|

|

The basic idea for the Internet of Things goes at least back to 1982, when a vending machine at Carnegie Mellon University was hooked up to an early version of the internet so it could report on its inventory and on whether the recently loaded sodas were cold. Networks of sensors began to show up in the insurance industry some 15 years ago via telematics in automobiles and are now showing up in every line of insurance. With billions of devices now connected and tens of billions expected to be connected to the internet soon, ITL Editor-in-Chief Paul Carroll chatted about the IoT’s implications with Sean Ringsted, an executive vice president at Chubb, who is both the chief risk officer and the chief digital business officer. A lightly edited version follows. |

ITL:

The IoT has been building momentum for years now. How far have we come?

Sean Ringsted:

The IoT is very exciting. It creates this value proposition where you can go beyond the “repair and replace” model for insurance and get to “predict and prevent” because you have so much information available to you in real time, not just after the fact.

When you think about fire, everybody knows the value of smoke alarms. Now think about water. You can use sensors to detect and manage water leaks in the same way. And they’re a major contributor of loss rate in buildings, both in frequency and in severity. It’s not just the cost, either. It’s all the headaches that go along with water damage that can be prevented. You don’t have to get new carpet, worry about mold, deal with the loss of business income. The value proposition is much less about claim payment and is much more service-driven, to prevent the loss.

You're starting to see applications for worksites. IoT devices can improve safety for workers on degree of bend and lifting heavy objects. Think about sensitive or valuable machinery that you can monitor for temperature and vibration and make sure they’re well-functioning.

Just the ability to monitor temperature fluctuations and humidity can have a significant bearing on the value of something such as marine cargo or fine art.

ITL:

In an interview a couple of years ago, you listed a number of industries where you saw potential for the IoT: financial services, education, real estate, transportation, life science, hospitals, construction and manufacturing. Would you walk us through some of those opportunities?

Ringsted:

Imagine you’re managing a property covering thousands and thousands of square feet. Someone will have to walk the property frequently, because problems happen at random times. Even if you know there’s some sort of problem, you still have to manually inspect to figure out where it originated. And maybe you have to do that in the dark. Now imagine all the work you save by having IoT sensors that not only tell you when you have a problem but tell you where it is.

We had a great example at a large public library with buildings spread through several towns. They installed our water and temperature IoT sensors on top of bookshelves, zip-tied to the boilers, pumps, hot water heaters and so on.

You know where this is going: water. Water and books are not a great combination, right? A defective sprinkler head started leaking, and of course it was in the middle of the night, so the damage would have been significant by the time anyone found the problem. But a sensor picked up the leak, sent a notification to a smartphone and got someone to the building quickly. They knew exactly where the problem was, without having needed to have someone continually inspecting every building.

And go back to what I was saying earlier. The issue isn’t just the financial aspect. Yes, they’d get the monetary value after the damage, but you may not get the books back, especially the valuable ones.

Now go to a horse racetrack. It had installed our sensors in a refrigeration unit at a restaurant that picked up temperature fluctuations that indicated the unit was failing. This time, the problem occurred on a day off, so a lot of food could have spoiled by the time anyone noticed. The sensors prevented that loss -- and headed off what could have been a big mess in the restaurant.

Another example is the roof hatches right above the pediatric unit at a hospital. Sensors detected three leaks, one of them above an electrical panel. Imagine the problems if water had gotten into electrical outlets.

We put the IoT devices in theaters on Broadway to protect high-value equipment. We put them in wine cellars.

So you start to get a real sense of the spread of potential uses – with the common thread being prevention. If you prevent something small from developing into something big, that’s fantastic.

ITL:

I’ve heard people talk for a while about what they call the Internet of Me – based on sensors on our wrists in our FitBits or Apple watches, maybe with slim cuffs that continually measure blood pressure, with perhaps contact lenses that constantly monitor blood sugar and even with sensors the size of a grain of rice that we ingest and that can measure all sorts of blood levels. Do you see much potential there?

Ringsted:

I think the promise is very cool. Look at the need and at the cost of healthcare. Anything you can do in the way of preventative health assessments is a good thing. Maybe your Apple watch picks up an irregularity in your heartbeat and you go see a doctor.

Sensors that monitor us could also encourage us to live healthier lifestyles. Maybe we insurers can provide incentives.

