The idea of risk-sharing

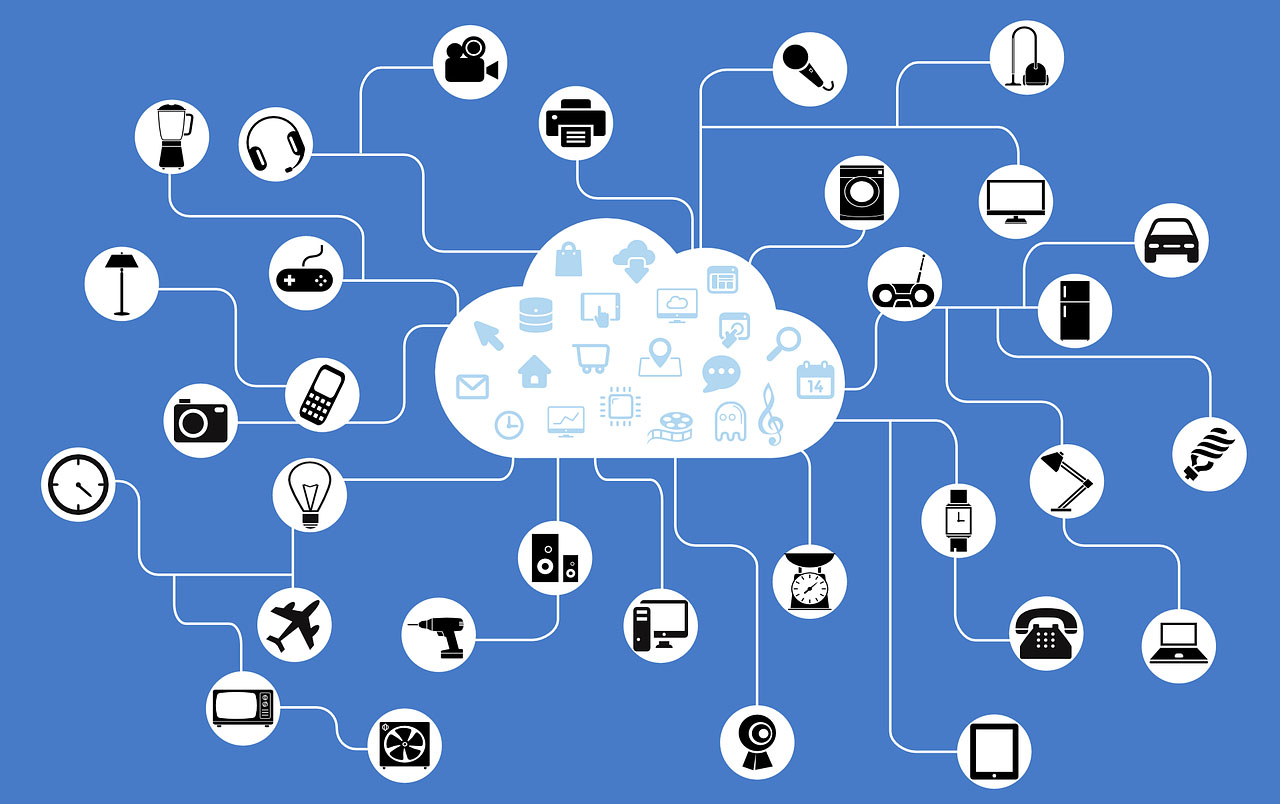

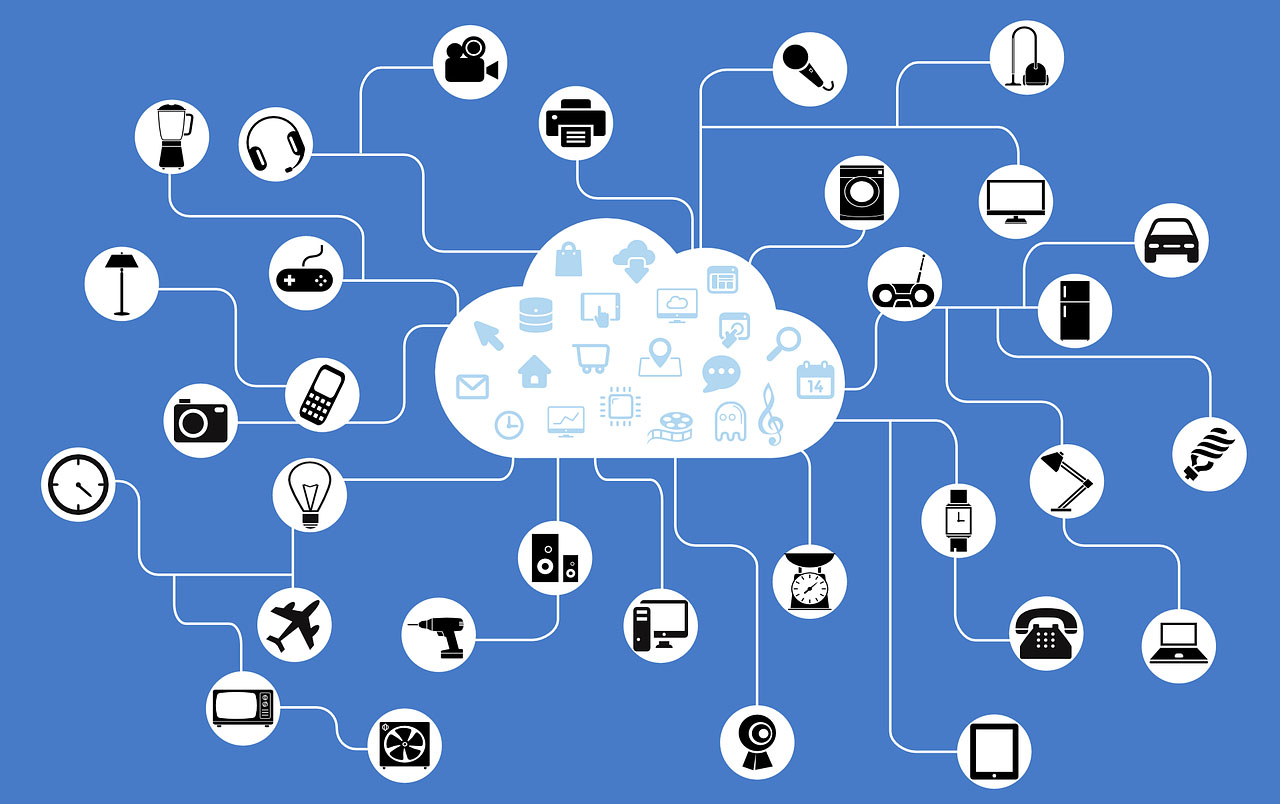

began 5,000 years ago when Chinese merchants combined their cargo on multiple ships. Now, this dinosaur industry is being pushed into the modern era with the help of the Internet of Things (IOT). This technology has the power to transform insurance, but it comes with its own challenges.

The traditional insurance claims process has stayed the same for decades, and it doesn’t sit well with customers. According to an Accenture Strategy Report, customer churn because of declining loyalty and poor customer experience represents as much as

$470 billion in life and property and casualty premiums. The growth of the IOT has disrupted the industry and forced companies to change how they process claims.

Customers use technology in their everyday lives and expect companies to do so, as well. Just

15% of customers say they are satisfied with their insurer’s digital experience. In today’s fast-paced world, customers want results right away. Insurance claims that take weeks or months to process can be a serious source of frustration.

See also: Welcome to New IoT: ‘Insurance of Things’

However, the IOT allows insurers to move more quickly and make powerful data-driven decisions. Companies no longer have to wade through paperwork and can instead move through the claims process more efficiently. Instead of filling out countless forms, customers can now submit claims via mobile apps by taking a few pictures. Connected devices like biometric and environmental sensors make it easy to calculate risk and adjust policies as situations change.

Data from connected devices allows insurers to know their customers on a deeper level with more accurate personal information, which can help create powerful bonds and add an element of customization to insurance that has long been lacking. Insurers can also more easily detect fraud, recommend personalized products and create more accurate estimates. In an analog world, an insurer didn’t know when a customer put a house on the market. In a digital world, insurers can know of available homes right away and recommend a new home insurance policy, plus auto and life insurance coverage.

