For much of 2020, news media speculated about a potential epidemic of suicides as a result of the stressors and social strains related to the pandemic. For those of us in the work of suicide prevention, we urged for more conservative coverage. Why? Because we know that sensationalized media coverage around the topic of suicide runs the risk of developing what we call a cultural script.

Some journalists—unknowingly or intentionally—report in ways that, research has shown, increase suicide risk. Many elements of their reporting—romanticizing, glamorizing, gratuitously detailing the means of death or depicting the death scene—are considered unsafe reporting practices and have been shown to contribute to an uptick in suicide attempts and deaths in the days and weeks following a celebrity's suicide. Some media outlets do outstanding work reporting these newsworthy events with sensitivity. They follow practices that can help people find hope and link to life-saving resources like the National Suicide Prevention Lifeline.

Decades of research summarized in the Suicide Prevention Resource Center safe messaging reference guide encourage those giving public communications about suicide to follow these suggestions:

- Portray help-seeking as a reasonable action.

- Provide resources people can use for support.

- Give people who are willing to help others something to do.

- While you may want to communicate the importance of the issue, be careful not to normalize suicide.

- Emphasize that suicide can be prevented.

- Help distressed individuals to feel competent that they can do what needs to be done.

- Avoid giving very specific details of the tragedy.

The Power of Words

Language matters when discussing issues of suicide. Language reflects our attitudes and influences our attitudes and the attitudes of others. Words have power. Words matter. The language we choose is an indicator of social injustice and has the power to shape our ideas and feelings in insidious ways.

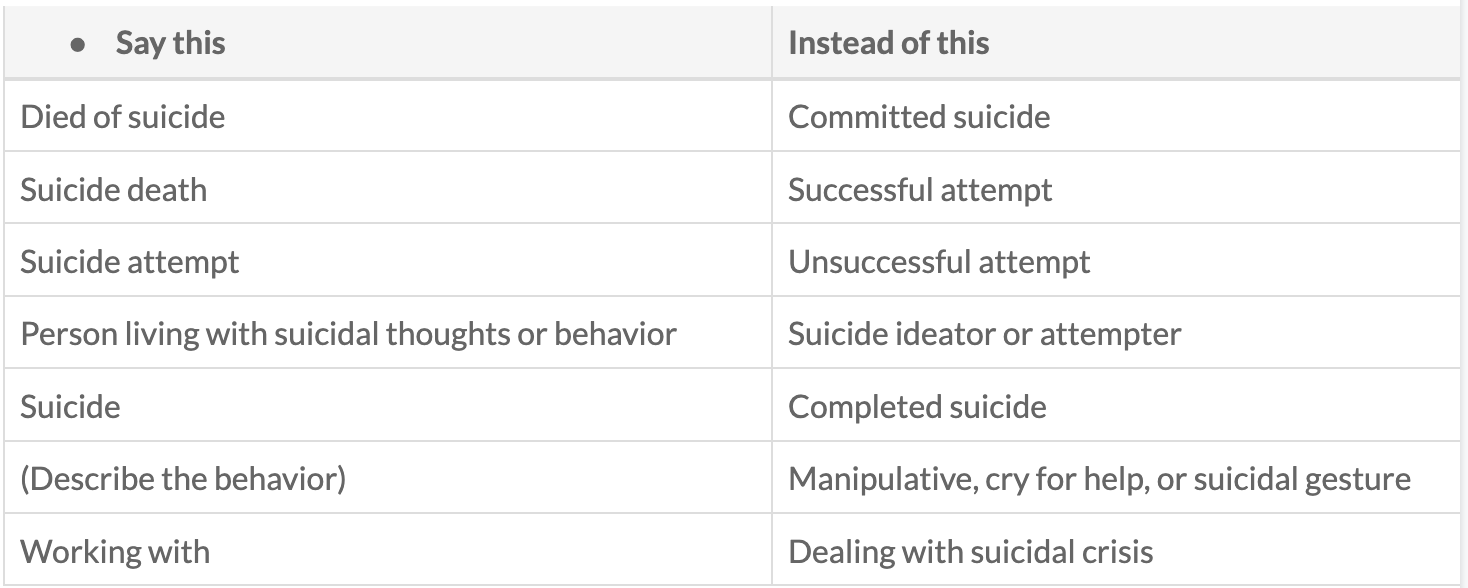

Phrases to Describe Suicide

For example, the phrase "committed suicide" is frowned on because it harks back to an era when suicide was considered a sin or a crime. Think about the times when we use the word "commit": "commit adultery" or "commit murder." Similarly, "successful suicide" or "unsuccessful attempt" are considered poor choices because they connote an achievement or something positive even though they result in tragic outcomes.

