The timing was excellent – or unfortunate – depending on your perspective. Just a week before South Korean President, Moon Jae-in, jets to Washington to talk DPRK denuclearization,

it was reported that a South Korean oil tanker had been detained.

The P PIONEER – the first local vessel seized by South Korean authorities — is

among four detained by Seoul. All are suspected of violating United Nations sanctions on fuel shipments to North Korea.

Just last month, the UN Security Council (which uses Windward technology)

published its latest report on North Korea. It laid out in graphic detail Pyongyang’s evolving tactics in evading sanctions, and the maritime compliance risk faced by anyone connected – however unwittingly – to vessels engaged in this kind of activity.

THE P PIONEER

According to reports, the P PIONEER was detained last October on suspicion of shipping oil to North Korea via clandestine ship-to-ship transfers and is “an indicator of the increasing pressure the U.S. is exerting on foreign governments and businesses to crack down on North Korean sanctions evasion,” according to

Tahlia Townsend and

Joseph Grasso, who head the International Trade Compliance and Insurance Practice Group at U.S. law firm Wiggin and Dana.

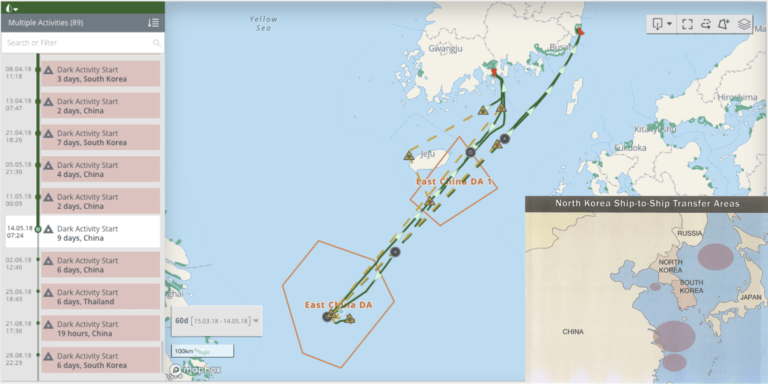

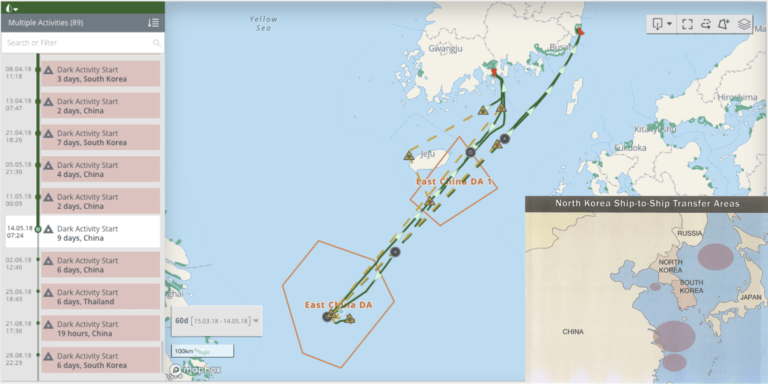

A Windward analysis of the vessel’s behavior in the 12 months leading up to its detention reveals a pattern of dark activities in several parts of the East China Sea. In total, we detected 13 separate occasions when this happened – the kind of deceptive shipping practices routinely employed by North Korea, as highlighted by an updated advisory

published last month by the U.S. Treasury’s Office of Foreign Assets Control. During our analysis, another notable pattern of behavior emerged: In the 12 months before it was detained, the P PIONEER

only visited ports in South Korea. In other words, every voyage the vessel undertook

began and

ended in South Korea.

Map showing polygons (areas) linked to possible clandestine oil transhipments to North Korea. Source: OFAC, UN.

See also: Can Insurers Stop Financial Crimes? Yes

Searching in the dark

Map showing polygons (areas) linked to possible clandestine oil transhipments to North Korea. Source: OFAC, UN.

