Excerpted from MSA's Q1-2018 Outlook Report (June 2018)

The insurance industry has been compared to the proverbial frog in the pot of ever hotter water. While things appear on the surface comparable to what they were like 10 years ago, perhaps with some nuanced variations, there appears to be little in the way of differences. Yes, mergers continue happening at the carrier level, and direct insurers are slowly gaining market share, but the band plays on. Industry associations continue holding conventions, insurers, reinsurers and brokers continue their traditions and year-end pilgrimages to London, Monte Carlo, Baden-Baden, NICC and the Aon Rendezvous, and the various other stations still welcome a familiar crowd. But signs that fundamental changes are afoot are becoming ever harder to ignore.

In Ernest Hemingway’s 1926 novel, "The Sun Also Rises," there’s a snippet of dialogue that seems apropos:

How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

The primary driver of the change is technology. The less noticeable catalyst, but no less important, is changes in regulatory mindsets. Let’s tackle both.

The two most influential market conduct regulators in Canada are readying themselves for technological disruption of the industries they oversee.

Quebec’s regulator, the AMF, has publicly expressed that it is "open for business" in terms of insurtech/ fintech under CEO Louis Morisset and Superintendent of Solvency Patrick Déry.

FSCO has recently moved to be more flexible within the tight bounds of its mandate, and its successor, FSRA, will be a modern independent agency purposely built for adaptability; it emerges from its cocoon under the guidance of a professional board and the stewardship of its CEO, Mark White, in April 2019.

FSRA and the AMF are positioning themselves to allow experimentation via regulatory sandboxes, whereby players can test initiatives in the field. This sandbox methodology is modeled after the Ontario Security Commission’s LaunchPad initiative.

See also: Global Trend Map No. 19: N. America (Part 1)

You may not have noticed it, but the regulatory ground in two of Canada’s largest provinces has shifted, and the stage is being set for ever-faster innovation in the Canadian insurtech space. In fact, in conversations with Guy Fraker, chief innovation officer at California-based Insurance Thought Leadership and emcee for the InsurTech North Conference in Gatineau in October, he advises that Canada is being looked at as a regulatory innovation hub by the global insurtech community.

Even under the old FSCO regime, Canada’s largest insurer, Intact, pulled off what might be a master stroke in July 2016 when it issued a fleet policy to Uber, providing coverage to tens of thousands of Uber drivers when engaged in Uber activities. So, in one fell swoop, a single insurer swept up tens of thousands of drivers. Intact pulled another coup by partnering with Turo in Canada. Turo is a peer-to-peer car-sharing marketplace that is busy disrupting the sleepy and sloppy car rental industry. This again gives Intact access to thousands of drivers with the stroke of a pen. Further, Intact may be able to leverage the access it has to those drivers to provide full auto coverage and even residential coverages. When these risks are gone, they’re lost to the rest of the market. Striking deals with the likes of Uber and Turo changes the game. In the U.S., Turo partners with Liberty Mutual, and with Allianz in Germany. Uber partners with Allstate, Farmers, James River and Progressive in the U.S. Aviva has pulled off a similar deal in Canada with Uber’s nemesis, Lyft.

