money have led to many insurers implementing automated underwriting. LIMRA says more than a quarter of U.S. life insurers have expanded their automated underwriting practices.

Now carriers are turning to software vendors that offer robotic process automation and AI to enable automated underwriting for group and voluntary benefits providers.

2. Ditto for Automated Claims

More than half of claims activities have already been replaced with automation, McKinsey found. Fully digital claims have reduced the average payment time by up to 5.5 days and assisted in achieving the highest satisfaction scores ever measured by the J.D. Power U.S. Property Claims Satisfaction Study.

Expect major investments in machine learning made in 2021 to accelerate back-end claims processing in 2022. Additionally, as insurers grow their partner ecosystems, application programming interfaces (APIs) will be increasingly deployed to smooth out the transaction and settle claims using third-party anti-fraud algorithms, databases and various machine learning applications.

3. Customers Want More Touchpoints

However, many consumers remain skeptical of the increased use of technology and automation in the insurance industry. A study by Accenture finds only 12% of insurance consumers trust an automated phone/web service when making a claim, while 49% trust a human adviser.

Insurers need to give customers more touchpoints. For example, regular electronic newsletters can highlight new product offerings, and company updates can point out that customer reps are always available.

4. Consumer Resistance to Virtual Assistants Must Be Addressed

Insurers can drastically reduce costs and turnaround time by adopting high-quality digital assistants that use conversational AI-based chatbots. While chatbots pose great opportunities, many consumers are skeptical about doing business with voice assistants. They still want to communicate with humans even if they have to wait in a queue.

Striking a balance between approaches is key, and it will require some trial and error to determine when a chatbot should let a human take over to best meet a customer’s needs.

5. Machine Learning Will Help Detect Fraud

This is an increasingly valuable way for insurers to detect and prevent fraudulent claims. Claims management and fraud prevention will continue in 2022 to advance as one of the most prominent areas where machine learning works for insurers.

6. “Cloudy” Weather Means Security Is Needed

While teams that take care of your system updates also work around the clock to ensure their cloud platform is secure, this does not mean that the cloud is a silver bullet when it comes to security.

Insurers preparing for cloud deployments must understand the importance of the shared responsibility model. While cloud infrastructure providers like Amazon, Microsoft and Google are responsible for the security of the cloud (infrastructure level), SaaS providers and their customers are responsible for security in the cloud at the application level.

Ransomware is growing. Insurers must adhere to security best practices relentlessly.

7. Blockchain Technology Will Advance

Many carriers are improving underwriting with smart contracts and blockchain. Underwriting improves because insurers can review accurate information on past insurance policies and claims and offer more precise pricing and selections for their insurance products using this new insurance technology.

While blockchain and smart contracts possess great opportunities for insurers, many are struggling to adapt. But adoption will continue to grow.

8. The Metaverse Will Draw Interest

The launch of the metaverse got insurance companies thinking about using extended reality to their advantage. A study by Accenture indicates 85% of insurance executives believe it’s essential to leverage XR insurance technology to close the physical distance gap when engaging with employees and customers.

9. Digital Distribution and Self-Service Will Become More Robust

Digital distribution enables customers to buy insurance products online, speeding the purchasing process and improving the customer experience. For example, State Farm’s self-service portal lets clients buy insurance policies online without taking a medical exam. The result has led to State Farm ranking second in client satisfaction among life insurers.

Digital distribution allows agents to do business with more clients, letting insurance companies lower commission costs per sale. In addition, the desire for superior digital tools among agents is more vital than ever. Many agents rate investing in digital or customer tools as the best way their employers can support them.

10. Insurtech Ecosystems Will Improve

McKinsey predicts ecosystems will account for 30% of global insurance revenues by 2025. Additionally, research from Accenture found 84% of insurance executives say ecosystems are essential to their strategy. These numbers indicate ecosystems will continue to be the insurance industry’s next big frontier for disruption.

11. Low-Code/No-Code Platforms Will Grow

Low-code/no-code software can reduce application deployment time from several months to a few hours! In 2022, this will be more pertinent than ever. Appian’s research shows IT departments are losing control over their growing digital infrastructure, and project backlogs are outpacing the addition of new IT resources. Low-code/no-code platforms don’t replace IT departments. Rather, they give IT breathing room to deploy their technical resources more strategically.

Low-code and no-code platforms may run the risk of encouraging “shadow IT” environments – managed outside of the IT department. This could result in security and workflow issues, inconsistencies in business logic and other unforeseen problems. Low-code/no-code solutions should be implemented following software development lifecycle and architectural best practices in collaboration with IT.

