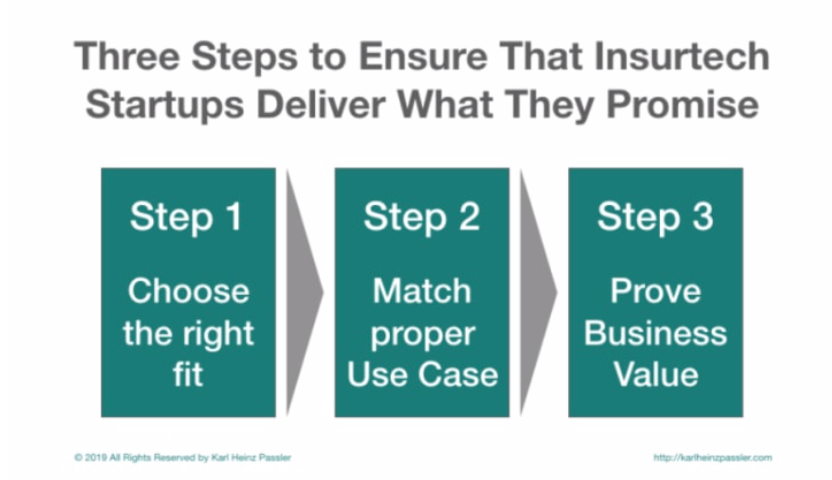

There are more than 1,000 insurtechs that can help established insurance organizations. Most of the startups look the same at first glance, but they are not all created equal. Apply this three-step process to ensure that startups deliver what they promise.

The Three Steps in a Video

This video lecture explains the three-step process in the context of "Separating the wheat from the chaff in relation to insurtechs." It contains examples that are briefly described in the following article.

Overview of the Three-Step Process

The three steps are:

Step one, focus your efforts and select startups with the right strategic and operational fit. Step two, take the skill of the startup, match it to corresponding activities and create a proper use case. And step three, prove the business value to your decision-makers before you invest more resources.

Step 1: Select Startups With the Right Fit

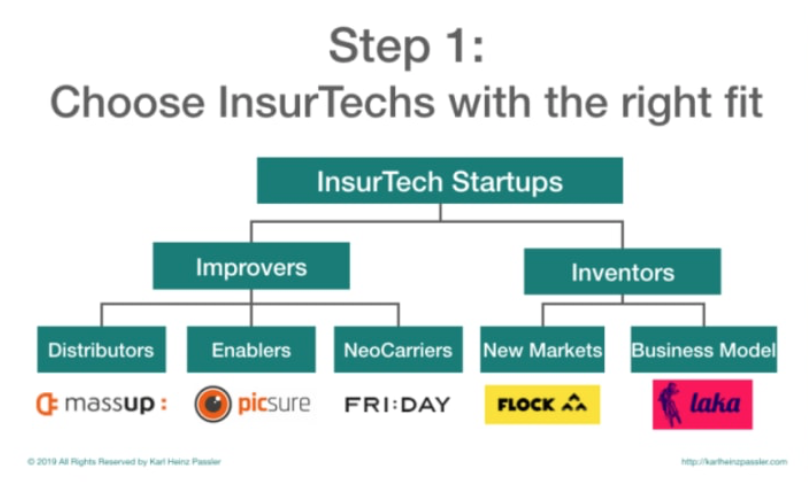

Start to focus your resources by dividing insurtech startups into the two groups of Improvers and Inventors. Improvers take the current insurance industry and apply state-of-the-art technology on top. In this way, they improve and digitize existing insurance processes and business models.

Divide Improvers further into three distinct types, based on their method of value creation. Distributors provide an excellent customer experience directly to policyholders. Enablers empower incumbent insurance providers to run digital services. NeoCarriers offer the full-stack of insurance activities to brokers, policyholders and incumbent risk carriers as a white-label solution.

See also: Will COVID-19 Disrupt Insurtech?

If you begin the journey of improving your business with insurtech startups, I would pick one of these types. The low-hanging fruit would be Enablers and Distributors because they relate the most to what your organization is doing today. Pick one, two or three startups and start working with a dedicated team.

The second group is Inventors. They don’t accept how insurance is done today. Inventors question the underlying assumptions, reevaluate them and re-invent insurance propositions and business models, offering new ways to provide insurance services.