See also: Can Insurers Stop Financial Crimes? Yes

Searching in the dark

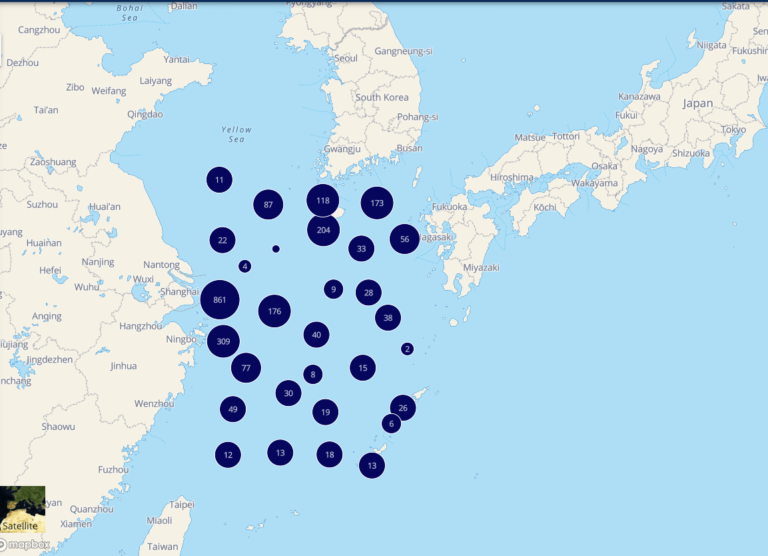

Detecting such behavior just by searching for “dark activity” won’t get you very far. Indeed, if you use this behavior as a proxy for illicit activity in the East China Sea, you’ll end up with a short list of 20,000 vessels during the past 12 months (the East China Sea is notorious for poor AIS coverage, meaning many vessels that “go dark” don’t do so deliberately). Of these, 1,200 were tankers – a number way too big to differentiate between innocent vessels just passing through and those potentially engaged in illicit oil trading with North Korea. If identifying dark activity was all we could do, compliance officers, charged with ensuring vessels they deal with are complying with sanctions, would probably jump overboard.

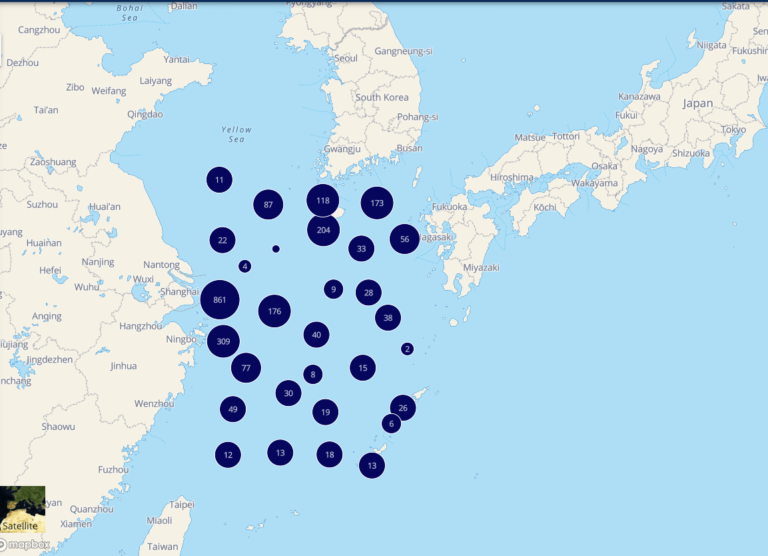

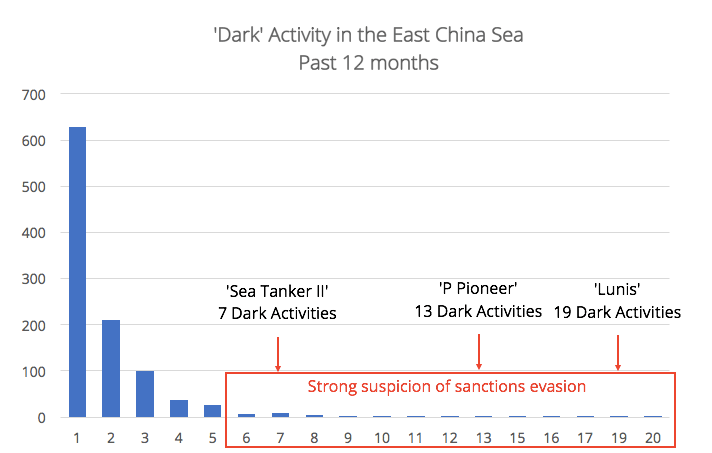

Map showing clusters of Dark Activities by vessels in the East China Sea over the past year