12. Predictive Analytics Will Aid in Competitive Benchmarking and Modeling

In 2022, insurers and distribution partners will be able to do much more with their data by using predictive analytics. PA takes historical data and feeds it into models that are trained over time with machine learning to generate predictions about trends and behavior patterns. Insurers can then make informed decisions about quoting, workload optimization, product recommendations and more.

This is especially valuable in employee benefits sales and underwriting. Insurers can leverage machine learning to process historical or synthetic data to identify the most successful sold plan designs for particular group sizes and industries. Using AI to generate a recommended alternative quote provides a valuable benchmark based on reliable data and reduces the guesswork.

13. Accelerated Underwriting Will Expand

Since the pandemic began, many insurers have had to embrace accelerated underwriting, supported by digital self-service tools and insurance technology. Now some lower-risk applicants can fly through the underwriting process without taking tests requiring body fluids. A survey found 74% of insurance companies say accelerated underwriting has reduced wait times for policies, 59% say it has diminished policy issue costs and 37% say it has increased sales.

Additionally, predictive analytics and machine-learning algorithms in underwriting make it easier and faster for customers to obtain life insurance coverage by skipping traditional tedious underwriting processes.

14. Open APIs Will Enable Growth

Open application programming interfaces are publicly available application programming interfaces that give other developers access to a software application or web service. They also manage how applications can communicate and interact with each other.

Open APIs let insurance companies showcase their services to the outside world so external partners can use them and bring added value to their customers. Companies connected through APIs can create an insurance technology ecosystem to offer a best-of-breed customer experience by intertwining digital services provided by multiple companies.

For example, a car dealer that uses open APIs could partner with an auto insurer to help sell car insurance right through the car dealer’s app. This would make it easier for customers to buy a car and insurance simultaneously.

15. Proactive Risk Management Will Grow With AI and Big Data

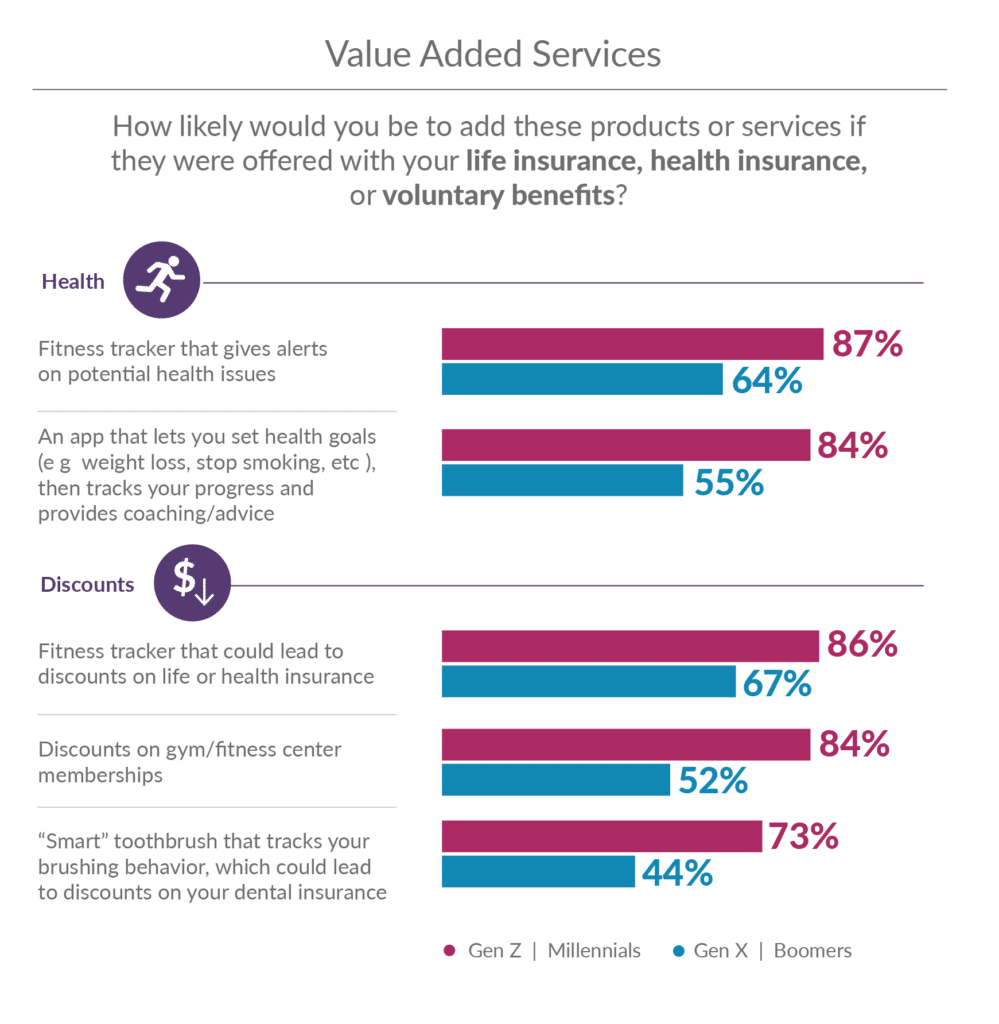

Life and health insurance companies are increasing their use of AI and predictive analytics to develop more preventative measures for their clients.