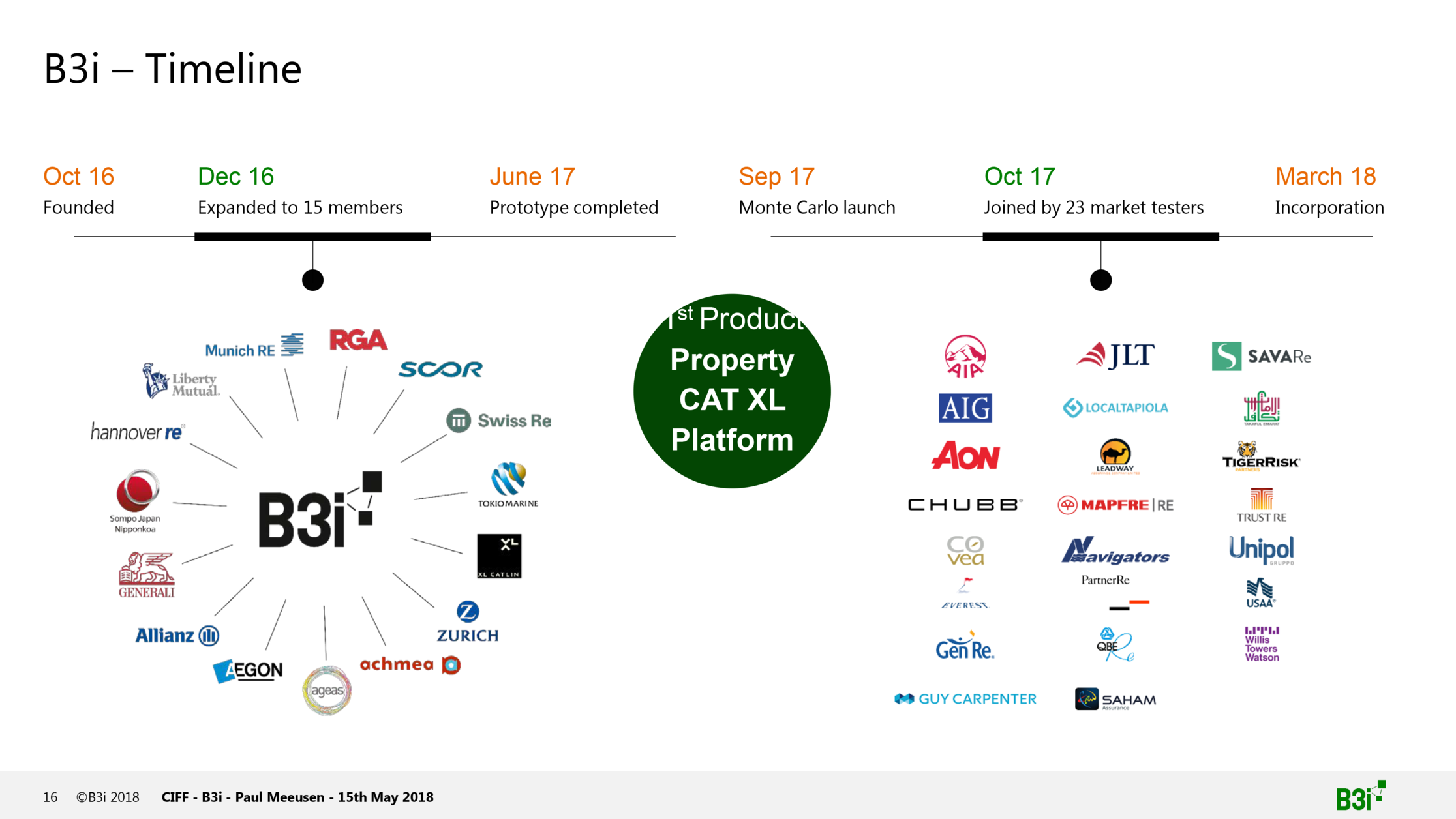

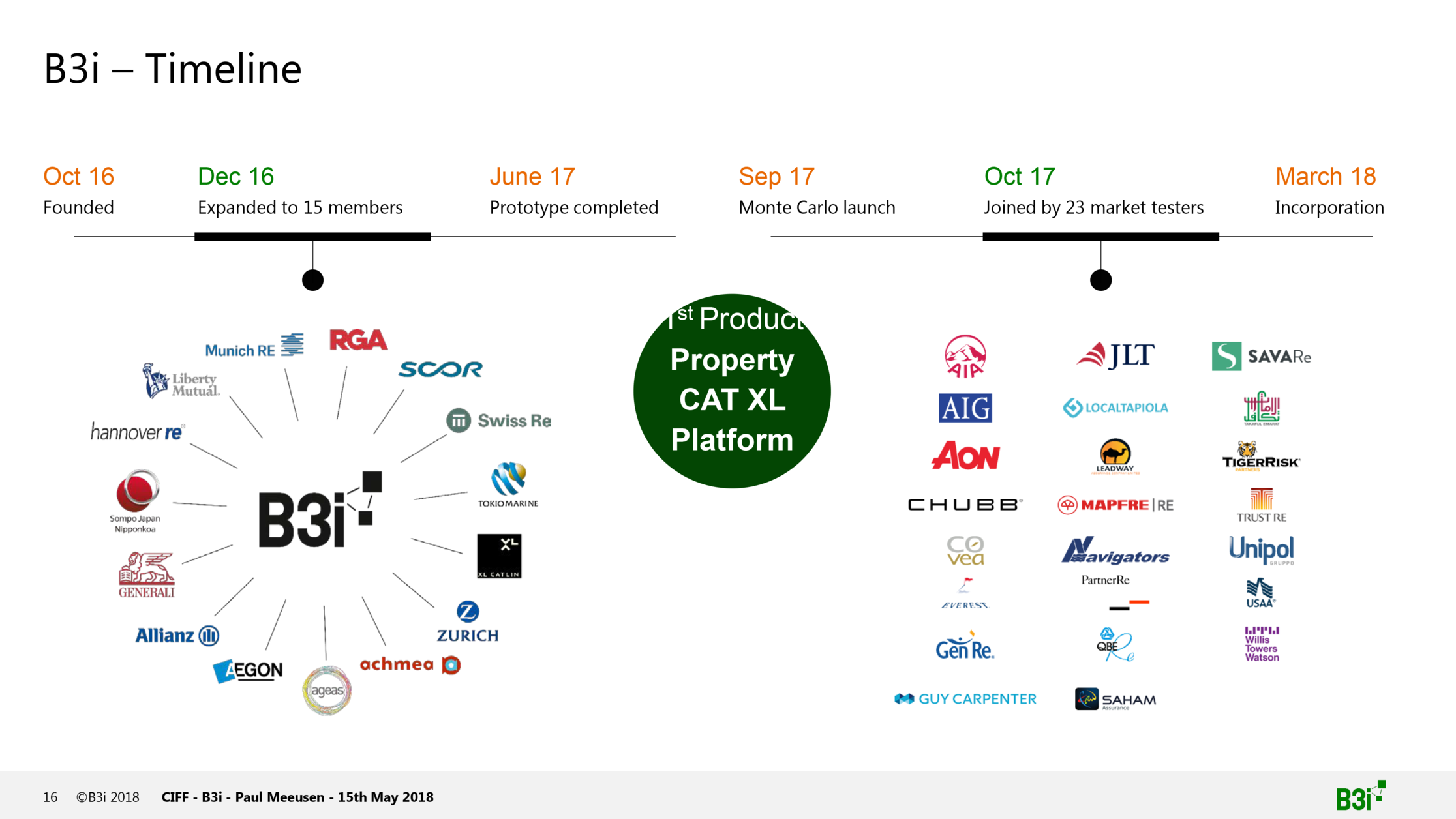

Further afield, B3i, the industry blockchain initiative has been established with the support of 15 large insurers/reinsurers. It is just starting up, but its mission is to remove friction from insurer/reinsurer transactions and risk transfer. When friction goes, so will costs. It is starting out slowly, but things may change suddenly – reshaping whole segments of the market. In addition to the original 15, the initiative has been joined by 23 industry testers.

In the U.S., The Institutes (the educational body behind the CPCU designation) launched a similar blockchain consortium called RiskBlock, which currently counts 18 members:

- American Agricultural Insurance

- American Family Insurance

- Chubb

- Erie Insurance

- Farmers Insurance

- The Hanover Insurance Group

- Horace Mann Educators

- Liberty Mutual Insurance

- Marsh

- Munich Reinsurance America

- Nationwide Insurance

- Ohio Mutual Insurance Group

- Penn National Insurance

- RCM&D

- RenaissanceRe

- State Automobile Mutual Insurance

- United Educators

- USAA

There is talk of establishing a Canadian insurance blockchain consortium, as well. You can hear from leaders of B3i, RiskBlock and parties involved in the Canadian initiative at the NICC in October.

Even further afield, if one was to look for an industry that makes the insurance sector look futuristic, one need not look further than the global supply chain shipping industry, with antiquated bills of lading, layers of intermediation and massive administrative overheads. Well, that industry is getting a serious wakeup call thanks to determination and drive of the world’s largest shipping company, Maersk. The company is taking its industry by the scruff of the neck and pulling it into the future whether it likes it or not – long-standing tradition, relationships and methods notwithstanding.