Map showing clusters of Dark Activities by vessels in the East China Sea over the past year

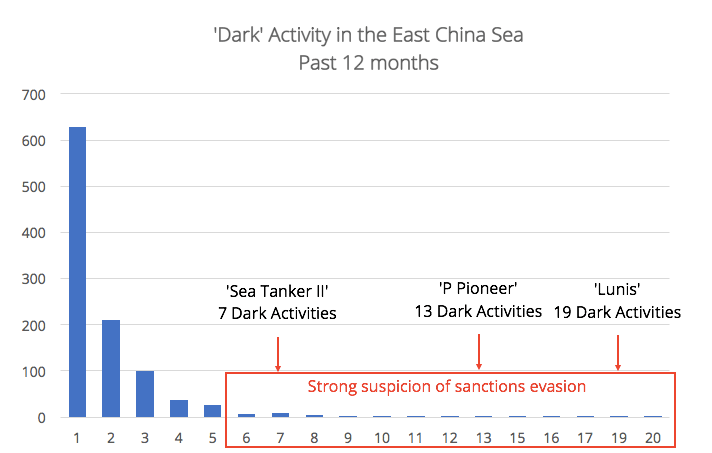

Where we can narrow things down for maritime compliance risk is by looking at how frequently vessels went dark – where it was an integral part of a vessel’s modus operandus. As the chart below shows, most tankers had no more than one dark activity in the area; only 3.5% of them did it more than five times. We can look more closely at repeat offenders, to find those that might be evading sanctions (our algorithms can detect which turn-off-transmissions are due to lack of reception and which due to skulduggery).

Distribution of vessel dark activity, highlighting two additional vessels that were mentioned in the recent OFAC advisory regarding DPRK as possibly being involved in illegal transports of petroleum products.

Behavioral Analysis

Distribution of vessel dark activity, highlighting two additional vessels that were mentioned in the recent OFAC advisory regarding DPRK as possibly being involved in illegal transports of petroleum products.