Big data offers revolutionary insight into a customer’s lifestyle, diet and general health. Insurers can better understand potential risk factors and make recommendations such as encouraging healthy habits to avoid future health issues. Potentially, an insurer could recommend the insured go to an emergency room because of the acute risk of a heart attack.

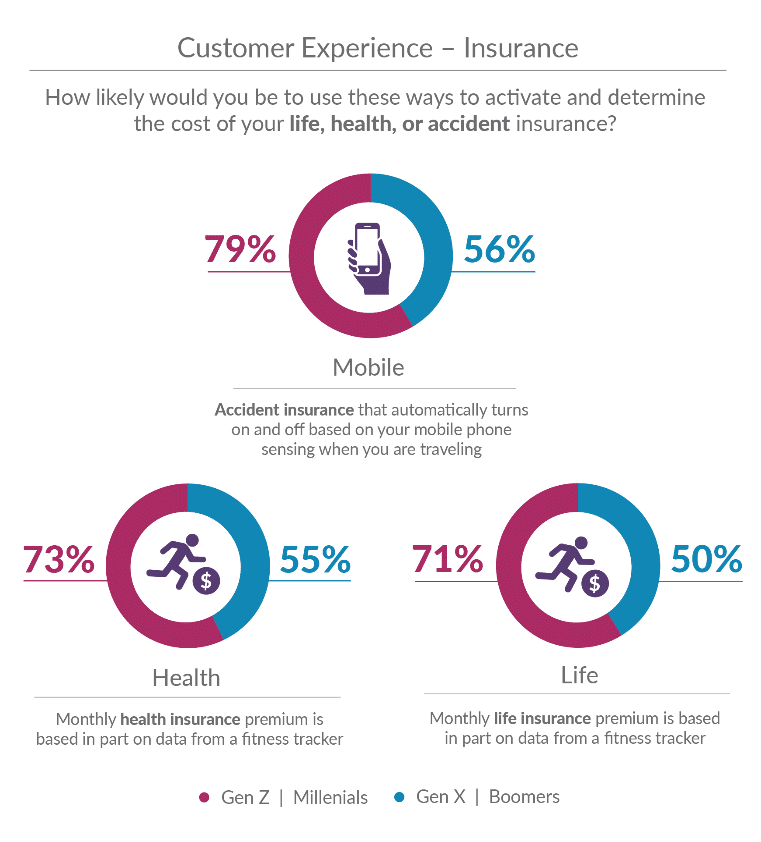

Additionally, big data collected from wearable devices can provide critical health and fitness information for life and health insurers. This information is crucial to developing interactive life insurance policies that track fitness and health data wearable devices and smartphones.

16. Tech Will Facilitate Embedded Insurance

InsTech London defines embedded insurance as “abstracting insurance functionality into technology in a way that enables any third-party distributor (usually a product or service providers in other sectors) to seamlessly integrate insurance products and solutions into their own customer propositions and journeys.”

For banks, car manufacturers and other distributors, implementing embedded insurance as part of a sale can help increase revenue and improve the overall value of their products or services. This is a win-win for both insurers and distributors as insurers can save money on distribution costs by implementing their products directly into the distributor’s platform.

17. Machine Vision Will Prove to Be, Well, Visionary

Machine vision refers to the AI-based analysis of images from sources such as smartphones, satellites and drones. In simple terms, machine vision is the eyes of applications and machines. It uses software algorithms to assess visual images based on existing data sets already assessed by humans.

In employee benefits, machine vision can greatly streamline the quoting process. Many requests for proposal still come in as images and PDF documents that cannot be interpreted as text by a typical computer. Moreover, client information cannot be copied and pasted from this format into the quoting tool, requiring manual rekeying of information by a human underwriter or salesperson whose time is better spent elsewhere. Expect adoption to increase in 2022.

18. Health Wearables Will Take Hold

The demand for health wearables is booming as advanced insurance technology allows people to monitor their health progress and get rewards for healthy living.