For example, Chubb’s LifeBalance app is a virtual coach that is available in Korea, Thailand, Hong Kong and Indonesia. It’s up to customers to decide how to set this up and tailor it, but it provides a pretty holistic view of their health. They can track their activities, their sleep and their diet and get feedback in terms of scores and incentives. We've had a couple of examples where the app has picked up health issues, and customers have gone to get medical help.

I think IoT really can lead the way on healthcare.

ITL:

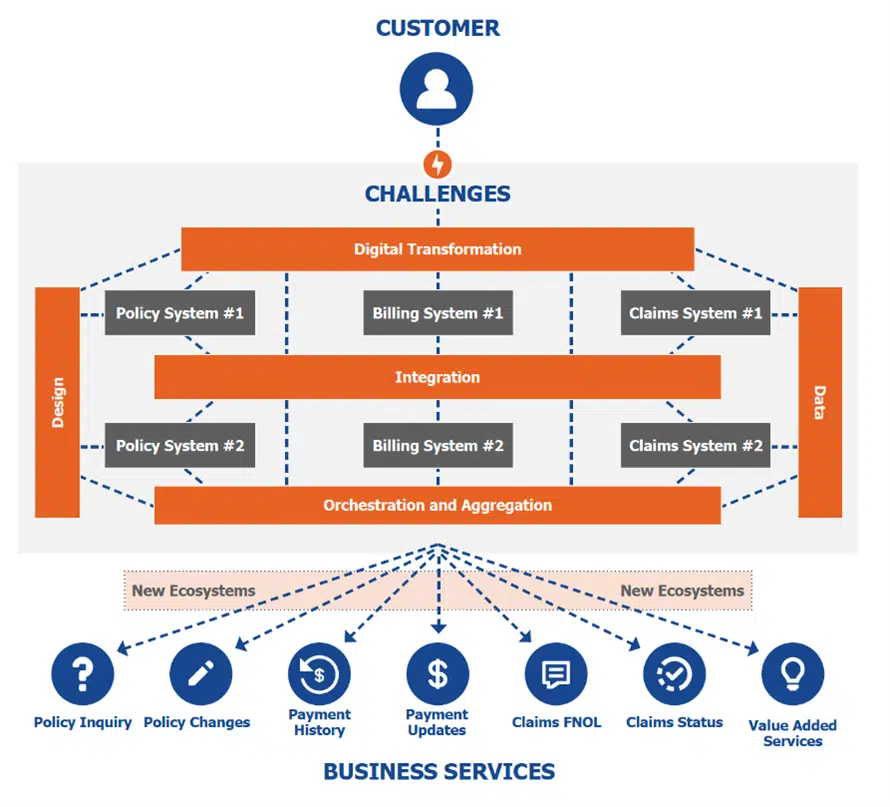

When people think about the IoT, a lot of them think about all the devices, but you have described the IoT as really an architecture. I think that’s the right way to think about it, because the devices don’t do you any good unless you have the right way to communicate from that water sensor in the library to the person in the middle of the night, or to a shutoff valve or whatever. Where are we in terms of building out the architecture, and where does it go from here?

Ringsted:

We're early days in terms of developing IoT architecture. You need interoperability between devices, networks and connection points. You also need to be able to maintain data security, especially for the sort of sensitive data we were just talking about. We spend a lot of time with our clients when we're installing these devices, making sure we're not compromising their perimeter. Any erosion of cybersecurity or privacy would damage reputations, so we have to get this right.

You have to think about how you’re going to capture the data, where you’re going to store it, how you’re going to aggregate it – and you have to be able to aggregate it at scale. So, we have a ways to go, but we’ll start small and be able to build out the IoT architecture, figuring it out along the way.

ITL:

I assume this will all get easier, certainly the ROI will increase, as more of these sensors and shutoff valves and so forth get built into buildings and machinery rather than being retrofitted. If so, how quickly do you see the economics changing?

Ringsted:

I think we’ve proven to ourselves that the ROI is already clear, and more and more of our clients are seeing that as we get more use cases to share. They don’t just prevent losses – and all the disruption that comes with them -- but save on manual inspection processes.

The argument is already compelling, and the prospects for the future are incredibly exciting.