Behavioral Analysis

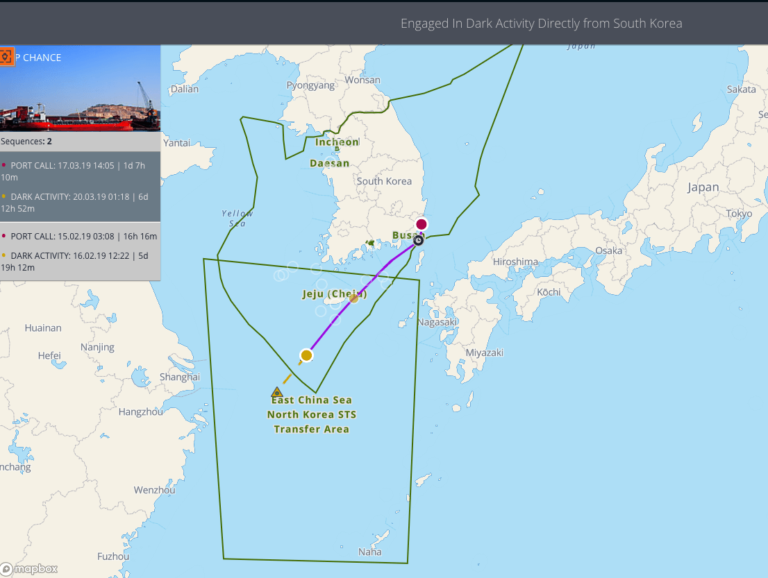

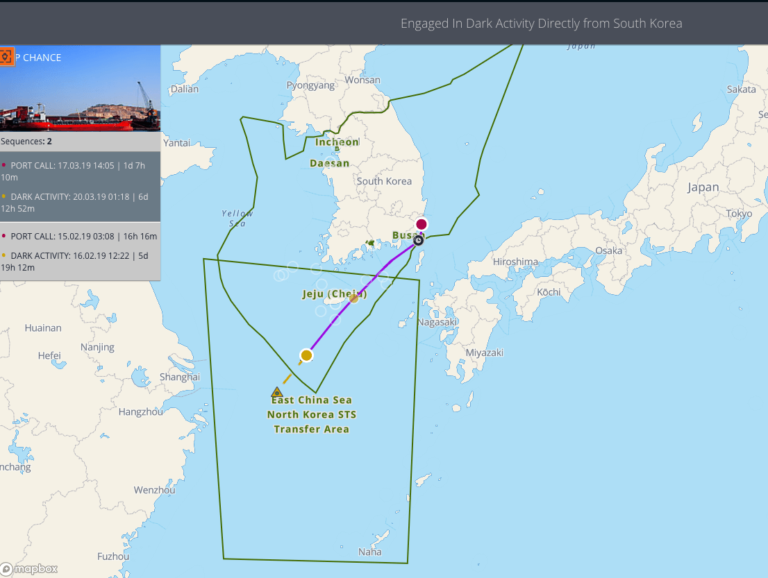

Another way to whittle down the list of potential miscreants is to look at trade patterns. As discussed above, most vessels passing through this area were heading to ports in the region. The P PIONEER’s voyages always started and finished in South Korea (with a dark activity in between), a pattern we see in just 81 other vessels over the past 12 months.

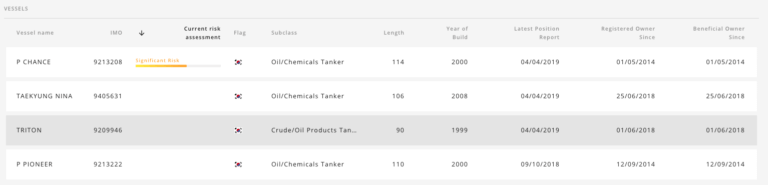

If we narrow our time window to the past 60 days, we find only 17 vessels were engaged in this pattern of behavior – a much more manageable data set. Within those 17, we find one, very interesting, vessel, called the P CHANCE.

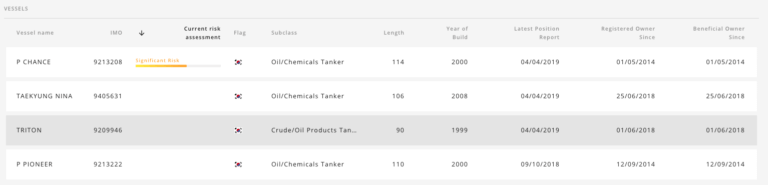

Like the P PIONEER, it’s a tanker; it’s flagged in South Korea; it had 21 dark activities in the region in the past year – including one last month. Oh, and it belongs to the same registered owner (see below).