These services track a wealth of data, such as daily steps, sleeping patterns, activity levels, heart rates, calories consumed, UV levels, temperature preferences, when people are home and not, and distance traveled in cars.

Data collected from wearables can provide critical health and fitness information. This information is vital to developing interactive life insurance policies that track fitness and health data through wearable devices and smartphones. In addition, the data gathered can give complimentary coverage or improved rates for both individuals and employee benefits using health and risk scores.

19. Automated Renewals Will Boom

Automated renewal applications can limit the need for carrier intervention for stock quotes by automatically queuing quotes for manual review and auto-generating policy renewal packages.

Additionally, automated renewal applications can connect with policy administration and claims systems by leveraging data for re-calculations at the anniversary of a policy’s renewal. This allows insurers to not worry about tracking renewals and the manual preparation of renewal quotes and letters. Employee benefits insurers can reduce renewal turnaround and touchpoints by 75%.

20. Automated Workload Balancing for Quotes Will Take Hold

During periods like open enrollment for employee benefits, the high volume of quotes requiring underwriter review can slow processes due to an inefficient allocation of human resources. About 30% to 40% of an underwriter’s time is spent on administrative tasks, such as rekeying data or manually executing analyses.

With AI, workload recommendations can be generated automatically. Carriers can train machine-learning models to assist sales and underwriting managers in suggesting the most effective distribution of quotes across the underwriting team.