First, in March 2017, Maersk teamed up with IBM to utilize blockchain technology for cross-border supply chain management. Using blockchain to work with a network of shippers, freight forwarders, ocean carriers, ports and customs authorities, the intent is to digitize (read automate/disintermediate) global trade.

More recently (May 28, 2018) and closer to home, Maersk announced that it has deployed the first blockchain platform for marine insurance called insurwave in a joint venture between Guardtime, a software security provider, and EY. The platform is being used by Willis Towers Watson, MS Amlin and XL Catlin (got your attention?). Microsoft Azure is providing the blockchain technology using ACORD standards. Inefficiencies, beware! Microsoft and Guardtime intend to extend insurwave to the global logistics, marine cargo, energy and aviation sectors.

See also: How Insurance and Blockchain Fit

Insurers that find themselves locked out of these types of large-scale initiatives will be left out in the cold.

We’re witnessing "SUDDENLY," and we’d better get used to it.

Quebec’s regulator, the AMF, has publicly expressed that it is "open for business" in terms of insurtech/ fintech under CEO Louis Morisset and Superintendent of Solvency Patrick Déry.

FSCO has recently moved to be more flexible within the tight bounds of its mandate, and its successor, FSRA, will be a modern independent agency purposely built for adaptability; it emerges from its cocoon under the guidance of a professional board and the stewardship of its CEO, Mark White, in April 2019.

