This article is the first in a series on key forces shaping the insurance industry.

Trend #1: In the future, insurance will be bought, sold, underwritten and serviced in a fundamentally different way, and that creates opportunities for industry leaders and problems for industry laggards.

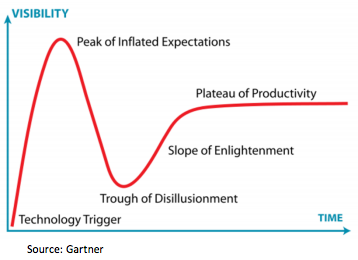

We are still in the initial stages of what Gartner terms the Hype Cycle, with an ever-increasing amount of noise and expectation without clear impact and results.

Have we reached the peak of inflated expectations? We expect not. Certainly, valuations continue to rise with relatively new businesses still at the effectively pre-revenue stage commanding valuations in the tens of millions. Hard to justify on any fundamental level.

However, at the core of insurtech, we continue to see a huge opportunity to innovate in a sector that is ripe for change – lack of customer engagement, lack of customer trust, outdated and legacy infrastructure combined with traditional and unpopular products all highlight the need for change and the underlying potential.

Ignore Insurtech at Your Own Risk

Eos has talked with dozens of insurance companies, and there is a wide range of responses from the insurance community about when, where, if and how to engage with insurtech.

The top insurance companies have, for the most part, followed a two-phased approach combining an innovation team with a corporate venture initiative. These carriers see the impending disruption clearly and want to be able to shape and influence the impact. The results so far have been mixed, as some large incumbents have found it difficult to circumvent legacy mindsets, governance, organizational structures and technology.

See also: 10 Trends at Heart of Insurtech Revolution

Other carriers have yet to agree/settle on an approach to deal with these disruptive forces.

Eos calculates that the impact of insurtech is at least 40% to the average carrier. We calculate that by looking at a 20% upside, and a 20% downside scenario:

On a conservative basis, insurers may risk losing at least 20% of their business to disruption. On the flip side, for those that embrace innovation there is an opportunity to grow their business by 20%.

Stated another way, the net present value (NPV) of insurtech is $100 million for every $1 billion of premium on the downside and $285 million on the upside, assuming a top-line and profitability improvement.

Timing is also key, as the scale of adoption and impact is not linear. The upside opportunity by investing now in the right opportunities is likely to give an insurer a lead that others can’t catch --- essentially a “first-mover” advantage. At the same time, the lost opportunity by delaying is exponential, not linear.

There are many ways to create and capture value

The positive momentum is further driven by the growth of insurtech into all areas of the value chain and across multiple product lines. We see two broad types of innovator: the "enabler" and the "disruptor."

The enabler is a business that significantly improves an existing part of the value chain driving efficiency, improved customer satisfaction or better customer outcomes. A great example is RightIndem, which is transforming the claims process by creating an end-to-end, customer-managed claims process.

The disruptor is a business that has developed a new approach to fulfilling part, or all, of the value chain. This is illustrated by Insure A Thing, an insurtech startup that has created a way of providing insurance without the need for an upfront premium.

On face value, the disruptors may appear more exciting, but the enablers perhaps better illustrate the underlying potential of insurtech, as there are an abundance of opportunities for most insurance companies to hit "the low-hanging fruit" and do things better, more cheaply and more aligned with the customer.

Insurtech is not an overnight revolution, and there are many ways to create and capture value that combine different elements of the above, for example:

- Low-hanging fruit -- these are mostly your enablers,

- True differentiators -- a combination of enablers and disruptors

- Measured bets for the future -- all pure disruptors

At Eos, we continue to adapt and evolve our investment strategy to take advantage of these opportunities, with an initial focus on our three core platforms:

- Digital distribution

- Frictionless claims

- Artificial intelligence for risk selection, underwriting, pricing and capital optimization

All of the above underpin our first trend and belief that the future of insurance will look very different than today, with all areas of the value chain from distribution, underwriting, products, claims and customer engagement changing fundamentally:

- Bought differently: As asset ownership (cars, homes, etc.) mobility and crossborder employment evolve with the shared economy, insurance covers (at least personal lines initially) will be bought on a just-in-time, on-demand, needs basis. Greater information transparency on the buyer and seller side will enable direct interaction with lower cost of intermediation/brokerage. We see this starting with simpler personal line covers and gradually evolving to more complex risks.

- Sold differently: Insurance will be quoted, bound and issued at points of transaction/sales/service enabled by ubiquitous IoT, telematics and external data availability. Selling will become increasingly distributed and linked to companies with strong customer engagement across both B2C and B2B sectors.

- Serviced differently: End consumers will choose how to be serviced and made whole via a channel, time and a manner of their choice. Servicing, especially claims, will focus on "delivering on the customer promise" as an integral part of the policy.

See also: Industry Trends for 2017

We hope you enjoy these insights, and look forward to collaborating with you as we create a new insurance future.

Next article in the series: Trend #2: “External data and contextual information will become increasingly more important than historical internal data for predicting risk and pricing.”

This article was written by Sam Evans, Carl Bauer-Schlichtegroll and Jonathan Kalman.

Have we reached the peak of inflated expectations? We expect not. Certainly, valuations continue to rise with relatively new businesses still at the effectively pre-revenue stage commanding valuations in the tens of millions. Hard to justify on any fundamental level.