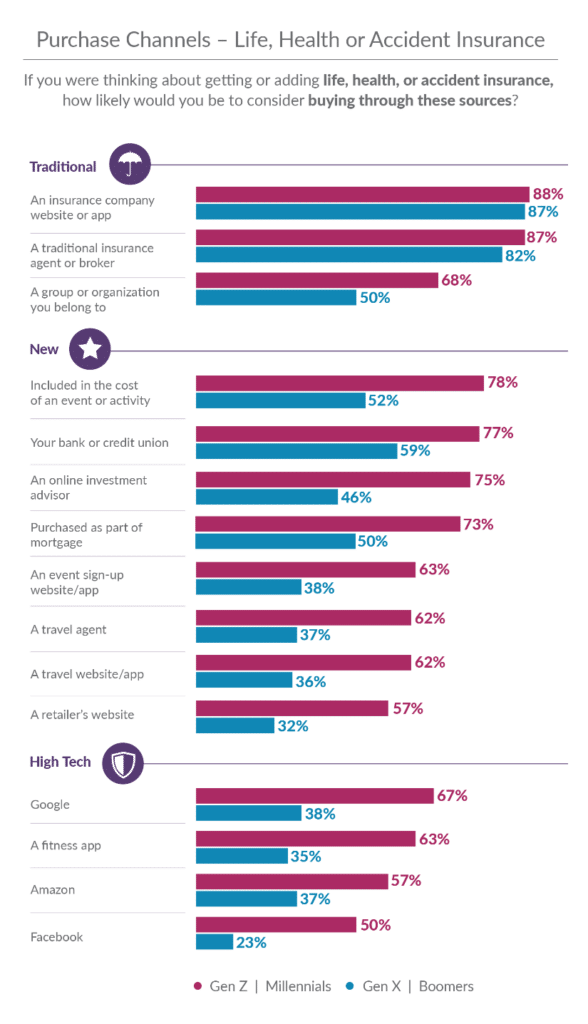

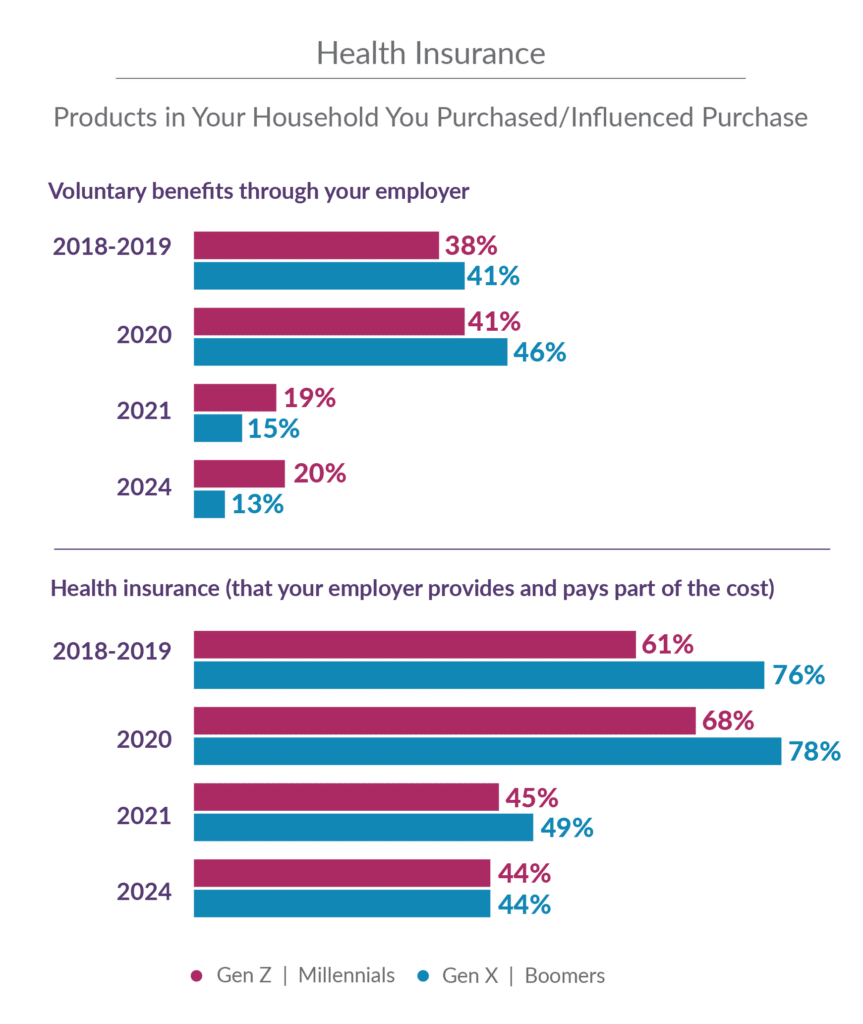

Sales channel insights for life/health/accident insurance

Sales channel insights for life/health/accident insurance

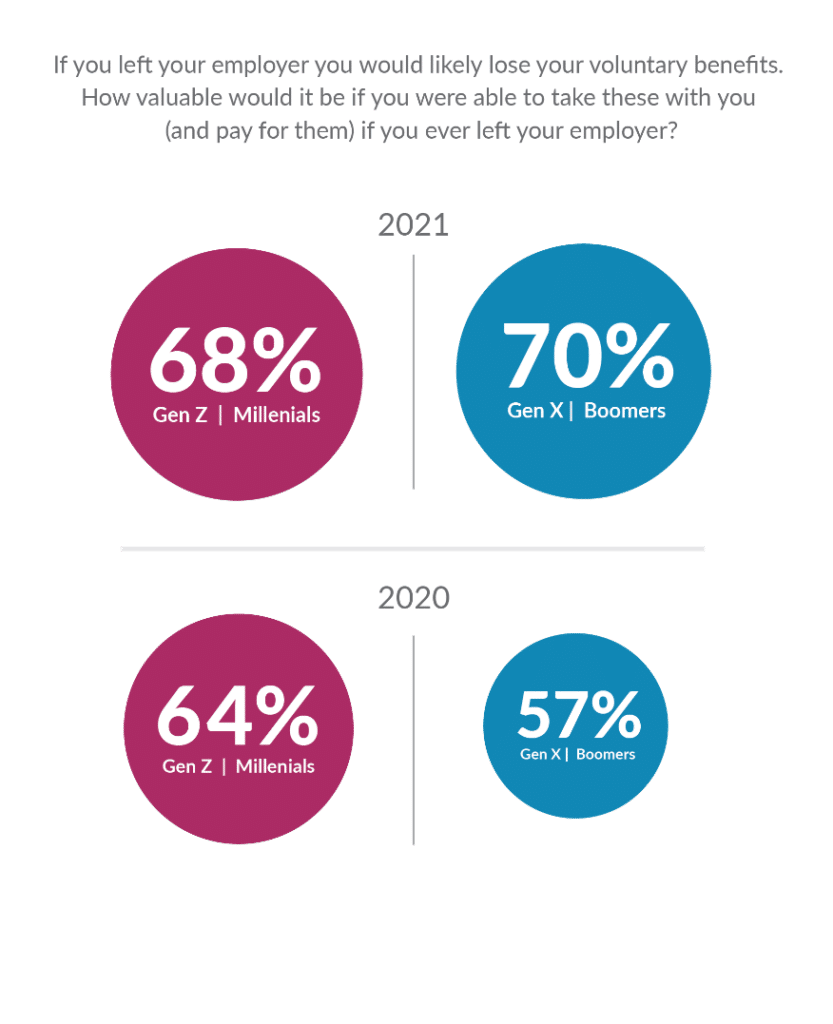

Seize the future

Seize the future