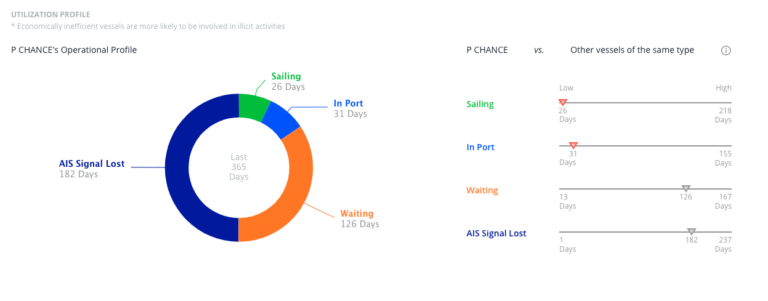

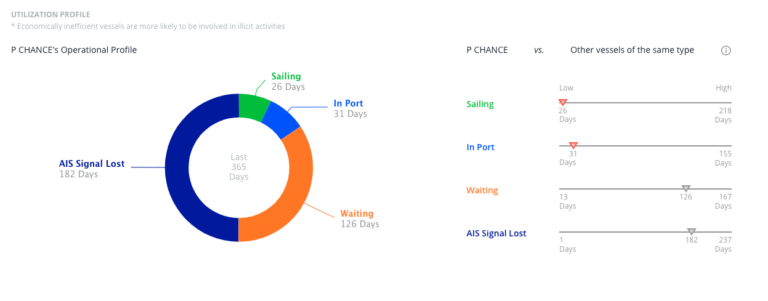

Looking at the P CHANCE’s

economic utilization profile, one can spot the same risk indicators but from a different perspective. With more than 15 dark activities in the East China Sea in 2018, the vessel spent only 31 days in port (compared with 80 days for similar tankers).

See also: Europe’s New Data Breach Requirements

To be sure, this analysis isn’t a smoking gun – it just means that out of the thousands of vessels transiting the East China Sea every month, this vessel stands out, indicating that further investigation may be warranted.

Maritime Compliance Risk

Maritime Compliance Risk

The deceptive shipping practices discussed in this article were once only relevant to intelligence agencies and NGOs that monitored and enforced sanctions. But as we’ve seen in the recent OFAC advisory, and the UN Panel of Experts report, sanctions enforcement is no longer something only bad actors need worry about; counterparty due diligence (CDD) teams in every industry that interacts with shipping now need to up its game considerably. Indeed, when list managers or compliance officers consume data feeds and black lists, the recent OFAC advisory might now require them to prepare and consume a global daily review of dynamic sanctions evasions tactics, to mitigate compliance risk. With the right technology, they can do so – while keeping their businesses running as usual.

Map showing polygons (areas) linked to possible clandestine oil transhipments to North Korea. Source: OFAC, UN.

See also: Can Insurers Stop Financial Crimes? Yes

Searching in the dark

Detecting such behavior just by searching for “dark activity” won’t get you very far. Indeed, if you use this behavior as a proxy for illicit activity in the East China Sea, you’ll end up with a short list of 20,000 vessels during the past 12 months (the East China Sea is notorious for poor AIS coverage, meaning many vessels that “go dark” don’t do so deliberately). Of these, 1,200 were tankers – a number way too big to differentiate between innocent vessels just passing through and those potentially engaged in illicit oil trading with North Korea. If identifying dark activity was all we could do, compliance officers, charged with ensuring vessels they deal with are complying with sanctions, would probably jump overboard.

Map showing polygons (areas) linked to possible clandestine oil transhipments to North Korea. Source: OFAC, UN.

See also: Can Insurers Stop Financial Crimes? Yes

Searching in the dark

Detecting such behavior just by searching for “dark activity” won’t get you very far. Indeed, if you use this behavior as a proxy for illicit activity in the East China Sea, you’ll end up with a short list of 20,000 vessels during the past 12 months (the East China Sea is notorious for poor AIS coverage, meaning many vessels that “go dark” don’t do so deliberately). Of these, 1,200 were tankers – a number way too big to differentiate between innocent vessels just passing through and those potentially engaged in illicit oil trading with North Korea. If identifying dark activity was all we could do, compliance officers, charged with ensuring vessels they deal with are complying with sanctions, would probably jump overboard.

Map showing clusters of Dark Activities by vessels in the East China Sea over the past year

Where we can narrow things down for maritime compliance risk is by looking at how frequently vessels went dark – where it was an integral part of a vessel’s modus operandus. As the chart below shows, most tankers had no more than one dark activity in the area; only 3.5% of them did it more than five times. We can look more closely at repeat offenders, to find those that might be evading sanctions (our algorithms can detect which turn-off-transmissions are due to lack of reception and which due to skulduggery).

Map showing clusters of Dark Activities by vessels in the East China Sea over the past year

Where we can narrow things down for maritime compliance risk is by looking at how frequently vessels went dark – where it was an integral part of a vessel’s modus operandus. As the chart below shows, most tankers had no more than one dark activity in the area; only 3.5% of them did it more than five times. We can look more closely at repeat offenders, to find those that might be evading sanctions (our algorithms can detect which turn-off-transmissions are due to lack of reception and which due to skulduggery).