However, at the core of insurtech, we continue to see a huge opportunity to innovate in a sector that is ripe for change – lack of customer engagement, lack of customer trust, outdated and legacy infrastructure combined with traditional and unpopular products all highlight the need for change and the underlying potential.

Ignore Insurtech at Your Own Risk

Eos has talked with dozens of insurance companies, and there is a wide range of responses from the insurance community about when, where, if and how to engage with insurtech.

The top insurance companies have, for the most part, followed a two-phased approach combining an innovation team with a corporate venture initiative. These carriers see the impending disruption clearly and want to be able to shape and influence the impact. The results so far have been mixed, as some large incumbents have found it difficult to circumvent legacy mindsets, governance, organizational structures and technology.

See also: 10 Trends at Heart of Insurtech Revolution

Other carriers have yet to agree/settle on an approach to deal with these disruptive forces.

Eos calculates that the impact of insurtech is at least 40% to the average carrier. We calculate that by looking at a 20% upside, and a 20% downside scenario:

On a conservative basis, insurers may risk losing at least 20% of their business to disruption. On the flip side, for those that embrace innovation there is an opportunity to grow their business by 20%.

Stated another way, the net present value (NPV) of insurtech is $100 million for every $1 billion of premium on the downside and $285 million on the upside, assuming a top-line and profitability improvement.

Timing is also key, as the scale of adoption and impact is not linear. The upside opportunity by investing now in the right opportunities is likely to give an insurer a lead that others can’t catch --- essentially a “first-mover” advantage. At the same time, the lost opportunity by delaying is exponential, not linear.

There are many ways to create and capture value

The positive momentum is further driven by the growth of insurtech into all areas of the value chain and across multiple product lines. We see two broad types of innovator: the "enabler" and the "disruptor."

The enabler is a business that significantly improves an existing part of the value chain driving efficiency, improved customer satisfaction or better customer outcomes. A great example is RightIndem, which is transforming the claims process by creating an end-to-end, customer-managed claims process.

The disruptor is a business that has developed a new approach to fulfilling part, or all, of the value chain. This is illustrated by Insure A Thing, an insurtech startup that has created a way of providing insurance without the need for an upfront premium.

On face value, the disruptors may appear more exciting, but the enablers perhaps better illustrate the underlying potential of insurtech, as there are an abundance of opportunities for most insurance companies to hit "the low-hanging fruit" and do things better, more cheaply and more aligned with the customer.

Insurtech is not an overnight revolution, and there are many ways to create and capture value that combine different elements of the above, for example:

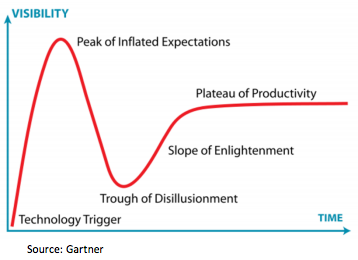

Have we reached the peak of inflated expectations? We expect not. Certainly, valuations continue to rise with relatively new businesses still at the effectively pre-revenue stage commanding valuations in the tens of millions. Hard to justify on any fundamental level.

However, at the core of insurtech, we continue to see a huge opportunity to innovate in a sector that is ripe for change – lack of customer engagement, lack of customer trust, outdated and legacy infrastructure combined with traditional and unpopular products all highlight the need for change and the underlying potential.

Ignore Insurtech at Your Own Risk

Eos has talked with dozens of insurance companies, and there is a wide range of responses from the insurance community about when, where, if and how to engage with insurtech.

The top insurance companies have, for the most part, followed a two-phased approach combining an innovation team with a corporate venture initiative. These carriers see the impending disruption clearly and want to be able to shape and influence the impact. The results so far have been mixed, as some large incumbents have found it difficult to circumvent legacy mindsets, governance, organizational structures and technology.

See also: 10 Trends at Heart of Insurtech Revolution

Other carriers have yet to agree/settle on an approach to deal with these disruptive forces.

Eos calculates that the impact of insurtech is at least 40% to the average carrier. We calculate that by looking at a 20% upside, and a 20% downside scenario:

On a conservative basis, insurers may risk losing at least 20% of their business to disruption. On the flip side, for those that embrace innovation there is an opportunity to grow their business by 20%.

Stated another way, the net present value (NPV) of insurtech is $100 million for every $1 billion of premium on the downside and $285 million on the upside, assuming a top-line and profitability improvement.

Timing is also key, as the scale of adoption and impact is not linear. The upside opportunity by investing now in the right opportunities is likely to give an insurer a lead that others can’t catch --- essentially a “first-mover” advantage. At the same time, the lost opportunity by delaying is exponential, not linear.

There are many ways to create and capture value

The positive momentum is further driven by the growth of insurtech into all areas of the value chain and across multiple product lines. We see two broad types of innovator: the "enabler" and the "disruptor."

The enabler is a business that significantly improves an existing part of the value chain driving efficiency, improved customer satisfaction or better customer outcomes. A great example is RightIndem, which is transforming the claims process by creating an end-to-end, customer-managed claims process.

The disruptor is a business that has developed a new approach to fulfilling part, or all, of the value chain. This is illustrated by Insure A Thing, an insurtech startup that has created a way of providing insurance without the need for an upfront premium.

On face value, the disruptors may appear more exciting, but the enablers perhaps better illustrate the underlying potential of insurtech, as there are an abundance of opportunities for most insurance companies to hit "the low-hanging fruit" and do things better, more cheaply and more aligned with the customer.

Insurtech is not an overnight revolution, and there are many ways to create and capture value that combine different elements of the above, for example: