Geopolitical unrest, inflationary pressure, supply chain disruption, and natural disasters. What does this mean? It means the insurance industry is in polycrisis. However, none of this is new to the industry. What is new is the sheer volume of information and noise the industry is bombarded with daily. This distorted signal-to-noise ratio is making risks feel bigger, newer, and more threatening than they may be.

During insurtech Send's INFUSE webinar, I had the opportunity to share my thoughts about the current polycrisis in the insurance industry. While my fellow panelists called for a unique approach and deeper partnerships with brokers to handle connected risks, I challenged conventional thinking about risk in 2025.

Is there a polycrisis, or is it just a perception?

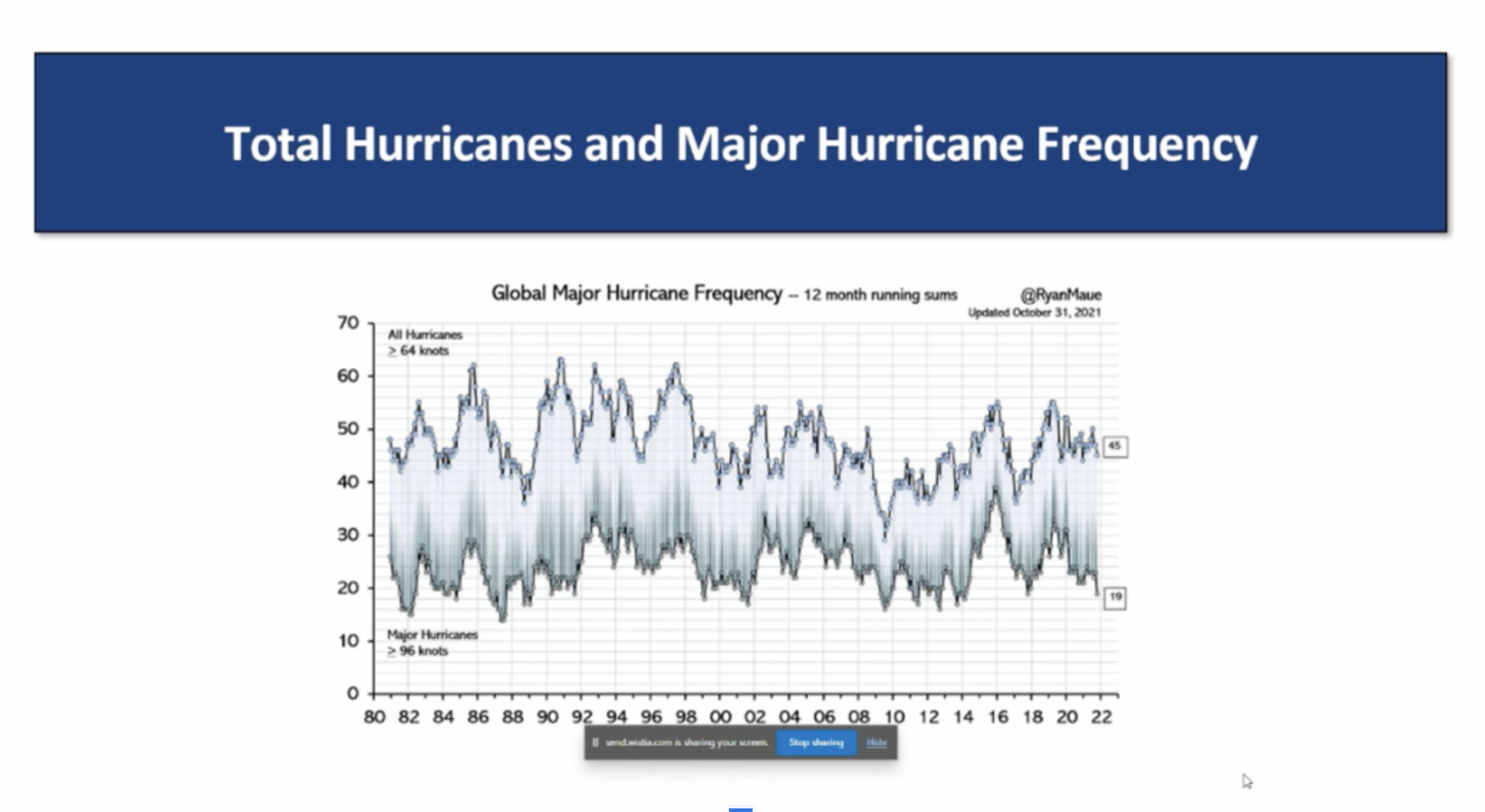

There is no denying that we are seeing a severe increase in connected risks. However, the term "polycrisis" doesn't need to be intimidating to a world that feels increasingly uncertain. We've been here before, just not with the same amplification. Climate, inflation, and supply chain risks have always been part of our industry's history. What has changed is the velocity of news cycles and the way anxiety spreads faster than fact. During the webinar, I presented data on hurricane frequency. The diagram below shows no significant rise in hurricanes over time, even as public perception suggests otherwise. This is why, for insurers, panic doesn't help; perspective does.

Innovation is critical; so is discipline

Still, we cannot ignore today's connected risks. They are complex and always evolving, and industry should, too, in response. Innovation is critical. My fellow panelist Neal Croft suggested that insurers must embrace continuous, real-time underwriting powered by high-quality data, scenario modeling, and adaptive decision-making tools. While I agree, I also believe we should be cautious not to discard the fundamentals of underwriting for the sake of transformation. Before we declare traditional models obsolete, we must ask ourselves: Are they truly broken, or are we not using them properly in a modern context?

Crisis in insurance means new opportunities

At Cross Cover, we've seen firsthand that elevated risk creates need, need creates innovation, and innovation creates business. Many of the most resilient and profitable firms I've encountered were born or transformed during turbulent periods.

Today's polycrisis is no different. Whether it's using parametric products to close protection gaps, deploying smarter data to assess climate risk, or simply partnering more deeply with brokers and clients, there is no shortage of ways to turn complexity into commercial advantage.

Filtering Out the Noise

As we discussed during the INFUSE webinar, the biggest risk isn't complexity; it's losing our grip on what's noise versus what's a true signal. We must:

- Challenge narratives that push fear instead of facts.

- Check our biases when reviewing risk data.

- Tune out the noise and focus on actionable signals.

Markets are resilient. So are insurers. Our job isn't to predict the next crisis perfectly; it's to respond with clarity, courage, and composure when it arrives. There's no doubt the insurance industry is standing at an inflection point. But we don't need to overreact. We need to recalibrate. Yes, embrace innovation. Yes, evolve underwriting. But do it with a clear head. We're not new to crises; we're built for them. Let's never forget that.