FSRA and the AMF are positioning themselves to allow experimentation via regulatory sandboxes, whereby players can test initiatives in the field. This sandbox methodology is modeled after the Ontario Security Commission’s LaunchPad initiative.

See also: Global Trend Map No. 19: N. America (Part 1)

You may not have noticed it, but the regulatory ground in two of Canada’s largest provinces has shifted, and the stage is being set for ever-faster innovation in the Canadian insurtech space. In fact, in conversations with Guy Fraker, chief innovation officer at California-based Insurance Thought Leadership and emcee for the InsurTech North Conference in Gatineau in October, he advises that Canada is being looked at as a regulatory innovation hub by the global insurtech community.

Even under the old FSCO regime, Canada’s largest insurer, Intact, pulled off what might be a master stroke in July 2016 when it issued a fleet policy to Uber, providing coverage to tens of thousands of Uber drivers when engaged in Uber activities. So, in one fell swoop, a single insurer swept up tens of thousands of drivers. Intact pulled another coup by partnering with Turo in Canada. Turo is a peer-to-peer car-sharing marketplace that is busy disrupting the sleepy and sloppy car rental industry. This again gives Intact access to thousands of drivers with the stroke of a pen. Further, Intact may be able to leverage the access it has to those drivers to provide full auto coverage and even residential coverages. When these risks are gone, they’re lost to the rest of the market. Striking deals with the likes of Uber and Turo changes the game. In the U.S., Turo partners with Liberty Mutual, and with Allianz in Germany. Uber partners with Allstate, Farmers, James River and Progressive in the U.S. Aviva has pulled off a similar deal in Canada with Uber’s nemesis, Lyft.

Quebec’s regulator, the AMF, has publicly expressed that it is "open for business" in terms of insurtech/ fintech under CEO Louis Morisset and Superintendent of Solvency Patrick Déry.

FSCO has recently moved to be more flexible within the tight bounds of its mandate, and its successor, FSRA, will be a modern independent agency purposely built for adaptability; it emerges from its cocoon under the guidance of a professional board and the stewardship of its CEO, Mark White, in April 2019.

FSRA and the AMF are positioning themselves to allow experimentation via regulatory sandboxes, whereby players can test initiatives in the field. This sandbox methodology is modeled after the Ontario Security Commission’s LaunchPad initiative.

See also: Global Trend Map No. 19: N. America (Part 1)

You may not have noticed it, but the regulatory ground in two of Canada’s largest provinces has shifted, and the stage is being set for ever-faster innovation in the Canadian insurtech space. In fact, in conversations with Guy Fraker, chief innovation officer at California-based Insurance Thought Leadership and emcee for the InsurTech North Conference in Gatineau in October, he advises that Canada is being looked at as a regulatory innovation hub by the global insurtech community.

Even under the old FSCO regime, Canada’s largest insurer, Intact, pulled off what might be a master stroke in July 2016 when it issued a fleet policy to Uber, providing coverage to tens of thousands of Uber drivers when engaged in Uber activities. So, in one fell swoop, a single insurer swept up tens of thousands of drivers. Intact pulled another coup by partnering with Turo in Canada. Turo is a peer-to-peer car-sharing marketplace that is busy disrupting the sleepy and sloppy car rental industry. This again gives Intact access to thousands of drivers with the stroke of a pen. Further, Intact may be able to leverage the access it has to those drivers to provide full auto coverage and even residential coverages. When these risks are gone, they’re lost to the rest of the market. Striking deals with the likes of Uber and Turo changes the game. In the U.S., Turo partners with Liberty Mutual, and with Allianz in Germany. Uber partners with Allstate, Farmers, James River and Progressive in the U.S. Aviva has pulled off a similar deal in Canada with Uber’s nemesis, Lyft.

Further afield, B3i, the industry blockchain initiative has been established with the support of 15 large insurers/reinsurers. It is just starting up, but its mission is to remove friction from insurer/reinsurer transactions and risk transfer. When friction goes, so will costs. It is starting out slowly, but things may change suddenly – reshaping whole segments of the market. In addition to the original 15, the initiative has been joined by 23 industry testers.

Further afield, B3i, the industry blockchain initiative has been established with the support of 15 large insurers/reinsurers. It is just starting up, but its mission is to remove friction from insurer/reinsurer transactions and risk transfer. When friction goes, so will costs. It is starting out slowly, but things may change suddenly – reshaping whole segments of the market. In addition to the original 15, the initiative has been joined by 23 industry testers.

In the U.S., The Institutes (the educational body behind the CPCU designation) launched a similar blockchain consortium called RiskBlock, which currently counts 18 members:

In the U.S., The Institutes (the educational body behind the CPCU designation) launched a similar blockchain consortium called RiskBlock, which currently counts 18 members: