The topic of Industry 4.0 has been discussed at many conferences in recent times. When you talk to participants and colleagues, you quickly realize that everyone associates this buzz phrase with something different. To make matters worse, the term is now used in almost every industry as a synonym for the digitized, automated and connected world, also known as the “smart factory.”

This article discusses the term Industry 4.0 and examines its impact on property insurance.

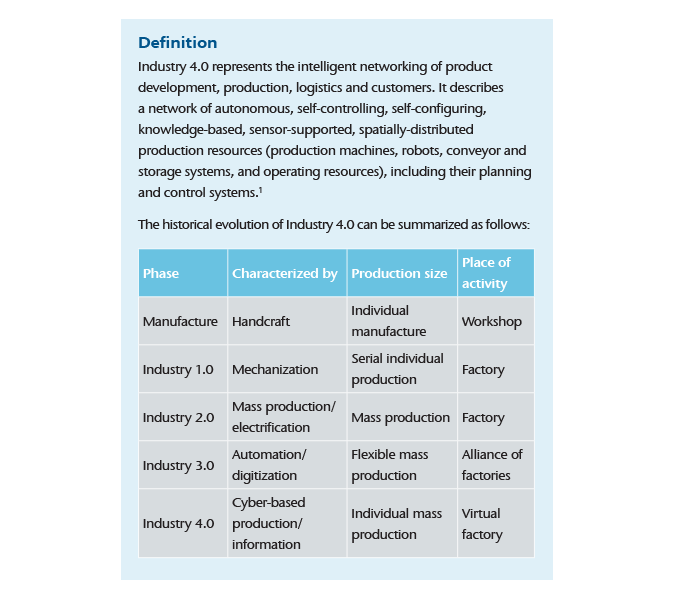

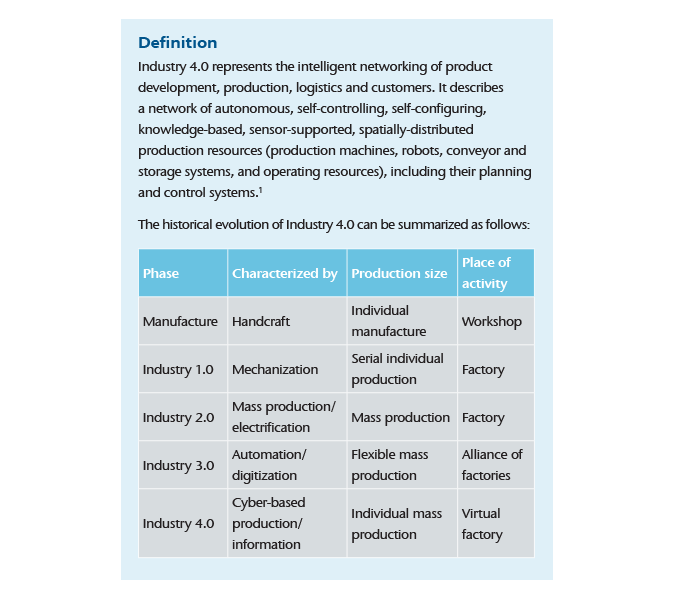

Industry 4.0 is a new level of organization and control over the entire value chain of a product – from idea and design, to flexible production of customized products and delivery to the customer. Customers and business partners are directly involved in the processes.

The term Industry 4.0 is synonymous with a range of available automation, data exchange and manufacturing technologies to increase production flexibility and efficiency/profitability and to advance the value chain conceptually in industrial production and manufacturing. The basic principle is the intelligent networking of machines, workpieces and systems as well as all other business processes along the entire value chain, in which everything is regulated and controlled independently.

The ultimate vision of Industry 4.0 is to create an intelligent factory in which all production and business units, machines and devices communicate with each other – as much as possible without human intervention, but involving both employees and external suppliers.

It should not be forgotten that the term Industry 4.0 is used synonymously for digitized production with the ultimate goal of increasing production at significantly lower costs.

Design principles

The design principles of Industry 4.0 can be summarized as follows:

Design principles

The design principles of Industry 4.0 can be summarized as follows:

Design principles

The design principles of Industry 4.0 can be summarized as follows:

Design principles

The design principles of Industry 4.0 can be summarized as follows:

-

- Networking/interaction: Machines, devices, sensors and people can network with each other and communicate via the Internet of Things, or the Internet of People.

- Information transparency: Sensor data extend information systems of digital factory models to create a virtual image of the real world.

- Decentralization: Cyber-physical systems are able to make independent decisions.

- Real-time decisions: Cyber-physical systems are able to collect and evaluate information and translate it directly into decisions.

- Service orientation: Products and services (of cyber-physical systems, people or smart factories) are offered via the Internet.

- Modularity: Smart factories adapt flexibly to changing requirements by exchanging or extending individual modules.

-

- Availability of relevant information in real time through connectivity of all entities involved in the value chain

- Reliability and stability for critical machine-to-machine (M2M) communication, including very short and stable latency (real time)

- Progress in network technology toward real-time actions

- Need to maintain the integrity of production processes

- Increased vulnerability of the supply chain

- IT security problems

- Data, network, cyber and device security, etc.

- Need to avoid unexpected IT errors that can lead to production downtime

- Protection of industrial know-how

- Lack of adequate skills to drive the Industry 4.0 revolution

- Threat of redundancy problems in the IT department

- Ethical and social impact on society – what would be the impact if a machine were to override the human decision

-

- To simulate plant and machine behavior before conversion and modernization

- To monitor machines set up at customers’ businesses

- To compare production, quality and maintenance data with other machines, and thus increase efficiency and the ability to identify problems – for example, imminent defects – so that repairs can be carried out early and a prolonged production downtime can be prevented

-

- Turning away from burning cost toward risk models

- Developing new loss prevention measures

- Developing artificial intelligence

- Introducing more extensive data analyses and forecast models to mitigate losses before they occur