Distribution of vessel dark activity, highlighting two additional vessels that were mentioned in the recent OFAC advisory regarding DPRK as possibly being involved in illegal transports of petroleum products.

Behavioral Analysis

Another way to whittle down the list of potential miscreants is to look at trade patterns. As discussed above, most vessels passing through this area were heading to ports in the region. The P PIONEER’s voyages always started and finished in South Korea (with a dark activity in between), a pattern we see in just 81 other vessels over the past 12 months.

If we narrow our time window to the past 60 days, we find only 17 vessels were engaged in this pattern of behavior – a much more manageable data set. Within those 17, we find one, very interesting, vessel, called the P CHANCE.

Distribution of vessel dark activity, highlighting two additional vessels that were mentioned in the recent OFAC advisory regarding DPRK as possibly being involved in illegal transports of petroleum products.

Behavioral Analysis

Another way to whittle down the list of potential miscreants is to look at trade patterns. As discussed above, most vessels passing through this area were heading to ports in the region. The P PIONEER’s voyages always started and finished in South Korea (with a dark activity in between), a pattern we see in just 81 other vessels over the past 12 months.

If we narrow our time window to the past 60 days, we find only 17 vessels were engaged in this pattern of behavior – a much more manageable data set. Within those 17, we find one, very interesting, vessel, called the P CHANCE.

Like the P PIONEER, it’s a tanker; it’s flagged in South Korea; it had 21 dark activities in the region in the past year – including one last month. Oh, and it belongs to the same registered owner (see below).

Like the P PIONEER, it’s a tanker; it’s flagged in South Korea; it had 21 dark activities in the region in the past year – including one last month. Oh, and it belongs to the same registered owner (see below).

Looking at the P CHANCE’s economic utilization profile, one can spot the same risk indicators but from a different perspective. With more than 15 dark activities in the East China Sea in 2018, the vessel spent only 31 days in port (compared with 80 days for similar tankers).

See also: Europe’s New Data Breach Requirements

To be sure, this analysis isn’t a smoking gun – it just means that out of the thousands of vessels transiting the East China Sea every month, this vessel stands out, indicating that further investigation may be warranted.

Looking at the P CHANCE’s economic utilization profile, one can spot the same risk indicators but from a different perspective. With more than 15 dark activities in the East China Sea in 2018, the vessel spent only 31 days in port (compared with 80 days for similar tankers).

See also: Europe’s New Data Breach Requirements

To be sure, this analysis isn’t a smoking gun – it just means that out of the thousands of vessels transiting the East China Sea every month, this vessel stands out, indicating that further investigation may be warranted.

Maritime Compliance Risk

The deceptive shipping practices discussed in this article were once only relevant to intelligence agencies and NGOs that monitored and enforced sanctions. But as we’ve seen in the recent OFAC advisory, and the UN Panel of Experts report, sanctions enforcement is no longer something only bad actors need worry about; counterparty due diligence (CDD) teams in every industry that interacts with shipping now need to up its game considerably. Indeed, when list managers or compliance officers consume data feeds and black lists, the recent OFAC advisory might now require them to prepare and consume a global daily review of dynamic sanctions evasions tactics, to mitigate compliance risk. With the right technology, they can do so – while keeping their businesses running as usual.

Maritime Compliance Risk

The deceptive shipping practices discussed in this article were once only relevant to intelligence agencies and NGOs that monitored and enforced sanctions. But as we’ve seen in the recent OFAC advisory, and the UN Panel of Experts report, sanctions enforcement is no longer something only bad actors need worry about; counterparty due diligence (CDD) teams in every industry that interacts with shipping now need to up its game considerably. Indeed, when list managers or compliance officers consume data feeds and black lists, the recent OFAC advisory might now require them to prepare and consume a global daily review of dynamic sanctions evasions tactics, to mitigate compliance risk. With the right technology, they can do so – while keeping their businesses running as usual.