Aside from improving the customer experience, using the IOT also helps insurers cut costs. Automation can cut the cost of the claims process by

as much as 30%. In many cases, those savings can be passed on to customers. IOT-connected devices have helped some insurance companies lower their premiums by

as much as 25%.

Most insurers believe that connected devices and more data will prevent greater losses, which could decrease the number of claims and lower insurance prices for customers who have reduced risks. In health insurance, data from devices can monitor a person’s health and recommend products and policies based on that data. Many companies are already offering discounts to customers who link their devices to their insurance coverage due to the likelihood of lower risks.

However, the growth of IOT in insurance isn’t without challenges. Consider the example of a Danish woman who had been receiving insurance payouts to cover her inability to work due to an injury. Her

profile on a running app told a different story—she was actually much more active than she claimed and regularly participated in sporting events that would have been near impossible if she really was an injured as she claimed to be. The woman’s insurance payments were cut in half, but questions arose about the rights of an insurance company to use data from IOT devices. Similar cases are popping up around the world of private customer information being shared online and companies using that information against their customers. Insurers need to be transparent and communicate their terms and conditions to their customers.

See also: Global Trend Map No. 7: Internet of Things

Most insurers know the importance of striking when the iron is hot and adopting new data-rich practices before they become commonplace and don’t yield a competitive advantage. However, the IOT shift is so great that it can be overwhelming for companies to know where to start to get the best results.

Aside from the growing pains, most insurers agree that the IOT will revolutionize the industry and customer experience. In an industry as regulated as insurance, taking advantage of new IOT technology is one way companies can stand out and offer a forward-thinking approach to their customers. It’s definitely time for change in insurance, and that change is coming through the IOT.