See also: What Is 988? Future of Crisis Services

Putting People First

Likewise, using "suicide" as a noun to describe a person ("the suicide was wheeled into the morgue") is considered dehumanizing and reductionist. When we identify a person solely by his or her mental illness ("They are bipolar"), we diminish that individual's wholeness. We wouldn't say, "They were a heart attack." Instead, we need to define a person by their life, not the manner of death, and say, "They were a person who died of suicide. They also loved to play golf, brew beer and climb mountains." Or: "They are a teacher, writer and animal lover who lives with a bipolar condition." Let's put people first and focus on their resilience. Instead of "suicide attempter," we can say "they are a person who has lived through a suicide attempt."

The litmus test for talking about suicide is to substitute the word "cancer" for the word "suicide" to see if the sentence still makes sense or if it has a negative connotation. We wouldn't say "committed cancer" or "successful cancer." We would simply say "cancer death" or "died of cancer." Thus, when it comes to suicide, we should say "suicide death" or "died of suicide."

We should also be wary of assuming intent when we use the phrases "cry for help" or "suicide gesture." This line of thinking can be a slippery slope. Instead of dismissing these suicidal behaviors as not serious, we should lean in and better understand what function they are serving in a person's life. Perhaps, we can get that need met in another way.

"Suicide Is Selfish"

In his book Myths about Suicide, Dr. Thomas Joiner goes to great lengths to dispute this common narrative of suicide as a selfish act. While it may appear that those who die of suicide are not taking into consideration the impact that their death will have on loved ones, there is much evidence to the contrary. The mind of a suicidal person is distorted and often holds the belief that he or she will be lessening their burden on loved ones by no longer being around. Avoid using this type of storyline.

"It Was Their Choice"

The idea of choice or free will is often discouraged when talking about suicide because thinking is often very impaired at the time of death. Sometimes, individuals in the throes of unimaginable emotional pain are not entirely capable of making a rational decision because their depression, addiction or other mental health condition often prevents them from generating alternative solutions to their problems. Many people I have interviewed who have survived an intense suicide crisis report that they experienced something akin to command hallucinations right before they attempted—voices inside their heads telling them to kill themselves.

At an American Association of Suicidology conference, Donna Schuurman challenged the audience to look up definitions of suicide. So, I did. Merriam-Webster defines it as "the act or an instance of taking one's own life voluntarily and intentionally."

The concept of choice is confusing because, while we never have direct access to the inner workings of a mind of someone who has died by suicide, there is much evidence that the thought processes are often gravely disordered by the effects of trauma, mental health conditions and substance abuse. If a person can't choose rationally due to impairment of the mind, the decision is not a choice.

The concept of choice is especially confusing to those bereaved by suicide. On the one hand, survivors of suicide loss who tried to keep their loved ones alive over time find the notion comforting. Even though they did all they could to prolong life, the final "decision" ultimately rested with the suicidal individual. On the other hand, survivors of suicide loss sometimes cannot fathom why their loved ones would choose death over love or the possibility of a better life.

Getting Positive Messages Out There: Hope, Strength and Healing

A few passionate resilience advocates can only go so far in changing the culture of mental health promotion and suicide prevention. We need workplaces, schools, faith communities and healthcare systems to model safe and compassionate language to help challenge existing misinformation and myths. We must learn to disseminate our messages to large numbers of people effectively. To do this, we need to craft safe and powerful messages, work collaboratively with traditional media outlets and use social media strategically.

Crafting Effective Messages about Suicide: Hope Is the Antidote

Suicide prevention is a hard sell. As a result, well-meaning health professionals often make serious errors when crafting messages for suicide prevention. We have a tendency to think that we need to grab the public's attention through graphic and scary messages when that just tends to turn people off. Instead, we need to think about aligning with our audience's beliefs, values, priorities and needs. We must craft messages that are engaging, provide people with the information we want them to remember and give them action steps.

Instead of just raising awareness by sharing statistics of suicide death, we can inspire hope by sharing stories of recovery and letting people know that help is available. Kevin Hines's story is one that spreads a ripple of hope around the world. He survived a jump off the Golden Gate Bridge, and his BuzzFeed video now has over 8 million views on YouTube. His main message: You are not alone, and brain health is possible. He is a fierce advocate for mental wellness and lives his message of fighting for a passion for life every day.

See also: Workplaces Coping With Suicide Trauma

Another positive media campaign, developed by the National Suicide Prevention Lifeline encourages everyone to #BeThe1To to take action to prevent suicide. The campaign is designed to be adapted to many different communities to help them move from awareness to prevention—because no one should die in isolation and despair.

We must talk about suicide if we are going to get in front of it. But HOW we talk about suicide matters. Unsafe messages and data that leaves us feeling that "suicide is an epidemic" can create harm. Instead, let's focus on messages and stories that inspire hope and healing and share resources that help people through their despair.

Opinions expressed in Expert Commentary articles are those of the author and are not necessarily held by the author's employer or IRMI. Expert Commentary articles and other IRMI Online content do not purport to provide legal, accounting or other professional advice or opinion. If such advice is needed, consult with your attorney, accountant or other qualified adviser.