Based on the Improvers method of value creation, you can divide these insurtechs into two types. New Market Conquerers enter new markets like drone insurance (e.g. Flock), shared economy (e.g. Airbnb) and the gig economy (e.g. Uber). New Business Model Operators are the more interesting type but also harder to understand. They could disrupt the insurance industry, so you need to deploy people who are really at home in the insurance industry to understand what is going on there. One example is Laka, with its bike insurance.

Step 2: Create a Proper Use Case

Take an insurtech with its capabilities, match it to the activities inside the insurance value chain and create a proper use case that will move the carrier's key performance indicators (KPIs) in the right direction.

Facilitate workshops with insurtechs to find out where you as an insurer can apply the new capabilities in your value chain. The value chain is a classic old school management insurtechs that documents the core activities that create value for the customer, our policyholder. This tool helps to identify suitable activities that are most likely to be located in the following departments: Asset and Risk Management, Policy Administration and Customer Service, Claims Management, Product Development and Underwriting and, of course, Marketing and Sales.

Start creating use cases in collaboration with the team of insurers and startups. A use case is the description of a workflow that creates additional value for the insurance company. After developing a series of use cases, select the most promising one and take the third step.

A startup can help detect fraud in images of claims by extracting data from images and giving insurers clues as to whether the image was manipulated after it was captured. If there are deviations from the policyholder's description (e.g. taken in Hamburg vs. Frankfurt), the insurer may have detected fraud. If the insurer does not have to pay, it reduces its loss ratio and thus increases its profit.

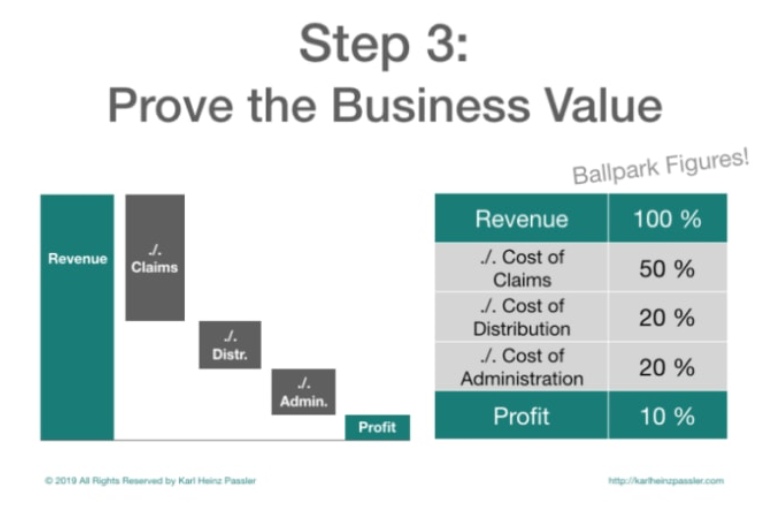

Step 3: Prove the Business Value

Prove the value of the use case before you begin to scale up. Use the value table with the five key figures on which carrier decisions are typically based. Deliver facts, not an opinion, to make the right investments.

Take the use case and execute a proof of concept (POC), do a prototype and test it. Experiment to create some real-world data. Take that data and put it into the value table with the five key figures insurance carriers decision-makers rely on. These are 1) Revenue 2) Cost of claims 3) Costs of Distribution 4) Costs of administration and 5) Profit. The calculation is as follows: Revenue minus Costs of Claims, minus Costs of Distribution, minus Costs of Administration equals Profit.

Enter your specific numbers from your test and analyze which of the KPIs will be influenced (at scale) by the use case you developed and tested. Calculate different scenarios and their results.

See also: Insurtechs Are Specializing

Another example: If you identify fraudsters and reduce your claims ratio by one percentage point (this makes your head of claims happy), you increase company profit by one percentage point (makes your CFO and CEO happy). At a premium of 1 billion euros, one percentage point corresponds to 10 million euros. All of us know that applying a "simple" image check doesn't cost 10 million euros. It is, therefore, a suspect for a proper use case to prove.

If you can prove the value of your use case with facts, it is easy to ask a decision-maker: We need more money because this use case brings the company more money than it costs.

Summary

By following this three-step process, innovators in insurance companies (and entrepreneurs in startups) can focus their efforts and only work with insurtech startups (vice versa with insurers) that have the right strategic and operational fit to help improve an organization.

Select the right partners and create proper use cases based on activities within the insurance value chain. Demonstrate the value of use cases through testing with POCs and prototypes. Then apply real-world data to the presented value table and analyze what will happen before scaling and investing more resources.

If you can prove the value of your use case with facts, you will be much more successful when asking your decision-makers for more money to invest and scale up.